BofA's Reassurance: Why Stretched Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Positive Outlook and Underlying Rationale

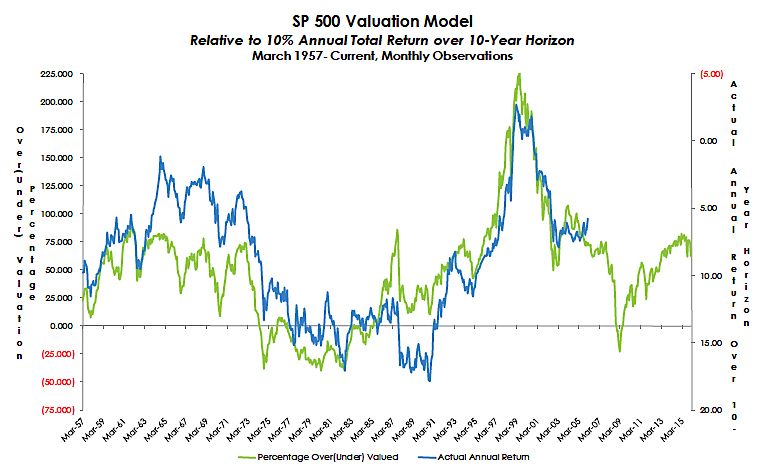

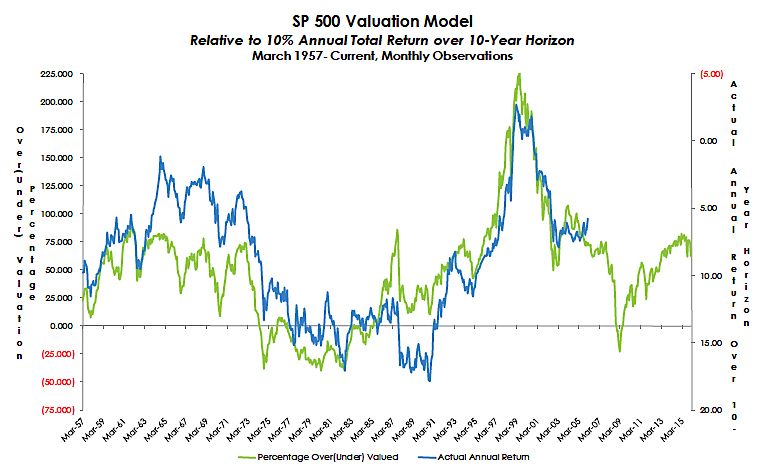

BofA's recent reports paint a surprisingly positive picture, arguing that current market valuations, while high, are not necessarily unsustainable. Their analysis considers a multitude of factors beyond simple price-to-earnings (P/E) ratios.

- Key Data Points: BofA cites projected earnings growth significantly outpacing inflation, suggesting that current valuations, even if seemingly high by historical standards, are supported by robust corporate profitability. They may also highlight specific P/E ratios for certain sectors and compare them to historical averages, showing that while elevated, these ratios aren't unprecedented in periods of strong economic growth.

- Methodology: BofA's assessment likely involves sophisticated econometric modeling, incorporating macroeconomic indicators, interest rate forecasts, and detailed company-specific financial projections. This detailed approach provides a more nuanced picture than simply looking at headline P/E ratios.

- Sector-Specific Bullishness: BofA might highlight sectors positioned to benefit from specific economic trends. For example, they might point to the continued growth potential of technology companies adapting to AI, or the resilience of consumer staples in the face of inflationary pressures. These sector-specific analyses further support their overall positive outlook, even amidst concerns about stretched valuations.

Addressing the Concerns of Stretched Stock Market Valuations

It's undeniable that high valuations carry inherent risks. The fear of a market correction is understandable. However, BofA's analysis attempts to mitigate these anxieties.

- Mitigating Valuation Risks: BofA likely points to robust corporate earnings growth as a key factor. Strong earnings can justify higher prices, even if P/E ratios appear elevated. Furthermore, relatively low inflation expectations (compared to recent peaks) may contribute to a more stable market environment.

- Interest Rate Impact: BofA's analysis likely incorporates various interest rate hike scenarios and their potential effects on stock valuations. While higher rates can impact valuations, the impact might be offset by the positive effects of stronger corporate earnings or other mitigating factors.

- Counterargument Rebuttals: The analysis likely addresses potential counterarguments, such as the possibility of a recession or a sharp downturn in corporate profits. BofA would likely provide data-driven rebuttals, highlighting factors that lessen the likelihood of these scenarios or emphasizing their preparedness for various economic outcomes.

The Role of Earnings Growth in Justifying Current Valuations

Projected earnings growth is crucial to BofA's positive outlook. High valuations become less concerning if companies continue to demonstrate strong profit increases.

- Examples of Strong Earnings Growth: BofA might cite specific examples of companies exceeding earnings expectations and exhibiting significant year-over-year growth. These examples support their argument that current valuations are not entirely detached from underlying fundamentals.

- P/E Ratio Context: High P/E ratios are often interpreted as overvaluation. However, if earnings are also expected to grow rapidly, the P/E ratio might normalize over time, making current valuations less concerning. BofA's analysis would likely emphasize this dynamic.

- Industry-Specific Factors: Earnings growth isn't uniform across all sectors. BofA's analysis likely accounts for industry-specific factors that drive varying levels of earnings growth and their impact on valuations within those sectors.

Long-Term Economic Projections and Their Influence on Market Sentiment

BofA's long-term economic outlook plays a significant role in justifying its positive market assessment, even amidst concerns of stretched stock market valuations.

- Supporting Economic Indicators: Their positive outlook is probably supported by projections of continued, albeit possibly slower, economic growth, low unemployment, and gradual inflation moderation. These indicators provide a backdrop for sustained corporate profitability.

- Long-Term Perspective: BofA likely argues that focusing on the long-term economic outlook mitigates the significance of short-term valuation fluctuations. Short-term market volatility is normal, and a long-term perspective is vital for successful investing.

- Geopolitical Factors: BofA's projections will likely incorporate considerations of geopolitical risks and their potential impact on the economy and market performance. They'd likely assess the potential impact of these events and offer an outlook that accounts for such uncertainties.

Diversification Strategies for Managing Valuation Risk

Even with a positive outlook, diversification remains crucial for managing risk in a market with stretched stock market valuations.

- Asset Class Diversification: Investors should consider diversifying across asset classes, including stocks, bonds, and potentially real estate, to reduce their overall portfolio's sensitivity to market fluctuations.

- Long-Term Investment Horizon: Maintaining a long-term investment horizon helps to weather short-term market volatility. Focusing on long-term growth reduces the impact of short-term valuation swings.

- Individualized Investment Strategy: It's vital to develop an investment strategy tailored to individual risk tolerance and financial goals. This requires careful consideration of one's personal circumstances and investment timeline.

Conclusion

BofA's analysis suggests that while "stretched stock market valuations" are a valid concern, they aren't necessarily a cause for immediate alarm. Robust earnings growth projections, a positive long-term economic outlook, and effective diversification strategies offer mitigating factors. Remember, even with high valuations, the overall outlook isn't necessarily bearish. Consider BofA's findings when making investment decisions, but always consult a financial advisor for personalized guidance on navigating these potentially volatile markets and managing your exposure to stretched stock market valuations. Further research into BofA's reports and related market analyses can provide a more comprehensive understanding of the current economic climate.

Featured Posts

-

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Jan 6th Falsehoods Allegations

Apr 29, 2025

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Jan 6th Falsehoods Allegations

Apr 29, 2025 -

Dsp Mutual Fund Cautious Outlook On Indian Stocks Increases Cash Reserves

Apr 29, 2025

Dsp Mutual Fund Cautious Outlook On Indian Stocks Increases Cash Reserves

Apr 29, 2025 -

Details Revealed Ccp United Front Work In Minnesota

Apr 29, 2025

Details Revealed Ccp United Front Work In Minnesota

Apr 29, 2025 -

Tariff Uncertainty Drives U S Businesses To Cut Costs

Apr 29, 2025

Tariff Uncertainty Drives U S Businesses To Cut Costs

Apr 29, 2025 -

Us Aid Sought By Lynas Rare Earths For Texas Refinery Due To Increased Costs

Apr 29, 2025

Us Aid Sought By Lynas Rare Earths For Texas Refinery Due To Increased Costs

Apr 29, 2025

Latest Posts

-

The Impact Of Zombie Office Buildings On Chicagos Real Estate Market

Apr 29, 2025

The Impact Of Zombie Office Buildings On Chicagos Real Estate Market

Apr 29, 2025 -

Key Republican Groups Threaten To Block Trumps Tax Bill

Apr 29, 2025

Key Republican Groups Threaten To Block Trumps Tax Bill

Apr 29, 2025 -

Zombie Buildings In Chicago Understanding The Office Real Estate Collapse

Apr 29, 2025

Zombie Buildings In Chicago Understanding The Office Real Estate Collapse

Apr 29, 2025 -

Can Trumps Tax Cuts Survive Internal Republican Opposition

Apr 29, 2025

Can Trumps Tax Cuts Survive Internal Republican Opposition

Apr 29, 2025 -

Chicagos Office Market Meltdown The Rise Of Zombie Buildings

Apr 29, 2025

Chicagos Office Market Meltdown The Rise Of Zombie Buildings

Apr 29, 2025