Are Expensive Offshore Wind Farms A Risky Investment?

Table of Contents

High Initial Capital Expenditure and Financing Challenges

Building offshore wind farms requires a substantial financial commitment. The costs are staggering, encompassing various stages of development: from extensive site surveys and meticulous environmental impact assessments to the complex and costly installation of foundations, turbine procurement, and grid connection infrastructure. These projects often require billions of dollars in investment.

Securing financing for such large-scale projects presents significant challenges. While debt financing from banks and financial institutions plays a major role, attracting sufficient equity investments is crucial. Government subsidies and tax incentives are often necessary to make these projects financially viable.

- High installation and maintenance costs: Offshore conditions present unique challenges, leading to higher installation and maintenance costs compared to onshore wind farms. Specialized equipment and skilled labor are required, driving up expenses.

- Dependence on government subsidies and tax incentives: Many offshore wind projects rely heavily on government support to become commercially attractive. Changes in government policies or reductions in subsidies can significantly impact project viability.

- Difficulty in attracting private investors: The lengthy project timelines and inherent risks associated with offshore wind energy make it challenging to attract private investors who may prefer shorter-term, lower-risk ventures.

- Potential for cost overruns and delays: Unforeseen circumstances, such as adverse weather conditions or technical difficulties, can lead to significant cost overruns and project delays, impacting the overall profitability.

Technological Risks and Operational Challenges

Offshore wind turbine technology is complex and constantly evolving. Reliability, maintenance, and repair in harsh marine environments pose considerable operational challenges. The turbines themselves are sophisticated pieces of engineering, subject to failures due to extreme weather, saltwater corrosion, and other factors.

Downtime caused by storms, equipment malfunctions, or grid connection issues can significantly impact energy production and revenue, making reliable technology crucial for the success of the project. This is particularly relevant when considering the return on investment (ROI) for offshore wind farms.

- Risk of turbine failure due to extreme weather conditions: Offshore locations are exposed to severe weather events that can damage or destroy turbines, leading to costly repairs or replacements.

- Challenges in accessing and maintaining turbines in remote locations: Servicing and repairing turbines in remote offshore locations can be difficult, expensive, and time-consuming, impacting operational efficiency.

- Potential for grid instability and power outages: Integrating large-scale offshore wind farms into existing electricity grids can pose challenges and risks related to grid stability and potential power outages.

- Technological advancements: Continuous technological advancements in turbine design, materials, and monitoring systems are helping to mitigate some of these technological risks and improve operational efficiency.

Environmental and Regulatory Risks

The potential environmental impacts of offshore wind farms must be carefully considered. Concerns exist about the effects on marine ecosystems, including noise pollution impacting marine mammals, habitat disruption for fish and other species, and the potential effects on bird populations. Thorough environmental impact assessments are crucial.

Navigating the regulatory landscape is another significant challenge. Obtaining necessary permits and approvals can be a lengthy and complex process, involving multiple government agencies and stakeholders. Regulatory uncertainty and potential changes in environmental policies add further risk.

- Potential impact on marine wildlife: Noise pollution from construction and operation can negatively affect marine wildlife, including marine mammals and fish. Habitat disruption from construction activities can also harm local ecosystems.

- Public opposition and concerns regarding visual impacts: Visual impacts on coastal landscapes can lead to public opposition and delays in project approvals.

- Lengthy and complex permitting processes: Securing all necessary permits and approvals can take several years, adding to project timelines and costs.

- Regulatory uncertainty and potential changes in policy: Changes in environmental regulations or government policies can impact project viability and profitability.

Geopolitical Risks and International Collaboration

Many offshore wind projects involve international collaborations, introducing geopolitical risks. Political instability in countries involved in the supply chain, trade disputes, and currency fluctuations can all impact project timelines and costs. Furthermore, reliance on international supply chains for components and expertise introduces additional vulnerabilities.

- Dependence on international supply chains: Offshore wind projects often rely on international supply chains for specialized components and expertise. Disruptions to these supply chains can cause delays and cost overruns.

- Geopolitical instability affecting project timelines and costs: Political instability or conflicts in regions involved in the project can significantly impact timelines and costs.

- Currency fluctuations impacting investment returns: Fluctuations in currency exchange rates can affect the profitability of projects involving international partners.

Potential Returns and Long-Term Viability

Despite the challenges, offshore wind farms offer significant long-term revenue potential. Power Purchase Agreements (PPAs) provide stable, long-term revenue streams, while carbon credit mechanisms can generate additional income. Government incentives and policies, such as Renewable Portfolio Standards (RPS) and tax credits, further support the financial viability of these projects. The increasing global demand for renewable energy sources is driving market growth, creating a favorable long-term outlook.

- Stable long-term revenue streams through PPAs: PPAs guarantee a fixed price for the electricity generated, providing a predictable and stable revenue stream for project developers.

- Potential for carbon credit revenue: Offshore wind farms contribute to reducing carbon emissions, creating opportunities to generate revenue through carbon credit markets.

- Increasing demand for renewable energy driving market growth: The global shift towards renewable energy is driving strong demand for offshore wind energy, increasing market attractiveness.

- Government policies and support reducing financial risks: Government policies and incentives, such as tax credits and subsidies, help to mitigate financial risks and improve project viability.

Conclusion

Investing in expensive offshore wind farms presents a complex equation, balancing significant upfront costs and technological challenges against the long-term potential for renewable energy generation and substantial returns. While risks are inherent, mitigation strategies exist. Careful planning, thorough risk assessment, robust financing structures, and continuous technological advancements are key to unlocking the potential of offshore wind energy.

Understanding the risks and rewards is crucial before making an investment in offshore wind farms. Conduct thorough due diligence, explore risk mitigation strategies, and seek expert advice to navigate the complexities of this evolving market. Learn more about the financial aspects of offshore wind farm investments today.

Featured Posts

-

Reform Uk Internal Conflict Whats Happening

May 03, 2025

Reform Uk Internal Conflict Whats Happening

May 03, 2025 -

George Floyd Protest Fbi Agents Reassigned Following Controversial Photo

May 03, 2025

George Floyd Protest Fbi Agents Reassigned Following Controversial Photo

May 03, 2025 -

Your Place In The Sun Navigating The Overseas Property Market

May 03, 2025

Your Place In The Sun Navigating The Overseas Property Market

May 03, 2025 -

Techiman South Ndc Election Petition Dismissed By High Court

May 03, 2025

Techiman South Ndc Election Petition Dismissed By High Court

May 03, 2025 -

Serie Joseph Tf 1 Critique Et Analyse De La Nouvelle Serie Policiere

May 03, 2025

Serie Joseph Tf 1 Critique Et Analyse De La Nouvelle Serie Policiere

May 03, 2025

Latest Posts

-

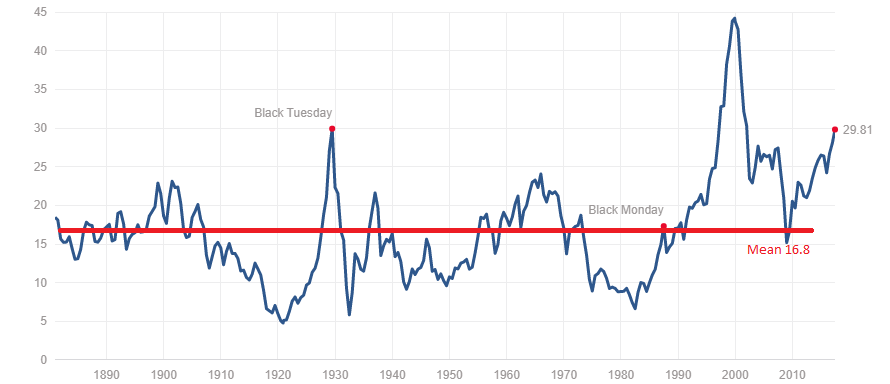

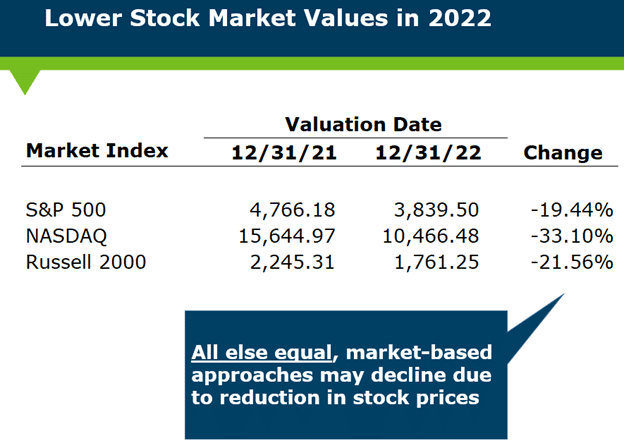

Stock Market Valuations Bof As Reassurance For Investors

May 04, 2025

Stock Market Valuations Bof As Reassurance For Investors

May 04, 2025 -

Are High Stock Market Valuations Cause For Concern Bof As Analysis

May 04, 2025

Are High Stock Market Valuations Cause For Concern Bof As Analysis

May 04, 2025 -

Effective Middle Management Key To Employee Engagement And Business Growth

May 04, 2025

Effective Middle Management Key To Employee Engagement And Business Growth

May 04, 2025 -

The China Factor Assessing Risks And Opportunities For Automakers Like Bmw And Porsche

May 04, 2025

The China Factor Assessing Risks And Opportunities For Automakers Like Bmw And Porsche

May 04, 2025 -

The Power Of Middle Management Fostering Collaboration And Driving Results

May 04, 2025

The Power Of Middle Management Fostering Collaboration And Driving Results

May 04, 2025