Case Study: Financing A 270MWh BESS In Belgium's Merchant Market

Table of Contents

Project Overview and Market Context

Our case study focuses on a 270MWh BESS project located in [Specific Location in Belgium], utilizing [Specific Battery Technology, e.g., Lithium-ion] technology. The system is designed to provide [Specific Services, e.g., frequency regulation, peak shaving, arbitrage] services within the Belgian electricity market. This project is particularly relevant given the evolving landscape of the Belgian energy market.

Belgium, like many European nations, is aggressively pursuing renewable energy targets, leading to a significant increase in intermittent renewable energy sources like solar and wind. This intermittency necessitates flexible energy solutions to ensure grid stability and reliability. The regulatory framework, including capacity mechanisms and support schemes for renewable energy integration, directly impacts the viability and attractiveness of BESS investments.

Key market drivers for BESS adoption in Belgium include:

- Increased Renewable Energy Penetration: Balancing the fluctuating output of solar and wind power.

- Grid Stability Enhancement: Providing ancillary services to maintain grid frequency and voltage.

- Arbitrage Opportunities: Capitalizing on price differences between peak and off-peak electricity hours.

- Capacity Market Participation: Securing revenue streams through participation in capacity mechanisms.

- Energy Security: Reducing reliance on fossil fuels and enhancing grid resilience.

Financing Structure and Sources

The financing of the 270MWh BESS project employed a blended approach, combining debt and equity financing. [Percentage]% of the total project cost was secured through debt financing from a consortium of financial institutions, including [Name of Banks/Financial Institutions]. These institutions provided long-term loans with favorable interest rates and repayment schedules tailored to the project's expected revenue streams.

The remaining [Percentage]% was financed through equity investments from [Names of Investors/Equity Partners], demonstrating strong investor confidence in the project's long-term viability. Government incentives, such as [Specific Incentives, e.g., tax credits, subsidies, grants], further enhanced the project's financial attractiveness.

Key financing terms and conditions included:

- Debt Financing: [Interest rate] interest rate, [Loan Tenure] year loan tenure, [Loan-to-value ratio] LTV ratio.

- Equity Financing: [Equity Stake Percentage]% equity stake, [Preferred Return Rate]% preferred return rate.

- Government Incentives: [Specific details of incentives and their monetary value].

Risk Assessment and Mitigation

Several key risks were identified and addressed during the project development phase:

- Technology Risk: Risk of equipment failure or performance degradation. This was mitigated through the use of proven technology from reputable manufacturers and comprehensive warranties.

- Regulatory Risk: Changes in regulations impacting project profitability. This was addressed through thorough regulatory due diligence and engagement with relevant authorities.

- Market Risk: Fluctuations in electricity prices and demand impacting revenue streams. Hedging strategies, including [Specific Hedging Strategies, e.g., power purchase agreements (PPAs)], were implemented to mitigate price volatility.

- Operational Risk: Unexpected downtime or operational inefficiencies. Robust operational and maintenance plans were developed to minimize downtime and ensure optimal performance.

Regulatory Compliance and Permitting

Navigating the Belgian regulatory framework for BESS projects required meticulous planning and engagement with various authorities. The permitting process involved obtaining several key approvals, including:

- Environmental permits

- Grid connection permits

- Building permits

- Planning permits

The entire permitting process took approximately [Number] months, highlighting the importance of proactive engagement with regulatory bodies.

Financial Performance and Return on Investment (ROI)

Projected financial performance indicates a strong return on investment for the 270MWh BESS project. Revenue streams are derived primarily from [Specific Revenue Streams, e.g., frequency regulation payments, energy arbitrage, capacity market payments]. Operating costs, including maintenance, insurance, and personnel, are factored into the profitability analysis.

Key financial indicators:

- Internal Rate of Return (IRR): [Percentage]%

- Net Present Value (NPV): [Monetary Value]

- Payback Period: [Number] years

Different scenarios, including variations in electricity prices and operational performance, were modeled to assess the project's resilience to market uncertainties.

Lessons Learned and Best Practices

This case study highlights the importance of a comprehensive and well-structured financing approach for large-scale BESS projects in Belgium's merchant market. Key lessons learned include:

- Early engagement with financial institutions: Securing financing commitments early in the project development phase.

- Thorough due diligence: Understanding the regulatory landscape and market dynamics.

- Effective risk management: Developing and implementing robust risk mitigation strategies.

- Strong project development team: Assembling a team with expertise in financing, engineering, and regulatory compliance.

Best practices for future BESS projects include:

- Exploring diverse financing options, including green bonds and project finance.

- Leveraging government incentives and support schemes.

- Developing strong partnerships with grid operators and energy market participants.

Conclusion: Key Takeaways and Call to Action

Successfully financing a 270MWh BESS in Belgium's merchant market requires a meticulous approach that considers the unique challenges and opportunities presented by the Belgian energy landscape. This case study demonstrates that a blended financing strategy, coupled with robust risk management and proactive regulatory engagement, can lead to a successful outcome. The project's strong financial performance underscores the growing attractiveness of BESS investments in Belgium and beyond. For those interested in exploring similar opportunities in financing BESS projects in Belgium or other competitive energy markets, we encourage you to contact [Contact Information or Link to Relevant Resources] for further guidance and support. Let's collaborate on shaping the future of sustainable energy through innovative BESS deployments.

Featured Posts

-

The Future Of Marvel How The Mcu Can Recapture Its Former Glory

May 04, 2025

The Future Of Marvel How The Mcu Can Recapture Its Former Glory

May 04, 2025 -

Nigel Farage Faces Defamation Claim From Rupert Lowe Over False Allegations

May 04, 2025

Nigel Farage Faces Defamation Claim From Rupert Lowe Over False Allegations

May 04, 2025 -

Targeting 2027 Jet Zeros Revolutionary Triangle Jet Design

May 04, 2025

Targeting 2027 Jet Zeros Revolutionary Triangle Jet Design

May 04, 2025 -

Gold Faces Headwinds Understanding The Double Week Price Drop In 2025

May 04, 2025

Gold Faces Headwinds Understanding The Double Week Price Drop In 2025

May 04, 2025 -

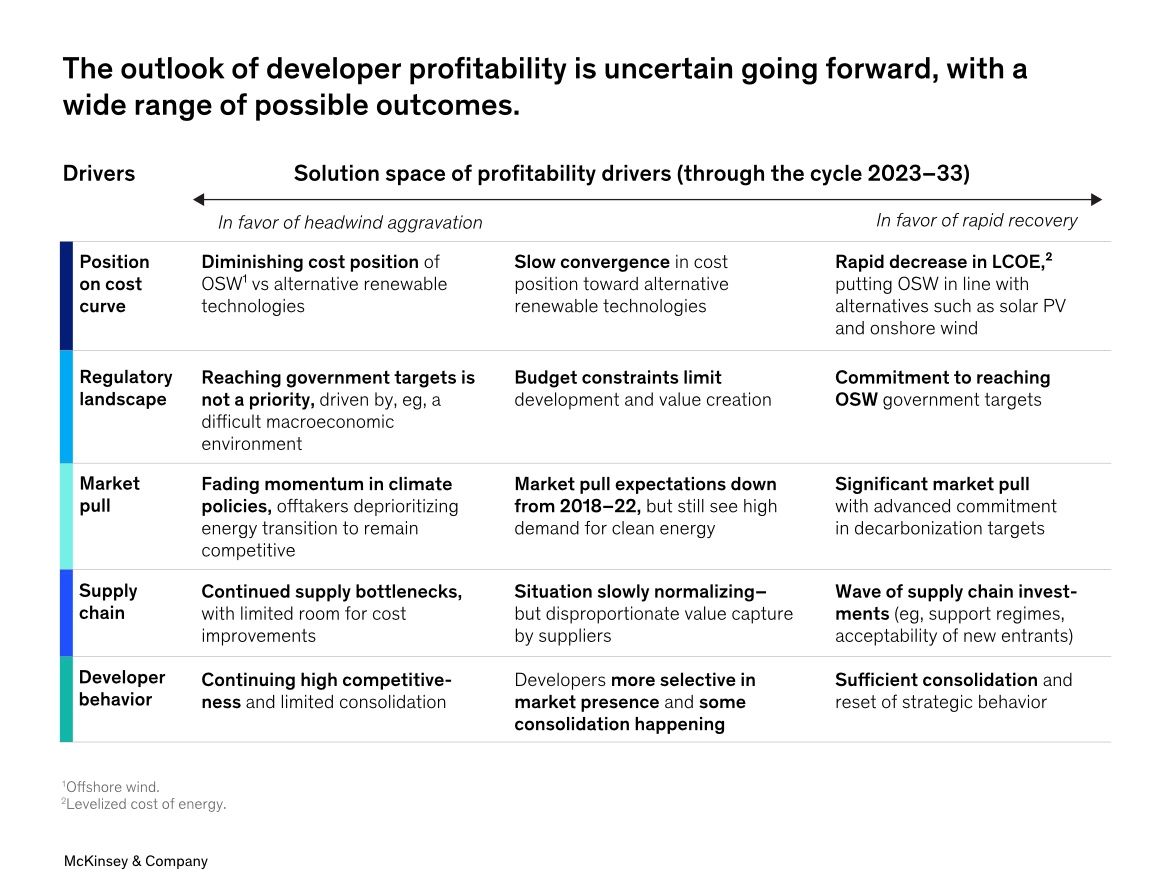

Is The Offshore Wind Boom Over A Cost Analysis

May 04, 2025

Is The Offshore Wind Boom Over A Cost Analysis

May 04, 2025

Latest Posts

-

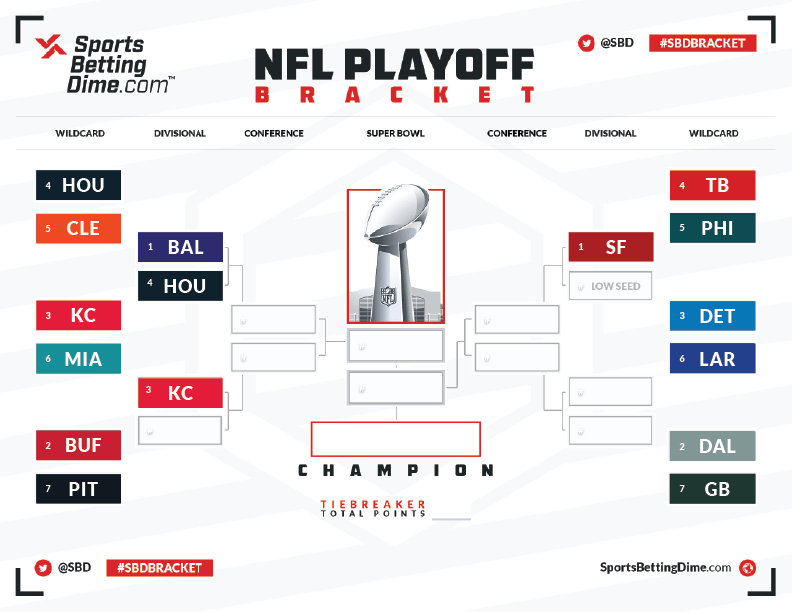

Nhl Playoffs Showdown Saturdays Crucial Standings Battles

May 04, 2025

Nhl Playoffs Showdown Saturdays Crucial Standings Battles

May 04, 2025 -

Understanding The Recent Gold Price Downturn Back To Back Weekly Losses In 2025

May 04, 2025

Understanding The Recent Gold Price Downturn Back To Back Weekly Losses In 2025

May 04, 2025 -

Golds Unexpected Dip Two Weeks Of Losses In Early 2025

May 04, 2025

Golds Unexpected Dip Two Weeks Of Losses In Early 2025

May 04, 2025 -

Analysis Golds Recent Decline And What It Means For Investors In 2025

May 04, 2025

Analysis Golds Recent Decline And What It Means For Investors In 2025

May 04, 2025 -

Canadiens Vs Oilers Your Morning Coffee Hockey Recap And Outlook

May 04, 2025

Canadiens Vs Oilers Your Morning Coffee Hockey Recap And Outlook

May 04, 2025