Ryanair's Future: Impact Of Tariff Wars And Planned Stock Buyback Program

Table of Contents

The Impact of Tariff Wars on Ryanair's Operations

Tariff wars create significant headwinds for businesses operating globally, and Ryanair is no exception. The airline's future profitability is directly impacted by these geopolitical events.

Increased Fuel Costs

Rising fuel prices, a direct consequence of global trade tensions and imposed tariffs, significantly impact Ryanair's operational costs. This increased expense eats into profit margins and directly influences the airline's pricing strategy.

- Increased fuel surcharges: Ryanair, like other airlines, may need to pass on some of these increased costs to passengers through higher ticket prices.

- Potential route adjustments: To mitigate fuel costs, Ryanair might adjust its flight routes, favoring shorter distances or opting for more fuel-efficient aircraft.

- Hedging strategies: Ryanair employs various hedging strategies to minimize the impact of fuel price volatility, but these strategies can only offer partial protection against significant price swings.

The impact on ticket pricing and profitability is undeniable. Even small increases in fuel costs can have a substantial effect on Ryanair's bottom line, potentially impacting its ability to offer its famously low fares. For example, specific tariffs on jet fuel imports could lead to a direct increase in operational expenses, forcing the company to re-evaluate its pricing models.

Supply Chain Disruptions

Tariffs don't just impact fuel; they disrupt the entire supply chain. Aircraft maintenance, parts procurement, and even the delivery of in-flight services are vulnerable to delays and price increases caused by global trade disputes.

- Delays in maintenance: Delays in receiving essential parts can lead to longer aircraft downtime, impacting flight schedules and potentially resulting in flight cancellations.

- Increased costs for spare parts: Tariffs on imported parts inflate their prices, increasing the overall cost of aircraft maintenance and repair.

- Potential for flight cancellations: Unforeseen supply chain disruptions due to tariffs can directly lead to flight cancellations, causing significant inconvenience to passengers and reputational damage to Ryanair.

The consequences of these disruptions on Ryanair's schedule reliability and customer satisfaction are severe. Disgruntled customers could impact future bookings, leading to decreased revenue and a negative impact on the company's overall brand perception.

Impact on Tourism and Passenger Demand

Uncertainty caused by tariff wars can dampen overall consumer confidence, which negatively affects travel demand. This poses a serious threat to Ryanair's revenue streams.

- Reduced consumer spending on leisure travel: Economic uncertainty discourages discretionary spending, including leisure travel, impacting the number of passengers opting for budget airlines like Ryanair.

- Potential shifts in travel patterns: Passengers might choose shorter or less expensive trips, or delay travel altogether, affecting specific routes and seasonal demand.

- Impact on specific routes: Routes heavily reliant on tourism from countries involved in tariff disputes may experience a disproportionately significant decline in passenger numbers.

These changes directly influence Ryanair’s revenue streams and its overall growth trajectory. The airline's ability to adapt to these shifting market conditions will be crucial to its long-term success.

Analyzing Ryanair's Stock Buyback Program

Ryanair's announcement of a significant stock buyback program provides a contrasting perspective to the challenges posed by tariff wars. This strategic move signals confidence in the airline's future prospects.

Strategic Implications

The buyback program indicates Ryanair's belief in its future performance and potential for increased shareholder value. This move has several key implications.

- Share price increase: Buybacks reduce the number of outstanding shares, theoretically increasing the earnings per share (EPS) and boosting the stock price.

- Reduced number of outstanding shares: This makes each remaining share more valuable.

- Potential for higher earnings per share (EPS): Higher EPS is attractive to investors and can further contribute to an increase in the share price.

The financial implications for investors are potentially positive, and the program reflects Ryanair's overall capital allocation strategy, prioritizing shareholder returns.

Funding and Financial Health

Understanding how Ryanair is funding the buyback is critical to assessing its financial health and long-term sustainability.

- Debt levels: The buyback's funding source could impact Ryanair's debt levels, potentially increasing financial risk if financed through debt.

- Cash reserves: Using cash reserves for the buyback could reduce the airline's ability to invest in future growth opportunities, such as fleet expansion or new route development.

- Impact on future investment opportunities: Significant capital expenditure on the buyback might limit funds available for other crucial investments.

Assessing the long-term sustainability of the buyback program considering external economic challenges, particularly the impact of tariff wars, is essential.

Investor Sentiment and Market Reaction

Market reaction to the buyback announcement provides valuable insight into investor confidence in Ryanair's future.

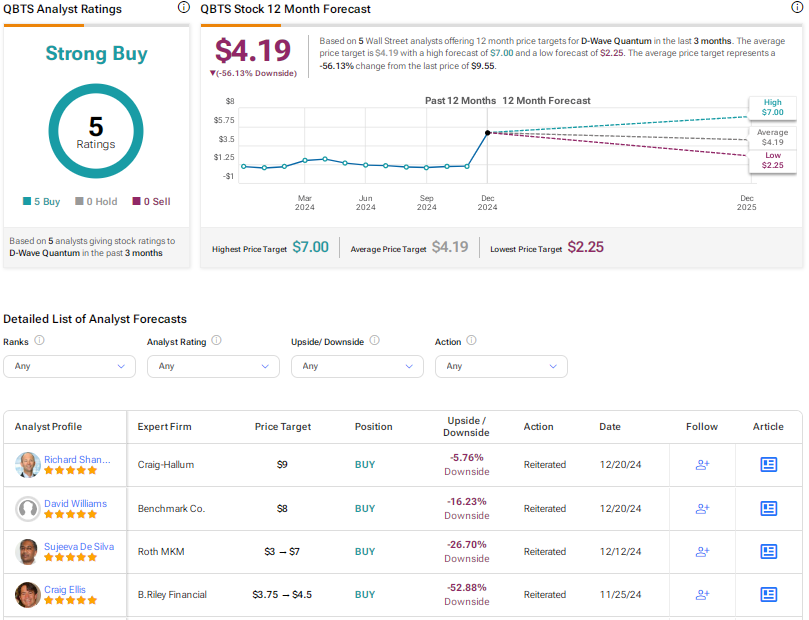

- Stock price fluctuations: The immediate and subsequent stock price fluctuations offer clues about the market's reception of the news.

- Investor confidence: Positive market reaction signals strong investor confidence in Ryanair's management and future prospects.

- Analyst ratings: Analyst ratings and reports offer professional insights into the implications of the buyback and its potential impact on the airline's future performance.

The long-term outlook for Ryanair’s stock depends on the success of the buyback program and how effectively the airline navigates the ongoing challenges of tariff wars and other market uncertainties.

Conclusion

Ryanair's future is intricately linked to its ability to navigate the challenges posed by global tariff wars and the success of its stock buyback program. While the buyback demonstrates confidence, the impact of tariffs on fuel costs, supply chains, and overall travel demand remains a significant concern. Careful monitoring of these factors is crucial for understanding Ryanair's performance and long-term trajectory. To stay updated on the latest developments regarding Ryanair's future, continue to follow industry news and analysis related to Ryanair's future and the impact of global economic trends on low-cost airlines.

Featured Posts

-

Watercolor Script Review A Promising New Playwright

May 21, 2025

Watercolor Script Review A Promising New Playwright

May 21, 2025 -

Abn Amro Groeiend Autobezit Stimuleert Occasionverkoop

May 21, 2025

Abn Amro Groeiend Autobezit Stimuleert Occasionverkoop

May 21, 2025 -

Wayne Gretzkys Patriotism In The Spotlight Examining The Impact Of Trumps Policies

May 21, 2025

Wayne Gretzkys Patriotism In The Spotlight Examining The Impact Of Trumps Policies

May 21, 2025 -

Wireless Headphones Enhanced Features And Improved Performance

May 21, 2025

Wireless Headphones Enhanced Features And Improved Performance

May 21, 2025 -

Le Bouillon A Clisson Un Festival De Spectacles Engages

May 21, 2025

Le Bouillon A Clisson Un Festival De Spectacles Engages

May 21, 2025

Latest Posts

-

D Wave Quantum Qbts Stock Explaining The Significant Drop In 2025

May 21, 2025

D Wave Quantum Qbts Stock Explaining The Significant Drop In 2025

May 21, 2025 -

The 2025 Plunge Of D Wave Quantum Qbts Causes And Implications

May 21, 2025

The 2025 Plunge Of D Wave Quantum Qbts Causes And Implications

May 21, 2025 -

2025 D Wave Quantum Qbts Stock Performance Factors Contributing To The Fall

May 21, 2025

2025 D Wave Quantum Qbts Stock Performance Factors Contributing To The Fall

May 21, 2025 -

D Wave Quantum Inc Qbts Analyzing The 2025 Stock Market Performance

May 21, 2025

D Wave Quantum Inc Qbts Analyzing The 2025 Stock Market Performance

May 21, 2025 -

Understanding The D Wave Quantum Qbts Stock Drop In 2025

May 21, 2025

Understanding The D Wave Quantum Qbts Stock Drop In 2025

May 21, 2025