Analyzing Warren Buffett's Investment Portfolio: Successes And Setbacks

Table of Contents

Warren Buffett's Winning Strategies: A Deep Dive into Successes

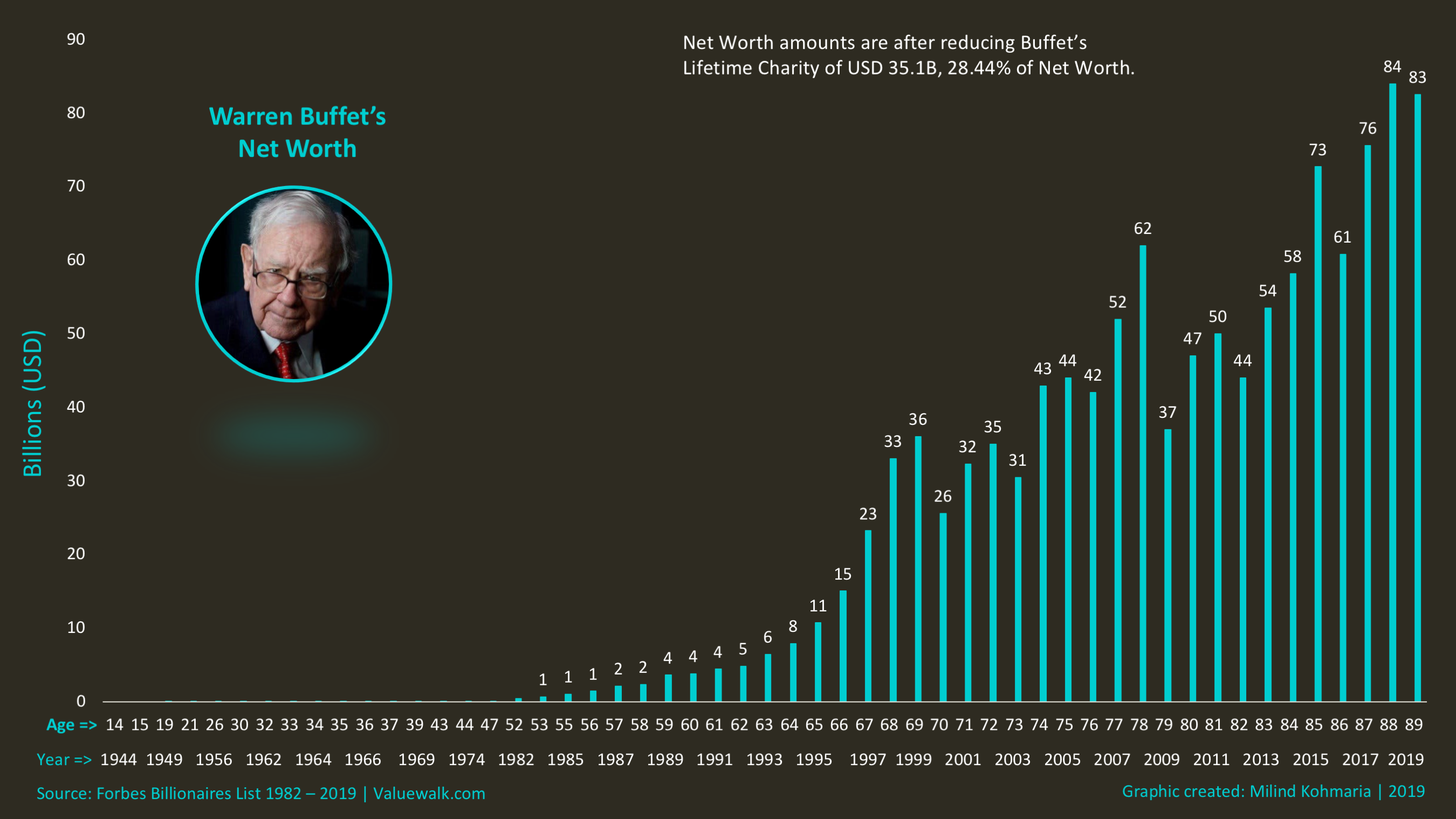

Warren Buffett's remarkable investment track record stems from a combination of shrewd strategies consistently applied over decades. His approach to building his investment portfolio is a masterclass in long-term value investing.

Identifying Undervalued Companies:

Buffett's success hinges on his ability to identify undervalued companies with strong fundamentals. He focuses intensely on a company's intrinsic value – its true worth based on its assets, earnings, and future prospects – rather than solely relying on its current market price. This involves thorough fundamental analysis, scrutinizing the company's financials, management team, competitive landscape, and overall business model.

- Look for durable competitive advantages (moats): Buffett seeks companies with strong brand recognition, patents, or other barriers to entry that protect them from competition.

- Favor businesses with predictable earnings: Consistent and predictable earnings provide a stable foundation for long-term growth.

- Invest in companies you understand: Buffett famously advises investors to stick to what they know. Investing in companies whose business models you understand minimizes risk.

Examples of Buffett's successful picks include Coca-Cola and American Express. His investment in Coca-Cola, started in the 1980s, has generated significant returns through both capital appreciation and consistent dividend payouts. Similarly, his long-term holding of American Express has yielded substantial profits due to the company's resilient business model and strong brand reputation. These investments exemplify the power of identifying undervalued, high-quality companies and holding them for the long term.

Long-Term Holding and Patience:

Buffett is famously averse to short-term market fluctuations. He believes in the power of compounding returns, letting his investments grow steadily over many years, even decades. This patient approach allows him to ride out market downturns and benefit from the long-term growth of his holdings.

- Avoid emotional decision-making: Market volatility can trigger impulsive reactions. Buffett's discipline helps him avoid these emotional pitfalls.

- Ignore market noise: He focuses on the fundamentals of a company, rather than being swayed by short-term market trends and speculation.

- Stay disciplined in your investment strategy: Consistency is key. Sticking to a well-defined investment plan is crucial for long-term success.

This strategy of long-term holding significantly contributes to the overall success of Warren Buffett's investment portfolio, showcasing the power of patience and discipline in investing.

Strategic Acquisitions and Synergies:

Beyond individual stocks, Buffett has made highly successful acquisitions that have significantly enhanced his portfolio's value. The acquisition of Burlington Northern Santa Fe (BNSF) railway exemplifies this strategy. This acquisition diversified Berkshire Hathaway's holdings into infrastructure and transportation, adding a significant and stable revenue stream.

- Due diligence is paramount: Before making an acquisition, Buffett conducts extensive research and due diligence to ensure the target company aligns with his investment philosophy.

- Integration of acquired businesses is key to success: He focuses on seamlessly integrating acquired companies into Berkshire Hathaway's existing operations to maximize synergies and efficiency.

- Focus on synergies and cost efficiencies: Buffett looks for acquisitions where he can leverage existing resources and expertise to improve profitability and efficiency.

Examining Warren Buffett's Setbacks and Lessons Learned

Even the most successful investors experience setbacks. Analyzing Warren Buffett's less successful investments provides valuable lessons for aspiring investors.

The Dexter Shoe Company Acquisition:

The Dexter Shoe Company acquisition serves as a reminder that not all investments are winners. This investment, made in the 1990s, ultimately resulted in a loss for Berkshire Hathaway. The failure highlighted the importance of thorough due diligence and understanding the nuances of a specific industry.

- Not all acquisitions are successful: Even with meticulous research, acquisitions can fail due to unforeseen circumstances or changes in market dynamics.

- Thorough due diligence is crucial: This emphasizes the need for rigorous research and analysis before making any significant investment, especially in acquisitions.

- Don't be afraid to admit mistakes: Recognizing and admitting mistakes is crucial for learning and improvement.

The Energy Sector Investments:

Some of Buffett's investments in the energy sector haven't performed as well as others in his portfolio. This highlights the risk involved in any investment and the importance of understanding market conditions and specific sector trends.

- Even great investors make mistakes: Nobody is immune to losses.

- Market cycles and unforeseen events can impact investments: External factors can significantly impact the performance of even well-researched investments.

- Diversification across sectors is important, but understanding your investments is paramount: While diversification is crucial, it's not a guarantee of success.

Lessons from Buffett's Mistakes:

Buffett's willingness to admit mistakes and learn from them is a key ingredient to his long-term success. He consistently adapts his strategies based on new information and experiences.

- Continuous learning and adaptation are essential: The investment landscape is constantly evolving. Staying informed and adapting strategies is vital.

- Humility is key in investing: Recognizing limitations and avoiding overconfidence are crucial for long-term success.

- Accept losses and move on: Losses are an inevitable part of investing. Learning from them and moving forward is key.

Conclusion:

Analyzing Warren Buffett's investment portfolio reveals a consistent strategy focused on long-term value investing, meticulous research, and patience. While he's experienced setbacks, his willingness to learn from mistakes and adapt his approach underscores the importance of continuous learning and discipline in the investment world. By understanding his successes and failures, aspiring investors can gain valuable insights into building a robust and profitable investment portfolio. Start analyzing your own portfolio today using the principles learned from understanding Warren Buffett's investment portfolio. Emulate his strategies to potentially achieve similar long-term success in your own investment journey.

Featured Posts

-

The Staffing Shortage At Newark Airport 7 Days Of Disruption And Beyond

May 06, 2025

The Staffing Shortage At Newark Airport 7 Days Of Disruption And Beyond

May 06, 2025 -

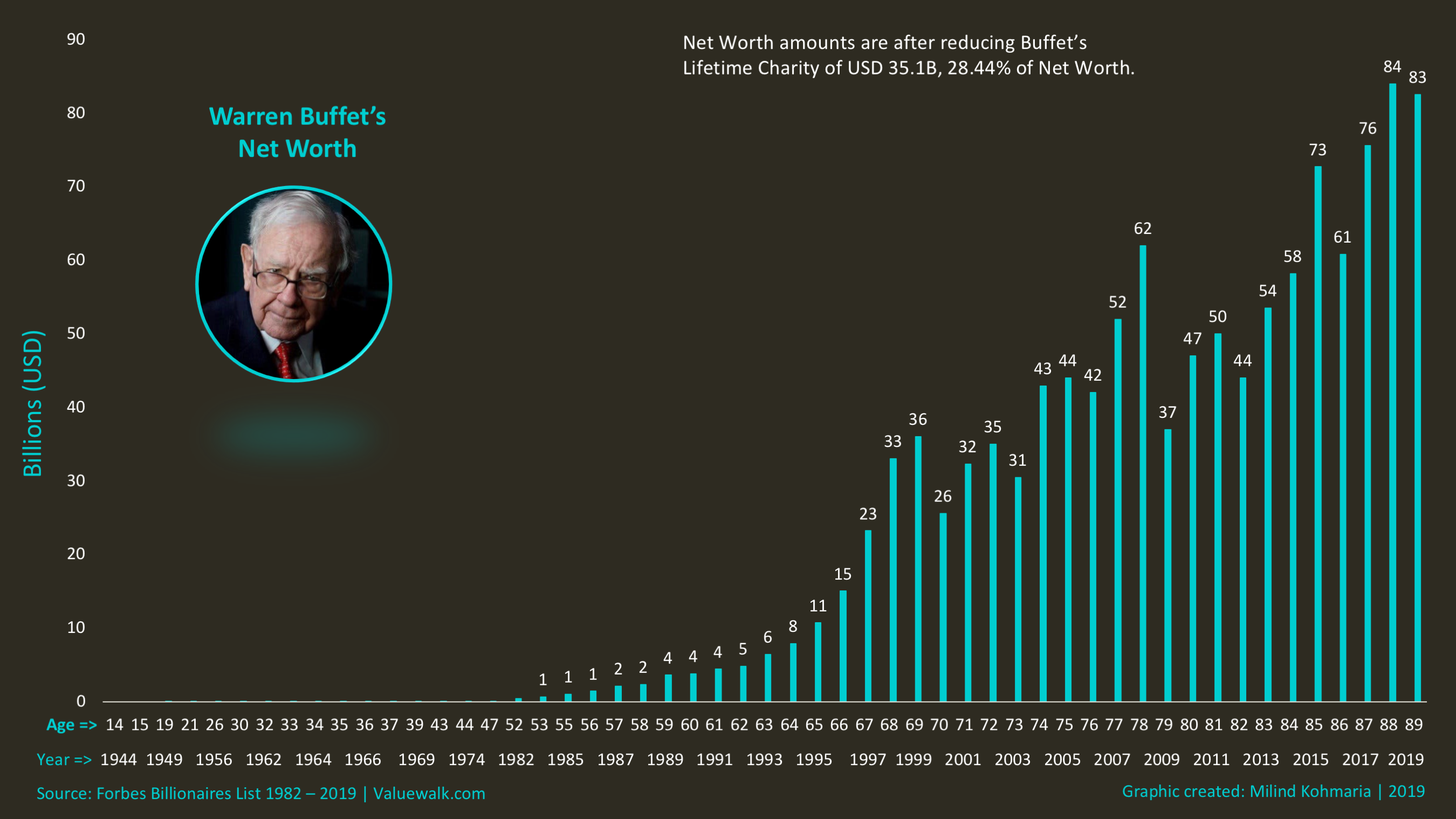

Western Canadas Economic Potential A Call To Action From Gary Mar

May 06, 2025

Western Canadas Economic Potential A Call To Action From Gary Mar

May 06, 2025 -

Decoding Princess Dianas Met Gala Dress Risk Rebellion And Redesign

May 06, 2025

Decoding Princess Dianas Met Gala Dress Risk Rebellion And Redesign

May 06, 2025 -

Saving Venice A High Tech Solution To Rising Tides

May 06, 2025

Saving Venice A High Tech Solution To Rising Tides

May 06, 2025 -

The Environmental Impact Of Abandoned Gold Mines A Toxic Threat

May 06, 2025

The Environmental Impact Of Abandoned Gold Mines A Toxic Threat

May 06, 2025

Latest Posts

-

Shopify Developers Lifetime Revenue Share Model Explained

May 06, 2025

Shopify Developers Lifetime Revenue Share Model Explained

May 06, 2025 -

Gold Prices Fall Facing First Double Digit Weekly Losses Of 2025

May 06, 2025

Gold Prices Fall Facing First Double Digit Weekly Losses Of 2025

May 06, 2025 -

Gold Market Update Two Straight Weeks Of Losses In 2025

May 06, 2025

Gold Market Update Two Straight Weeks Of Losses In 2025

May 06, 2025 -

White Lotus Casting Patrick Schwarzeneggers Response To Nepotism Criticism

May 06, 2025

White Lotus Casting Patrick Schwarzeneggers Response To Nepotism Criticism

May 06, 2025 -

Schwarzenegger Joins Guadagninos Film Details On The New Role

May 06, 2025

Schwarzenegger Joins Guadagninos Film Details On The New Role

May 06, 2025