DSP Signals Caution: Indian Stock Market Concerns Prompt Cash Increase

Table of Contents

Rising Inflation and its Impact on Indian Equities

India's inflation rate has been a significant concern, impacting corporate earnings and investor sentiment. While the Reserve Bank of India (RBI) is actively combating inflation through rising interest rates, this measure simultaneously dampens economic growth and negatively impacts stock valuations. Higher interest rates increase borrowing costs for companies, reducing their profitability and potentially leading to slower expansion.

- Impact on consumer spending: Increased prices lead to reduced consumer purchasing power, impacting demand for goods and services.

- Effect on corporate profit margins: Higher input costs squeeze profit margins, forcing companies to either raise prices further or absorb losses.

- Potential for slower economic growth: A combination of higher interest rates and reduced consumer spending can lead to a slowdown in overall economic growth.

- Vulnerable sectors: Sectors like consumer discretionary and manufacturing are particularly vulnerable to the effects of inflation.

Global Geopolitical Uncertainty and its Ripple Effect on India

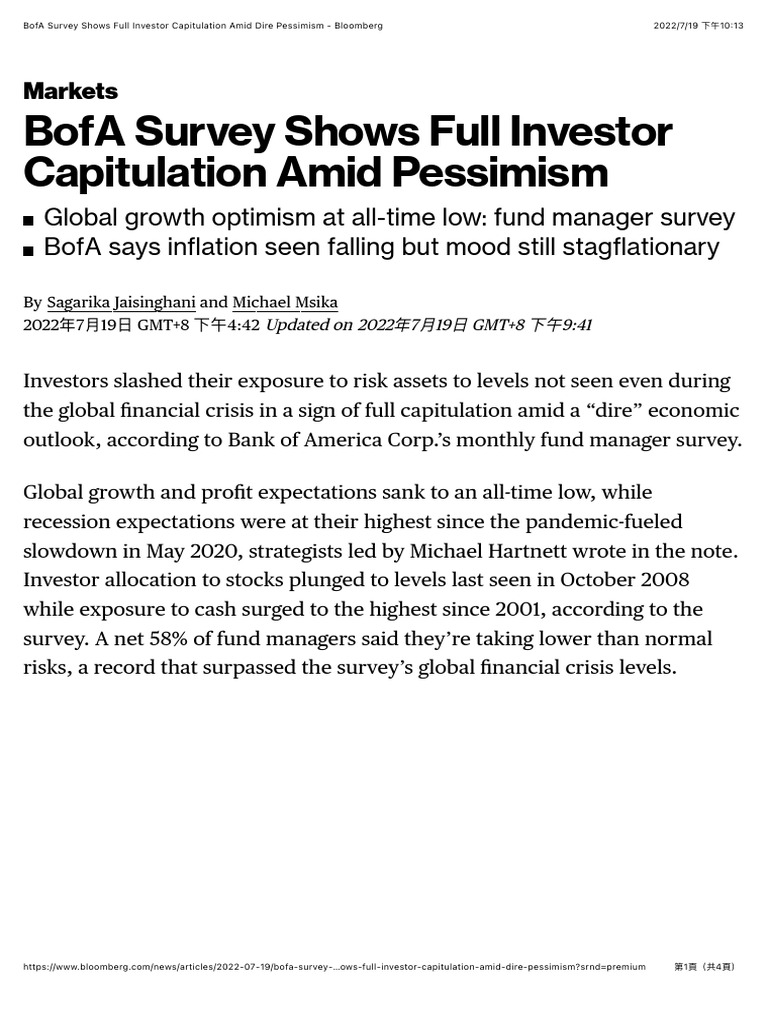

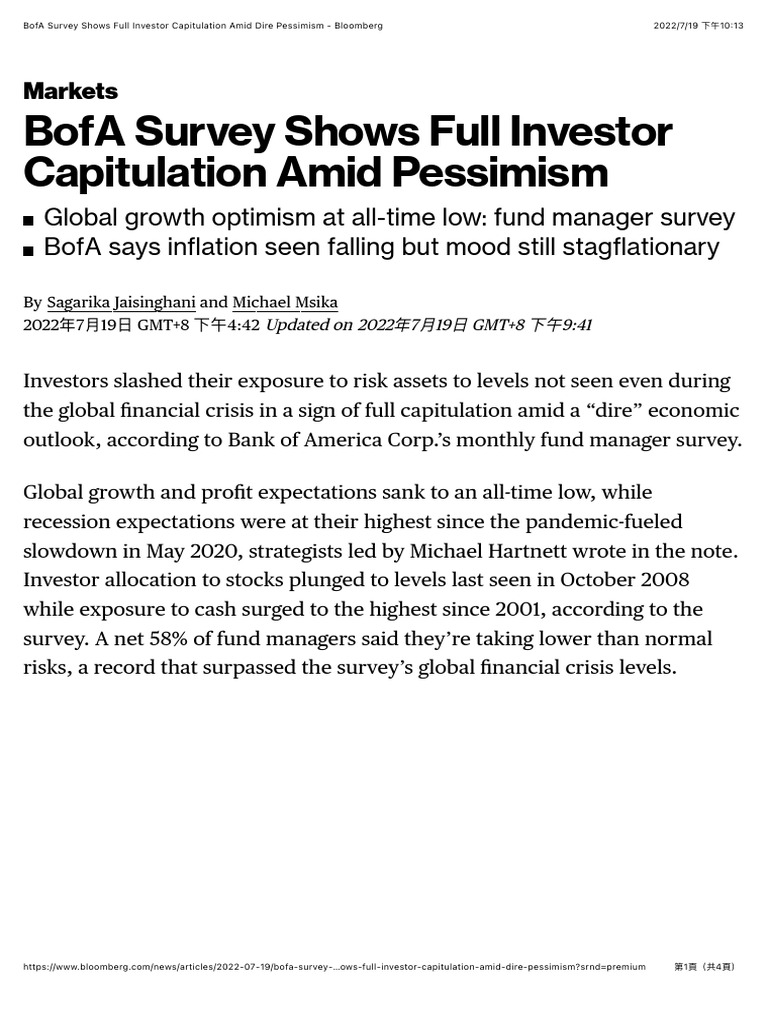

The current global economic climate is fraught with uncertainty. The ongoing war in Ukraine, escalating US-China tensions, and various other geopolitical events are creating a ripple effect, impacting investor confidence worldwide, including in India. This uncertainty fuels risk aversion, prompting investors to seek safer havens for their investments.

- Impact of global supply chain disruptions: The war in Ukraine and other geopolitical factors have disrupted global supply chains, impacting the availability and cost of essential goods.

- Fluctuations in commodity prices: Prices of crucial commodities like crude oil have experienced significant volatility, affecting inflation and corporate profitability.

- Foreign investment flows: Geopolitical instability can lead to fluctuations in foreign investment flows into and out of India, creating market volatility.

- Impact on the Indian Rupee: Global uncertainty can weaken the Indian Rupee against other major currencies, affecting import costs and potentially reducing investor confidence.

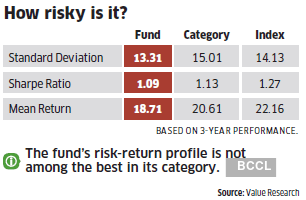

DSP's Strategic Response: Increased Cash Holdings

In response to these challenges, DSP Investment Managers have strategically increased their cash holdings, reflecting a more conservative investment approach. This move prioritizes capital preservation over potentially higher returns in a volatile market. While this strategy may result in missing out on some potential gains, it significantly mitigates the risk of substantial losses.

- Percentage increase in cash holdings: [Insert percentage if available from reliable sources]. This demonstrates a significant shift towards a more cautious stance.

- Reasons for a conservative approach: DSP likely believes the current market conditions justify prioritizing capital preservation over aggressive growth strategies.

- Potential benefits of a cautious approach: Reduced risk of significant losses during market downturns, providing a stronger foundation for future investments.

- Potential downsides of a conservative approach: Missed opportunities for higher returns if the market experiences a significant upswing.

Analyzing the Current Market Sentiment and Future Outlook

Current market sentiment towards the Indian stock market is cautious, reflecting the prevailing uncertainties. Financial analysts offer varied predictions, making it crucial for investors to carefully analyze market indicators and expert opinions before making decisions.

- Key indicators to watch: The Nifty 50 and Sensex indices provide vital insights into the overall market performance.

- Expert opinions and market analysis: Following reputable financial analysts and their assessments of the market is crucial for informed decision-making.

- Potential catalysts for market growth or decline: Factors like easing inflation, resolution of geopolitical tensions, and government policies can significantly influence the market's trajectory.

DSP Signals Caution – A Call for Prudent Investment Strategies in the Indian Stock Market

In summary, DSP Investment Managers' increased cash holdings reflect legitimate concerns regarding inflation, geopolitical uncertainty, and market volatility. This cautious approach underscores the need for prudent investment strategies in the current Indian stock market climate. Investors should carefully assess their risk tolerance and diversify their portfolios. Before making any investment decisions, thoroughly research the market, consult with financial advisors, and stay updated on the latest news and analysis concerning DSP Investment Managers and broader market trends. Understanding the signals of caution, like the one sent by DSP, is crucial for navigating the complexities of the Indian stock market.

Featured Posts

-

Nba Fines Anthony Edwards 50 000 For Vulgar Response To Fan

Apr 29, 2025

Nba Fines Anthony Edwards 50 000 For Vulgar Response To Fan

Apr 29, 2025 -

Cassidy Hutchinsons Fall Memoir A Look Inside The January 6th Hearings

Apr 29, 2025

Cassidy Hutchinsons Fall Memoir A Look Inside The January 6th Hearings

Apr 29, 2025 -

Top Performing India Fund Dsp Takes A Conservative Approach

Apr 29, 2025

Top Performing India Fund Dsp Takes A Conservative Approach

Apr 29, 2025 -

Final Days Of The Canadian Election A Close Race For Mark Carney

Apr 29, 2025

Final Days Of The Canadian Election A Close Race For Mark Carney

Apr 29, 2025 -

Stock Market Valuation Concerns Bof A Offers A Counterargument

Apr 29, 2025

Stock Market Valuation Concerns Bof A Offers A Counterargument

Apr 29, 2025

Latest Posts

-

From Street Sweeper To National Icon The Story Of Macario Martinez

Apr 29, 2025

From Street Sweeper To National Icon The Story Of Macario Martinez

Apr 29, 2025 -

The Unexpected Rise Of Macario Martinez From Street Sweeper To National Fame

Apr 29, 2025

The Unexpected Rise Of Macario Martinez From Street Sweeper To National Fame

Apr 29, 2025 -

Macario Martinez From Street Sweeper To National Celebrity

Apr 29, 2025

Macario Martinez From Street Sweeper To National Celebrity

Apr 29, 2025 -

Stock Market Valuation Concerns Bof A Offers A Counterargument

Apr 29, 2025

Stock Market Valuation Concerns Bof A Offers A Counterargument

Apr 29, 2025 -

Dismissing Valuation Concerns Bof As Argument For A Bullish Stock Market

Apr 29, 2025

Dismissing Valuation Concerns Bof As Argument For A Bullish Stock Market

Apr 29, 2025