Bitcoin's 10-Week High: Implications For The $100,000 Price Target

Table of Contents

Factors Contributing to Bitcoin's 10-Week High

Several interconnected factors have contributed to Bitcoin's impressive 10-week high, creating a confluence of positive influences on its price. Understanding these factors is crucial for assessing the likelihood of it reaching the $100,000 target.

Increased Institutional Investment

The growing adoption of Bitcoin by institutional investors is a major catalyst for the recent price surge. Hedge funds, corporations, and even sovereign wealth funds are increasingly allocating a portion of their portfolios to Bitcoin, driven by several key factors. MicroStrategy, Tesla, and numerous other large corporations have made significant Bitcoin purchases, demonstrating a growing confidence in the cryptocurrency's long-term value proposition.

- Increased regulatory clarity: While regulatory frameworks still vary significantly across jurisdictions, increasing clarity around Bitcoin's legal status in key markets has boosted investor confidence.

- Improved custodial solutions: The emergence of secure and regulated custodial services has made it easier for institutional investors to manage and safeguard their Bitcoin holdings.

- Diversification strategies: Many institutions are incorporating Bitcoin into their portfolios as a hedge against traditional asset classes, seeking diversification and potentially higher returns.

Macroeconomic Factors and Inflation

The current macroeconomic environment plays a significant role in Bitcoin's price appreciation. Global inflation, coupled with concerns about fiat currency devaluation, has driven investors towards alternative assets like Bitcoin, perceived as a store of value that is less susceptible to inflationary pressures.

- Weakening dollar: The weakening US dollar, a reserve currency, makes alternative assets like Bitcoin more attractive to international investors.

- Rising inflation rates: High inflation erodes the purchasing power of fiat currencies, pushing investors to seek inflation hedges like Bitcoin.

- Potential for quantitative easing: Continued monetary easing by central banks can further fuel inflation, increasing the demand for Bitcoin as a safe haven asset.

Growing Adoption and Network Activity

The expanding global adoption of Bitcoin as both a payment method and a store of value is another key driver of its price increase. Increased network activity, such as transaction volume and hash rate, reflects a growing and more robust ecosystem.

- Increased user adoption in emerging markets: Bitcoin is gaining traction in developing countries where traditional financial systems may be underdeveloped or unreliable.

- Growing merchant acceptance: More and more businesses are accepting Bitcoin as a form of payment, broadening its use cases and increasing demand.

- Improving transaction speeds: The expansion of the Lightning Network, a second-layer scaling solution, is improving Bitcoin's transaction speeds and reducing fees, enhancing its practicality for everyday use.

Assessing the Viability of the $100,000 Price Target

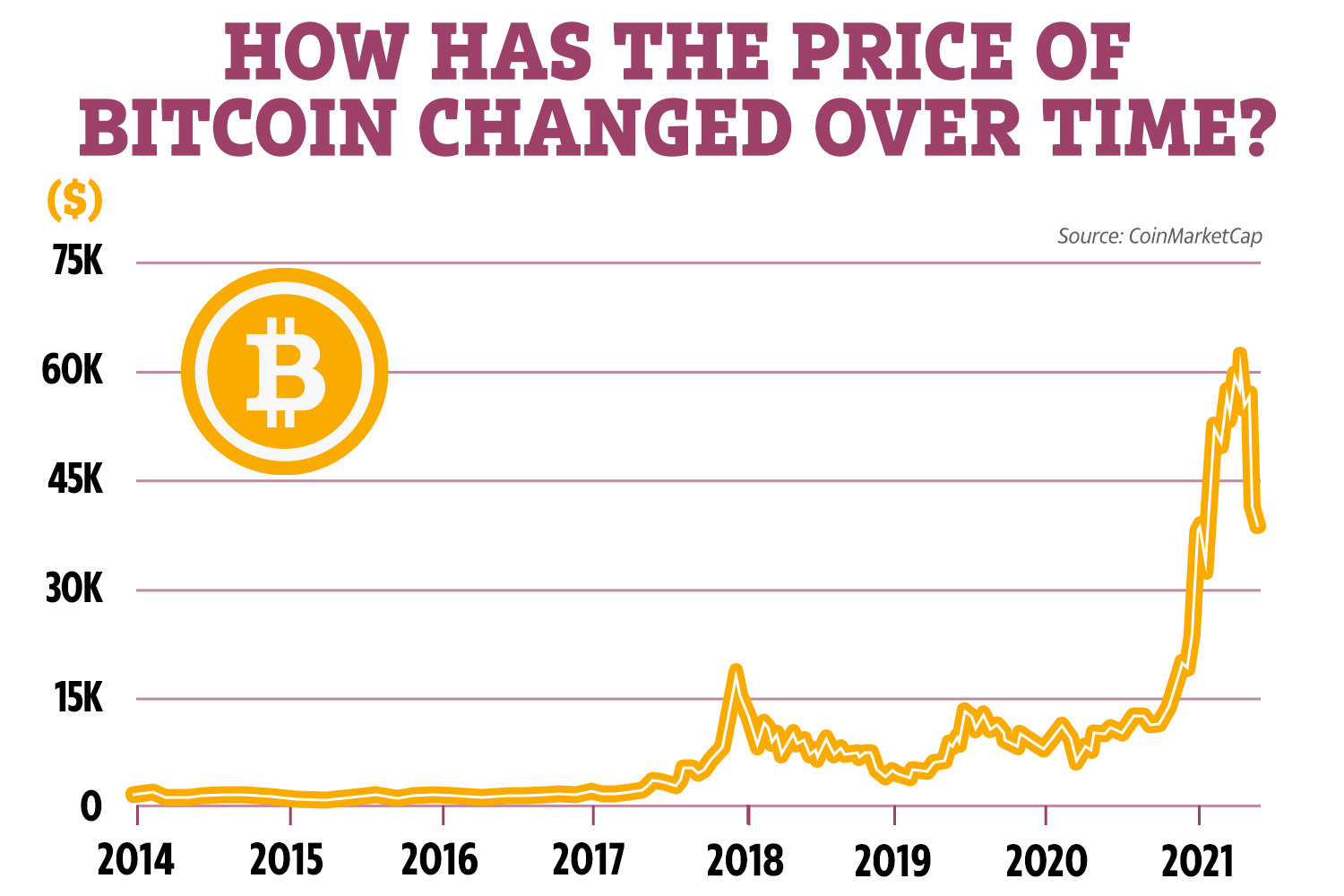

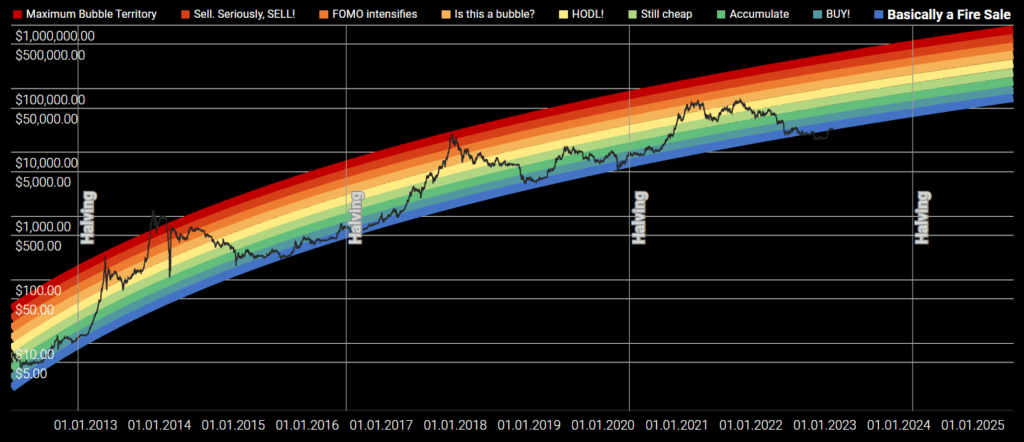

While Bitcoin's recent surge is encouraging, reaching the $100,000 price target is not guaranteed. A comprehensive analysis requires examining various factors, including technical analysis, on-chain metrics, and potential risks.

Technical Analysis and Chart Patterns

Technical analysis plays a crucial role in predicting potential price movements. Examining Bitcoin's price charts, identifying support and resistance levels, and analyzing technical indicators can offer insights into potential future price action.

- Moving averages: Analyzing moving averages helps identify trends and potential trend reversals.

- RSI (Relative Strength Index): RSI is a momentum indicator that can signal overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): MACD is a trend-following momentum indicator that can help identify buy and sell signals.

- Fibonacci retracements: Fibonacci retracements are used to identify potential support and resistance levels based on historical price movements.

On-Chain Metrics and Market Sentiment

Analyzing on-chain data, such as the distribution of Bitcoin supply, active addresses, and transaction volume, provides valuable insights into market sentiment and potential price trends.

- Whale accumulation: Tracking large Bitcoin holdings (whale activity) can indicate potential future price movements.

- Miner behavior: Analyzing miner behavior, such as hash rate and mining profitability, can provide insights into the health and stability of the network.

- Network growth: Monitoring the growth of the Bitcoin network, such as the number of active addresses and transactions, reflects overall adoption and usage.

Potential Risks and Challenges

Despite the positive momentum, several risks could hinder Bitcoin's progress toward the $100,000 price target.

- Regulatory crackdowns: Increased regulatory scrutiny in various jurisdictions could negatively impact Bitcoin's price.

- Market manipulation: The potential for market manipulation remains a concern, although it's increasingly difficult to manipulate Bitcoin's price due to its decentralized nature and growing liquidity.

- Security breaches: While the Bitcoin network itself is secure, exchanges and custodial services remain vulnerable to security breaches, which could negatively impact investor confidence.

Conclusion

Bitcoin's recent 10-week high is a significant development, influenced by a confluence of factors including increased institutional investment, favorable macroeconomic conditions, and growing adoption. While the $100,000 price target remains ambitious, the current momentum and underlying fundamentals suggest a potential path towards it. However, it's crucial to acknowledge the inherent risks and uncertainties within the cryptocurrency market. Further analysis of technical indicators, on-chain metrics, and macroeconomic trends is essential to accurately predict Bitcoin's future price. Stay informed and continue researching Bitcoin's price movements to make informed decisions regarding your investment strategy. Monitor the ongoing developments in the Bitcoin market and assess the implications for the coveted $100,000 price target.

Featured Posts

-

Nba Fines Anthony Edwards 50 000 For Vulgar Comment To Fan

May 07, 2025

Nba Fines Anthony Edwards 50 000 For Vulgar Comment To Fan

May 07, 2025 -

Ralph Macchio On My Cousin Vinny Reboot Update And Joe Pescis Involvement

May 07, 2025

Ralph Macchio On My Cousin Vinny Reboot Update And Joe Pescis Involvement

May 07, 2025 -

Understanding The Value Of Middle Management In Todays Workplace

May 07, 2025

Understanding The Value Of Middle Management In Todays Workplace

May 07, 2025 -

Papezev Pozdrav Mnozici Na Trgu Sv Petra Pred Tradicionalnim Blagoslovom

May 07, 2025

Papezev Pozdrav Mnozici Na Trgu Sv Petra Pred Tradicionalnim Blagoslovom

May 07, 2025 -

Is Macrons Vision For A European Netflix Becoming Reality

May 07, 2025

Is Macrons Vision For A European Netflix Becoming Reality

May 07, 2025

Latest Posts

-

Bitcoin Investment Weighing The Potential For A 1 500 Return

May 08, 2025

Bitcoin Investment Weighing The Potential For A 1 500 Return

May 08, 2025 -

Five Year Bitcoin Forecast Potential For A 1 500 Rise

May 08, 2025

Five Year Bitcoin Forecast Potential For A 1 500 Rise

May 08, 2025 -

1 500 Bitcoin Growth Fact Or Fiction Examining The Prediction

May 08, 2025

1 500 Bitcoin Growth Fact Or Fiction Examining The Prediction

May 08, 2025 -

Is A 1 500 Bitcoin Price Surge Realistic Expert Analysis

May 08, 2025

Is A 1 500 Bitcoin Price Surge Realistic Expert Analysis

May 08, 2025 -

Wall Street Predicts 110 Gain For This Black Rock Etf In 2025

May 08, 2025

Wall Street Predicts 110 Gain For This Black Rock Etf In 2025

May 08, 2025