Federal Reserve: Why Rate Cuts Remain Unlikely

Table of Contents

Persistent Inflation as a Major Hurdle

Inflation remains a significant obstacle to any consideration of Federal Reserve rate cuts. The current inflation rate is stubbornly above the Federal Reserve's target of 2%, a deviation that raises serious concerns. This isn't just about headline inflation; core inflation—which excludes volatile food and energy prices—also shows persistent strength, indicating a broader inflationary pressure within the economy. This "stickiness" of core inflation suggests that simply waiting for inflation to subside organically is unlikely to be sufficient.

- Recent CPI and PCE data: The Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) index, key indicators of inflation, consistently show elevated readings, far exceeding the Fed's target.

- Factors driving inflation: Several factors fuel this persistent inflation, including lingering supply chain disruptions, robust wage growth, and strong consumer demand. These intertwined elements create a complex challenge for the Federal Reserve.

- The Fed's inflation target: The Federal Reserve's explicit target is 2% inflation. The current gap between the actual inflation rate and the target is considerable and needs to be addressed before any consideration of rate cuts.

Strong Labor Market Dampening Rate Cut Expectations

The current strength of the US labor market further reduces the likelihood of Federal Reserve rate cuts. With unemployment at historically low levels and robust job growth continuing, the economy exhibits little of the weakness that would typically necessitate stimulative monetary policy like rate cuts. This robust labor market, while positive in many respects, complicates the Fed's efforts to control inflation.

- Recent unemployment figures and job creation numbers: The consistently low unemployment rate and strong job creation figures demonstrate the health of the labor market.

- Wage growth and its contribution to inflation: Strong wage growth, while beneficial for workers, also contributes to inflationary pressures, creating a delicate balancing act for the Federal Reserve.

- The Fed's focus on maximum employment: The Federal Reserve's dual mandate includes achieving maximum employment. However, pursuing this goal aggressively without simultaneously managing inflation could be counterproductive.

The Fed's Commitment to Price Stability

The Federal Reserve's dual mandate—price stability and maximum employment—currently prioritizes price stability. Recent communication from Fed officials underscores their unwavering commitment to lowering inflation, even at the potential cost of slower economic growth. This commitment is evident in their sustained hawkish stance and reluctance to signal any imminent shift towards easing monetary policy.

- Quotes from Fed officials: Statements from key Federal Reserve officials consistently emphasize the importance of bringing inflation down to the 2% target.

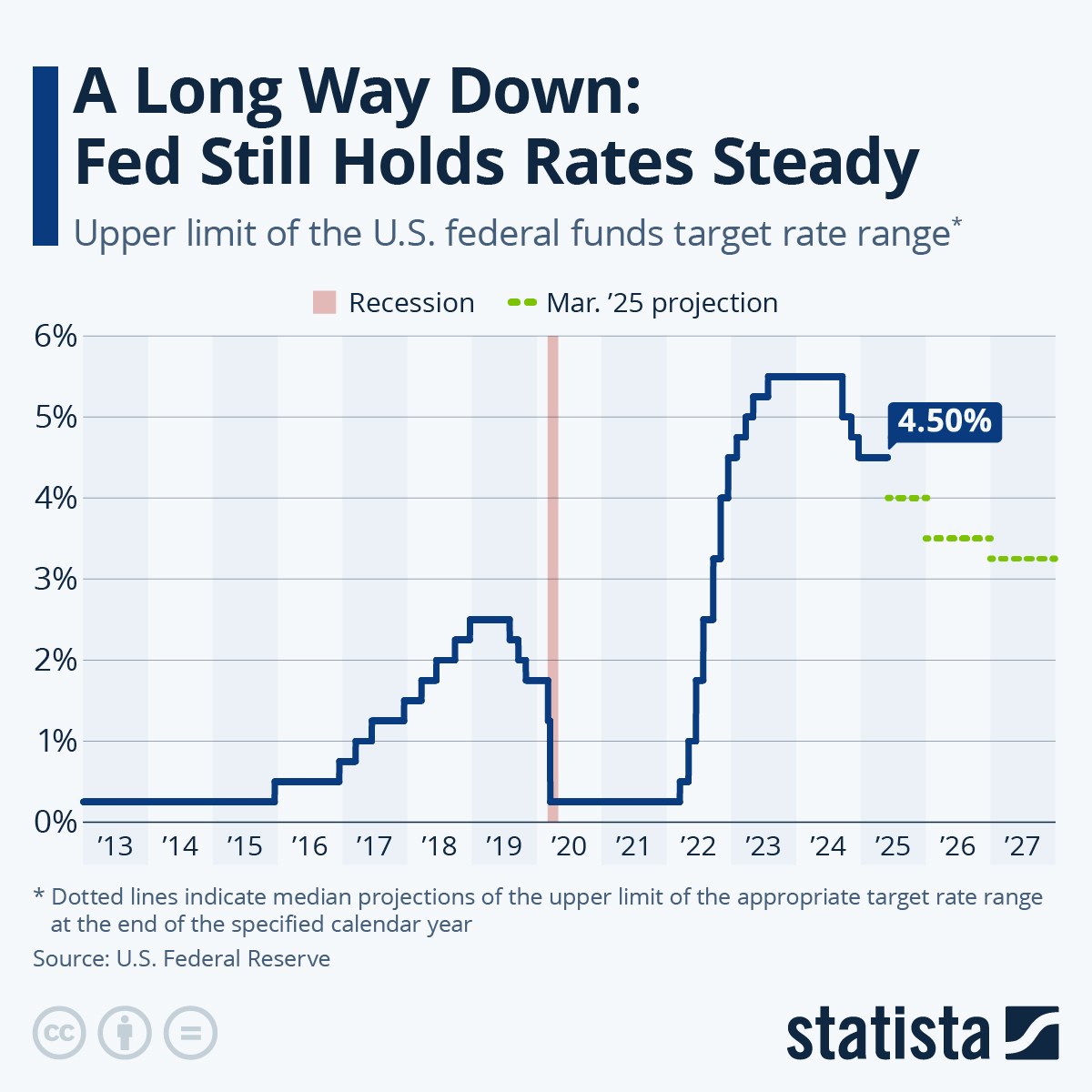

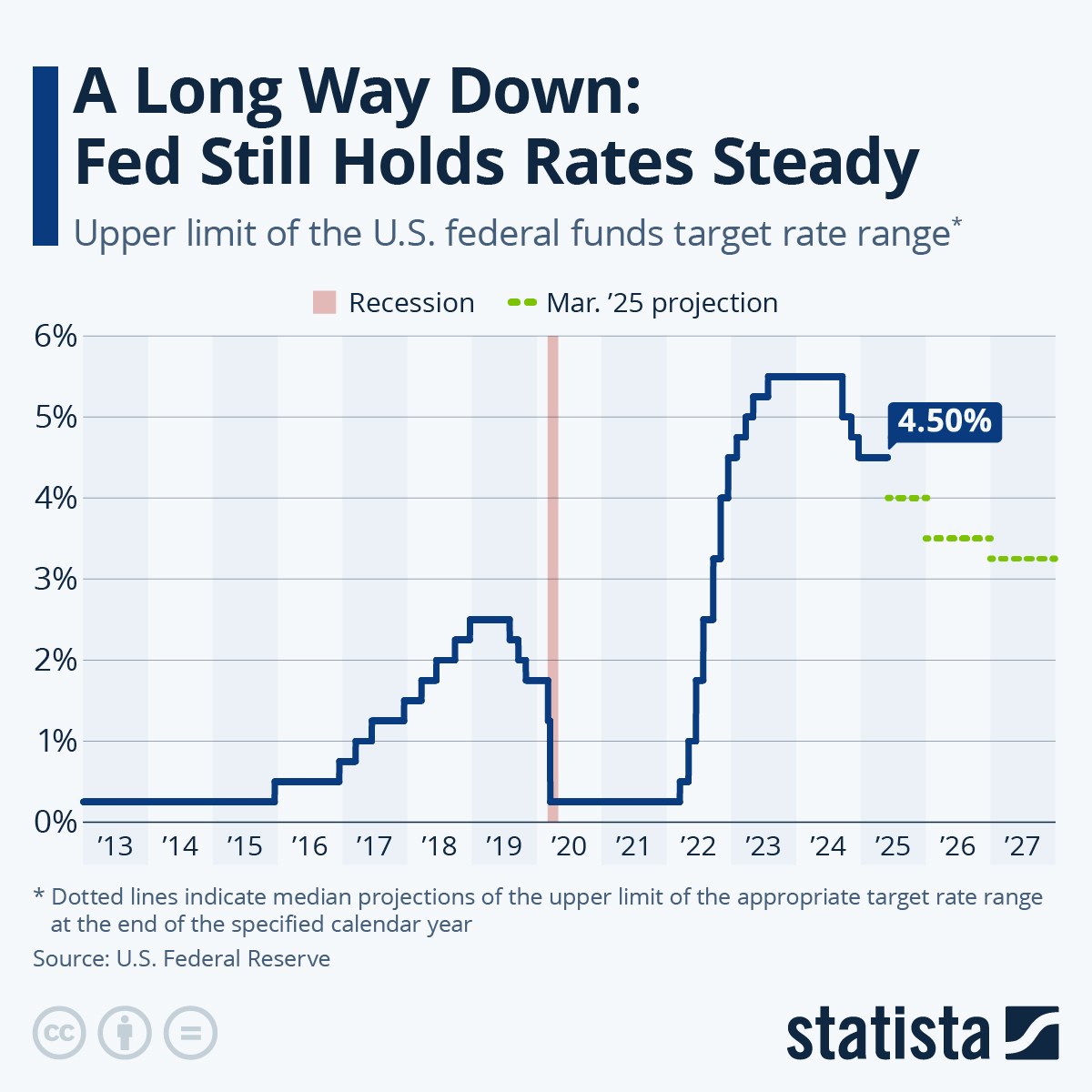

- The Fed's dot plot and its implications: The dot plot, a summary of individual Federal Reserve officials' projections for future interest rates, provides insights into the likely trajectory of monetary policy and currently suggests a continued hold or further increases before any potential rate cuts.

- Consequences of premature rate cuts: Prematurely cutting rates while inflation remains high could reignite inflationary pressures, potentially undermining the Fed's credibility and requiring even more aggressive action later on.

Potential Risks of Premature Rate Cuts

The risks associated with prematurely cutting rates while inflation remains high are substantial. A premature easing of monetary policy could reignite inflationary pressures, potentially leading to a more prolonged and painful battle against inflation. It could also undermine the credibility of the Federal Reserve's commitment to price stability, making future efforts to control inflation more challenging.

- Risk of inflation becoming entrenched: Allowing inflation to persist could lead to it becoming entrenched in the economy, making it far more difficult to control.

- Potential for increased market volatility: A sudden shift in monetary policy could increase market volatility, potentially unsettling investors and impacting economic confidence.

- Jeopardizing the Fed's progress: Premature rate cuts could jeopardize the hard-won progress the Federal Reserve has made in curbing inflation, potentially setting back the economy.

Conclusion: Federal Reserve Rate Cuts: A Distant Prospect

In summary, several factors strongly suggest that Federal Reserve rate cuts are unlikely in the near term. Persistent inflation, a robust labor market, the Fed's commitment to price stability, and the considerable risks associated with premature easing all point to a continued period of relatively tight monetary policy. The Federal Reserve's primary focus remains on bringing inflation down to its target, and any consideration of Federal Reserve rate cuts will depend heavily on the success of this effort. Stay informed about future Federal Reserve announcements and economic data releases to gain a clearer understanding of the evolving landscape surrounding Federal Reserve rate cuts and monetary policy.

Featured Posts

-

Punjab Governments Initiative Technical Training For Transgender Community

May 10, 2025

Punjab Governments Initiative Technical Training For Transgender Community

May 10, 2025 -

The Aftermath Of The Nottingham Attacks Survivors Powerful Testimony

May 10, 2025

The Aftermath Of The Nottingham Attacks Survivors Powerful Testimony

May 10, 2025 -

Investing In Palantir Analyzing The 40 Growth Projection For 2025 And Beyond

May 10, 2025

Investing In Palantir Analyzing The 40 Growth Projection For 2025 And Beyond

May 10, 2025 -

The Relationship Between Dangote Refinery Nnpc And Petrol Price Fluctuations

May 10, 2025

The Relationship Between Dangote Refinery Nnpc And Petrol Price Fluctuations

May 10, 2025 -

Nottingham Attacks Police Officers Face Misconduct Meeting

May 10, 2025

Nottingham Attacks Police Officers Face Misconduct Meeting

May 10, 2025