CFP Board CEO's Retirement In Early 2026: What It Means For Financial Planning

Table of Contents

Leadership Transition at the CFP Board: A Time of Change

The CEO plays a pivotal role at the CFP Board, overseeing strategic direction, managing operations, and representing the organization to stakeholders. The upcoming CFP Board CEO's retirement necessitates a smooth and effective leadership transition. The process of selecting and onboarding a new CEO will be crucial in maintaining the Board's stability and momentum. A successful transition ensures continuity in vital initiatives and minimizes disruption to the certification process and ongoing operations.

Potential challenges include:

- Impact on ongoing CFP Board initiatives: Ongoing projects, such as curriculum revisions or technological upgrades, could face temporary delays or alterations in direction.

- Potential for shifts in strategic direction: The new CEO may bring a different vision and priorities, leading to adjustments in the Board's overall strategy.

- Importance of a smooth leadership transition to maintain stability: A prolonged or turbulent transition can erode public confidence in the CFP certification and the profession as a whole.

Potential Impacts on CFP Certification and Standards

The CFP Board CEO's retirement might indirectly influence CFP certification requirements and standards. While not immediately expected, a change in leadership could open the door to future revisions. This could impact both aspiring and current CFP professionals.

Possible implications include:

- Examination changes: The new leadership might revisit the CFP exam's content and format to ensure it aligns with evolving industry needs and standards.

- Ethical standard updates: There could be adjustments to the Code of Ethics and Standards of Conduct, reflecting changes in financial regulations or best practices.

- Continuing education requirements: Updates to continuing education mandates might be introduced to keep CFP professionals abreast of current financial trends and regulations.

The Broader Implications for the Financial Planning Industry

The implications of the CFP Board CEO's retirement extend beyond the CFP Board itself, influencing the entire financial planning landscape. The transition presents an opportunity to reassess the profession's future direction and adapt to emerging challenges.

Key considerations include:

- Impact on public trust and confidence: A seamless transition will be vital in maintaining public trust in CFP professionals and the value of CFP certification.

- Influence on industry regulations: The CFP Board's leadership plays a role in shaping industry regulations and advocating for the profession's interests. A change in leadership could subtly shift these dynamics.

- Potential changes in industry landscape: The transition may influence how the financial planning industry interacts with other related fields, like investment management or tax planning.

Preparing for the Future: Strategies for CFP Professionals

CFP professionals should proactively prepare for the changes that might arise from the CFP Board CEO's retirement. Staying informed and adapting to potential adjustments will be crucial for maintaining professional standing and competitiveness.

Practical strategies include:

- Staying informed about CFP Board announcements: Regularly check the CFP Board website and other official channels for updates on the leadership transition and any subsequent changes to certification or regulations.

- Continuing professional development: Invest in ongoing education to enhance skills and knowledge, ensuring you remain up-to-date with industry best practices and regulatory changes.

- Networking and collaboration within the industry: Engage with other CFP professionals through professional organizations and networking events to share information and insights.

Conclusion: Navigating the Future After the CFP Board CEO's Retirement

The CFP Board CEO's retirement marks a significant turning point for the financial planning profession. While the transition presents potential challenges, it also offers opportunities for growth and adaptation. By staying informed about upcoming changes at the CFP Board, actively engaging in continuing professional development, and collaborating with fellow professionals, CFPs can successfully navigate this period and ensure they remain competitive in the evolving financial planning landscape. Stay informed about the CFP Board CEO's retirement and prepare for changes affecting CFP certification. Understand the implications for your financial planning business and take proactive steps to maintain your professional standing.

Featured Posts

-

Ananya Pandays Pet Dog Riot Turns One A Paw Some Birthday Celebration

May 02, 2025

Ananya Pandays Pet Dog Riot Turns One A Paw Some Birthday Celebration

May 02, 2025 -

Six Nations 2024 Key Takeaways Frances Win And The British And Irish Lions Squad

May 02, 2025

Six Nations 2024 Key Takeaways Frances Win And The British And Irish Lions Squad

May 02, 2025 -

Find Newsround On Bbc Two Hd Your Complete Guide

May 02, 2025

Find Newsround On Bbc Two Hd Your Complete Guide

May 02, 2025 -

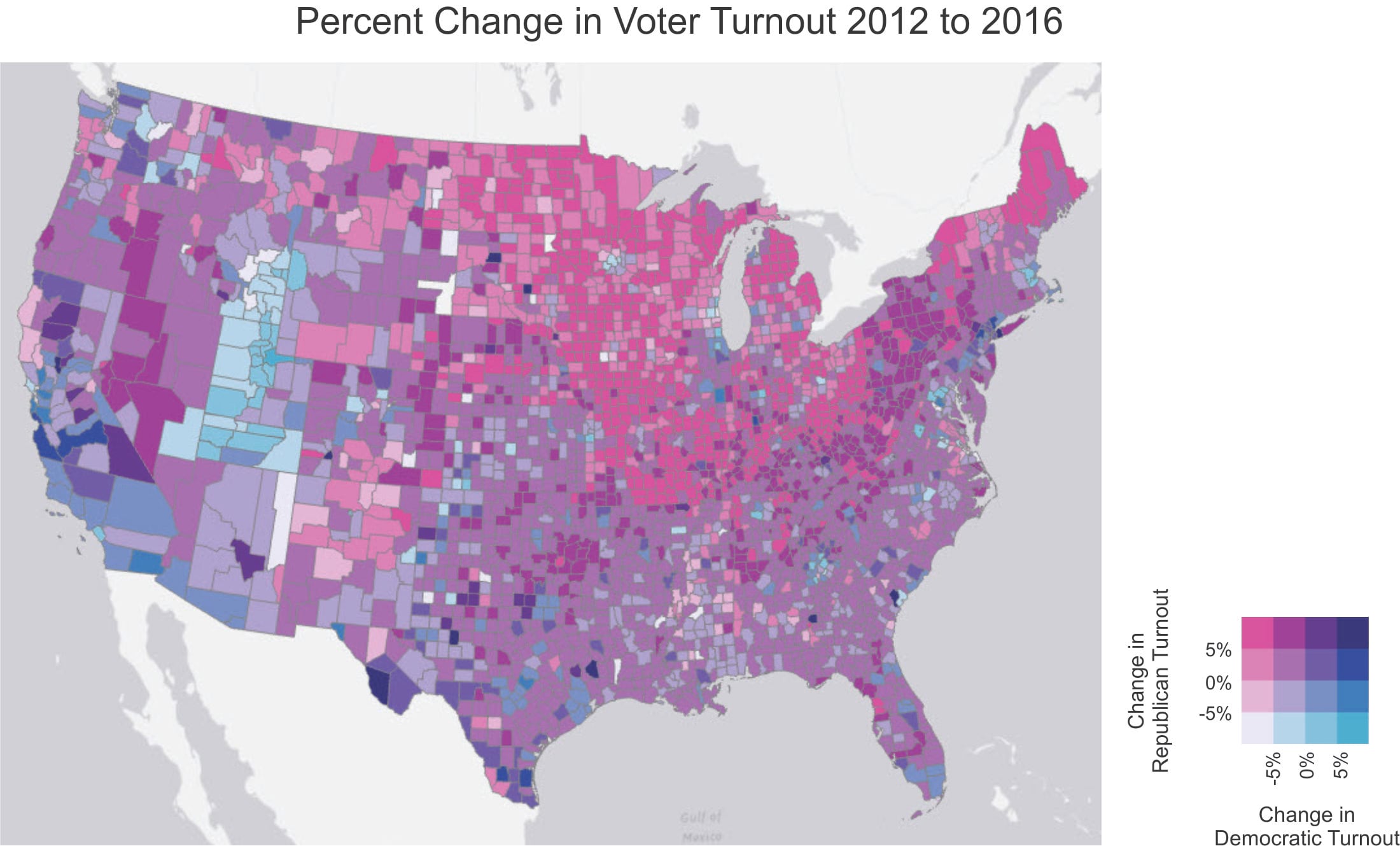

Florida And Wisconsin Voter Turnout Understanding The Shifting Political Tides

May 02, 2025

Florida And Wisconsin Voter Turnout Understanding The Shifting Political Tides

May 02, 2025 -

The Photoshop Controversy Christina Aguileras Altered Image In Recent Shoot

May 02, 2025

The Photoshop Controversy Christina Aguileras Altered Image In Recent Shoot

May 02, 2025

Latest Posts

-

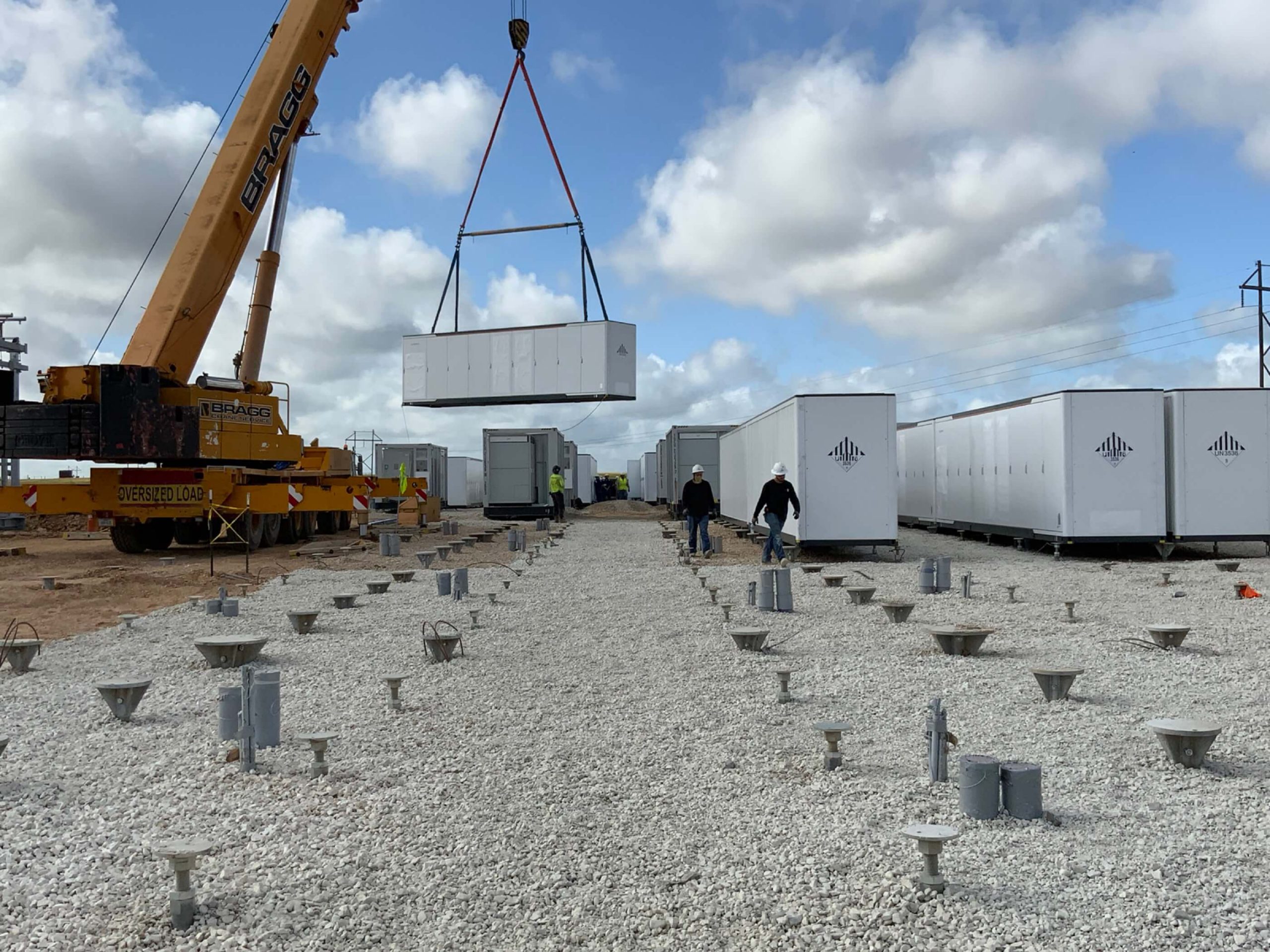

Analysis Of Financing Strategies For A 270 M Wh Bess Project In The Belgian Merchant Market

May 03, 2025

Analysis Of Financing Strategies For A 270 M Wh Bess Project In The Belgian Merchant Market

May 03, 2025 -

Belgiums Energy Transition Funding A 270 M Wh Bess Project In A Competitive Market

May 03, 2025

Belgiums Energy Transition Funding A 270 M Wh Bess Project In A Competitive Market

May 03, 2025 -

Investment In Belgiums Energy Sector A Case Study Of 270 M Wh Bess Financing

May 03, 2025

Investment In Belgiums Energy Sector A Case Study Of 270 M Wh Bess Financing

May 03, 2025 -

270 M Wh Bess Financing In Belgium Challenges And Opportunities In The Merchant Market

May 03, 2025

270 M Wh Bess Financing In Belgium Challenges And Opportunities In The Merchant Market

May 03, 2025 -

Navigating The Belgian Merchant Market Financing Options For A 270 M Wh Bess Project

May 03, 2025

Navigating The Belgian Merchant Market Financing Options For A 270 M Wh Bess Project

May 03, 2025