Analyzing Palantir Stock: Investment Opportunities Before May 5th

Table of Contents

H2: Palantir's Recent Financial Performance and Future Projections

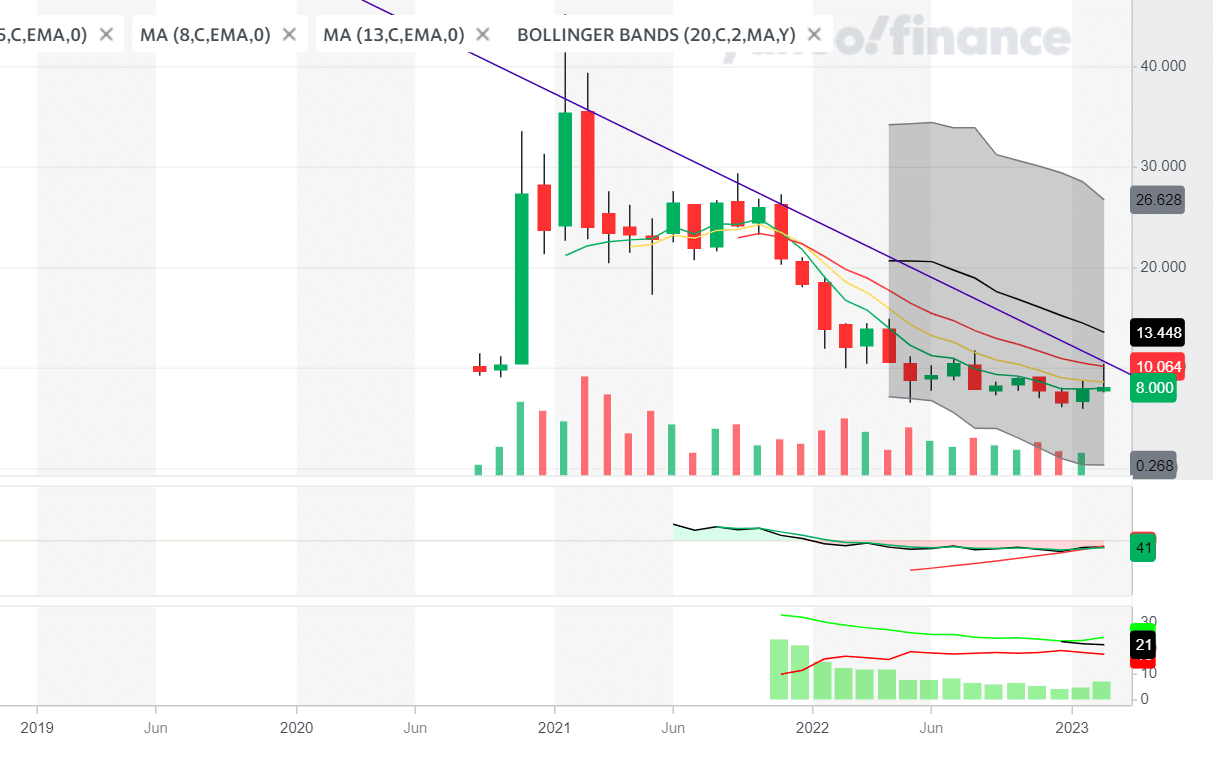

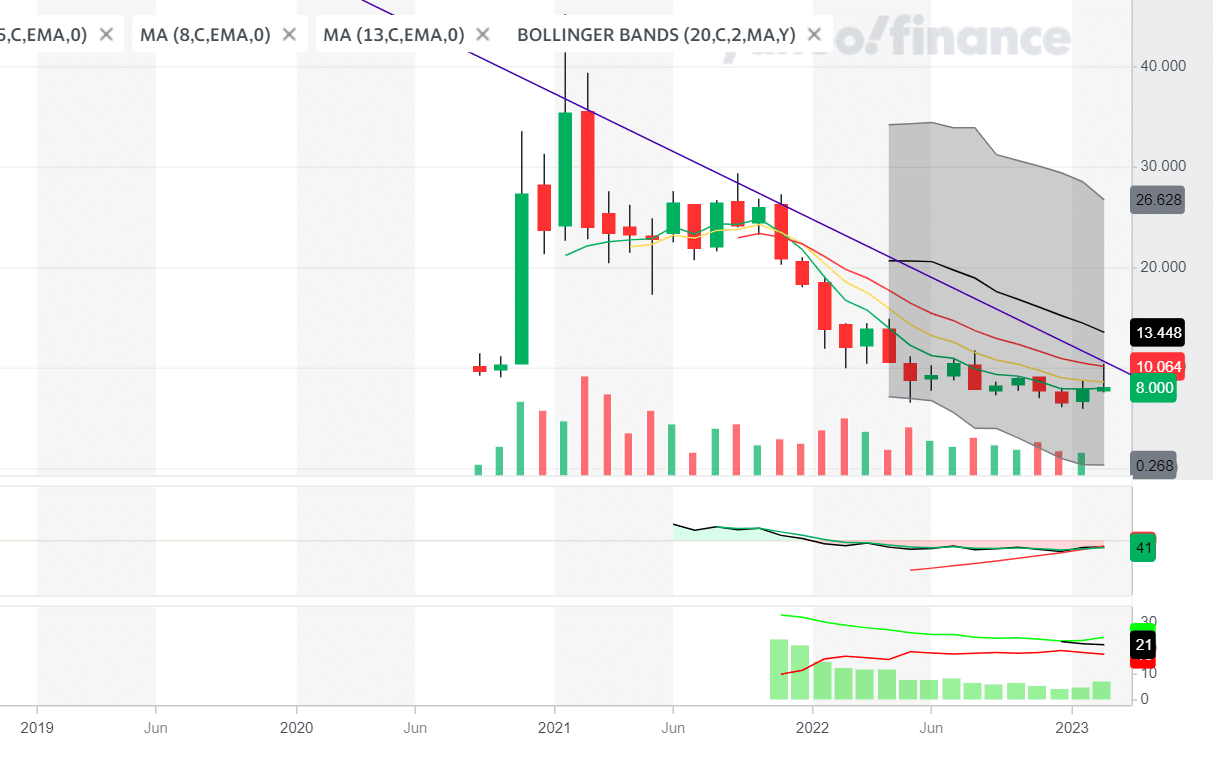

Palantir's recent performance and future outlook are crucial for any Palantir stock analysis. Let's examine the key metrics.

H3: Q4 2022 Earnings Report Analysis: Palantir's Q4 2022 earnings report revealed important insights into the company's trajectory. While specific numbers need to be updated with the latest financial release, the following points are generally key to consider:

- Revenue growth rate: Analyze the percentage increase in revenue compared to the previous year and the previous quarter. A strong growth rate indicates positive momentum.

- Net income/loss: Determine whether Palantir achieved profitability or incurred a loss, and examine the trend of profitability over time.

- Key performance indicators (KPIs): Look at metrics like customer acquisition cost, average revenue per user (ARPU), and customer churn rate to gauge the health of the business.

- Management commentary on future prospects: Pay close attention to management's guidance for the upcoming quarters, as this provides valuable insight into their expectations for future performance.

H3: Analyst Ratings and Price Targets: Understanding the consensus opinion of financial analysts is another important aspect of a thorough Palantir stock analysis.

- Average price target: The average price target from various analysts provides a benchmark for future price expectations.

- High and low price targets: The range of price targets highlights the uncertainty surrounding the stock's future performance.

- Number of analysts with buy/hold/sell ratings: The distribution of buy, hold, and sell ratings offers a snapshot of the overall sentiment among analysts. A preponderance of buy ratings could signal strong investor confidence.

H3: Long-Term Growth Potential: Analyzing Palantir's long-term prospects requires a multifaceted approach.

- Market share potential: Assess Palantir's potential to capture a larger share of the growing big data and analytics market.

- Competitive advantages: Identify Palantir's unique strengths, such as its proprietary software and strong government relationships, that provide a competitive edge.

- Technological innovation pipeline: Examine Palantir's ongoing investment in research and development to gauge its ability to maintain its technological leadership.

H2: Key Factors Influencing Palantir Stock Price Before May 5th

Several factors could significantly influence Palantir's stock price before May 5th. Understanding these is critical for any successful PLTR stock investment.

H3: Upcoming Earnings Reports and Events: Keep a close eye on Palantir's calendar for any upcoming events.

- Dates of upcoming announcements: Note any scheduled earnings reports, product launches, or partnerships that could move the stock price.

- Potential market reactions: Anticipate how the market might react to these announcements based on historical trends and the general market sentiment.

- Expected impact on stock price: Consider the potential positive or negative impact on the stock price based on the anticipated news.

H3: Geopolitical and Macroeconomic Factors: Global events can significantly influence market sentiment.

- Specific geopolitical events: Consider the impact of global conflicts, political instability, or trade tensions on Palantir's business.

- Their potential impact: Evaluate how these events could affect Palantir's revenue, profitability, and investor confidence.

- Macroeconomic factors and their implications: Analyze the impact of inflation, interest rate hikes, and economic growth on the overall market and Palantir's valuation.

H3: Competitive Landscape: Understanding the competitive landscape is essential.

- Major competitors: Identify Palantir's main competitors in the data analytics and government contracting sectors.

- Their strengths and weaknesses: Assess the competitive advantages and disadvantages of Palantir relative to its rivals.

- Market share dynamics: Analyze the market share trends to understand Palantir's position and potential for future growth.

H2: Investment Strategies and Risk Assessment

Careful consideration of investment strategies and potential risks is vital for any PLTR stock investment.

H3: Potential Investment Strategies: Different strategies suit different risk tolerances.

- Buy-and-hold: A long-term strategy suitable for investors with a high risk tolerance and a long-term perspective.

- Swing trading: A short-to-medium-term strategy that involves taking advantage of short-term price fluctuations.

- Options trading: A more complex strategy that offers higher potential rewards but also carries higher risks.

H3: Risk Factors: Investing in Palantir carries inherent risks.

- Market volatility: Palantir's stock price can be highly volatile, making it susceptible to significant price swings.

- Competition: The competitive landscape is dynamic, and new entrants could disrupt Palantir's market share.

- Regulatory hurdles: Government regulations and compliance requirements could impact Palantir's operations and profitability.

3. Conclusion:

This Palantir stock analysis has explored Palantir's financial performance, future projections, and key factors influencing its stock price before May 5th. We've outlined potential investment strategies and identified key risks to consider. Remember, this analysis is not financial advice. The information provided should be used in conjunction with your own research.

This analysis of Palantir stock provides valuable insights into potential investment opportunities before May 5th. Remember to conduct your own due diligence before making any investment decisions regarding Palantir stock (PLTR). Thoroughly analyze the latest financial reports and consider your personal risk tolerance before investing. Further research into Palantir's technology, market position, and competitive landscape is crucial for a comprehensive understanding before making any investment decisions related to analyzing Palantir stock.

Featured Posts

-

New Totalitarian Threat Lais Ve Day Address To Taiwan

May 10, 2025

New Totalitarian Threat Lais Ve Day Address To Taiwan

May 10, 2025 -

Uk Student Visas Restrictions For Pakistani Students And Asylum Implications

May 10, 2025

Uk Student Visas Restrictions For Pakistani Students And Asylum Implications

May 10, 2025 -

Stiven King Povernuvsya Komentari Pro Trampa Ta Maska

May 10, 2025

Stiven King Povernuvsya Komentari Pro Trampa Ta Maska

May 10, 2025 -

7 Year Prison Term For Gpb Capital Founder David Gentile In Fraud Case

May 10, 2025

7 Year Prison Term For Gpb Capital Founder David Gentile In Fraud Case

May 10, 2025 -

The Bull Markets Return Overturning Bearish Predictions On Wall Street

May 10, 2025

The Bull Markets Return Overturning Bearish Predictions On Wall Street

May 10, 2025