Funding Your SME's Sustainability Journey

Table of Contents

Understanding Your Sustainability Needs and Goals

Before diving into funding options, it's crucial to understand your SME's specific sustainability needs and define clear, measurable goals. This involves a thorough assessment and the development of a comprehensive sustainable business plan.

Conducting a Sustainability Assessment

A robust sustainability audit is paramount. This involves:

- Identifying key areas for improvement: Pinpoint areas where your SME can make the biggest impact, such as energy efficiency improvements, waste reduction strategies, and sustainable supply chain management.

- Setting measurable targets: Define specific, measurable, achievable, relevant, and time-bound (SMART) goals. For example, aim to reduce your carbon footprint by 15% within the next two years. This allows you to track progress and demonstrate ROI to potential investors.

- Prioritizing initiatives: Based on their impact and feasibility, prioritize initiatives. Focus on projects with the highest potential for environmental and economic benefits. This ensures efficient allocation of resources.

This ESG assessment will form the foundation of your application for SME sustainability funding. Understanding your carbon footprint reduction potential is critical for attracting green financing.

Developing a Sustainable Business Plan

A well-structured sustainable business plan is essential for securing funding. This plan should:

- Outline specific projects: Detail the individual sustainability initiatives you plan to undertake.

- Specify required resources: Clearly outline the financial and human resources needed for each project.

- Estimate anticipated costs: Provide a realistic budget for each initiative, including implementation costs and ongoing maintenance.

- Project ROI (Return on Investment): Demonstrate the potential economic benefits of your sustainability initiatives, such as cost savings from energy efficiency or increased sales from eco-friendly products. This is crucial for attracting investors.

This comprehensive ESG strategy will showcase your commitment to sustainability and increase your chances of securing sustainable business financing. A clearly defined sustainability roadmap will also help you track your progress over time.

Exploring Funding Options for SME Sustainability

Several funding avenues exist to support your SME's sustainability journey. Let's explore some key options for sustainable business financing.

Government Grants and Subsidies

Many governments offer government grants for sustainability and green subsidies to encourage businesses to adopt environmentally friendly practices. These grants often have specific eligibility criteria. Research programs relevant to your industry and location.

- Example (Adapt to your region): The [Insert Name of Relevant Government Program] offers grants for SMEs implementing energy-efficient technologies. [Insert Link to Program].

- Eligibility criteria typically include: Business size, location, type of project, and environmental impact. Carefully review all requirements before applying.

- Key resources: Check your national and regional government websites for details on available sustainable business grants.

Remember to thoroughly research the available green subsidies in your area.

Green Loans and Financing

Green loans are specifically designed to finance environmentally friendly projects. They often come with lower interest rates and favorable terms compared to traditional loans.

- Characteristics of green loans: Lower interest rates, longer repayment periods, and flexible terms.

- Alternative financing options: Explore green bonds, which are debt securities issued to raise capital for green projects. Impact investing focuses on generating positive social and environmental impact alongside financial returns.

- Key resources: Contact your bank or explore specialized green finance institutions.

Private Investment and Crowdfunding

Attracting private investment or utilizing crowdfunding platforms can provide further sustainable finance avenues.

- Angel investors and venture capital: Many angel investors and venture capital firms are actively seeking opportunities in the green tech and sustainable business sectors. A strong business plan emphasizing environmental and social impact is crucial.

- Crowdfunding platforms: Platforms like Kickstarter and Indiegogo allow you to raise capital directly from the public, engaging customers and building brand loyalty.

- Key resources: Research impact investors specializing in sustainable businesses. Explore various crowdfunding platforms suited to your project.

Managing and Measuring the Impact of Sustainability Investments

After securing SME sustainability funding, effectively managing and measuring the impact of your investments is crucial.

Tracking Key Performance Indicators (KPIs)

Monitoring your progress through relevant sustainability KPIs is vital.

- Key KPIs: Energy consumption, waste reduction rates, carbon emissions, water usage, and supply chain sustainability metrics.

- Data collection and analysis: Implement systems to track these KPIs accurately and analyze the data regularly.

- Regular reporting: Use this data to demonstrate the effectiveness of your initiatives and to inform future investments.

Regular monitoring of your sustainability KPIs ensures you remain on track and allows for adjustments as needed.

Reporting and Transparency

Transparent reporting on your sustainability performance builds trust with stakeholders.

- ESG reporting: Prepare regular reports detailing your environmental, social, and governance performance.

- Stakeholder communication: Share your sustainability progress with investors, customers, employees, and the wider community.

- Corporate Social Responsibility (CSR) reporting: Integrate your sustainability performance into your broader CSR reporting framework.

Effective sustainability reporting and ESG disclosure are essential for building a strong reputation and attracting further investment.

Securing the Funding for Your SME's Sustainability Journey

In conclusion, securing SME sustainability funding is achievable through various avenues. Government grants, green loans, private investment, and crowdfunding offer diverse options. A well-defined sustainability plan, including clear goals and measurable KPIs, is crucial for attracting investors and securing funding. Accurate impact measurement and transparent reporting further demonstrate your commitment and build trust. Don't let the cost of sustainability hold your SME back. Start exploring the various funding avenues available to implement your sustainability plan and build a more responsible and profitable business. Begin your journey towards SME sustainability funding today!

[Insert Links to Relevant Resources: Government websites, funding platforms, etc.]

Featured Posts

-

Sabics Gas Business Ipo Exploring Saudi Arabias Energy Future

May 19, 2025

Sabics Gas Business Ipo Exploring Saudi Arabias Energy Future

May 19, 2025 -

Interdisciplinary And Transdisciplinary Approaches A Necessary Shift In Research

May 19, 2025

Interdisciplinary And Transdisciplinary Approaches A Necessary Shift In Research

May 19, 2025 -

Gazze Den Yerinden Edilen Filistinlilerin Zorlu Hayati

May 19, 2025

Gazze Den Yerinden Edilen Filistinlilerin Zorlu Hayati

May 19, 2025 -

Ufc 313 Post Fight Admission Fuels Robbery Debate

May 19, 2025

Ufc 313 Post Fight Admission Fuels Robbery Debate

May 19, 2025 -

Experience Uber One In Kenya Free Deliveries And Exclusive Discounts

May 19, 2025

Experience Uber One In Kenya Free Deliveries And Exclusive Discounts

May 19, 2025

Latest Posts

-

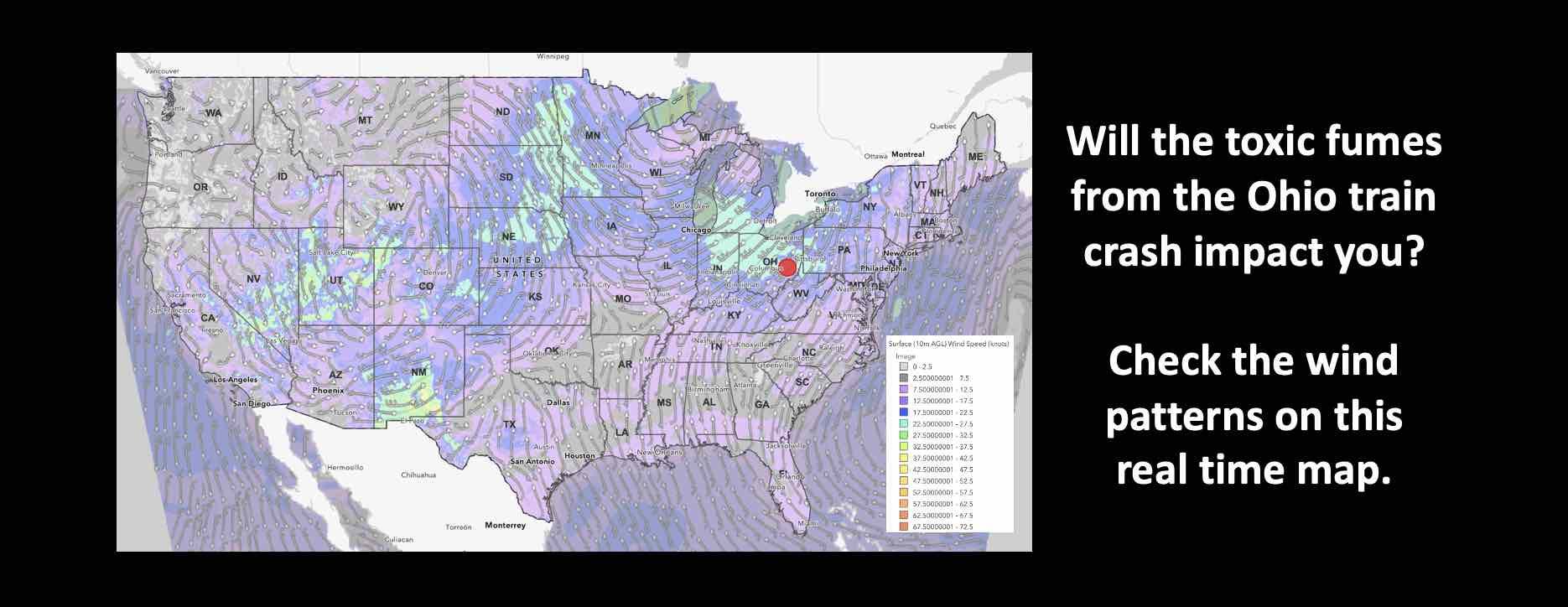

Ohio Train Disaster Persistent Toxic Chemicals Found In Buildings

May 19, 2025

Ohio Train Disaster Persistent Toxic Chemicals Found In Buildings

May 19, 2025 -

Toxic Chemical Residue From Ohio Derailment Months Long Contamination

May 19, 2025

Toxic Chemical Residue From Ohio Derailment Months Long Contamination

May 19, 2025 -

Federal Investigation Office365 Breach Nets Millions For Hacker

May 19, 2025

Federal Investigation Office365 Breach Nets Millions For Hacker

May 19, 2025 -

Millions Stolen After Office365 Hack Of Executive Inboxes Fbi Alleges

May 19, 2025

Millions Stolen After Office365 Hack Of Executive Inboxes Fbi Alleges

May 19, 2025 -

Severe Storms And Tornadoes 25 Fatalities Extensive Damage In Central Us

May 19, 2025

Severe Storms And Tornadoes 25 Fatalities Extensive Damage In Central Us

May 19, 2025