DSP Mutual Fund: Cautious Outlook On Indian Stocks, Increases Cash Reserves

Table of Contents

Reasons for DSP Mutual Fund's Cautious Stance

DSP Mutual Fund's decision to increase its cash reserves reflects a prudent approach to navigating the current economic climate. Several factors contribute to this cautious stance:

Global Economic Headwinds

The global economic landscape presents significant challenges. High inflation in many developed economies has forced central banks, including the US Federal Reserve, to aggressively raise interest rates. This has led to:

- Rising US interest rates: Higher rates increase borrowing costs, impacting corporate profitability and slowing economic growth globally, including in India.

- Geopolitical instability in Europe: The ongoing conflict in Ukraine continues to disrupt global supply chains and fuel inflationary pressures.

- Supply chain disruptions: Lingering supply chain bottlenecks continue to impact businesses and contribute to higher prices.

These factors negatively impact investor sentiment, increasing market volatility and making accurate predictions difficult. This uncertainty is a key driver behind DSP Mutual Fund's more conservative approach.

Domestic Economic Concerns

Beyond global headwinds, several domestic factors also contribute to DSP Mutual Fund's cautious outlook:

- Inflationary pressures: Persistent inflation in India erodes purchasing power and dampens consumer demand.

- Rural demand slowdown: Weakness in rural consumption, a significant driver of India's economic growth, is another concern.

- Upcoming elections: Political uncertainty surrounding upcoming elections can also influence investor sentiment and market behavior.

These domestic challenges add to the overall uncertainty, prompting DSP Mutual Fund to adopt a more defensive strategy.

Valuation Concerns

DSP Mutual Fund's assessment likely includes a careful analysis of current market valuations. While specific data isn't publicly available without access to internal documents, several indicators like Price-to-Earnings (P/E) ratios and overall market capitalization may suggest that some sectors are overvalued. This perception of potentially inflated valuations contributes to their decision to increase cash reserves and avoid further investment until valuations become more attractive.

Impact of Increased Cash Reserves

The decision to increase cash reserves has several implications for DSP Mutual Fund and its investors:

Reduced Risk Exposure

Higher cash reserves act as a significant buffer against market downturns. By reducing their exposure to volatile equities, DSP Mutual Fund aims to mitigate potential losses during periods of market uncertainty. This more conservative approach prioritizes capital preservation. Risk mitigation strategies like maintaining a high cash position are particularly effective during volatile market periods.

Potential for Future Opportunities

The increased cash reserves are not intended to be a permanent holding. DSP Mutual Fund aims to deploy these funds when attractive investment opportunities emerge. A flexible approach allows for opportunistic investments in sectors showing strong potential once market conditions improve. They might target sectors less affected by the current economic slowdown or those poised for growth in the medium to long term.

Implications for Investors

This strategic shift will impact both existing and potential investors. In the short term, returns might be lower than if the fund were fully invested in equities. However, in the long term, a cautious approach could lead to better risk-adjusted returns, particularly if the market experiences a significant correction. Investors should carefully consider their risk tolerance and investment horizon before making any decisions. Those with a longer-term investment strategy may find this approach suitable, while those seeking short-term gains might consider alternatives.

Alternative Investment Strategies Considered by DSP Mutual Fund

While increasing cash reserves is a primary strategy, DSP Mutual Fund may also consider other avenues:

Debt Instruments

Allocating more funds to debt instruments like government bonds or high-quality corporate bonds can provide relatively stable returns and reduce overall portfolio volatility. This approach offers a balance between risk and return.

Gold and other precious metals

Gold, often viewed as a safe haven asset, may be considered as a diversification tool to further mitigate risks associated with equity market fluctuations.

International Diversification

To further reduce risk, DSP Mutual Fund might explore opportunities in international markets, diversifying away from potential regional economic downturns. This can provide a buffer against adverse events impacting only the Indian market.

Conclusion

DSP Mutual Fund's decision to increase cash reserves reflects a prudent response to current market uncertainties. This strategy prioritizes risk mitigation and positions the fund for future opportunities. While short-term returns may be affected, this approach could lead to better long-term risk-adjusted returns. Investors should carefully assess their investment goals and risk tolerance in light of this strategic shift. For more information on how this affects your investment portfolio with DSP Mutual Fund, consult with a financial advisor and review the latest updates on the DSP Mutual Fund website.

Featured Posts

-

Anthony Edwards Nba Imposes 50 K Fine For Offensive Remarks To Fan

Apr 29, 2025

Anthony Edwards Nba Imposes 50 K Fine For Offensive Remarks To Fan

Apr 29, 2025 -

Secret Service Closes Investigation Into White House Cocaine Incident

Apr 29, 2025

Secret Service Closes Investigation Into White House Cocaine Incident

Apr 29, 2025 -

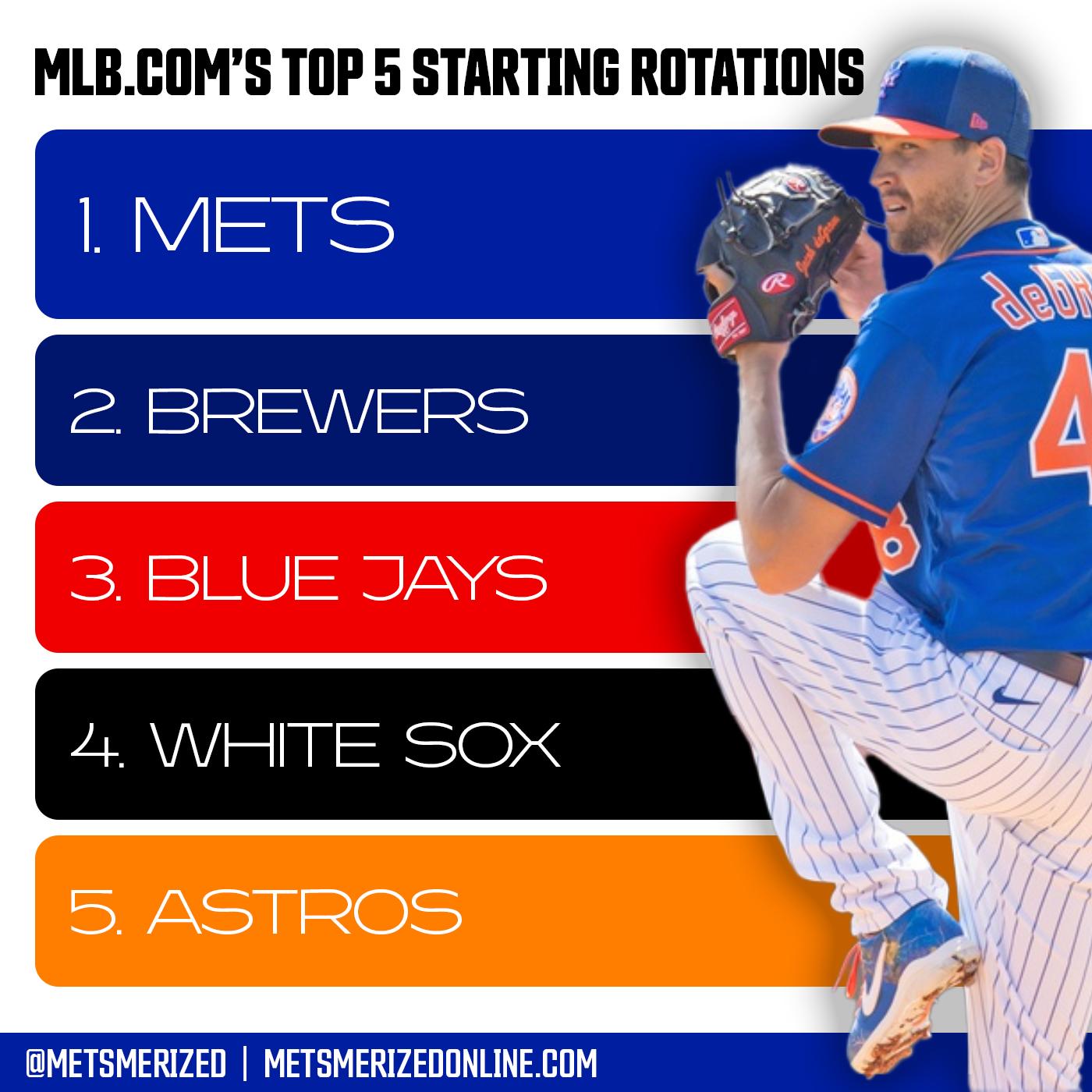

Has Mets Pitcher Shown Enough For A Rotation Spot

Apr 29, 2025

Has Mets Pitcher Shown Enough For A Rotation Spot

Apr 29, 2025 -

Dsp Signals Caution Indian Stock Market Concerns Prompt Cash Increase

Apr 29, 2025

Dsp Signals Caution Indian Stock Market Concerns Prompt Cash Increase

Apr 29, 2025 -

Tariff Uncertainty Drives U S Businesses To Cut Costs

Apr 29, 2025

Tariff Uncertainty Drives U S Businesses To Cut Costs

Apr 29, 2025

Latest Posts

-

The Impact Of Zombie Office Buildings On Chicagos Real Estate Market

Apr 29, 2025

The Impact Of Zombie Office Buildings On Chicagos Real Estate Market

Apr 29, 2025 -

Key Republican Groups Threaten To Block Trumps Tax Bill

Apr 29, 2025

Key Republican Groups Threaten To Block Trumps Tax Bill

Apr 29, 2025 -

Zombie Buildings In Chicago Understanding The Office Real Estate Collapse

Apr 29, 2025

Zombie Buildings In Chicago Understanding The Office Real Estate Collapse

Apr 29, 2025 -

Can Trumps Tax Cuts Survive Internal Republican Opposition

Apr 29, 2025

Can Trumps Tax Cuts Survive Internal Republican Opposition

Apr 29, 2025 -

Chicagos Office Market Meltdown The Rise Of Zombie Buildings

Apr 29, 2025

Chicagos Office Market Meltdown The Rise Of Zombie Buildings

Apr 29, 2025