DAX Rally: Can It Withstand A Wall Street Comeback?

Table of Contents

Factors Fueling the Current DAX Rally

Several interconnected factors have contributed to the robust DAX rally. Understanding these elements is crucial for assessing the sustainability of the current market trend.

Strength of the German Economy

Germany's economic resilience has played a pivotal role in the DAX's performance. Several key sectors are contributing to this strength:

- Positive GDP growth: Recent GDP figures point towards continued, albeit moderate, growth in the German economy, bolstering investor confidence.

- Robust industrial production: Germany's manufacturing sector, a cornerstone of its economy, has shown signs of strength, contributing significantly to overall economic output and positively influencing DAX performance.

- Improving consumer confidence: Rising consumer confidence indicates increased spending and a more positive economic outlook, further supporting the DAX rally.

- Export performance relative to global competitors: Despite global economic headwinds, Germany's exports have remained relatively strong, showcasing the competitiveness of its businesses and contributing to the overall strength of the German economy and, subsequently, the DAX. This strength in exports is a key indicator of the health of the German economy and its influence on the DAX performance.

European Central Bank (ECB) Policies

The European Central Bank's (ECB) monetary policies have had a notable impact on the DAX's trajectory.

- Interest rate decisions: The ECB's interest rate decisions, while carefully calibrated to manage inflation, have also influenced borrowing costs and investor sentiment, indirectly impacting DAX volatility.

- Quantitative easing programs: Although winding down, past quantitative easing programs injected liquidity into the market, supporting asset prices, including those within the DAX.

- Inflation targets: The ECB's focus on managing inflation within its target range provides a degree of stability, influencing investor confidence and contributing to the DAX’s performance. This impact on investor sentiment is crucial for understanding the DAX's volatility.

- Impact on investor sentiment: The ECB's overall communication and policy stance significantly influence investor sentiment, directly affecting the DAX's price movements.

Global Investment Flows

Global investment trends have also played a crucial role in supporting the DAX rally.

- Shifting investor preferences: Investors are constantly re-evaluating their portfolios, and the DAX has benefited from shifts in investor preferences towards European markets.

- Safe-haven asset status: During periods of global uncertainty, the DAX, alongside other European markets, can be viewed as a relatively safe-haven asset, attracting investment flows. This status, however, is not guaranteed and is subject to changes in global sentiment and risk appetite.

- Comparative performance against other major indices: The DAX's relative performance against other major indices, such as the S&P 500 and the FTSE 100, influences global investment flows, making it an attractive investment destination for diversification purposes. This competitive performance is a major factor in attracting global investment.

Potential Threats from a Wall Street Comeback

While the DAX rally shows strength, a potential Wall Street comeback could present significant threats.

US Dollar Strength

A strengthening US dollar poses a considerable risk to the DAX.

- Impact on exports: A stronger dollar makes German exports more expensive in global markets, potentially impacting export performance and slowing economic growth.

- Currency fluctuations: Fluctuations between the euro and the US dollar directly impact the profitability of German companies with significant international operations, impacting the DAX's value.

- Investor confidence: A strong dollar can shift investor sentiment away from euro-denominated assets, potentially leading to capital outflows from the DAX.

US Economic Recovery

A robust US economic recovery could divert investment capital away from Europe.

- US job market: A strong US job market signifies economic health and attracts investment. This increased activity can divert funds from the European market and away from the DAX.

- Consumer spending: Increased US consumer spending further signals economic strength, drawing investors' attention away from alternative markets.

- Technological advancements: US leadership in certain technological sectors can attract significant investment, drawing resources away from Europe and the DAX.

- Investor confidence: A robust US economic recovery boosts investor confidence in US markets, potentially diverting investment away from Europe.

Geopolitical Risks

Global uncertainties pose a risk to both the US and German markets.

- Inflation: Persistent high inflation globally can impact investor sentiment and lead to market volatility in both the US and Europe, impacting the DAX.

- Energy prices: Volatile energy prices, particularly in Europe, can impact economic growth and consumer confidence, negatively influencing the DAX.

- Supply chain disruptions: Global supply chain disruptions can negatively affect production and exports in Germany, impacting the DAX.

- Political instability: Geopolitical instability anywhere in the world can cause uncertainty and affect global markets including the DAX and Wall Street.

Conclusion

The DAX rally has been driven by strong German economic fundamentals, supportive ECB policies, and favorable global investment flows. However, a potential Wall Street comeback, fueled by a strong US dollar and a robust US economic recovery, poses significant risks. Geopolitical risks add another layer of complexity. Careful monitoring of key economic indicators, currency fluctuations, and geopolitical developments is crucial for understanding the future trajectory of the DAX.

Call to Action: Stay informed about the ongoing DAX rally and its vulnerability to a potential Wall Street rebound. Continue following our analysis for deeper insights into the DAX's performance and its future outlook. Understanding the factors influencing the DAX rally is crucial for making informed investment decisions. Learn more about the intricacies of the DAX and its potential vulnerabilities to navigate the complexities of the global market.

Featured Posts

-

Konchita Vurst Peredbachennya Peremozhtsiv Yevrobachennya 2025 Unian

May 25, 2025

Konchita Vurst Peredbachennya Peremozhtsiv Yevrobachennya 2025 Unian

May 25, 2025 -

Nemecke Spolocnosti A Hromadne Prepustanie Aktualny Prehlad

May 25, 2025

Nemecke Spolocnosti A Hromadne Prepustanie Aktualny Prehlad

May 25, 2025 -

Nimi Muistiin 13 Vuotias Ajaa Ferrarille

May 25, 2025

Nimi Muistiin 13 Vuotias Ajaa Ferrarille

May 25, 2025 -

Qfzt Daks Alalmany Atfaq Tjary Amryky Syny Yuhdth Frqa

May 25, 2025

Qfzt Daks Alalmany Atfaq Tjary Amryky Syny Yuhdth Frqa

May 25, 2025 -

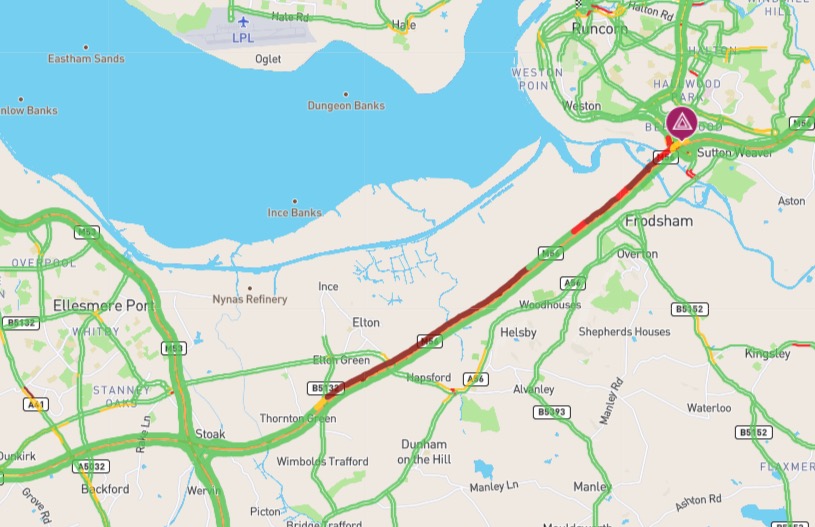

Significant Delays On M56 Near Cheshire Deeside After Collision

May 25, 2025

Significant Delays On M56 Near Cheshire Deeside After Collision

May 25, 2025

Latest Posts

-

Stock Market Update European Shares Up Lvmh Down After Trumps Tariff Remarks

May 25, 2025

Stock Market Update European Shares Up Lvmh Down After Trumps Tariff Remarks

May 25, 2025 -

European Market Reaction Trumps Tariff Comments And Lvmh Stock Plunge

May 25, 2025

European Market Reaction Trumps Tariff Comments And Lvmh Stock Plunge

May 25, 2025 -

En France La Chine Et La Censure Des Voix Critiques

May 25, 2025

En France La Chine Et La Censure Des Voix Critiques

May 25, 2025 -

Auto Tariff Relief Speculation Drives European Stock Market Gains Lvmh Shares Fall

May 25, 2025

Auto Tariff Relief Speculation Drives European Stock Market Gains Lvmh Shares Fall

May 25, 2025 -

Le Silence Force Des Dissidents Francais Face A La Puissance Chinoise

May 25, 2025

Le Silence Force Des Dissidents Francais Face A La Puissance Chinoise

May 25, 2025