Financial Planning: CFP Board CEO Announces 2026 Retirement

Table of Contents

Impact of the CEO's Retirement on the CFP Board

The CEO's departure marks the end of an era at the CFP Board, an organization vital to upholding the standards of the financial planning profession. Their contributions, including [insert specific examples of the CEO's achievements and contributions if known], have significantly shaped the landscape of financial planning. This leadership transition presents both challenges and opportunities.

The search for a new CEO will be crucial, influencing the CFP Board's strategic direction and operational efficiency. This transition period might lead to:

- Increased scrutiny on CFP Board operations: The change in leadership will likely invite closer examination of the organization's policies and procedures.

- Potential changes in strategic direction: The incoming CEO may bring a fresh perspective, leading to shifts in the CFP Board's priorities and initiatives.

- Opportunities for modernization and innovation: This is a chance to leverage technology and adapt to the evolving needs of the financial planning industry.

- Need for succession planning within the CFP Board: The CFP Board itself needs robust succession planning to ensure continued stability and effectiveness.

Implications for Financial Planners and Consumers

The CEO's retirement, while seemingly internal to the CFP Board, has ripple effects throughout the financial planning industry and for consumers. Changes within the CFP Board could translate into:

- Potential shifts in CFP certification requirements: Future certification might necessitate new skills or knowledge, requiring financial planners to adapt their professional development.

- Impact on the professional development of financial advisors: Ongoing education and training for CFP professionals might evolve to reflect the changing landscape.

- Changes in industry regulations and compliance: The CFP Board plays a vital role in setting industry standards, and changes at the top could subtly alter regulations.

- Maintaining public trust in Certified Financial Planners: The CFP Board's leadership is crucial for upholding public confidence in Certified Financial Planners.

The Future of Financial Planning

The financial planning landscape is constantly evolving. Technological advancements, like robo-advisors and fintech platforms, are reshaping how financial services are delivered. Client needs are also diversifying, demanding a more holistic and personalized approach to financial planning. This necessitates continuous professional development for financial planners.

- Growing demand for financial planning services: An aging population and increasing economic complexity are driving greater demand for financial advice.

- Technological advancements shaping the industry (robo-advisors, fintech): Financial planners must embrace technology to remain competitive and offer efficient services.

- Importance of ethical conduct and fiduciary responsibility: Maintaining the highest ethical standards is critical for building and sustaining client trust.

- The role of financial planning in retirement security: Retirement planning remains a cornerstone of financial planning, requiring long-term strategies and careful consideration.

Preparing for Your Own Financial Future

Regardless of the changes at the CFP Board, your personal financial planning remains crucial. Taking proactive steps today can significantly impact your future financial security.

- Setting financial goals (retirement, education, etc.): Define your short-term and long-term financial objectives.

- Creating a budget and managing expenses: Track your income and expenses to understand your spending habits.

- Investing for the long term: Develop an investment strategy aligned with your risk tolerance and financial goals.

- Planning for retirement and estate planning: Ensure you have a comprehensive plan for your retirement and the distribution of your assets.

To find a qualified financial advisor, consider using resources like the CFP Board's website ([insert link if available]).

Securing Your Financial Future Through Strategic Financial Planning

The CFP Board CEO's retirement highlights the ongoing evolution of the financial planning profession. While changes at the top might bring uncertainty, the fundamental importance of comprehensive financial planning remains unwavering. Proactive planning, guided by a qualified CFP professional, is key to securing your financial well-being. Start planning your financial future today. Find a qualified Certified Financial Planner® professional near you and take control of your financial well-being. Don't delay your retirement planning or your overall financial strategy; engage with a financial advisor to navigate the complexities of financial planning and build a secure future.

Featured Posts

-

Robinson Nuclear Plant Successful Safety Inspection Paves Way For License Renewal To 2050

May 02, 2025

Robinson Nuclear Plant Successful Safety Inspection Paves Way For License Renewal To 2050

May 02, 2025 -

Analyzing Xrp Ripple At Under 3 A Buying Guide

May 02, 2025

Analyzing Xrp Ripple At Under 3 A Buying Guide

May 02, 2025 -

Obituary Priscilla Pointer Amy Irvings Mother 100

May 02, 2025

Obituary Priscilla Pointer Amy Irvings Mother 100

May 02, 2025 -

Fortnite V34 30 Update Sabrina Carpenter Skin New Features And Patch Notes

May 02, 2025

Fortnite V34 30 Update Sabrina Carpenter Skin New Features And Patch Notes

May 02, 2025 -

Xrp Ripple Investment Is It Worth Buying Under 3

May 02, 2025

Xrp Ripple Investment Is It Worth Buying Under 3

May 02, 2025

Latest Posts

-

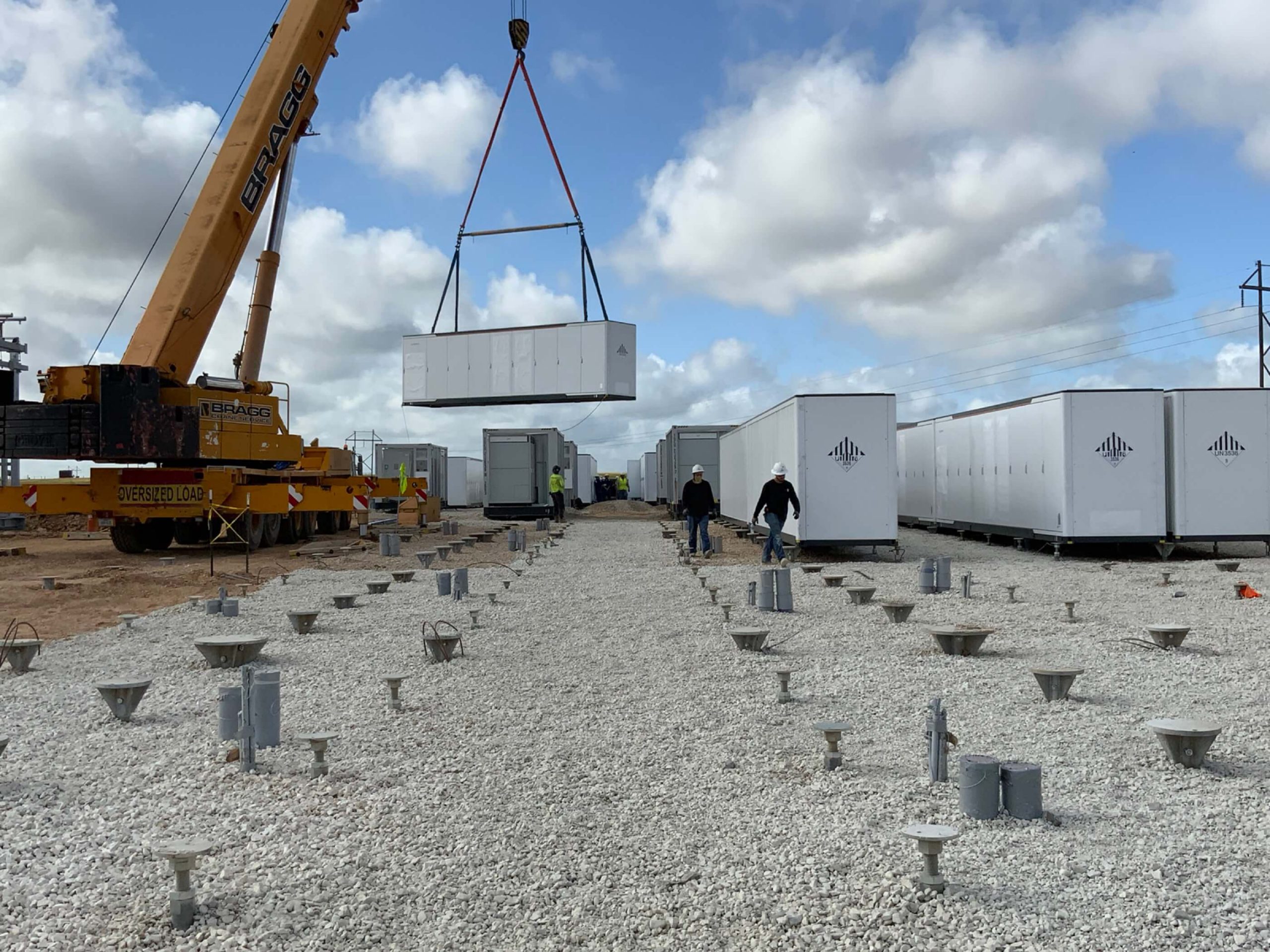

Analysis Of Financing Strategies For A 270 M Wh Bess Project In The Belgian Merchant Market

May 03, 2025

Analysis Of Financing Strategies For A 270 M Wh Bess Project In The Belgian Merchant Market

May 03, 2025 -

Belgiums Energy Transition Funding A 270 M Wh Bess Project In A Competitive Market

May 03, 2025

Belgiums Energy Transition Funding A 270 M Wh Bess Project In A Competitive Market

May 03, 2025 -

Investment In Belgiums Energy Sector A Case Study Of 270 M Wh Bess Financing

May 03, 2025

Investment In Belgiums Energy Sector A Case Study Of 270 M Wh Bess Financing

May 03, 2025 -

270 M Wh Bess Financing In Belgium Challenges And Opportunities In The Merchant Market

May 03, 2025

270 M Wh Bess Financing In Belgium Challenges And Opportunities In The Merchant Market

May 03, 2025 -

Navigating The Belgian Merchant Market Financing Options For A 270 M Wh Bess Project

May 03, 2025

Navigating The Belgian Merchant Market Financing Options For A 270 M Wh Bess Project

May 03, 2025