Canadian Regulators Halt Diversity And Climate Disclosure Projects Amid Backlash

Table of Contents

Reasons for the Regulatory Halt

Several factors contributed to the regulatory decision to halt or delay these crucial initiatives related to Canadian climate and diversity disclosure.

Political Pressure and Lobbying

Intense lobbying efforts from industries potentially negatively impacted by increased transparency surrounding climate change and diversity initiatives played a significant role.

- Examples of specific lobbying groups: Industry associations representing fossil fuel companies, resource extraction firms, and sectors with historical diversity challenges have actively lobbied against mandatory disclosure.

- Evidence of political influence: Reports indicate direct communication between lobbying groups and government officials, influencing the regulatory decision-making process. Analysis of parliamentary records and public statements reveals this pressure.

- Arguments presented by lobbyists: Concerns raised include increased compliance costs, competitive disadvantages, and the potential for burdensome regulations stifling economic growth. Counterarguments emphasize the importance of transparency and accountability for investors and the public good.

The counterarguments highlight the long-term economic benefits of a sustainable and equitable business environment and the risk of stranded assets due to climate change inaction.

Concerns Regarding Data Reliability and Comparability

Ensuring consistent and reliable data collection for climate-related and diversity metrics across diverse companies presents a significant challenge.

- Examples of inconsistencies: Different companies employ varying methodologies for measuring carbon emissions, diversity representation, and other ESG factors, leading to incomparable data.

- Lack of standardized frameworks: The absence of universally accepted standards and guidelines makes it difficult to assess the accuracy and reliability of reported data. This lack of standardization hinders meaningful comparisons between companies.

- Potential for greenwashing: Concerns exist that companies might engage in "greenwashing" – exaggerating or misrepresenting their ESG performance – in the absence of robust verification mechanisms.

Addressing these concerns requires developing a robust and standardized framework for data collection, verification, and reporting, including the creation of clearly defined metrics and auditing processes.

Economic Impacts and Market Volatility

Concerns about the potential economic consequences of mandatory disclosure, including increased compliance costs for businesses, fueled the regulatory pause.

- Estimates of compliance costs: Studies have offered varying estimates of the cost of compliance, with some suggesting significant burdens, particularly for smaller companies. These estimations, however, need further refinement, as methodologies differ considerably.

- Potential impact on SMEs: Small and medium-sized enterprises (SMEs) may face disproportionately higher compliance costs compared to larger corporations, potentially hindering their growth and competitiveness.

- Arguments about market instability: Opponents argue that mandatory disclosure could lead to market volatility, as investors react to new information about companies' ESG performance. However, proponents argue that increased transparency ultimately leads to more informed investment decisions and a more resilient market.

Detailed cost-benefit analyses are needed to accurately assess the economic impacts and weigh them against the social and environmental benefits of mandatory disclosure. Focus should be on implementing cost-effective solutions and providing support for SMEs to navigate the compliance process.

Impact on Investors and Stakeholders

The regulatory halt on Canadian climate and diversity disclosure has significant implications for investors and other stakeholders.

Loss of Transparency and Accountability

The suspension of mandatory disclosure initiatives limits investors' access to critical ESG-related information, hindering informed investment decisions.

- Examples of investor concerns: Investors are increasingly demanding transparency and accountability from companies on ESG matters, and the regulatory halt undermines this growing expectation.

- Impact on responsible investing strategies: The lack of consistent and reliable data makes it more challenging for investors to implement effective responsible investing strategies aligned with their ESG preferences.

- Potential for increased risk: Limited transparency increases the risk of investing in companies with poor ESG performance, potentially leading to financial losses and reputational damage.

Reliable and consistent data on ESG performance is essential for investors to make informed decisions and allocate capital to companies aligned with their values and risk tolerance.

Setback for Environmental and Social Progress

The regulatory decision represents a significant setback for Canada's commitment to addressing climate change and promoting diversity within corporations.

- References to international agreements: The pause contradicts Canada's international commitments to reduce greenhouse gas emissions and promote sustainable development.

- Canada's climate targets: Delayed disclosure could hinder progress towards Canada's climate targets and its commitments under the Paris Agreement.

- Impact on social equity initiatives: Reduced transparency surrounding diversity initiatives undermines efforts to promote equality, diversity, and inclusion within Canadian corporations.

The lack of progress in ESG disclosure could damage Canada's international reputation and undermine its efforts to attract foreign investment committed to sustainable and responsible business practices.

The Ongoing Debate and Future Outlook

The regulatory pause has sparked a debate about the future of ESG reporting in Canada.

Calls for Regulatory Reform

Advocates are calling for improvements to the regulatory framework to address concerns while maintaining meaningful disclosure.

- Proposals for improved data standards: The development of internationally recognized standards and guidelines is crucial for ensuring data consistency and reliability.

- Enhanced enforcement mechanisms: Stronger enforcement mechanisms are needed to deter greenwashing and ensure that companies accurately report their ESG performance.

- Increased stakeholder engagement: Greater involvement of stakeholders, including investors, NGOs, and academics, in the development and implementation of the regulatory framework is essential.

A phased approach, starting with pilot programs and focusing on material ESG issues, could help mitigate concerns about compliance costs and data reliability while building a robust framework for future expansion.

Potential for Resumption of Disclosure Initiatives

The possibility remains that regulatory bodies will revisit and restart climate and diversity disclosure projects in the future.

- Potential timelines: The timing of a potential resumption depends on various factors, including political will, stakeholder engagement, and the development of a more robust regulatory framework.

- Necessary conditions for resumption: Addressing concerns about data reliability, compliance costs, and market volatility will be crucial for restarting these initiatives. Political support for mandatory disclosure will also be essential.

- The political climate surrounding the issue: The political landscape surrounding ESG reporting will play a significant role in determining the future trajectory of these initiatives.

A collaborative approach involving all relevant stakeholders is crucial to build a regulatory framework that balances the need for transparency and accountability with legitimate concerns about cost and feasibility.

Conclusion

The decision by Canadian regulators to halt or delay mandatory climate and diversity disclosure projects represents a significant setback for transparency and accountability within the Canadian corporate sector. While concerns regarding data reliability, economic impacts, and political pressure are valid, the suspension ultimately undermines investor confidence, hinders progress towards environmental and social goals, and weakens Canada's position on the global ESG stage. Moving forward, a revised approach that addresses these concerns while upholding the crucial need for transparency is essential. A robust and effective regulatory framework for Canadian climate and diversity disclosure remains critically important for a sustainable and equitable future. The ongoing debate necessitates a thoughtful and collaborative effort to find a balance between legitimate concerns and the imperative for meaningful corporate accountability in Canadian climate and diversity disclosure. Let's work together to create a more transparent and sustainable future through effective Canadian climate and diversity disclosure.

Featured Posts

-

Bota De Oro 2024 25 Clasificacion Y Aspirantes

Apr 25, 2025

Bota De Oro 2024 25 Clasificacion Y Aspirantes

Apr 25, 2025 -

Sinner Jack O Connell The I Am Legend Villain We Deserved

Apr 25, 2025

Sinner Jack O Connell The I Am Legend Villain We Deserved

Apr 25, 2025 -

Sinners And Jack O Connell Exploring A Defining Performance

Apr 25, 2025

Sinners And Jack O Connell Exploring A Defining Performance

Apr 25, 2025 -

Bears To Interview Ashton Jeanty At Nfl Scouting Combine

Apr 25, 2025

Bears To Interview Ashton Jeanty At Nfl Scouting Combine

Apr 25, 2025 -

Nfl Combine Ashton Jeanty Set For Meeting With Chicago Bears

Apr 25, 2025

Nfl Combine Ashton Jeanty Set For Meeting With Chicago Bears

Apr 25, 2025

Latest Posts

-

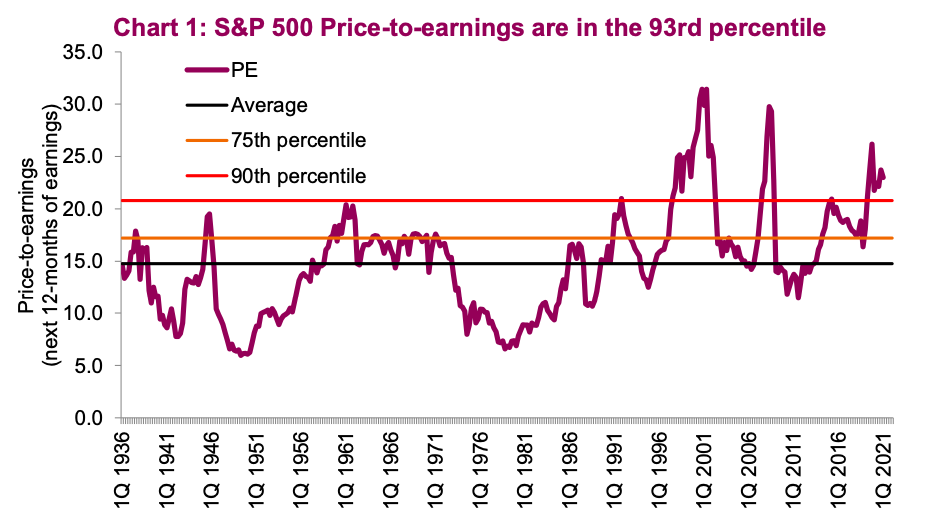

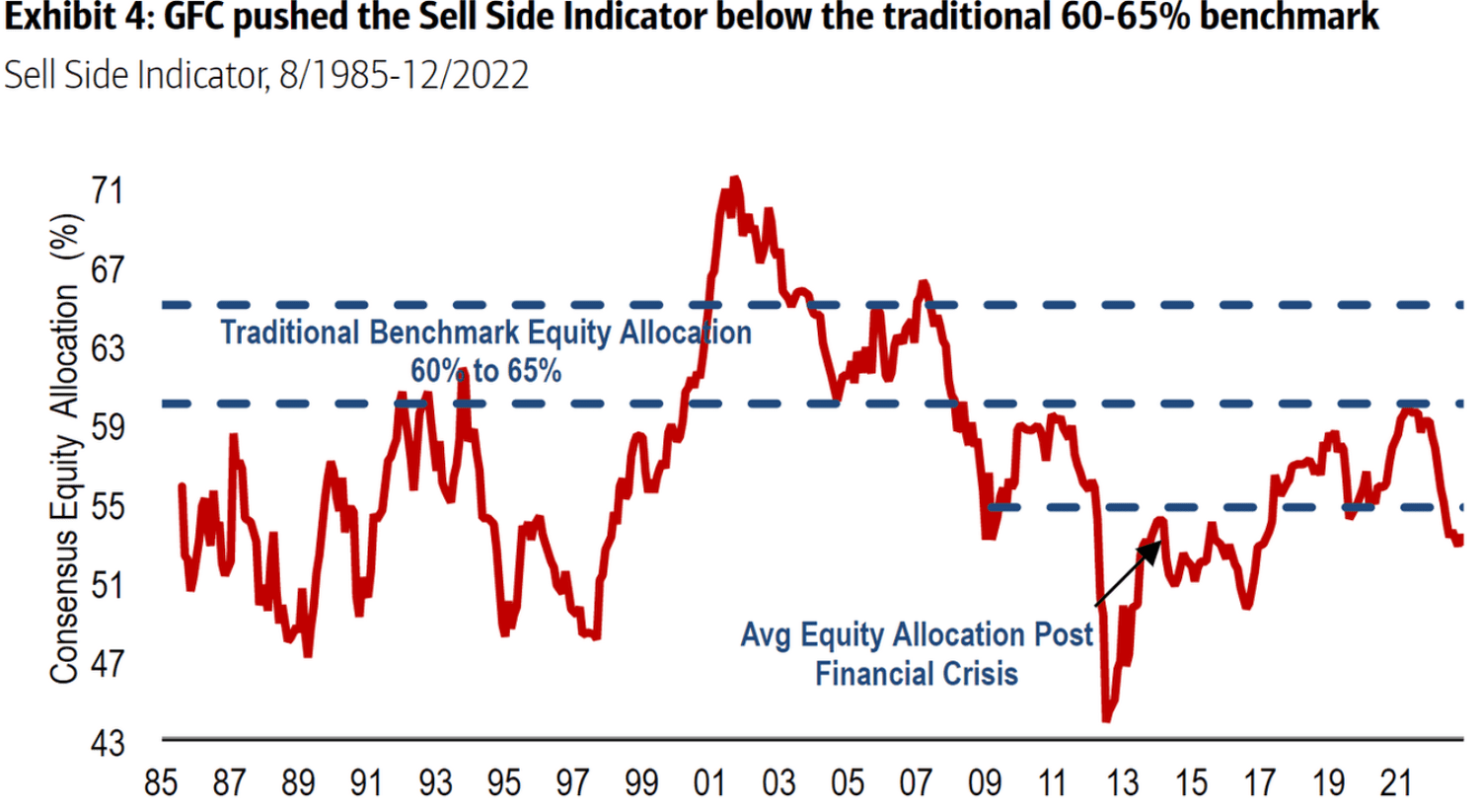

Addressing Investor Concerns Bof As View On High Stock Market Valuations

Apr 26, 2025

Addressing Investor Concerns Bof As View On High Stock Market Valuations

Apr 26, 2025 -

Bof A On Stock Market Valuations A Rationale For Investor Confidence

Apr 26, 2025

Bof A On Stock Market Valuations A Rationale For Investor Confidence

Apr 26, 2025 -

Why Current Stock Market Valuations Are Not A Reason To Panic According To Bof A

Apr 26, 2025

Why Current Stock Market Valuations Are Not A Reason To Panic According To Bof A

Apr 26, 2025 -

Understanding Stock Market Valuations Bof As Argument For Calm

Apr 26, 2025

Understanding Stock Market Valuations Bof As Argument For Calm

Apr 26, 2025 -

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025