Escape To The Country: Budgeting For Rural Life

Table of Contents

Housing Costs: More Than Just the Mortgage

Rural living often conjures images of charming cottages and sprawling farmsteads. But the reality of "Escape to the Country" necessitates a realistic appraisal of housing costs, which extend far beyond the mortgage payment.

Property Prices and Taxes

Rural property prices can vary dramatically depending on location, proximity to amenities, and the property's condition. While you might find bargains, don't be surprised by higher property taxes compared to urban centers.

- Consider property taxes, school taxes, and potential special assessments. These can significantly impact your monthly budget.

- Research average property prices in your target area. Use online real estate portals and consult local real estate agents to get a clear picture.

- Factor in potential renovation costs – older properties are common in rural areas. Many rural homes require updates or repairs, adding unexpected costs to your initial investment. Budget for plumbing, electrical work, and general cosmetic improvements.

Maintenance and Repairs

Homes in rural areas often require more maintenance due to increased exposure to the elements. Expect higher upkeep costs compared to city living.

- Budget for regular upkeep of fences, roofing, and plumbing. These are essential systems that need regular attention to prevent costly repairs later.

- Factor in potential costs for heating and cooling, which can be higher in rural areas. Older homes may lack efficient insulation, leading to increased energy consumption.

- Plan for unexpected repairs; these can be costly and harder to arrange quickly. Finding qualified tradespeople in rural areas can be challenging, and their services may come at a premium.

Transportation: Rethinking Your Commute

Reliable transportation is critical when embracing a rural lifestyle. The convenience of public transport often diminishes in rural settings, necessitating a careful assessment of transportation costs.

Vehicle Costs

Owning a reliable vehicle is non-negotiable for most rural residents. Consider the various costs involved.

- Factor in the cost of a vehicle (purchase or lease), insurance, fuel, and maintenance. The distance to work, shops, and medical facilities will significantly impact fuel costs.

- Consider the distance to work, shops, and medical facilities. A longer commute translates directly to higher fuel and maintenance expenses.

- Explore the possibility of carpooling or alternative transportation options. These can help mitigate some of the costs associated with owning and maintaining a vehicle.

Infrastructure Costs

Limited access to essential services is a common feature of rural life. Factor in potential costs related to infrastructure.

- Research internet availability and pricing in your target area. High-speed internet access might be limited or expensive in some rural locations.

- Consider costs for well maintenance, septic system servicing, or generator upkeep. These are essential systems for rural properties that often require regular maintenance and occasional repairs.

- Investigate potential costs for road maintenance or snow removal (depending on the climate). Private road maintenance or snow removal might be your responsibility in some rural areas.

Cost of Living: Beyond the Big Ticket Items

While the charm of rural living is undeniable, it's essential to realistically assess the everyday costs.

Groceries and Utilities

While some rural areas boast farmers' markets and locally sourced produce, grocery costs can still be higher due to limited competition and transportation costs. Utilities can also be more expensive.

- Compare grocery prices in rural vs. urban areas. Factor in the cost of traveling to larger towns for shopping.

- Research utility costs (water, electricity, gas). These can be significantly higher in rural areas due to distance from utility grids and limited competition.

- Consider the cost of heating fuel (wood, propane, etc.). Heating costs can be substantial, depending on the climate and your home's efficiency.

Healthcare and Education

Access to healthcare and education can be more limited and potentially more expensive in rural areas.

- Research healthcare options and costs in your target area. Longer travel distances to hospitals and specialists can add significant expenses.

- Consider transportation costs for medical appointments. Factor in travel time, fuel, and potential overnight stays if specialized care is required.

- Investigate school options and associated fees (private or public transport). School bus routes might be less frequent or non-existent in some rural locations.

Unexpected Expenses: Planning for the Unforeseen

Rural living presents unique challenges that can lead to unexpected expenses. Preparation is key.

- Emergency fund: Create a substantial emergency fund to cover unforeseen repairs, medical emergencies, or job loss. Aim for at least 3-6 months' worth of living expenses.

- Unexpected weather events: Be prepared for potential expenses related to storms, floods, or other natural disasters. Consider insurance coverage for these events.

- Wildlife encounters: Rural areas often have wildlife that can cause damage to property or require professional removal. Factor in potential costs for pest control or wildlife removal services.

Conclusion

Escaping to the country offers a unique lifestyle, but careful budgeting is crucial for a successful transition. By thoughtfully considering housing costs, transportation expenses, the overall cost of living, and potential unexpected expenses, you can create a realistic budget for your "Escape to the Country" dream. Don't let the financial unknowns deter you; thorough planning and a realistic budget will ensure you can enjoy the peace and tranquility of rural life without compromising your financial security. Start planning your "Escape to the Country" today with a well-defined budget!

Featured Posts

-

Kak Brezhnev Spas Garazh Istoriya Mesti Myagkovu I Sovetskoy Satiry

May 25, 2025

Kak Brezhnev Spas Garazh Istoriya Mesti Myagkovu I Sovetskoy Satiry

May 25, 2025 -

The Annie Kilner Kyle Walker Controversy Examining The Allegations

May 25, 2025

The Annie Kilner Kyle Walker Controversy Examining The Allegations

May 25, 2025 -

Pedestrian Hit By Car On Princess Road Latest Updates And Emergency Response

May 25, 2025

Pedestrian Hit By Car On Princess Road Latest Updates And Emergency Response

May 25, 2025 -

Intimacy Growth And The Making Of Her In Deep An Interview With Matt Maltese

May 25, 2025

Intimacy Growth And The Making Of Her In Deep An Interview With Matt Maltese

May 25, 2025 -

Emergency Services Respond To M56 Overturn Motorway Closed Casualty Care

May 25, 2025

Emergency Services Respond To M56 Overturn Motorway Closed Casualty Care

May 25, 2025

Latest Posts

-

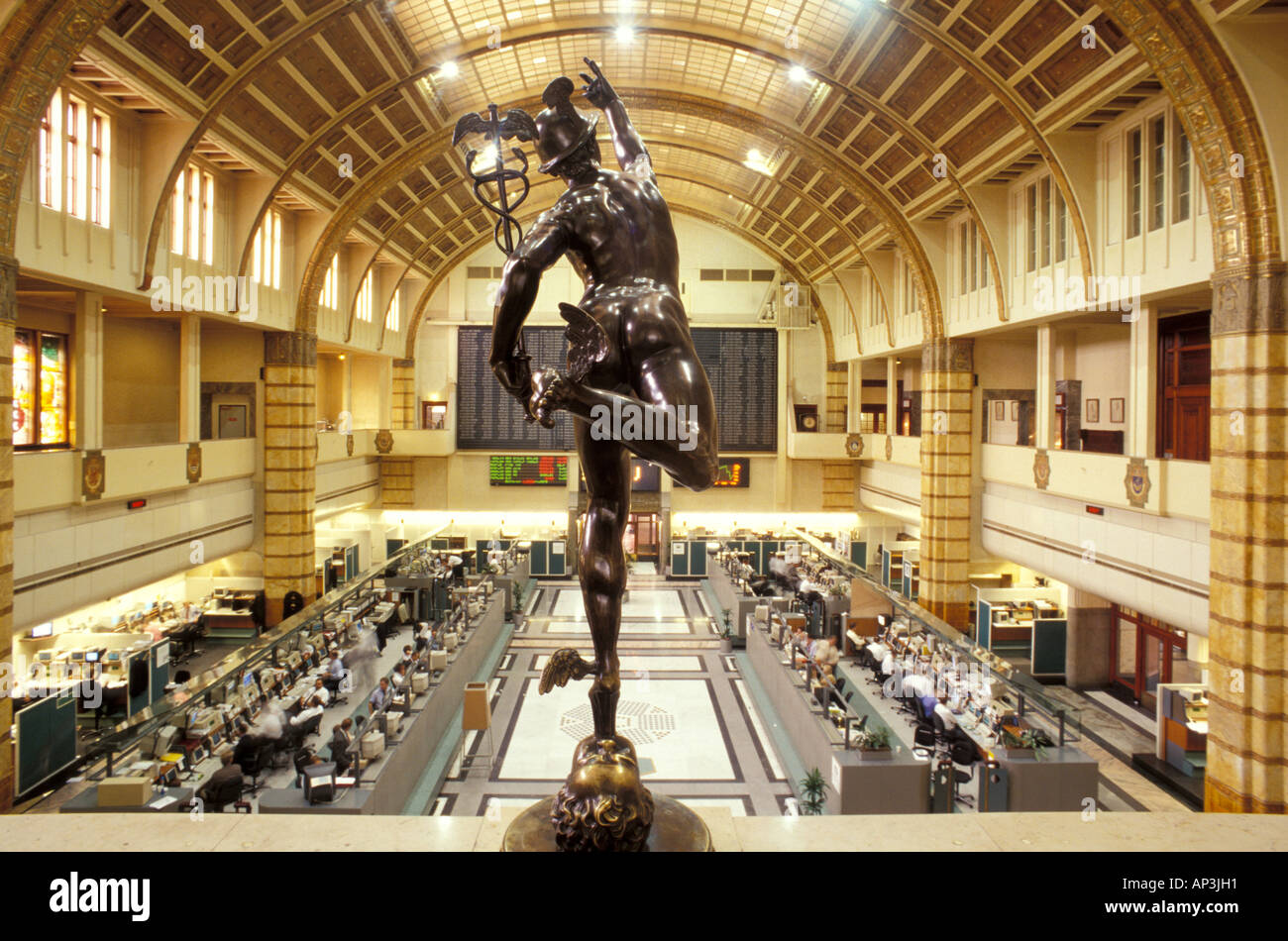

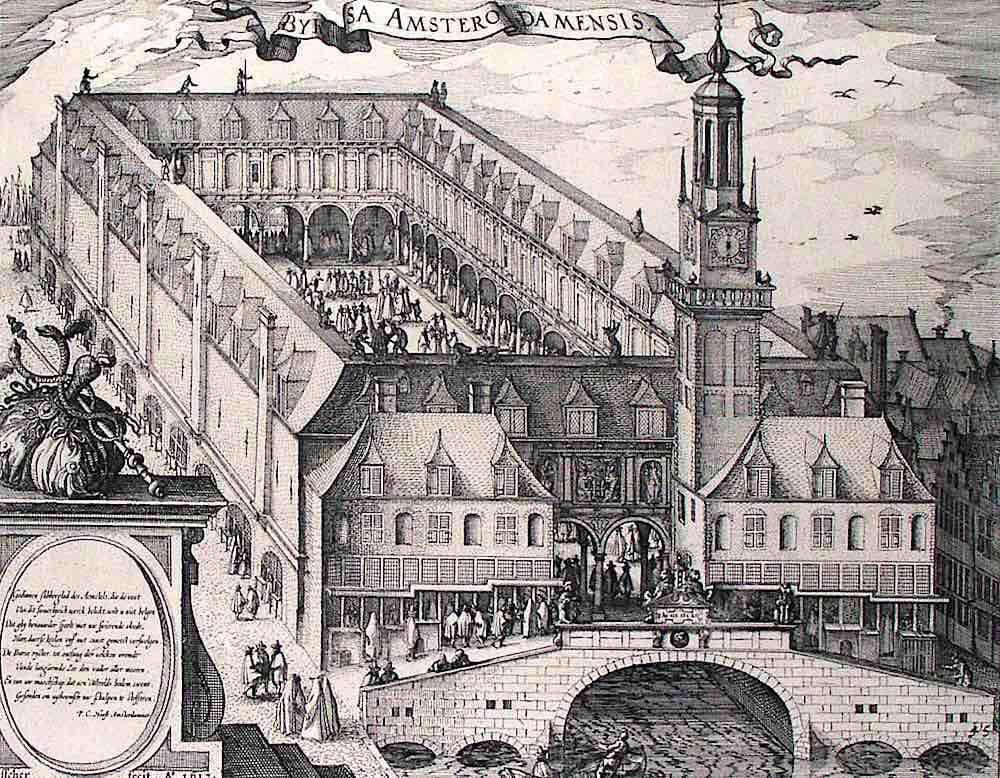

11 Drop Amsterdam Stock Exchange Faces Continued Market Decline

May 25, 2025

11 Drop Amsterdam Stock Exchange Faces Continued Market Decline

May 25, 2025 -

Amsterdam Stock Market Significant Losses Continue For Third Day

May 25, 2025

Amsterdam Stock Market Significant Losses Continue For Third Day

May 25, 2025 -

Gucci Under Demna A Fashion Analysis

May 25, 2025

Gucci Under Demna A Fashion Analysis

May 25, 2025 -

Three Day Slump On Amsterdam Stock Exchange Market Down 11

May 25, 2025

Three Day Slump On Amsterdam Stock Exchange Market Down 11

May 25, 2025 -

Amsterdam Exchange 11 Loss Extends Negative Trend To Three Days

May 25, 2025

Amsterdam Exchange 11 Loss Extends Negative Trend To Three Days

May 25, 2025