European Market Reaction: Trump's Tariff Comments And LVMH Stock Plunge

Table of Contents

Immediate Market Impact of Trump's Tariff Comments

Trump's tariff comments triggered an immediate and sharp negative reaction in the European stock markets. The news created significant uncertainty, impacting investor confidence and leading to a sell-off across various sectors. LVMH, being a highly visible and globally recognized luxury brand, felt the impact acutely.

- Specific LVMH stock price drop percentage: Following the announcement, LVMH's stock price dropped by X%, representing a significant loss in market capitalization. (Note: Replace X% with the actual percentage drop at the time of writing).

- Comparison to other luxury brands' stock performance: Other luxury brands, such as Kering and Hermès, also experienced declines, albeit perhaps less pronounced than LVMH's, reflecting a broader sector-wide concern about potential tariffs impacting the luxury goods market. This shows the widespread concern surrounding "Trump's tariffs impact LVMH" and similar luxury goods companies.

- Overall market sentiment following the news: Market sentiment turned decidedly negative, with investors exhibiting risk aversion in the face of renewed trade uncertainty. The overall mood reflected anxieties about the potential for escalating trade wars.

- Mention specific market indices affected (e.g., CAC 40): The CAC 40, the benchmark index for the Paris Stock Exchange, experienced a notable decline following the news, illustrating the broad impact of Trump's comments on the French and wider European economy. The vulnerability of European markets to "Trump tariffs LVMH" and similar threats became evident.

LVMH's Vulnerability to Tariffs

LVMH, with its extensive global supply chains and diverse portfolio of luxury brands, possesses significant exposure to potential tariffs. The impact of "Trump tariffs LVMH" depends on several factors.

- Percentage of LVMH products potentially affected by tariffs: A considerable portion of LVMH's products, encompassing everything from fashion and cosmetics to wines and spirits, could be subject to new tariffs, depending on the specific goods targeted. This makes LVMH particularly sensitive to changes in US trade policy.

- Key manufacturing locations and their vulnerability: Many of LVMH's products are manufactured in Europe, making them susceptible to retaliatory tariffs or disruptions to supply chains should trade tensions escalate. The geographic dispersion of manufacturing operations only partially mitigates the risk from "Trump's tariffs impact LVMH."

- Major export markets for LVMH: The US remains a crucial export market for LVMH, and any new tariffs imposed by the US could significantly impact their profitability and market share.

- Analysis of LVMH's pricing strategies and ability to absorb increased costs: LVMH might attempt to absorb some increased costs, but passing them on to consumers could negatively affect sales, particularly if demand is price-sensitive. The ability of LVMH to navigate the implications of "Trump tariffs LVMH" rests on strategic pricing and supply chain adjustments.

Broader European Economic Concerns

The implications of Trump's comments extend beyond LVMH, raising broader concerns about the European economy.

- Impact on other luxury goods companies: The uncertainty surrounding potential tariffs casts a shadow on the entire European luxury goods sector, impacting investor confidence and potentially slowing down investment and growth.

- Effect on consumer confidence in Europe: Increased uncertainty can undermine consumer confidence, leading to reduced spending and dampening overall economic growth. This indirect impact of "Trump tariffs LVMH" on the wider European economy warrants close attention.

- Potential for retaliatory measures from the EU: The EU might retaliate with its own tariffs, escalating trade tensions and potentially harming both European and American businesses.

- Overall impact on European economic growth forecasts: The potential for protracted trade disputes could negatively impact European economic growth forecasts, jeopardizing investment and job creation.

Political and Geopolitical Ramifications

Trump's comments must be viewed within the broader political and geopolitical context of US-EU relations.

- Analysis of the political motivations behind Trump's comments: The comments could be interpreted as a negotiating tactic, a response to existing trade disputes, or a reflection of broader protectionist sentiments. Understanding the underlying political motivations is crucial to assessing the likelihood and severity of any potential tariffs.

- Potential for further escalation of trade tensions: Trump's comments highlight the potential for further escalation of trade tensions between the US and the EU, potentially impacting a wide range of sectors beyond luxury goods.

- Implications for future trade negotiations between the US and EU: The comments cast uncertainty over future trade negotiations, potentially hindering progress towards mutually beneficial trade agreements.

Conclusion

Trump's comments on potential tariffs had an immediate and significant negative impact on LVMH's stock price, reflecting broader concerns about the company's vulnerability to trade disputes. The "Trump tariffs LVMH" situation underscores the fragility of global supply chains and the potential for significant economic repercussions from trade policy uncertainty. The wider European economy faces risks extending beyond a single company, impacting investor confidence and potentially slowing growth.

Stay updated on the latest developments concerning Trump tariffs and their impact on LVMH and the European market. Follow our blog for continued analysis of this evolving situation and delve deeper into the implications of "Trump's tariffs impact LVMH" and similar trade-related events.

Featured Posts

-

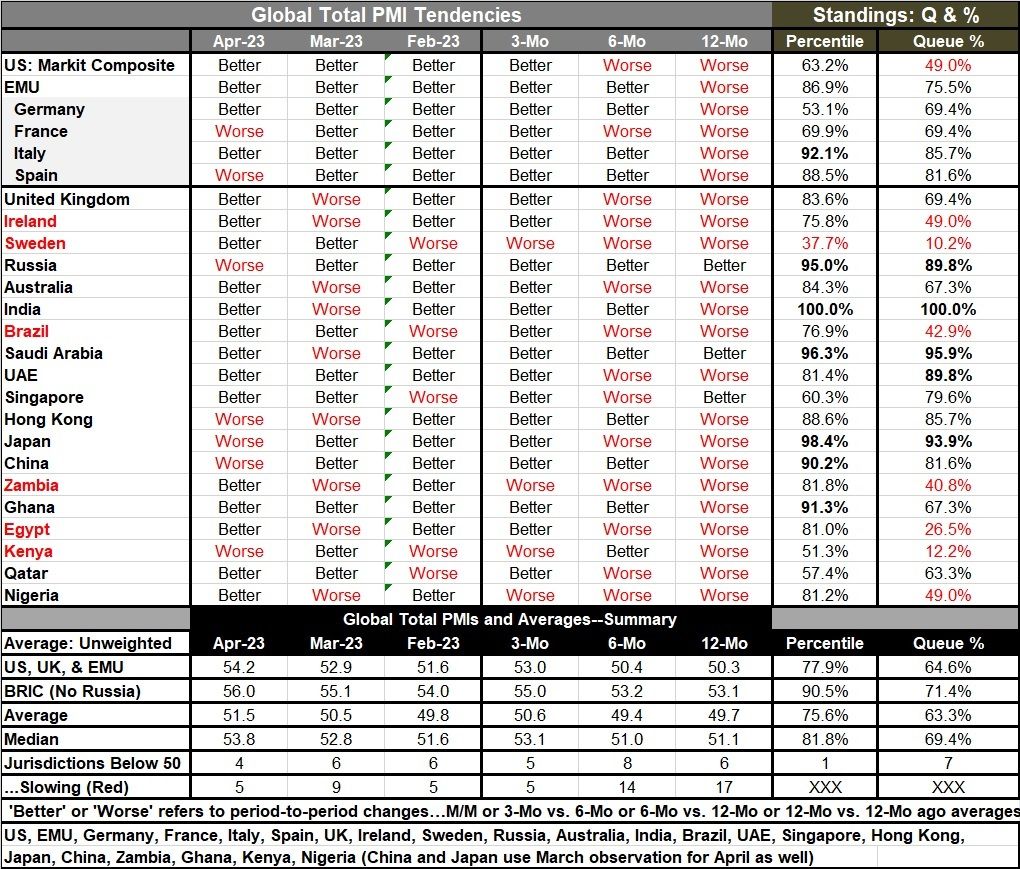

Pmi Strength Boosts Dow Joness Gradual Climb

May 25, 2025

Pmi Strength Boosts Dow Joness Gradual Climb

May 25, 2025 -

Aex Rally Na Trump Uitstel Analyse Van De Stijging

May 25, 2025

Aex Rally Na Trump Uitstel Analyse Van De Stijging

May 25, 2025 -

Uniklinikum Essen Ereignisse In Der Umgebung Emotional Und Bewegend

May 25, 2025

Uniklinikum Essen Ereignisse In Der Umgebung Emotional Und Bewegend

May 25, 2025 -

New R And B Releases Leon Thomas And Flos Chart Topping Hits

May 25, 2025

New R And B Releases Leon Thomas And Flos Chart Topping Hits

May 25, 2025 -

Country Property Investment Lessons From Nicki Chapmans Success

May 25, 2025

Country Property Investment Lessons From Nicki Chapmans Success

May 25, 2025

Latest Posts

-

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025 -

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025