CAC 40 Weekly Performance: Mixed Results, Slight Decrease (March 7, 2025)

Table of Contents

Sectoral Performance: Winners and Losers in the CAC 40

The CAC 40 sector performance exhibited a divergence in fortunes last week. While some sectors thrived, others experienced significant headwinds. Analyzing the top performing CAC 40 stocks and the underperforming CAC 40 stocks provides crucial insights into the market's dynamics.

- Top Performers: The Energy sector led the gains, buoyed by rising oil prices. Companies like TotalEnergies saw a significant increase in their share price. The Luxury Goods sector also performed relatively well, with LVMH showing resilience despite broader market anxieties.

- Underperformers: The Technology sector experienced a downturn, mirroring a global trend of investors reassessing valuations in the tech space. Companies like STMicroelectronics saw a notable decline. The Financial sector also underperformed, influenced by concerns about rising interest rates.

This sectoral analysis CAC 40 highlights the importance of diversification in investment portfolios. Analyzing individual company performances within each sector, such as the robust performance of luxury brands contrasted with the challenges faced by tech firms, provides a more granular understanding of the market's current sentiment.

Key Factors Influencing CAC 40's Weekly Movement

Several macroeconomic factors significantly impacted the CAC 40 market drivers last week.

- Inflation Concerns: The release of slightly higher-than-expected inflation figures in France fueled concerns about further interest rate hikes by the European Central Bank (ECB), impacting investor sentiment and contributing to the overall decline.

- Geopolitical Events: Ongoing geopolitical tensions continue to create uncertainty in the global market, influencing risk appetite and impacting the CAC 40.

- Company-Specific News: A few significant announcements from individual companies within the CAC 40, such as a disappointing earnings report from a major bank, also contributed to the index's downward trend.

Understanding these geopolitical impacts on CAC 40 and the CAC 40 news is crucial for interpreting the index's weekly fluctuations. The interplay of macroeconomic data and company-specific events often determines the overall market direction.

Technical Analysis of the CAC 40's Weekly Chart

A CAC 40 technical analysis of the weekly chart reveals some key insights.

- Support and Resistance: The index tested a key support level at 7000 points, which prevented a more significant drop. However, resistance remains strong around 7200 points.

- Trading Volume: Trading volume was relatively high throughout the week, indicating considerable investor activity and potential for further price movement.

- Technical Indicators: The Relative Strength Index (RSI) suggests the market is currently oversold, potentially hinting at a bounce-back in the coming days. Moving averages are also showing signs of bearish momentum. However, the absence of clear chart patterns like a head and shoulders formation makes prediction challenging. This CAC 40 trading volume data should be considered with other factors.

Analyzing these CAC 40 chart patterns and indicators offers a different perspective, supplementing the fundamental analysis already presented. This CAC 40 support and resistance analysis is crucial for short-term trading strategies.

Comparison with Other Major European Indices

Comparing the CAC 40 vs DAX and CAC 40 vs FTSE 100 reveals some interesting divergences. While the CAC 40 experienced a slight decrease, the DAX (German stock market index) showed a more pronounced decline, and the FTSE 100 (UK stock market index) demonstrated surprising resilience. This European stock market comparison suggests that sector-specific factors and national economic conditions played a role in the varied performances of these major indices. This index performance comparison indicates that the French market might be exhibiting its own unique set of sensitivities.

Conclusion: Recap and Future Outlook for CAC 40 Performance

In summary, the CAC 40 weekly performance last week displayed mixed results, ultimately concluding with a modest decline. Factors like inflation concerns, geopolitical tensions, and company-specific news all contributed to this movement. Technical analysis suggests potential for a short-term rebound, though broader market conditions and future economic data will be crucial for determining the direction of the index. Monitoring the CAC 40 support and resistance levels will be essential to gauge the market's immediate future.

To stay updated on the latest developments and gain a deeper understanding of the CAC 40 weekly performance, we encourage you to subscribe to our newsletter or follow us on social media for regular updates on the CAC 40 and other major market indices. Regular monitoring of these key indicators will improve your understanding of this crucial market.

Featured Posts

-

Konchita Vurst Ot Evrovideniya 2014 K Roli Devushki Bonda

May 24, 2025

Konchita Vurst Ot Evrovideniya 2014 K Roli Devushki Bonda

May 24, 2025 -

Ecb Faiz Karari Avrupa Borsalari Icin Etkiler Ve Analiz

May 24, 2025

Ecb Faiz Karari Avrupa Borsalari Icin Etkiler Ve Analiz

May 24, 2025 -

Photos Lego Master Manny Garcias Visit To Veterans Memorial Elementary

May 24, 2025

Photos Lego Master Manny Garcias Visit To Veterans Memorial Elementary

May 24, 2025 -

Analyzing The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Analyzing The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Amsterdam Stock Exchange Drops 2 After Trumps Tariff Increase

May 24, 2025

Amsterdam Stock Exchange Drops 2 After Trumps Tariff Increase

May 24, 2025

Latest Posts

-

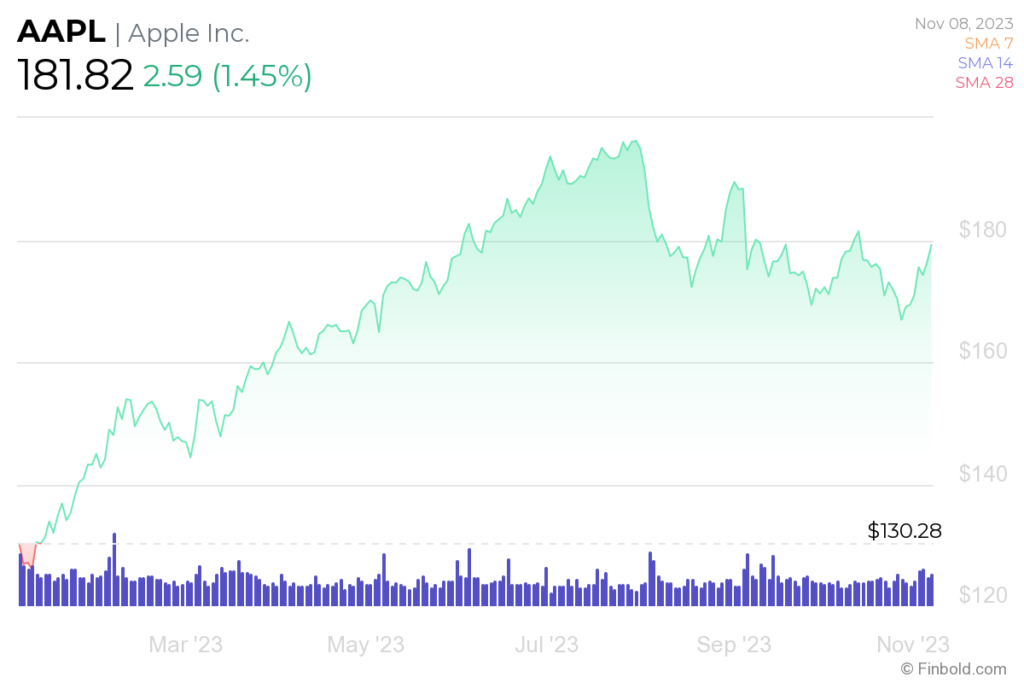

254 Apple Stock Price Prediction Should You Buy Now

May 24, 2025

254 Apple Stock Price Prediction Should You Buy Now

May 24, 2025 -

Apple Stock Prediction Analyst Targets 254 Is It A Buy At 200

May 24, 2025

Apple Stock Prediction Analyst Targets 254 Is It A Buy At 200

May 24, 2025 -

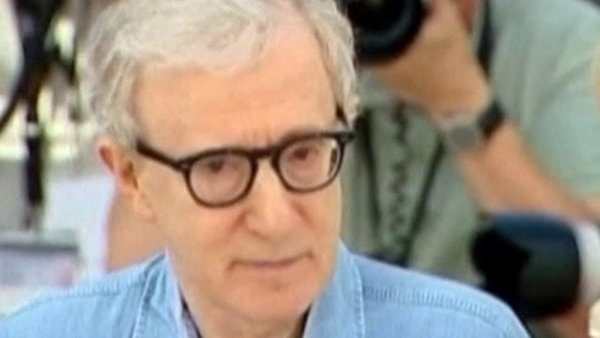

Woody Allen Sexual Abuse Accusations Reignited Sean Penns Backing Sparks Debate

May 24, 2025

Woody Allen Sexual Abuse Accusations Reignited Sean Penns Backing Sparks Debate

May 24, 2025 -

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 24, 2025

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 24, 2025 -

Sean Penns Recent Appearance And Controversial Statements Explained

May 24, 2025

Sean Penns Recent Appearance And Controversial Statements Explained

May 24, 2025