Apple's Stock Performance: A Post-Trump Tariff Assessment

Table of Contents

The Impact of Trump-Era Tariffs on Apple's Supply Chain

Apple's immense success is built upon a globally intricate supply chain. Components for its iconic iPhones, Macs, and other products are sourced from numerous countries, with a significant reliance on manufacturing in China. The Trump administration's imposition of tariffs, particularly those targeting goods imported from China, directly impacted Apple's operations. Specific tariffs affected various components, from memory chips and display panels to finished goods. These tariffs, implemented in stages, created considerable uncertainty and increased the cost of production.

- Increased production costs due to tariffs: The added tariff costs were substantial, impacting Apple's profit margins on each unit sold. This forced Apple to evaluate its pricing strategies carefully.

- Potential shifts in manufacturing locations to mitigate tariff impacts: To lessen dependence on China and mitigate tariff risks, Apple explored, and in some cases implemented, diversification of its manufacturing base. This involved shifting some production to countries like India and Vietnam.

- Impact on Apple's pricing strategies: While Apple absorbed some of the increased costs, it also passed on a portion to consumers through subtly increased prices. This delicate balancing act aimed to maintain market share while protecting profitability.

- Analysis of how these cost increases affected profit margins: The increased costs undeniably squeezed Apple's profit margins, though the company's strong brand loyalty and pricing power allowed it to navigate these challenges more effectively than some competitors. Analyzing quarterly earnings reports during this period reveals the fluctuating impact of these tariff-induced cost pressures.

Apple's Stock Price Fluctuations during the Tariff Period

Apple's stock price (AAPL) exhibited considerable volatility during the period of tariff implementation and escalation. The imposition of new or increased tariffs often coincided with short-term dips in the stock price, reflecting investor concerns about the potential impact on Apple's profitability and future growth. Conversely, periods of de-escalation or positive trade news often led to rallies.

[Insert Chart/Graph here showing Apple's stock price movements correlated with key tariff announcements]

- Correlation between tariff announcements and stock price volatility: A clear correlation existed between major tariff announcements and subsequent fluctuations in Apple's stock price. Negative news tended to trigger sell-offs, while positive developments boosted investor confidence.

- Stock price reactions to specific tariff escalations or de-escalations: Specific events, such as the announcement of new tariffs on Chinese goods or negotiations towards tariff reductions, had measurable and immediate effects on Apple's stock price.

- Comparative analysis of Apple's stock performance against competitors: A comparative analysis against other tech giants impacted by tariffs (e.g., companies heavily reliant on Chinese manufacturing) provides valuable context for understanding Apple's relative performance during this turbulent period.

- Mention any significant investor reactions or analyst reports during this period: Investor sentiment and analyst reports during this time highlighted concerns about supply chain disruptions and the impact on future earnings, directly influencing Apple's stock price.

Strategies Employed by Apple to Mitigate Tariff Impacts

To offset the negative consequences of the tariffs, Apple adopted a multi-pronged strategy focused on supply chain diversification and cost optimization. These actions were crucial in protecting Apple's bottom line and maintaining its market position.

- Increased investment in regions outside of China: Apple significantly increased its investments in manufacturing facilities and partnerships in countries like India and Vietnam, aiming to diversify its production base and reduce reliance on China.

- Negotiations with the government to reduce or avoid tariffs: Apple, like many other multinational companies, likely engaged in negotiations with US and Chinese governments to influence tariff policies or obtain exemptions.

- Implementation of cost-cutting measures: Internal cost-cutting measures were likely implemented across various departments to compensate for the increased costs resulting from tariffs.

- Changes in product design or sourcing to minimize tariff impact: Apple may have subtly altered product designs or sourcing strategies to minimize the impact of tariffs on specific components.

Long-Term Effects on Apple's Stock Performance and Strategy

The Trump-era tariffs had a lasting impact on Apple's long-term strategy, pushing the company to enhance its supply chain resilience and geographic diversification. While the initial impact on Apple's stock performance was marked by volatility, the company's proactive adjustments ultimately helped to mitigate the long-term negative consequences.

- Sustainability of the diversification strategies: The diversification strategies implemented are likely to continue beyond the tariff period, enhancing Apple's resilience to future geopolitical and economic uncertainties.

- Impact on future product pricing and profitability: The lessons learned during the tariff period will likely shape Apple's future pricing strategies and overall approach to managing production costs.

- Shift in investor sentiment towards Apple post-tariff period: Investor sentiment towards Apple shifted to reflect the company's adaptability and resilience in the face of significant challenges.

- Lessons learned for future geopolitical and economic uncertainties: The experience provided valuable insights for navigating future geopolitical risks and economic uncertainties, refining Apple's approach to supply chain management and risk mitigation.

Conclusion

The Trump-era tariffs presented significant challenges to Apple's supply chain and, consequently, its stock performance. However, Apple's strategic responses – namely supply chain diversification and cost-cutting measures – proved effective in mitigating the long-term negative impacts. The experience underscores the significant impact of global trade policies on major corporations like Apple. Stay informed on the evolving global trade landscape to better understand the factors that influence Apple's stock performance and make informed investment decisions regarding Apple's stock and other related companies impacted by trade policies.

Featured Posts

-

Astonishing 90mph Refueling Police Helicopter Chase Ends In Dramatic Fuel Stop

May 24, 2025

Astonishing 90mph Refueling Police Helicopter Chase Ends In Dramatic Fuel Stop

May 24, 2025 -

Forbes 2025 La Classifica Degli Uomini Piu Ricchi Del Mondo Cambia Ancora

May 24, 2025

Forbes 2025 La Classifica Degli Uomini Piu Ricchi Del Mondo Cambia Ancora

May 24, 2025 -

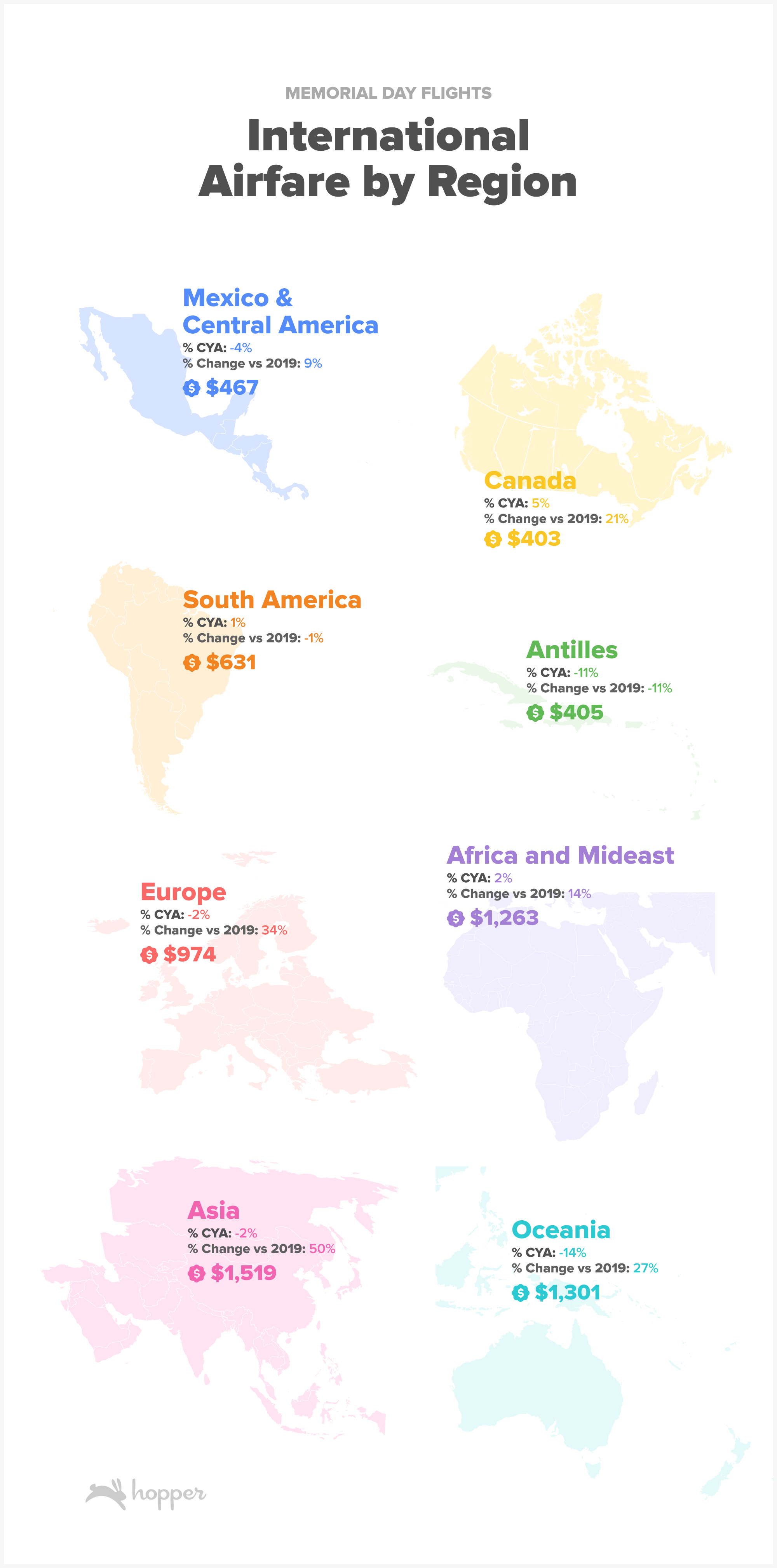

Memorial Day 2025 Airfare When To Book For The Best Prices

May 24, 2025

Memorial Day 2025 Airfare When To Book For The Best Prices

May 24, 2025 -

Essen And Nrw Die Eissorte Mit Der Keiner Gerechnet Hat

May 24, 2025

Essen And Nrw Die Eissorte Mit Der Keiner Gerechnet Hat

May 24, 2025 -

Auto Tariff Relief Speculation Lifts European Shares Lvmh Experiences Sharp Decline

May 24, 2025

Auto Tariff Relief Speculation Lifts European Shares Lvmh Experiences Sharp Decline

May 24, 2025

Latest Posts

-

The Nfls Tush Push Lives On The End Of The Butt Ban

May 24, 2025

The Nfls Tush Push Lives On The End Of The Butt Ban

May 24, 2025 -

Understanding High Stock Market Valuations Bof As Analysis

May 24, 2025

Understanding High Stock Market Valuations Bof As Analysis

May 24, 2025 -

The Thames Water Bonus Controversy What Went Wrong

May 24, 2025

The Thames Water Bonus Controversy What Went Wrong

May 24, 2025 -

Thames Water Executive Bonuses A Case Study In Corporate Governance

May 24, 2025

Thames Water Executive Bonuses A Case Study In Corporate Governance

May 24, 2025 -

Public Scrutiny Of Thames Water Executive Compensation

May 24, 2025

Public Scrutiny Of Thames Water Executive Compensation

May 24, 2025