Freepoint Eco-Systems Secures Project Finance From ING

Table of Contents

Details of the Project Finance Deal

Freepoint Eco-Systems has secured €50 million (or equivalent in another currency, specify amount) in project finance from ING. This significant investment will be used to fund several key initiatives within Freepoint Eco-Systems' portfolio. These include expanding their existing wind farm projects in [Location], developing a new solar energy facility in [Location], and furthering research and development into next-generation sustainable energy technologies. The financing agreement has a term of 10 years, structured to align with the long-term nature of these renewable energy projects.

- Key features of the financing agreement: The agreement includes a sustainability-linked loan component, tying interest rates to Freepoint Eco-Systems' performance against pre-defined environmental, social, and governance (ESG) targets.

- Unique aspects of the deal: The innovative financing structure incorporates a blended finance approach, combining concessional finance from [Source, if applicable] with commercial financing from ING. This structure helps to de-risk the projects and makes them more attractive to investors.

- Environmental goals: The projects aim to reduce carbon emissions by [Quantifiable amount] annually, contributing significantly to the global effort to mitigate climate change.

The Significance for Freepoint Eco-Systems

This substantial funding from ING is transformative for Freepoint Eco-Systems. It allows the company to significantly accelerate its growth strategy, expanding its operational capacity and unlocking the potential for numerous new projects focused on renewable energy and sustainable development. This investment provides the necessary financial muscle to scale operations and deliver on their ambitious environmental goals.

- Improved market position: Securing this finance enhances Freepoint Eco-Systems' market position, establishing them as a leading player in the sustainable energy sector.

- Enhanced credibility: The partnership with ING, a globally recognized and respected financial institution, significantly boosts Freepoint Eco-Systems’ credibility and reputation.

- Accelerated deployment: The funding enables faster deployment of sustainable solutions, bringing positive environmental impact to communities sooner.

ING's Role in Sustainable Finance

ING has demonstrated a strong commitment to sustainable and responsible investing, actively participating in various green finance initiatives. The bank is a leading player in the green bond market and actively supports environmentally friendly projects globally. Their collaboration with Freepoint Eco-Systems underscores their dedication to financing solutions that contribute to a more sustainable future.

- ING's sustainability goals: ING aims to achieve net-zero emissions across its financed emissions by 2050, aligning with the Paris Agreement targets.

- Similar projects: ING has previously financed several similar renewable energy projects worldwide, demonstrating their experience and expertise in this sector.

- Contribution to sustainable finance: ING's support of Freepoint Eco-Systems contributes to the growing momentum in sustainable finance, promoting the development of responsible and environmentally conscious investment strategies.

The Future of Sustainable Project Finance

The growing trend of green financing is crucial in addressing the urgent challenges of climate change. Financial institutions are increasingly recognizing the importance of directing capital towards sustainable development initiatives. This partnership between Freepoint Eco-Systems and ING exemplifies this trend and points towards a future where collaborations between businesses and financial institutions drive positive environmental change.

- Future growth: The sustainable finance sector is expected to experience significant growth in the coming years, driven by increasing investor demand for ESG-compliant investments and stricter environmental regulations.

- Government policies: Government policies and incentives, such as tax breaks and subsidies for renewable energy projects, play a vital role in shaping the growth of the green finance sector.

- Transparency and accountability: Transparency and robust reporting are critical to ensuring the integrity and credibility of sustainable investments.

Investing in a Greener Future with Freepoint Eco-Systems

The successful securing of project finance from ING is a significant milestone for Freepoint Eco-Systems, marking a substantial step towards achieving its ambitious environmental goals. This collaboration showcases ING's dedication to sustainable finance and highlights the growing importance of responsible investing in tackling climate change. The partnership signifies a powerful force for positive environmental impact and paves the way for future collaborations focused on scaling sustainable solutions. Learn more about Freepoint Eco-Systems' commitment to green project finance and explore sustainable investment opportunities with them by visiting [Link to Freepoint Eco-Systems website]. Discover more about ING's initiatives in sustainable finance at [Link to ING's sustainability page]. Together, we can invest in a greener future.

Featured Posts

-

Abn Amro Rapporteert Forse Groei In Occasionverkoop

May 21, 2025

Abn Amro Rapporteert Forse Groei In Occasionverkoop

May 21, 2025 -

Britains Got Talent Walliams And Cowells Public Dispute Intensifies

May 21, 2025

Britains Got Talent Walliams And Cowells Public Dispute Intensifies

May 21, 2025 -

Blockbusters Bgt Special A Comprehensive Guide

May 21, 2025

Blockbusters Bgt Special A Comprehensive Guide

May 21, 2025 -

Abn Amro Bonus Payments Under Scrutiny Potential Fine From Dutch Regulator

May 21, 2025

Abn Amro Bonus Payments Under Scrutiny Potential Fine From Dutch Regulator

May 21, 2025 -

Exploring The Richness Of Cassis Blackcurrant Liqueur

May 21, 2025

Exploring The Richness Of Cassis Blackcurrant Liqueur

May 21, 2025

Latest Posts

-

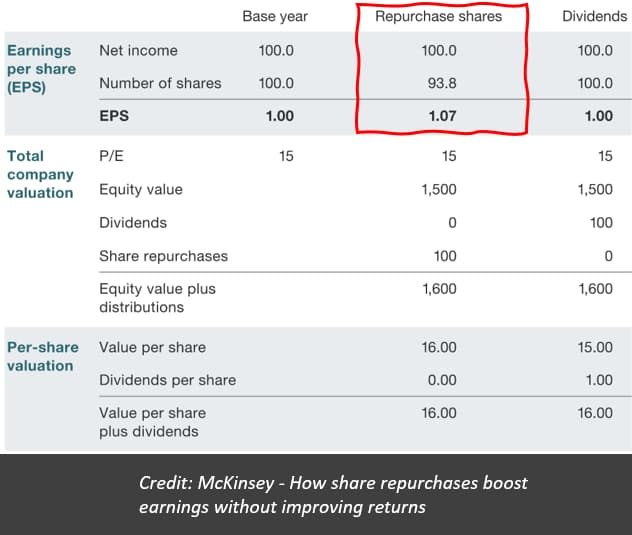

Ryanairs Future Impact Of Tariff Wars And Planned Stock Buyback Program

May 21, 2025

Ryanairs Future Impact Of Tariff Wars And Planned Stock Buyback Program

May 21, 2025 -

Wildfire Betting Examining The Los Angeles Fire Season And Its Impact On Gambling Markets

May 21, 2025

Wildfire Betting Examining The Los Angeles Fire Season And Its Impact On Gambling Markets

May 21, 2025 -

Ryanairs Growth Outlook Tariff Conflicts And Planned Share Repurchases

May 21, 2025

Ryanairs Growth Outlook Tariff Conflicts And Planned Share Repurchases

May 21, 2025 -

Post Nuclear Taiwan The Growing Reliance On Lng Cargoes

May 21, 2025

Post Nuclear Taiwan The Growing Reliance On Lng Cargoes

May 21, 2025 -

Ryanair Tariff Wars Pose Biggest Threat To Growth Announces Share Buyback

May 21, 2025

Ryanair Tariff Wars Pose Biggest Threat To Growth Announces Share Buyback

May 21, 2025