Big Oil Holds Firm On Production Despite Rising Demand: OPEC+ Implications

Table of Contents

OPEC+ Production Strategy and its Rationale

The OPEC+ alliance, comprising the Organization of the Petroleum Exporting Countries (OPEC) and other major oil-producing nations, has a complex production strategy. Their current agreement focuses on gradual production adjustments, often prioritizing market stability and preventing price crashes. However, the decision to resist increasing output in the face of rising demand raises questions about their underlying motives.

Several factors influence OPEC+'s decision to maintain production levels:

- Market Share: Maintaining current production levels allows OPEC+ members to retain a significant share of the global oil market, potentially hindering the growth of competing producers.

- Price Stability: While higher demand might justify increased production for higher profits, OPEC+ might fear that a sudden supply surge could lead to a significant price drop, impacting the revenue of member states.

- Geopolitical Considerations: The decisions of OPEC+ are often influenced by geopolitical factors, including relations between member countries and their strategies concerning competing energy sources and international relations.

Current production quotas for major OPEC+ members vary significantly, reflecting their individual production capacities and economic needs. The reasons behind the decision to resist increasing production are multifaceted, involving a blend of economic calculations and geopolitical strategies. The potential risks of this strategy include exacerbating inflation and fueling global economic instability. However, the benefits, from their perspective, lie in preserving market share and maintaining price stability within a desired range.

Impact on Global Oil Prices and Market Volatility

Constrained supply in the face of rising demand inevitably exerts upward pressure on global oil prices. This limited supply creates an imbalance, increasing the potential for price volatility. Small disruptions to production or unexpected increases in demand can trigger significant price swings.

- Recent trends in oil prices show a steady climb, driven by increasing demand and production constraints.

- Forecasts for future oil prices, based on current production levels, predict continued upward pressure, potentially leading to further economic uncertainty.

- The impact on inflation and consumer spending is substantial. Higher oil prices translate directly into higher transportation costs, impacting the cost of goods and services across the board.

The current situation sets the stage for a potentially volatile oil market, sensitive to even minor changes in supply or demand.

Consequences for Consumers and the Global Economy

Higher oil prices have far-reaching consequences for consumers and the global economy. Increased energy costs affect transportation, manufacturing, and heating, leading to higher prices for various goods and services.

- Specific examples of sectors most affected by rising oil prices include transportation (airlines, trucking), manufacturing (energy-intensive industries), and agriculture (fertilizers, machinery).

- Potential government responses to rising energy costs range from subsidies and tax breaks to investments in renewable energy sources.

- Long-term implications for economic stability are concerning, with the potential for reduced economic growth and increased social unrest.

The sustained pressure on oil prices risks further fueling inflation and potentially hindering economic growth, particularly in developing nations heavily reliant on oil imports.

Geopolitical Implications and Strategic Alliances

OPEC+'s production decisions have significant geopolitical implications, influencing the relationships between member countries and other oil-producing nations. The strategy impacts global energy security and the balance of power within the international community.

- Examples of countries impacted by OPEC+'s decisions include oil-importing nations experiencing increased inflation and economic strain.

- Potential for increased competition among oil-producing nations rises as countries seek to increase their market share in a constrained environment.

- The role of alternative energy sources in mitigating the impact of OPEC+'s strategy is becoming increasingly important as nations invest in renewable energy alternatives to reduce their reliance on fossil fuels.

The current situation highlights the complexities of global energy politics and the need for diverse and sustainable energy solutions.

Conclusion: Big Oil's Production Strategy and the Future of OPEC+

Big oil's decision to maintain production levels despite surging global demand has significant implications. This strategy, driven by a combination of economic and geopolitical factors, directly impacts global oil prices, consumer spending, and overall economic stability. Higher oil prices translate to increased costs for consumers and businesses, potentially hindering economic growth and fueling inflation. The geopolitical implications are equally significant, impacting relationships between oil-producing nations and the global energy landscape. Understanding the implications of big oil's production strategy is crucial for navigating the complexities of the global energy market. To stay informed about future developments, follow relevant news sources and engage in ongoing discussions regarding the future of OPEC+ production and its impact on the global energy markets. Understanding the intricacies of this dynamic situation is crucial for making informed decisions in the face of this evolving challenge.

Featured Posts

-

Analysis Gold Suffers First Double Week Loss Of 2025

May 05, 2025

Analysis Gold Suffers First Double Week Loss Of 2025

May 05, 2025 -

Supporting Lizzo Her Trainer Addresses Fitness Criticism

May 05, 2025

Supporting Lizzo Her Trainer Addresses Fitness Criticism

May 05, 2025 -

The Influence Of Peter Green Shaping The Sound Of Fleetwood Mac

May 05, 2025

The Influence Of Peter Green Shaping The Sound Of Fleetwood Mac

May 05, 2025 -

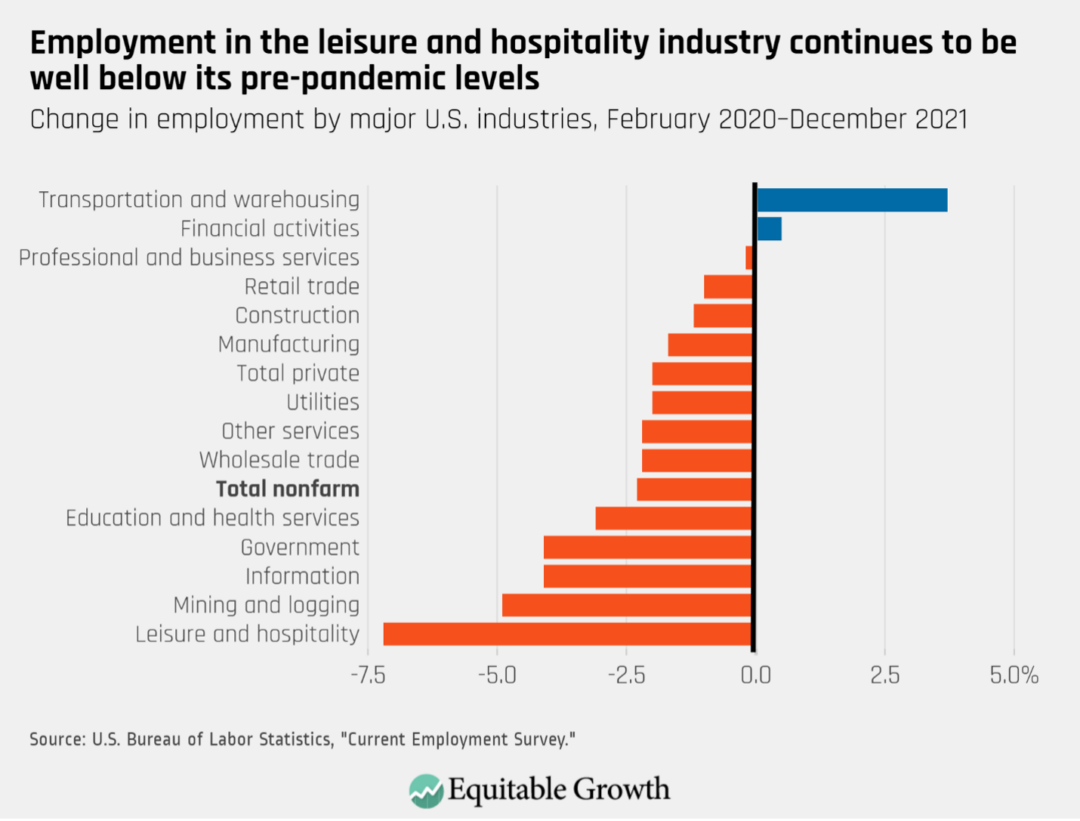

Strong April Jobs Report U S Employment Growth Continues

May 05, 2025

Strong April Jobs Report U S Employment Growth Continues

May 05, 2025 -

Showdown Saturday Nhl Playoffs Crucial Games And Standings Update

May 05, 2025

Showdown Saturday Nhl Playoffs Crucial Games And Standings Update

May 05, 2025

Latest Posts

-

Exploring Fleetwood Macs Vast And Popular Music Catalog

May 05, 2025

Exploring Fleetwood Macs Vast And Popular Music Catalog

May 05, 2025 -

Fleetwood Macs Extensive Catalog Enduring Popularity Of Their Top Albums

May 05, 2025

Fleetwood Macs Extensive Catalog Enduring Popularity Of Their Top Albums

May 05, 2025 -

Lindsey Buckingham And Mick Fleetwood Reunite In The Studio

May 05, 2025

Lindsey Buckingham And Mick Fleetwood Reunite In The Studio

May 05, 2025 -

Lindsey Buckingham And Mick Fleetwood A Studio Reunion

May 05, 2025

Lindsey Buckingham And Mick Fleetwood A Studio Reunion

May 05, 2025 -

The Lindsey Buckingham And Mick Fleetwood Reunion Details And Fan Reactions

May 05, 2025

The Lindsey Buckingham And Mick Fleetwood Reunion Details And Fan Reactions

May 05, 2025