CoreWeave (CRWV): Jim Cramer's Analysis Of The Cloud Computing Upstart

Table of Contents

Jim Cramer's Stance on CoreWeave (CRWV): Bullish or Bearish?

Determining Jim Cramer's precise stance on CoreWeave requires careful examination of his pronouncements. While specific quotes need to be referenced from his recent shows and analysis (which are constantly evolving), we can analyze the likely factors influencing his opinion. His overall sentiment likely leans towards optimism, given CoreWeave’s position in a high-growth market.

- Positive Aspects: Cramer likely highlights CoreWeave's focus on specialized GPU infrastructure, a key differentiator in the competitive cloud computing market. The explosive growth of AI and machine learning, heavily reliant on GPU power, positions CoreWeave favorably. He might also praise the strong management team and their innovative approach to cloud infrastructure.

- Potential Concerns: However, a cautious investor like Cramer would undoubtedly acknowledge risks. Intense competition from established giants like AWS, Azure, and GCP is a significant concern. The rapidly evolving nature of cloud technology demands constant innovation, and failure to adapt could impact CoreWeave’s market share. Cramer might express concern regarding the company's financial performance, profitability, and potential market volatility.

CoreWeave's Business Model and Competitive Advantage

CoreWeave's unique selling proposition (USP) lies in its specialized infrastructure optimized for GPU-intensive workloads. Unlike general-purpose cloud providers, CoreWeave caters specifically to the needs of AI, machine learning, and high-performance computing applications.

- Target Market: Its primary target market consists of companies and researchers heavily reliant on GPU processing power, including startups in AI, large enterprises with demanding computational needs, and academic institutions conducting advanced research.

- Technological Infrastructure: CoreWeave leverages a massive network of GPUs, providing unparalleled computing power for its clients. This focus on specialized hardware gives it a competitive edge over more generalized cloud offerings.

- Key Differentiators: This specialization allows CoreWeave to offer superior performance and efficiency for specific workloads, potentially attracting clients seeking optimized solutions for complex AI and machine learning projects. The company may also have strategic partnerships that further enhance its capabilities.

Financial Performance and Growth Potential of CRWV

Assessing CoreWeave’s financial health requires access to up-to-date financial statements and reports. Key performance indicators (KPIs) to consider include revenue growth, gross margin, operating expenses, and profitability. Analyzing these metrics offers insight into the company's operational efficiency and sustainability.

- Growth Prospects: The rapidly expanding AI market fuels CoreWeave’s growth potential. Increased demand for advanced computing power will likely translate to higher revenue streams for the company. Expansion into new markets and service offerings further enhances its long-term growth prospects.

- Macroeconomic Factors: Global economic conditions, interest rate changes, and overall investor sentiment play a significant role in CoreWeave's valuation and its attractiveness to investors.

- Valuation: Determining whether CRWV is appropriately valued necessitates a comprehensive analysis of its financials relative to its peers and future growth projections.

Risks and Challenges Facing CoreWeave (CRWV)

Despite its strong potential, CoreWeave faces several risks and challenges.

- Competition: Intense competition from established cloud providers with vastly greater resources and market presence presents a substantial threat.

- Technological Dependence: CoreWeave's reliance on specific hardware and software technologies makes it susceptible to changes in the technology landscape. A shift in industry standards could impact its competitiveness.

- Scalability Challenges: Rapid growth can bring operational challenges, requiring significant investment in infrastructure and personnel. Failure to scale efficiently could impede future growth.

Investing in CoreWeave (CRWV): A Final Verdict Based on Jim Cramer's Insights

Jim Cramer’s analysis, while not explicitly stated here, would likely present a nuanced view of CoreWeave's investment potential. While the company's focus on a high-growth market segment is attractive, significant competitive pressures and operational challenges need careful consideration.

CoreWeave's strengths lie in its specialized GPU infrastructure and the explosive growth of the AI market. However, the risks associated with competition and market volatility should not be underestimated. Whether CRWV represents a worthwhile investment depends on individual risk tolerance and investment goals.

Call to Action: Before making any investment decisions related to CoreWeave (CRWV) stock, conduct thorough due diligence, research the company's financials, and stay informed about industry trends. Remember to seek professional financial advice to help make informed decisions regarding your investment portfolio. Understanding the complexities of the cloud computing market and the stock market is vital when considering CoreWeave CRWV as part of your investment strategy.

Featured Posts

-

Analysis Ftcs Appeal Of The Microsoft Activision Merger Decision

May 22, 2025

Analysis Ftcs Appeal Of The Microsoft Activision Merger Decision

May 22, 2025 -

The Thames Water Executive Bonus Scandal A Detailed Analysis

May 22, 2025

The Thames Water Executive Bonus Scandal A Detailed Analysis

May 22, 2025 -

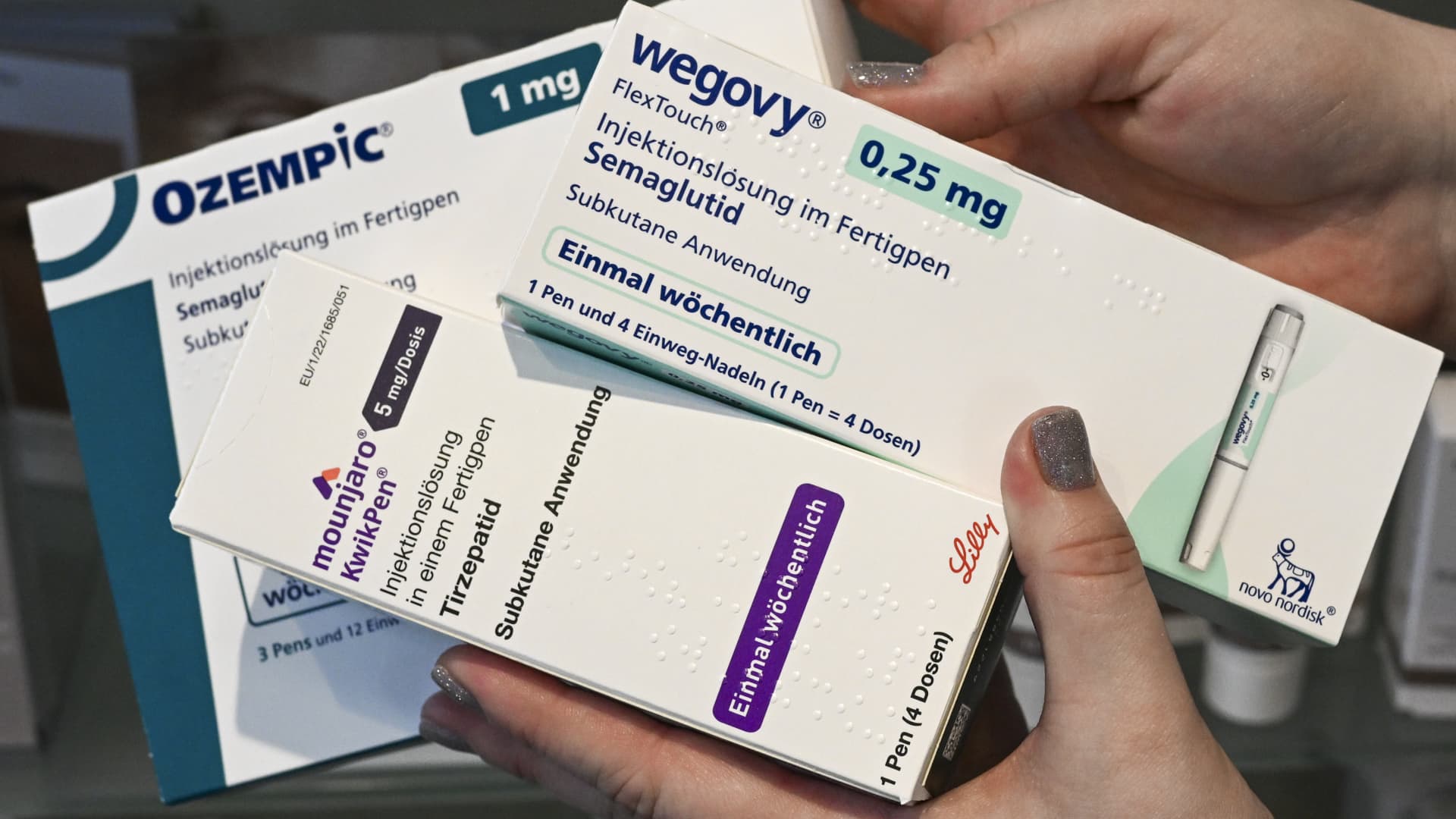

Fda Crackdown On Ozempic Copies Supply Shortages Loom

May 22, 2025

Fda Crackdown On Ozempic Copies Supply Shortages Loom

May 22, 2025 -

Is Lack Of Funds Holding You Back Practical Solutions

May 22, 2025

Is Lack Of Funds Holding You Back Practical Solutions

May 22, 2025 -

British Ultrarunner Eyes Australian Crossing Speed Record

May 22, 2025

British Ultrarunner Eyes Australian Crossing Speed Record

May 22, 2025

Latest Posts

-

Lower Gas Prices In Toledo Current Cost Per Gallon

May 22, 2025

Lower Gas Prices In Toledo Current Cost Per Gallon

May 22, 2025 -

Toledo Gas Prices Drop Per Gallon Cost Decreases

May 22, 2025

Toledo Gas Prices Drop Per Gallon Cost Decreases

May 22, 2025 -

Gas Buddy Reports On Falling Gas Prices In Virginia This Week

May 22, 2025

Gas Buddy Reports On Falling Gas Prices In Virginia This Week

May 22, 2025 -

Gas Prices Down In Virginia Gas Buddys Week Over Week Analysis

May 22, 2025

Gas Prices Down In Virginia Gas Buddys Week Over Week Analysis

May 22, 2025 -

Weekly Virginia Gas Price Report Significant Drop Reported By Gas Buddy

May 22, 2025

Weekly Virginia Gas Price Report Significant Drop Reported By Gas Buddy

May 22, 2025