Bitcoin Price Rally: Analysis Of The Recent Surge Towards $100,000

Table of Contents

Macroeconomic Factors Fueling the Bitcoin Price Rally

Several macroeconomic trends have significantly contributed to the recent Bitcoin price rally, positioning Bitcoin as a potential safe haven asset and a hedge against inflation.

Inflation and the Search for Safe Havens

High inflation rates globally are eroding the purchasing power of fiat currencies, pushing investors towards alternative assets perceived as inflation hedges. Bitcoin, with its fixed supply of 21 million coins, is increasingly seen as a store of value, similar to gold. This decreased faith in traditional financial systems is a major catalyst for the Bitcoin price surge.

- Decreased faith in fiat currencies: Concerns about government debt and quantitative easing policies are fueling a flight to alternative assets.

- Increased demand for Bitcoin as a store of value: Investors are seeking assets that hold their value despite inflationary pressures.

- Institutional investment in Bitcoin: Large corporations and institutional investors are allocating a portion of their portfolios to Bitcoin, further increasing demand.

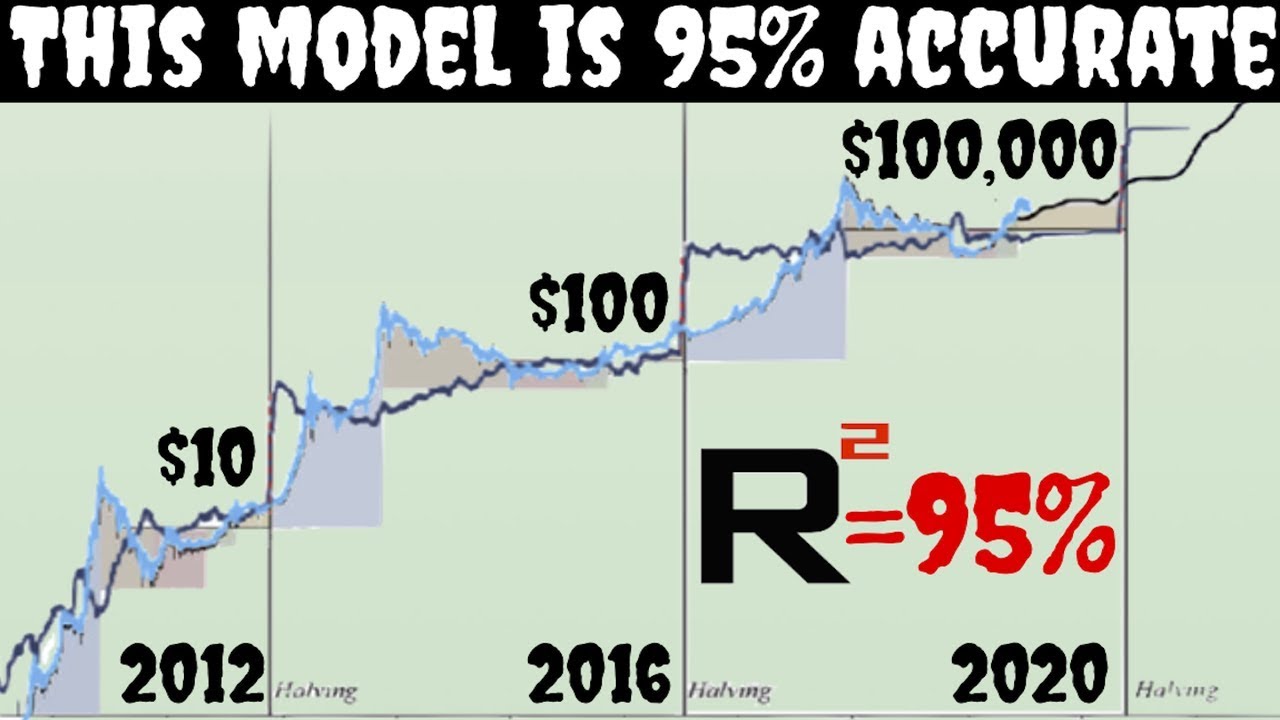

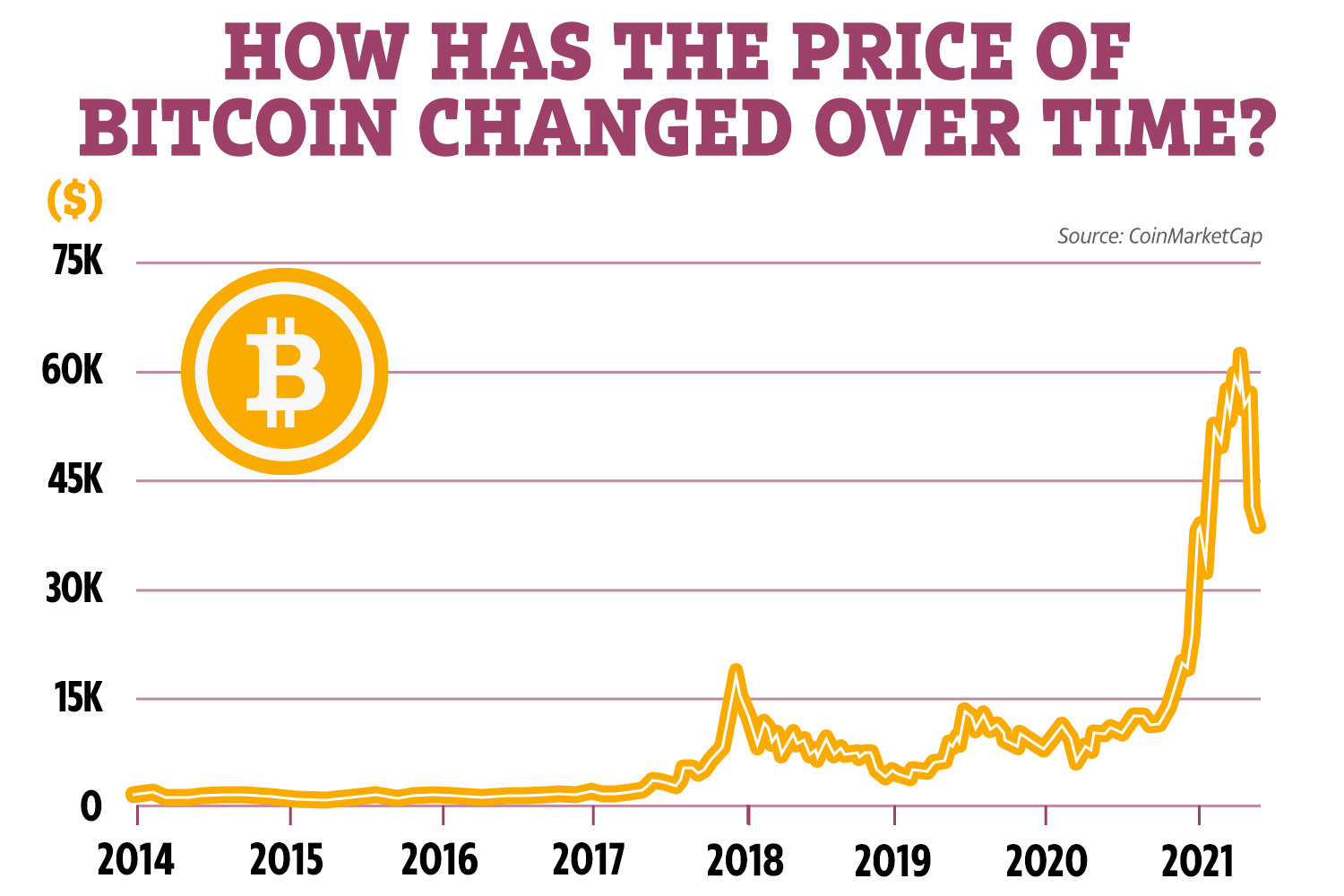

Data reveals a strong correlation between rising inflation rates in various countries and an increase in Bitcoin's price. For instance, during periods of high inflation in 2021, Bitcoin experienced significant price appreciation. This suggests a growing recognition of Bitcoin as a hedge against economic uncertainty.

Government Regulations and Institutional Adoption

Evolving government regulations and increasing institutional adoption are significantly bolstering investor confidence in Bitcoin. While regulatory uncertainty remains a concern in some jurisdictions, positive developments are driving increased legitimacy and acceptance.

- Grayscale Bitcoin Trust (GBTC): The continued growth of GBTC, a publicly traded Bitcoin investment vehicle, demonstrates institutional interest in Bitcoin.

- MicroStrategy's Bitcoin holdings: MicroStrategy's substantial Bitcoin holdings showcase the growing acceptance of Bitcoin as a corporate treasury asset.

- Positive regulatory shifts in certain jurisdictions: Favorable regulatory frameworks in some countries are fostering a more conducive environment for Bitcoin adoption and investment.

The entry of institutional investors into the Bitcoin market adds significant weight to the price rally. Their substantial investments inject liquidity and stability, making Bitcoin a more attractive asset for both institutional and retail investors.

Technological Advancements and Network Upgrades

Significant technological advancements and network upgrades have enhanced Bitcoin's functionality, scalability, and security, attracting more users and investors, contributing to the Bitcoin price surge.

The Lightning Network and Scalability Improvements

The Lightning Network, a layer-2 scaling solution, addresses Bitcoin's scalability challenges by enabling faster and cheaper transactions outside the main blockchain. This improvement in transaction speed and efficiency contributes to increased adoption and price appreciation.

- Increased transaction throughput: The Lightning Network dramatically increases the number of transactions Bitcoin can process per second.

- Reduced transaction fees: Users benefit from significantly lower transaction fees compared to on-chain transactions.

- Enhanced scalability: The Lightning Network enhances Bitcoin's ability to handle a growing number of users and transactions.

- Improved user experience: Faster and cheaper transactions lead to a more user-friendly experience, encouraging wider adoption.

Taproot Upgrade and Enhanced Privacy

The Taproot upgrade, implemented in 2021, significantly improved Bitcoin's functionality and security, making it more attractive to users and investors.

- Improved privacy features: Taproot enhances the privacy of Bitcoin transactions by making them more indistinguishable.

- Reduced transaction sizes: Taproot reduces the size of Bitcoin transactions, further improving scalability and efficiency.

- Enhanced smart contract capabilities: Taproot lays the groundwork for more sophisticated smart contract functionality on the Bitcoin network.

Market Sentiment and Speculative Trading

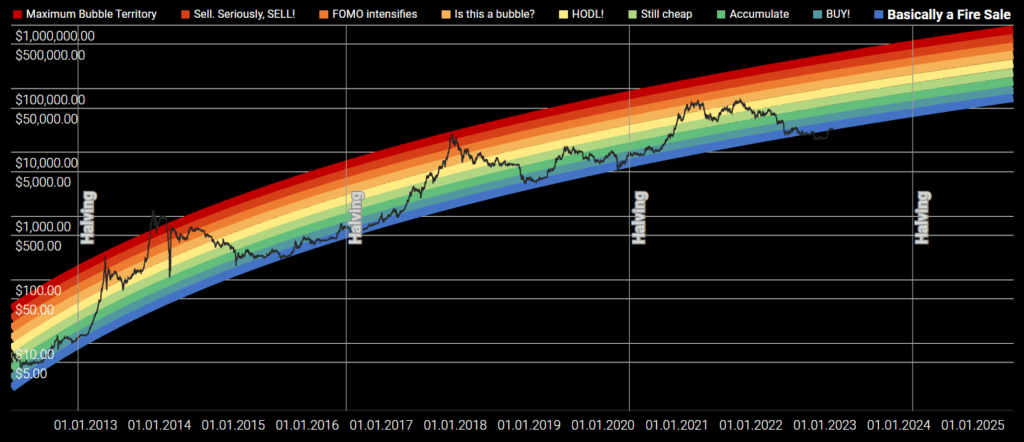

Market sentiment, driven by social media influence and retail investor participation, significantly impacts Bitcoin's price volatility and contributes to the current Bitcoin price rally.

Social Media Influence and FOMO

Social media platforms play a considerable role in shaping market sentiment, particularly through influencer marketing and the "fear of missing out" (FOMO) effect.

- Elon Musk's tweets: High-profile endorsements from influential figures like Elon Musk can trigger significant price swings.

- Celebrity endorsements: Celebrities promoting Bitcoin can increase public awareness and drive demand.

- Impact of viral trends: Viral trends and online discussions can significantly influence market sentiment and create speculative bubbles.

Retail Investor Participation and Market Volatility

Increased participation from retail investors has amplified Bitcoin's volatility, contributing to both upward and downward price swings.

- Increased trading volume: Retail investor activity contributes to higher trading volumes, making the market more susceptible to price fluctuations.

- Price fluctuations: The influx of retail investors can lead to rapid price increases and decreases.

- The role of exchanges: The role of cryptocurrency exchanges in facilitating retail trading is crucial in understanding market volatility.

Conclusion

The recent Bitcoin price rally towards $100,000 is a complex phenomenon driven by a confluence of macroeconomic factors, technological advancements, and market sentiment. Increased institutional adoption, inflation concerns, and significant network upgrades like Taproot have all contributed to this remarkable surge. However, volatility remains an inherent characteristic of the cryptocurrency market. Understanding the interplay of these forces is crucial for navigating the Bitcoin landscape.

Call to Action: Understanding the drivers behind the Bitcoin price rally is crucial for both seasoned investors and newcomers. Continue learning about the factors influencing the Bitcoin price, stay updated on market trends, and make informed decisions regarding your Bitcoin investment strategy. Keep monitoring the Bitcoin price rally and its potential future developments. The future of Bitcoin, and the broader crypto market, is still unfolding – stay informed to make the most of this exciting asset class.

Featured Posts

-

Eastern Conference Finals Cavaliers Claim Top Spot

May 07, 2025

Eastern Conference Finals Cavaliers Claim Top Spot

May 07, 2025 -

Police Respond To Shooting At Arizona Restaurant Several Injured

May 07, 2025

Police Respond To Shooting At Arizona Restaurant Several Injured

May 07, 2025 -

The Karate Kid A Comprehensive Guide To The Franchise

May 07, 2025

The Karate Kid A Comprehensive Guide To The Franchise

May 07, 2025 -

Analysis Chicago Bulls 22 Point Loss To Cleveland Cavaliers

May 07, 2025

Analysis Chicago Bulls 22 Point Loss To Cleveland Cavaliers

May 07, 2025 -

Capitals Duo Ovechkin And Orlovs Miami Intermission

May 07, 2025

Capitals Duo Ovechkin And Orlovs Miami Intermission

May 07, 2025

Latest Posts

-

Alex Carusos Playoff History Making Performance In Thunder Game 1 Victory

May 08, 2025

Alex Carusos Playoff History Making Performance In Thunder Game 1 Victory

May 08, 2025 -

Analyzing The 1 500 Bitcoin Growth Prediction A Realistic Outlook

May 08, 2025

Analyzing The 1 500 Bitcoin Growth Prediction A Realistic Outlook

May 08, 2025 -

Bitcoin Investment Weighing The Potential For A 1 500 Return

May 08, 2025

Bitcoin Investment Weighing The Potential For A 1 500 Return

May 08, 2025 -

Five Year Bitcoin Forecast Potential For A 1 500 Rise

May 08, 2025

Five Year Bitcoin Forecast Potential For A 1 500 Rise

May 08, 2025 -

1 500 Bitcoin Growth Fact Or Fiction Examining The Prediction

May 08, 2025

1 500 Bitcoin Growth Fact Or Fiction Examining The Prediction

May 08, 2025