China's Central Bank Addresses Tariff Concerns With Rate Cuts And Lending

Table of Contents

Rate Cuts to Stimulate Economic Activity

The PBoC's recent interest rate cuts are a key component of its strategy to counter the negative effects of tariffs. These Interest Rate Cuts China are designed to lower borrowing costs for businesses and consumers, thereby encouraging investment and spending, and ultimately boosting economic activity. The rationale behind this move is straightforward: cheaper credit should incentivize businesses to expand, hire more workers, and invest in new projects, while lower rates can also stimulate consumer spending on durable goods and services.

- Specific percentage of rate cuts announced: The PBoC has implemented several rate cuts, totaling X% in the last [period - e.g., quarter, year]. The exact figures vary depending on the specific lending rate, but the overall trend shows a clear commitment to easing monetary policy.

- Target sectors most likely to benefit from lower rates: Small and medium-sized enterprises (SMEs), a vital engine of Chinese economic growth, are expected to be major beneficiaries. The manufacturing sector, heavily impacted by trade tensions, is another key target for these China Lending Policies.

- Potential impact on inflation: While lower interest rates can stimulate economic growth, there's a potential risk of increased inflation. The PBoC will need to carefully monitor inflation indicators to ensure the rate cuts do not lead to an unsustainable rise in prices.

- Comparison to previous rate cut cycles: This recent series of rate cuts differs from previous cycles in [explain the differences; e.g., the specific context of trade war pressures, targeting of specific sectors, etc.].

Increased Lending to Support Businesses and Infrastructure

In conjunction with rate cuts, the PBoC is actively increasing lending to support businesses and infrastructure projects. This focus on China Lending Policies reflects a concerted effort to counteract the economic slowdown resulting from trade tensions. The PBoC is employing various mechanisms to achieve this goal, including targeted lending programs aimed at specific sectors and a relaxation of reserve requirements for commercial banks.

- Specific targets for lending increases: The PBoC has set ambitious targets for increasing lending to SMEs, aiming for a Y% increase in SME loans within [timeframe]. This demonstrates a commitment to supporting the backbone of the Chinese economy.

- Examples of infrastructure projects receiving funding: Major infrastructure projects, such as high-speed rail expansion, renewable energy initiatives, and improvements to transportation networks, are receiving substantial funding. These projects not only create jobs but also lay the groundwork for future economic growth.

- Potential risks associated with increased lending: The significant increase in lending carries the risk of increased debt levels, both for businesses and the government. This could potentially lead to financial instability if not managed carefully.

- Measures to mitigate risks: To mitigate these risks, the PBoC is likely to implement measures such as stricter loan assessment criteria, increased monitoring of bank lending practices, and proactive management of non-performing loans.

The Impact of US-China Trade Tensions on PBoC Policy

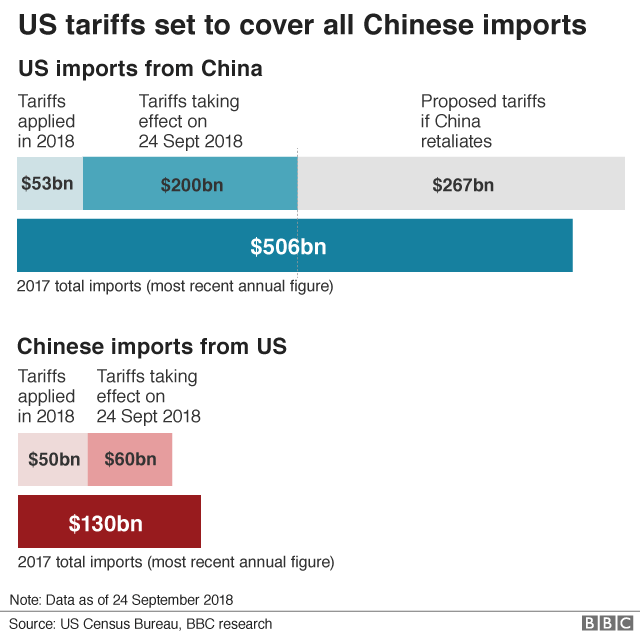

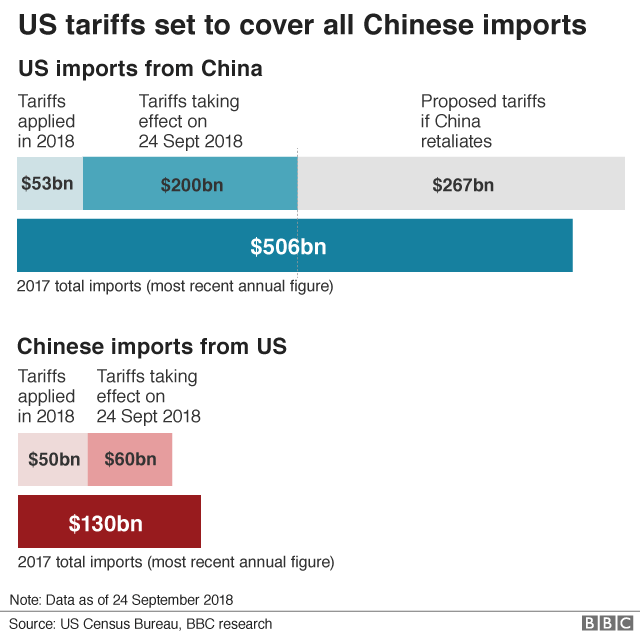

The ongoing US-China Trade War Impact has profoundly shaped the PBoC's monetary policy decisions. The imposition of tariffs by both the US and China has led to uncertainty, reduced investment, and dampened economic growth. The PBoC's rate cuts and increased lending are direct responses to these challenges, aimed at offsetting the negative effects of the trade war and bolstering economic resilience.

- Specific examples of tariffs impacting the Chinese economy: Tariffs on goods such as [mention specific examples] have significantly impacted Chinese industries, leading to job losses and reduced production.

- How rate cuts and increased lending aim to offset these negative impacts: By lowering borrowing costs and increasing the availability of credit, the PBoC aims to provide a cushion against the negative economic consequences of the trade war.

- Potential limitations of the PBoC's response: Monetary policy alone cannot fully compensate for the disruptive effects of a trade war. Structural reforms and other policy measures might be necessary for a more comprehensive solution.

- Alternative strategies the PBoC could consider: Other strategies the PBoC could consider include fiscal stimulus, structural reforms to improve efficiency, and further opening up of the Chinese economy.

Monitoring Economic Indicators for Effectiveness

The PBoC will closely monitor key China Economic Indicators to evaluate the effectiveness of its rate cuts and lending initiatives. This data-driven approach allows for adjustments to policy as needed. The success or failure of the current strategy will be judged based on several key indicators.

- Key indicators: Key indicators include GDP growth, inflation, unemployment rates, and investment levels. Improvements in these areas would signal the success of the PBoC's measures.

- Expected timeframe for assessing the effectiveness of the measures: A comprehensive assessment of the effectiveness of the policy changes will likely require several months, allowing sufficient time to observe the impact on various sectors of the economy.

- Potential adjustments to policy based on the observed indicators: Depending on the observed economic indicators, the PBoC may choose to further adjust its monetary policy by implementing additional rate cuts, increasing lending targets, or implementing other supportive measures.

Conclusion

In response to tariff concerns, China's Central Bank has employed a two-pronged strategy: strategic Interest Rate Cuts China and significantly increased lending. While this approach offers the potential to stimulate economic activity and mitigate the negative impacts of trade tensions, it also carries risks, notably increased debt levels. The PBoC’s success will hinge on its ability to manage these risks while effectively monitoring key China Economic Indicators. Stay informed on the evolving situation regarding China's Central Bank policies and their impact on the global economy. Follow our updates for further analysis of China's Central Bank's strategies in managing economic challenges.

Featured Posts

-

Micro Strategy Vs Bitcoin In 2025 Which Is The Better Investment

May 08, 2025

Micro Strategy Vs Bitcoin In 2025 Which Is The Better Investment

May 08, 2025 -

Tuerkiye De Kripto Para Piyasasi Bakan Simsek In Uyarilari Ve Analiz

May 08, 2025

Tuerkiye De Kripto Para Piyasasi Bakan Simsek In Uyarilari Ve Analiz

May 08, 2025 -

Kripto Para Islemlerinde Dikkat Rusya Merkez Bankasi Nin Yeni Uyarisi

May 08, 2025

Kripto Para Islemlerinde Dikkat Rusya Merkez Bankasi Nin Yeni Uyarisi

May 08, 2025 -

De Andre Hopkins Joins The Ravens Contract Breakdown And Impact

May 08, 2025

De Andre Hopkins Joins The Ravens Contract Breakdown And Impact

May 08, 2025 -

Decline In Taiwanese Investment In Us Bond Etfs Causes And Implications

May 08, 2025

Decline In Taiwanese Investment In Us Bond Etfs Causes And Implications

May 08, 2025