Country Property Investment: Lessons From Nicki Chapman's Success

Table of Contents

Understanding the Unique Aspects of Country Property Investment

Country property investment differs significantly from urban property investment. Understanding these nuances is crucial for success. Factors often overlooked in city-based investments become paramount in the countryside.

Location, Location, Location – Redefined for Rural Properties

The classic real estate mantra holds true, but its interpretation shifts in rural settings. Location in the countryside extends beyond proximity to shops and transport links.

- Commuting Distances: Consider the daily commute to work if applicable. Long distances can impact lifestyle and property value.

- Local Amenities: Access to essential services like supermarkets, schools, and healthcare facilities is crucial. A remote location might offer tranquility, but it could also limit accessibility.

- Broadband Access: Reliable high-speed internet is increasingly vital, especially for those working remotely. Check availability before purchasing.

- Market Trends: Analyze local property price trends and identify areas with strong growth potential. Look beyond immediate figures and consider future development possibilities.

- Tourism Potential: Properties in areas with strong tourism potential can offer higher rental yields and increased capital appreciation. Consider proximity to popular attractions.

- Lifestyle Factors: The desirability of a location is influenced by lifestyle factors such as proximity to walking trails, nature reserves, and other recreational activities.

Research Checklist:

- Local schools' reputations and Ofsted ratings

- Access to hospitals and GP surgeries

- Proximity to major roads, train stations, or airports

Assessing Property Condition and Potential

Older properties are common in rural areas. Thorough assessment is vital to avoid costly surprises.

- Property Surveys: Engage a qualified surveyor to conduct a comprehensive survey, identifying any structural issues or potential problems.

- Renovation Costs: Factor in potential renovation costs. Outdated plumbing, electrical systems, and inefficient insulation can significantly impact ROI.

- Maintenance Requirements: Country properties often require more maintenance than urban properties. Consider the long-term implications of upkeep.

- Hidden Problems: Be vigilant for signs of damp, subsidence, pest infestations, and outdated systems.

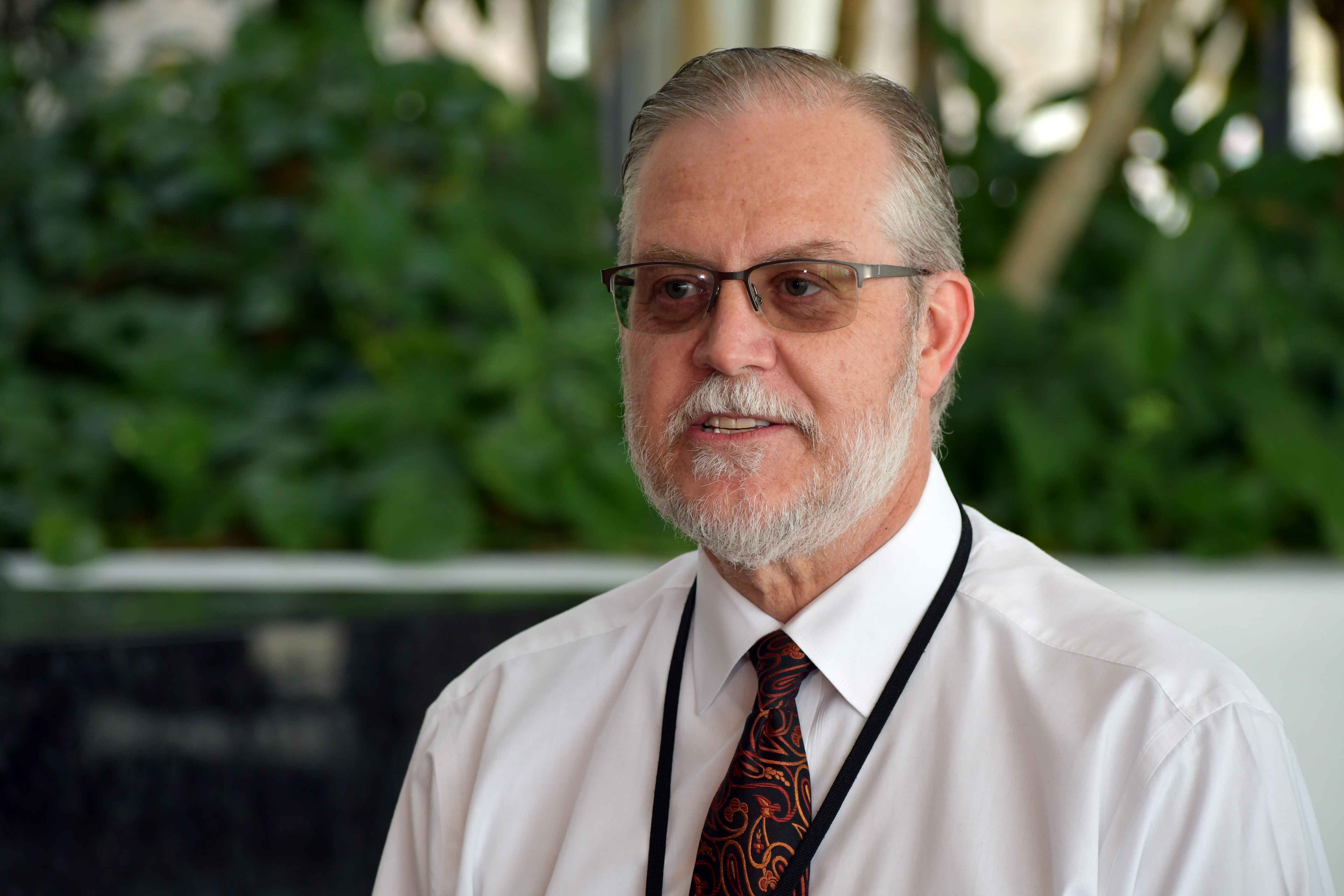

Learning from Nicki Chapman's Strategies

Nicki Chapman's success stems from a keen eye for undervalued properties and a strategic approach to risk management. Let's explore her methods.

Identifying Undervalued Properties

Finding hidden gems in the countryside requires diligent research and a sharp eye.

- Market Research: Thorough market research is crucial to identify properties priced below their true market value.

- Negotiation Skills: Be prepared to negotiate effectively. Understanding the seller's motivations can help secure a favorable price.

- Due Diligence: Always perform thorough due diligence before committing to a purchase. This involves checking legal titles, planning permissions, and any outstanding issues.

Nicki Chapman's Tactics:

- Attending local property auctions

- Networking with local estate agents

- Utilizing online property portals effectively

- Directly contacting landowners

Managing Risks and Challenges

Country property investment carries unique risks. Proactive risk management is essential.

- Seasonal Variations: Rental demand can fluctuate seasonally. Plan accordingly to mitigate potential income dips.

- Maintenance Challenges: Remote locations can make finding tradespeople and sourcing materials more challenging. Have a contingency plan.

- Legal and Planning: Rural properties often have specific legal and planning considerations. Engage experts for guidance.

Risk Mitigation Strategies:

- Comprehensive insurance coverage for buildings and contents

- A well-maintained emergency fund for unexpected repairs

- Thorough research of local planning regulations and restrictions

Financial Planning and Investment Strategies for Country Properties

Securing the right financing and developing a sound long-term strategy are vital for success.

Securing Financing

Financing a country property purchase often requires a strategic approach.

- Mortgage Options: Explore various mortgage options, including those specifically designed for rural properties.

- Bridging Loans: Consider bridging loans if you need to finance renovations or purchase before selling an existing property.

- Demonstrating Viability: Lenders will assess your financial strength and the viability of your investment. Prepare a comprehensive business plan.

Financial Preparation:

- Build a strong credit history.

- Prepare a detailed business plan showcasing projected income and expenses.

- Compare interest rates and loan terms from different lenders.

Long-Term Investment Strategies

Think long-term to maximize your return on investment.

- Rental Income: Project rental income based on market rates and occupancy levels.

- Capital Appreciation: Assess the potential for capital appreciation over time.

- Tax Implications: Consult with a tax advisor to understand the tax implications of your investment.

Long-Term Considerations:

- Potential for future development or expansion

- Potential for converting the property into a holiday let or other alternative use

Conclusion

Country property investment, while presenting unique challenges, offers significant rewards for those who approach it strategically. By learning from successful investors like Nicki Chapman and understanding the specific aspects of the rural property market, you can increase your chances of success. Remember to conduct thorough research, manage risks effectively, and develop a solid financial plan. Don't delay your dreams of owning a country property – start your journey into the lucrative world of country property investment today!

Featured Posts

-

Annie Kilners Diamond Ring Confirmation Of Kyle Walker Relationship

May 25, 2025

Annie Kilners Diamond Ring Confirmation Of Kyle Walker Relationship

May 25, 2025 -

Ferraris State Of The Art Service Centre Now Open In Bengaluru

May 25, 2025

Ferraris State Of The Art Service Centre Now Open In Bengaluru

May 25, 2025 -

How To Interpret The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist

May 25, 2025

How To Interpret The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist

May 25, 2025 -

France L Etendue De L Influence Chinoise Et La Repression Des Voix Discordantes

May 25, 2025

France L Etendue De L Influence Chinoise Et La Repression Des Voix Discordantes

May 25, 2025 -

Facing Retribution The High Cost Of Challenging The Status Quo

May 25, 2025

Facing Retribution The High Cost Of Challenging The Status Quo

May 25, 2025

Latest Posts

-

Weekly Cac 40 Performance Slight Decline Stable Trend 07 03 2025

May 25, 2025

Weekly Cac 40 Performance Slight Decline Stable Trend 07 03 2025

May 25, 2025 -

Change At The Top Guccis Chief Industrial And Supply Chain Officer Resigns

May 25, 2025

Change At The Top Guccis Chief Industrial And Supply Chain Officer Resigns

May 25, 2025 -

Analisi Dell Impatto Dei Dazi Di Trump Del 20 Sul Settore Moda

May 25, 2025

Analisi Dell Impatto Dei Dazi Di Trump Del 20 Sul Settore Moda

May 25, 2025 -

Cac 40 Index End Of Week Report March 7 2025

May 25, 2025

Cac 40 Index End Of Week Report March 7 2025

May 25, 2025 -

Gucci Faces Supply Chain Leadership Change With Vians Departure

May 25, 2025

Gucci Faces Supply Chain Leadership Change With Vians Departure

May 25, 2025