Do Election Promises Lead To Higher Deficits And Slower Economic Growth?

Table of Contents

The Nature of Election Promises and Fiscal Policy

Election promises often translate directly into fiscal policy decisions, impacting a nation's budget significantly. Understanding the types of promises and their potential consequences is crucial for assessing their long-term effects.

Types of Promises Impacting the Budget:

- Tax cuts: Promises to reduce corporate tax rates, income taxes, or implement specific tax exemptions can significantly decrease government revenue. For example, a large-scale corporate tax cut might boost short-term economic activity but reduce government's ability to fund crucial social programs or infrastructure projects in the long run.

- Increased government spending: Pledges for increased spending on infrastructure projects (roads, bridges, public transportation), expansive social programs (healthcare, education, welfare), or a larger defense budget all directly increase government expenditure, potentially leading to larger budget deficits. The effectiveness of such spending often depends on its efficient allocation and economic conditions.

- Promises related to deregulation: While often framed as economically beneficial, deregulation can have varied fiscal consequences. Reduced environmental regulations might lead to short-term cost savings for businesses but potentially increase long-term environmental cleanup costs for the government. Similarly, financial deregulation can lead to short-term economic booms followed by financial crises requiring costly government bailouts.

Short-term vs. Long-term Impacts of Election Promises:

Policy changes stemming from election promises often have immediate and long-term impacts. A tax cut might stimulate the economy in the short term, boosting consumer spending and business investment. However, if not coupled with spending cuts or revenue-generating measures, this can lead to increased national debt over the long term. For instance, many countries have experienced periods of short-term economic growth fueled by increased government borrowing, only to face debt crises and slower growth later.

The Role of Political Ideology in Fiscal Promises:

Political ideologies significantly influence the types and scale of fiscal promises made during election campaigns. Generally, left-leaning parties often favor increased government spending on social programs and public services, potentially leading to higher deficits. Right-leaning parties, conversely, tend to prioritize tax cuts and reduced government spending, aiming for fiscal responsibility and potentially slower economic growth in the short term. However, the reality is often far more nuanced, with specific policies varying widely even within a single party's platform. Long-term fiscal planning is often overlooked in favor of short-term electoral gains, regardless of political affiliation.

The Economic Impact of Unfunded Election Promises

Unfunded election promises, those without clear plans for financing, have serious economic consequences. The lack of a concrete funding mechanism translates directly into increased national debt and a range of negative economic effects.

Increased National Debt and its consequences:

Unfunded promises necessitate increased government borrowing, leading to a rise in national debt. Higher debt levels can result in:

- Increased interest rates: Governments need to offer higher interest rates to attract investors, increasing the cost of borrowing for both the government and the private sector.

- Reduced investor confidence: High levels of national debt can erode investor confidence, making it more difficult and expensive for the government and businesses to secure loans.

- Currency devaluation: A consistently high debt-to-GDP ratio can lead to a devaluation of the national currency, impacting the country's international competitiveness.

Crowding Out Effect and Reduced Private Investment:

Government borrowing competes with private sector borrowing for available funds. This "crowding out effect" can lead to reduced private investment, hindering economic growth and job creation. When the government borrows heavily, it increases demand for loanable funds, driving up interest rates and making it more expensive for businesses to invest and expand.

Inflationary Pressures:

Excessive government spending, particularly when financed through borrowing, can fuel inflationary pressures. Increased demand for goods and services without a corresponding increase in supply can lead to higher prices. This can erode purchasing power, reduce savings, and destabilize the economy in the long term.

Analyzing the Link Between Election Promises and Economic Growth

The impact of election promises on economic growth is complex and multifaceted. While some promises might stimulate growth in the short term, others can have detrimental long-term effects.

The impact of fiscal stimulus on economic growth:

Government spending can stimulate economic activity, particularly during recessions. However, the effectiveness of fiscal stimulus depends heavily on how the funds are allocated. Wasteful spending or poorly designed programs can lead to minimal economic impact and exacerbate the national debt.

The role of investor confidence and economic uncertainty:

Unfunded or poorly explained election promises can create economic uncertainty, eroding investor confidence. This uncertainty can discourage investment, reduce consumer spending, and hinder overall economic growth. Transparency and responsible fiscal planning can help improve investor confidence and promote economic stability.

Long-term sustainable growth versus short-term gains:

The choice between short-term gains and long-term sustainable growth is a central challenge in economic policy. While some policies might deliver immediate economic benefits, they could create long-term fiscal instability. Sustainable growth strategies focus on responsible fiscal management and investments in areas such as education, infrastructure, and research and development, laying the foundation for long-term prosperity.

Conclusion: Understanding the Impact of Election Promises on Economic Health

Unrealistic election promises, particularly those without clear funding mechanisms, can lead to increased deficits and slower economic growth. Responsible fiscal policy, transparent budgeting, and careful consideration of the long-term economic consequences of policy decisions are vital for maintaining a healthy economy. Ignoring these factors can have devastating long-term consequences, undermining economic stability and hindering future prosperity. Become an informed voter by carefully analyzing the economic implications of election promises before casting your ballot. Demand responsible fiscal planning from your elected officials. Hold them accountable for the economic consequences of their election promises.

Featured Posts

-

Evangelista At 59 The Raw Emotion Of Revealing Mastectomy Scars

Apr 25, 2025

Evangelista At 59 The Raw Emotion Of Revealing Mastectomy Scars

Apr 25, 2025 -

Harrogate Spring Flower Show 40 000 Visitors Predicted

Apr 25, 2025

Harrogate Spring Flower Show 40 000 Visitors Predicted

Apr 25, 2025 -

Analysis Trumps Uncommon Reprimand Of Putin Over Kyiv

Apr 25, 2025

Analysis Trumps Uncommon Reprimand Of Putin Over Kyiv

Apr 25, 2025 -

Review Dope Thief Episode 7 Back To Basics

Apr 25, 2025

Review Dope Thief Episode 7 Back To Basics

Apr 25, 2025 -

Jack O Connell The Haunting Sinners Scene And His Return To Acting Roots

Apr 25, 2025

Jack O Connell The Haunting Sinners Scene And His Return To Acting Roots

Apr 25, 2025

Latest Posts

-

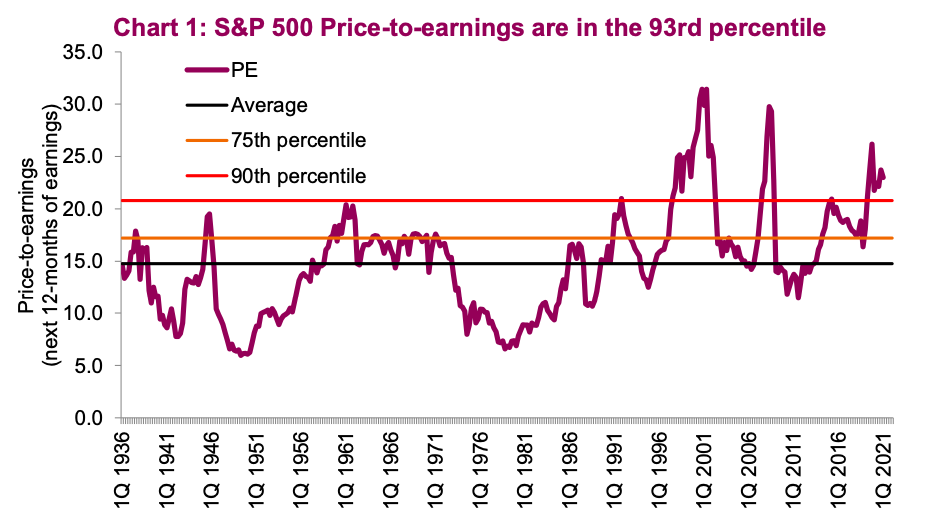

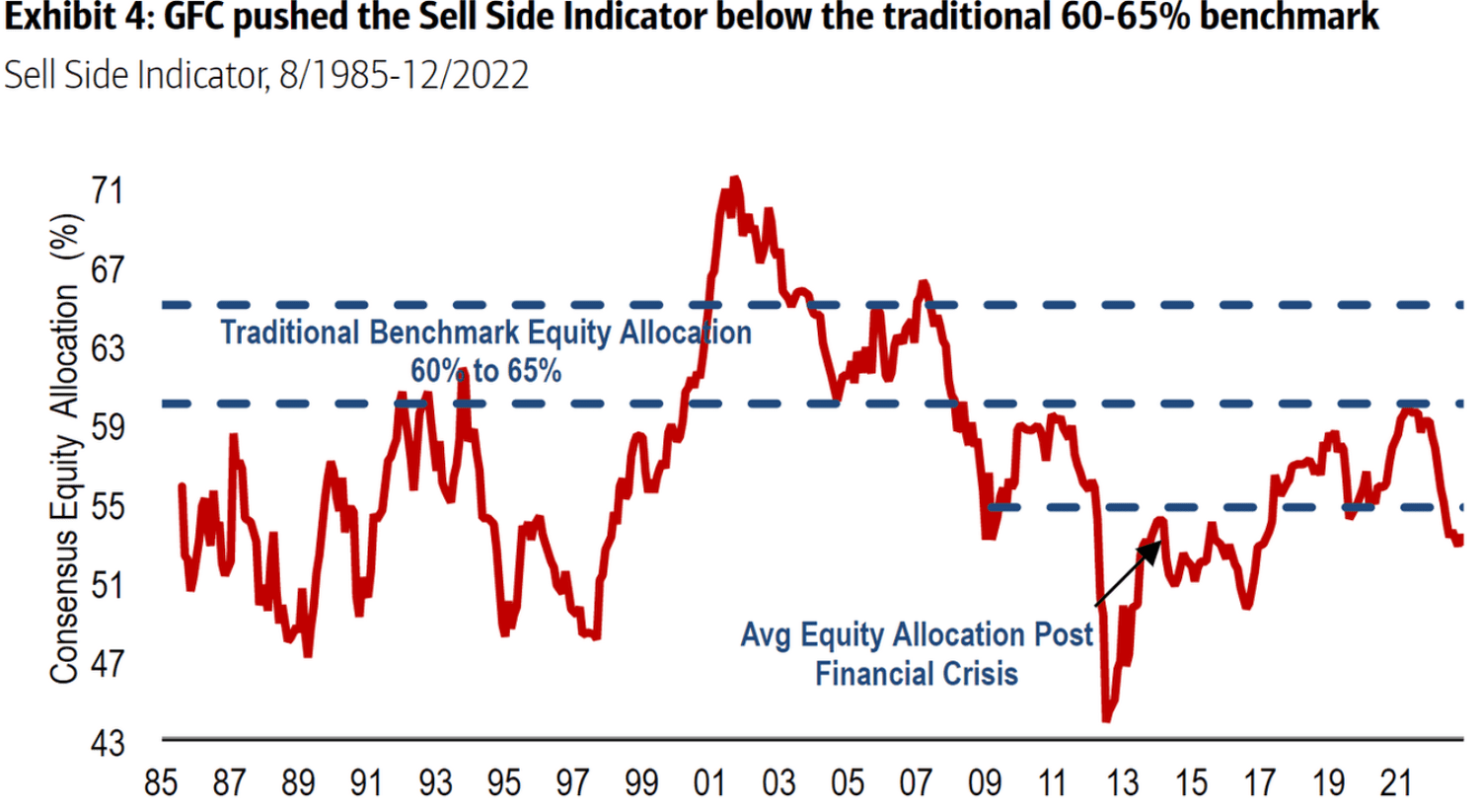

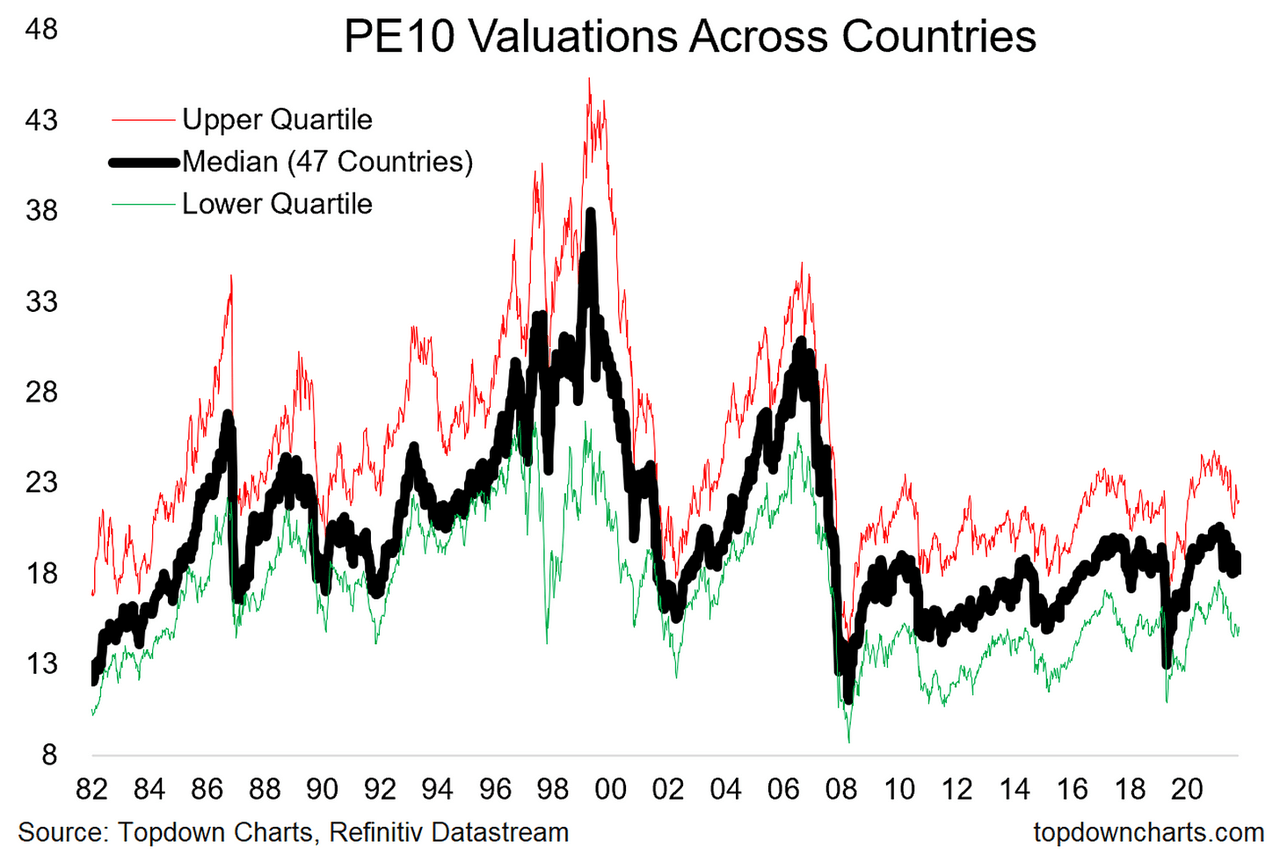

Addressing Investor Concerns Bof As View On High Stock Market Valuations

Apr 26, 2025

Addressing Investor Concerns Bof As View On High Stock Market Valuations

Apr 26, 2025 -

Bof A On Stock Market Valuations A Rationale For Investor Confidence

Apr 26, 2025

Bof A On Stock Market Valuations A Rationale For Investor Confidence

Apr 26, 2025 -

Why Current Stock Market Valuations Are Not A Reason To Panic According To Bof A

Apr 26, 2025

Why Current Stock Market Valuations Are Not A Reason To Panic According To Bof A

Apr 26, 2025 -

Understanding Stock Market Valuations Bof As Argument For Calm

Apr 26, 2025

Understanding Stock Market Valuations Bof As Argument For Calm

Apr 26, 2025 -

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025