European Markets React To Trump's Auto Tariff Statement; LVMH Stock Plunges

Table of Contents

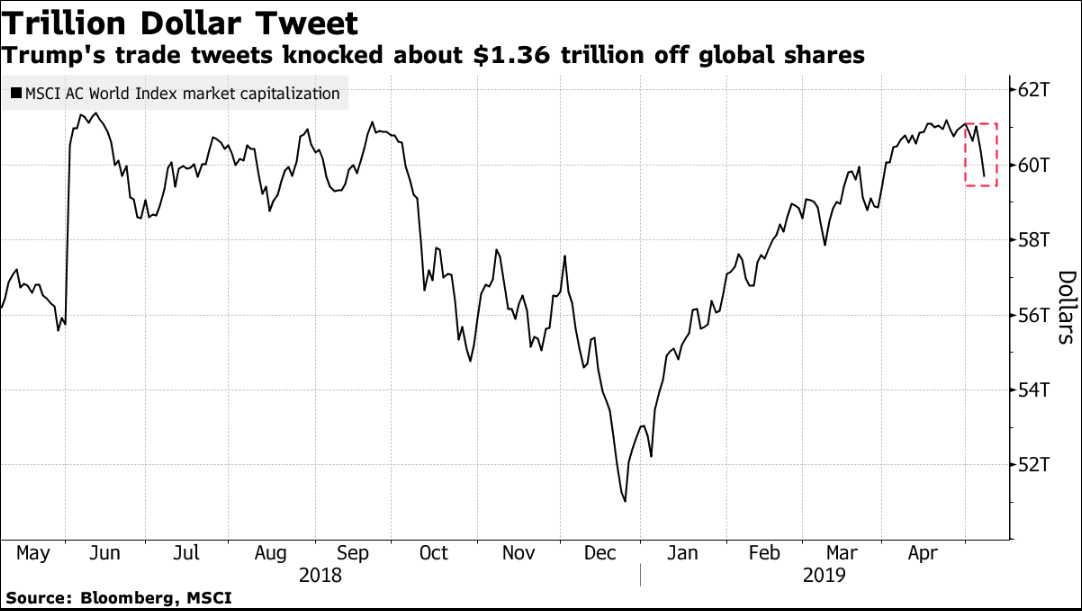

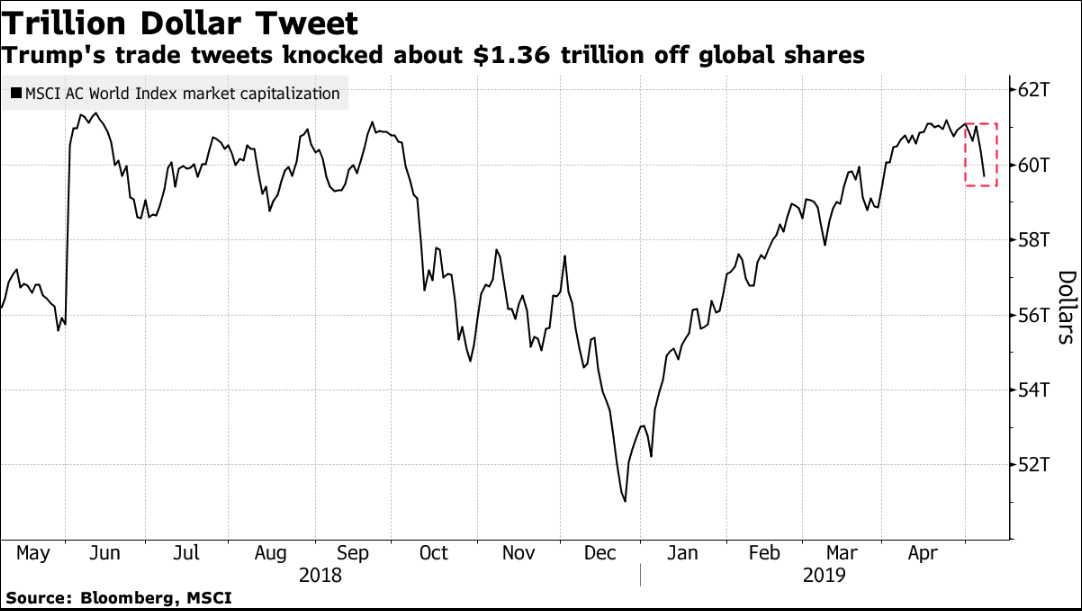

President Trump's recent announcement regarding potential auto tariffs on European imports has sent ripples of uncertainty through European financial markets. The news caused immediate and significant volatility, with luxury goods giant LVMH experiencing a particularly sharp stock plunge. This article delves into the market reactions, analyzes the potential causes, and explores the broader implications of this announcement for European businesses and the global economy.

Immediate Market Reactions to Trump's Tariff Announcement

LVMH Stock Plummet: Detailed analysis of LVMH's stock performance following the announcement.

Following the announcement, LVMH's stock experienced a dramatic fall. Preliminary reports indicated a drop of approximately 5% within the first hour of trading, with further declines throughout the day. Trading volume increased significantly, suggesting heightened investor anxiety and a rush to sell shares. Analyst commentary highlighted LVMH's considerable exposure to the US market and its vulnerability to tariffs on imported goods, contributing to the negative investor sentiment. The luxury goods sector's reliance on international trade and high import costs makes it particularly susceptible to tariff increases.

- Percentage Drop: Initial estimates suggest a 5-7% drop in LVMH's share price within the first trading day.

- Trading Volume: A substantial increase in trading volume was observed, indicating a significant shift in investor behavior.

- Analyst Commentary: Several analysts expressed concern about LVMH's future profitability given the potential impact of increased tariffs.

Broader European Market Impact: Assess the impact across various European stock exchanges.

The impact wasn't limited to LVMH. The announcement triggered a broader sell-off across European stock exchanges. Major indices, including the DAX (Germany), CAC 40 (France), and FTSE 100 (UK), all experienced declines, albeit to varying degrees. The automotive sector, unsurprisingly, suffered the most significant losses, but the ripple effect was felt across other sectors, including luxury goods, technology, and financials. The overall market uncertainty fueled by the tariff announcement led to a general risk-off sentiment amongst investors.

- DAX: Experienced a decline of approximately 2%.

- CAC 40: Saw a drop of around 1.8%.

- FTSE 100: Decreased by approximately 1.5%.

Currency Fluctuations: Analyze the effect on the Euro and other relevant currencies.

The news also impacted currency markets. The Euro, already under pressure from various geopolitical factors, weakened slightly against the US dollar following the announcement. This reflects the interconnectedness between trade tensions and currency values; increased trade uncertainty often leads to a flight to safer assets, like the US dollar, causing the Euro to depreciate. Other European currencies also experienced minor declines against the dollar.

- Euro/USD: The Euro experienced a slight weakening against the US dollar following the announcement.

- Interconnectedness: Trade uncertainty and currency fluctuations are intricately linked, with investor sentiment playing a crucial role.

Reasons Behind LVMH's Sharp Decline

Tariffs and Luxury Goods: Discuss the specific vulnerabilities of luxury brands to tariffs.

Luxury goods are particularly vulnerable to tariffs due to their high import costs and reliance on global supply chains. Many luxury brands, including LVMH, source materials and manufacture products in various countries before exporting them globally. Tariffs increase these costs, potentially squeezing profit margins and forcing brands to increase prices. This price increase could dampen consumer demand, especially in price-sensitive markets.

- High Import Costs: The inherent nature of luxury goods involves high import costs, making them particularly vulnerable to tariffs.

- International Trade Reliance: Global supply chains are essential for many luxury brands, increasing their sensitivity to trade policies.

- Price Sensitivity: Increased prices due to tariffs may reduce consumer demand for luxury items.

Investor Sentiment and Market Speculation: Explore the psychological impact of the announcement on investor confidence.

Beyond the direct impact of tariffs, the announcement significantly impacted investor sentiment. The fear of further trade escalation and the uncertainty surrounding future trade relations contributed to a sell-off in stocks, including LVMH. Investors worried about potential long-term consequences and reacted negatively to the increased risk. This also fueled speculation about potential ripple effects on other luxury brands.

- Fear of Escalation: The uncertainty surrounding potential retaliatory measures fueled investor anxiety.

- Ripple Effects: The decline in LVMH's stock price created concerns about the impact on other luxury brands.

Alternative Explanations: Explore other potential contributing factors beyond just tariffs.

While tariffs were a primary driver of the market reaction, other factors could have contributed to LVMH's sharp decline. Macroeconomic conditions, geopolitical events, or even company-specific news could have played a role. A thorough analysis would require considering all contributing factors to develop a comprehensive understanding.

- Macroeconomic Factors: Overall economic slowdown could have influenced investor sentiment.

- Geopolitical Events: Other international events could have indirectly contributed to market volatility.

- Company-Specific News: Any negative company-specific news could have exacerbated the situation.

Potential Long-Term Implications for European Businesses

Impact on Trade Relations: Analyze the potential for trade wars and their consequences for the EU-US relationship.

Trump's auto tariff statement could escalate into a full-blown trade war between the EU and the US. Retaliatory measures from the EU are highly likely, potentially affecting a wide range of goods and services. Such a trade war could have severe consequences for both economies, impacting global trade and supply chains. The long-term effects on global economic growth could be substantial.

- Retaliatory Measures: The EU could implement retaliatory tariffs on US goods.

- Global Trade Impact: A trade war would disrupt global trade and supply chains.

Effect on Consumer Spending: Explore how increased prices due to tariffs might affect consumer behavior.

Increased prices due to tariffs could significantly impact consumer spending, particularly for luxury goods. Consumers might shift their preferences towards domestically produced goods or seek alternatives from other countries, leading to a decrease in demand for luxury items from affected European brands. The elasticity of demand for luxury goods will play a crucial role in determining the extent of this impact.

- Shift in Consumer Preferences: Consumers might opt for domestic brands or cheaper alternatives.

- Elasticity of Demand: The responsiveness of luxury good demand to price changes will determine the impact.

Governmental Responses and Mitigation Strategies: Examine any actions taken by European governments to address the situation.

European governments are likely to respond to the threat of tariffs through various measures. These could include trade negotiations with the US, the implementation of subsidies to support affected industries, or other protective measures. The effectiveness of these strategies will depend on their scope and implementation.

- Trade Negotiations: The EU might engage in negotiations with the US to resolve the trade dispute.

- Subsidies: Governments may provide subsidies to help mitigate the negative impact on industries.

Conclusion

President Trump's auto tariff statement has created significant uncertainty and volatility in European markets, with luxury brands like LVMH experiencing particularly sharp stock declines. The immediate market reactions reflect a broader concern over escalating trade tensions and their potential long-term economic consequences. The impact extends beyond luxury goods, affecting various sectors and potentially triggering retaliatory measures from the EU.

Call to Action: Stay informed about the ongoing developments regarding Trump's auto tariff statement and its impact on European markets by regularly checking our website for updates on European market reactions to Trump's trade policies and the LVMH stock performance. Understanding the implications of these trade policies is crucial for investors and businesses alike.

Featured Posts

-

Revised Agenda For Philips 2025 Annual General Meeting Of Shareholders

May 24, 2025

Revised Agenda For Philips 2025 Annual General Meeting Of Shareholders

May 24, 2025 -

Borsa Italiana La Fed Detta L Agenda Performance Banche E Italgas

May 24, 2025

Borsa Italiana La Fed Detta L Agenda Performance Banche E Italgas

May 24, 2025 -

Get Your Bbc Radio 1 Big Weekend Tickets Everything You Need To Know

May 24, 2025

Get Your Bbc Radio 1 Big Weekend Tickets Everything You Need To Know

May 24, 2025 -

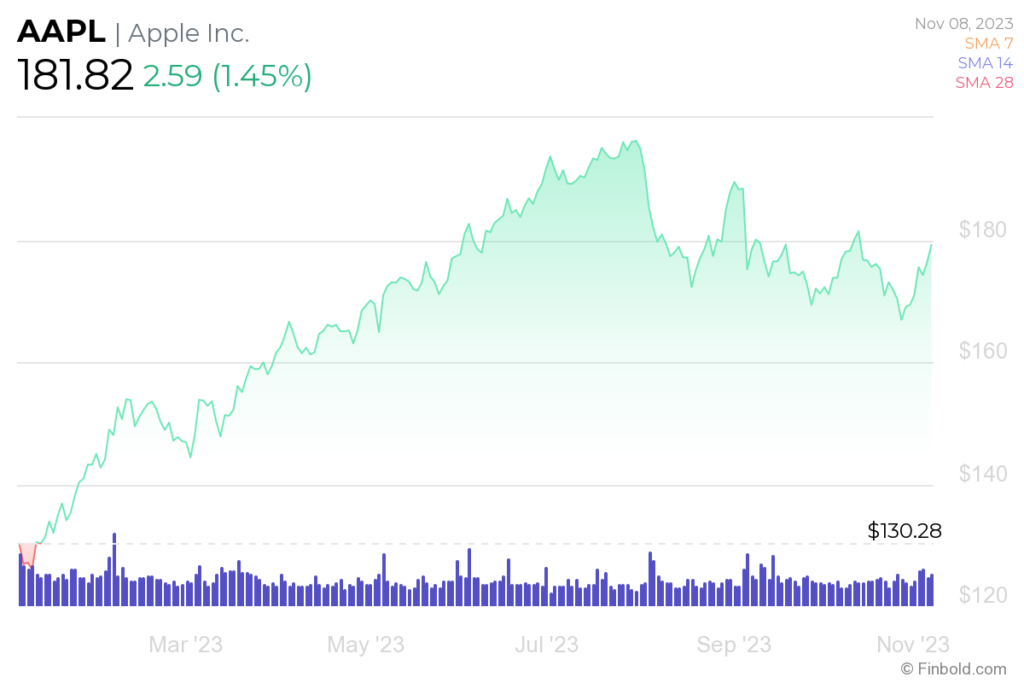

Apples Resilience Assessing The Impact Of Past And Future Tariffs

May 24, 2025

Apples Resilience Assessing The Impact Of Past And Future Tariffs

May 24, 2025 -

Glastonbury 2025 Lineup Leak Confirmed Artists And Ticket Information

May 24, 2025

Glastonbury 2025 Lineup Leak Confirmed Artists And Ticket Information

May 24, 2025

Latest Posts

-

254 Apple Stock Price Prediction Should You Buy Now

May 24, 2025

254 Apple Stock Price Prediction Should You Buy Now

May 24, 2025 -

Apple Stock Prediction Analyst Targets 254 Is It A Buy At 200

May 24, 2025

Apple Stock Prediction Analyst Targets 254 Is It A Buy At 200

May 24, 2025 -

Woody Allen Sexual Abuse Accusations Reignited Sean Penns Backing Sparks Debate

May 24, 2025

Woody Allen Sexual Abuse Accusations Reignited Sean Penns Backing Sparks Debate

May 24, 2025 -

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 24, 2025

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 24, 2025 -

Sean Penns Recent Appearance And Controversial Statements Explained

May 24, 2025

Sean Penns Recent Appearance And Controversial Statements Explained

May 24, 2025