Gold (XAUUSD) Price Rebound: Weak US Data Fuels Rate Cut Expectations

Table of Contents

Weak US Economic Data and its Impact on Gold Prices

Weak US economic data has played a pivotal role in the recent gold (XAUUSD) price rebound. Several key indicators point towards a softening economy, prompting reassessments of the Federal Reserve's monetary policy stance.

Softening Inflationary Pressures

Recent declines in inflation indicators signal a potential shift in the economic landscape.

- Lower-than-expected CPI figures: The Consumer Price Index (CPI) has shown a slower-than-anticipated rise in recent months, suggesting that inflationary pressures might be easing.

- Slowing wage growth: Moderate wage growth further supports the narrative of decelerating inflation.

Lower inflation reduces the pressure on the Federal Reserve to maintain aggressively high interest rates. This makes gold, a non-yielding asset, relatively more attractive compared to interest-bearing instruments. The reduced appeal of high-yield bonds and other fixed-income investments drives investors towards alternative assets like gold.

Slowing Economic Growth

Weakening economic indicators paint a picture of slowing growth in the US economy.

- GDP growth deceleration: Recent GDP growth figures have fallen short of expectations, signaling a potential slowdown in economic activity.

- Manufacturing PMI contraction: The Manufacturing Purchasing Managers' Index (PMI) indicates contraction in the manufacturing sector, highlighting further economic weakness.

This economic uncertainty increases investor anxiety, boosting demand for safe-haven assets like gold (XAUUSD). Gold is traditionally viewed as a safe haven during periods of economic turmoil, providing a degree of protection against market volatility.

Impact on the US Dollar

The inverse relationship between the US dollar and gold prices is a crucial factor in understanding recent gold (XAUUSD) price movements.

- Negative correlation between USD index and gold price: Historically, a weaker US dollar tends to correlate with a higher gold price.

- Dollar's role as a reserve currency: The US dollar's status as a global reserve currency influences its inverse relationship with gold. A weaker dollar makes gold more affordable for international investors, thereby increasing demand.

As the US dollar weakens, investors often seek alternative assets like gold, driving up its price. The recent weakening of the dollar has, therefore, contributed to the gold (XAUUSD) price rebound.

Rising Expectations of a Fed Rate Cut and its Influence on Gold

Growing market expectations of a Federal Reserve interest rate cut significantly influence the gold (XAUUSD) price.

Market Speculation and Forecasting

Market analysts are increasingly predicting a potential Fed rate cut, although the timing remains a subject of debate.

- Analyst predictions vary: While many analysts anticipate a rate cut, the exact timing and magnitude vary considerably.

- Reasoning behind predictions: Analysts cite weak economic data and easing inflation as primary reasons for their rate-cut forecasts.

Lower interest rates typically benefit gold prices. Decreased interest rates reduce the opportunity cost of holding non-yielding assets like gold, making them more appealing to investors.

Gold's Role as a Hedge against Inflation and Rate Cuts

Gold has historically served as a hedge against inflation and periods of interest rate cuts.

- Historical data supports correlation: Historical data demonstrates a positive correlation between gold prices and periods of low inflation or rate cuts.

- Gold as a safe haven: Investors view gold as a safe haven, seeking its protection during periods of economic uncertainty.

Gold's performance during past instances of rate cuts and periods of low inflation reinforces its value as a hedge against such economic conditions.

Technical Analysis of the Gold (XAUUSD) Price Chart

Technical analysis of the gold (XAUUSD) price chart offers further insight into the current market dynamics.

Support and Resistance Levels

Identifying key support and resistance levels is crucial for assessing potential future price movements.

- Significant price levels: Specific price levels act as support (price floor) and resistance (price ceiling).

- Influence on price movements: These levels can influence future price action, acting as potential turning points.

By identifying these levels, traders can anticipate potential price reversals or continuations.

Technical Indicators

Technical indicators provide additional signals regarding the gold (XAUUSD) price trend.

- Moving averages: Moving averages provide insights into the price trend and potential momentum shifts.

- RSI (Relative Strength Index): The RSI indicator helps to identify overbought or oversold conditions, providing insight into potential price corrections.

Technical analysis, combined with fundamental analysis, provides a holistic view for making informed trading decisions.

Conclusion

The recent rebound in the gold (XAUUSD) price is primarily driven by weak US economic data and the growing anticipation of a Fed rate cut. These factors have increased investor demand for gold as a safe-haven asset and a hedge against inflation and lower interest rates. Analyzing economic indicators, market sentiment, and technical charts offers a comprehensive understanding of the current gold market dynamics. Stay informed about upcoming economic data releases and Federal Reserve announcements to effectively navigate the gold (XAUUSD) market and capitalize on potential price movements. Keep a close watch on the gold (XAUUSD) price for further developments and make informed investment decisions regarding your gold holdings.

Featured Posts

-

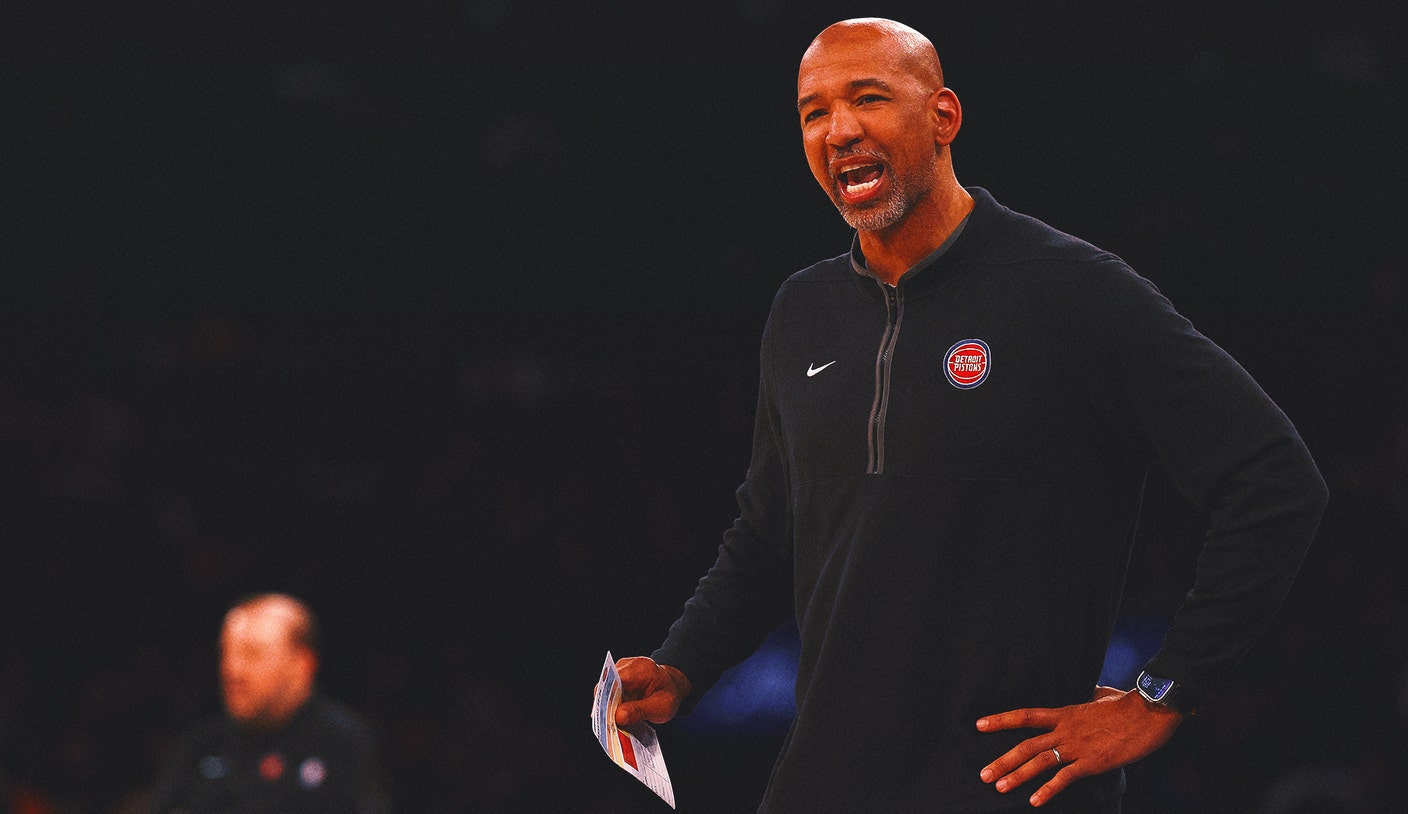

Missed Call Controversy Officials Address Late Game Decision In Knicks Pistons Matchup

May 17, 2025

Missed Call Controversy Officials Address Late Game Decision In Knicks Pistons Matchup

May 17, 2025 -

Josh Alexanders Aew Journey Don Callis Impact Wrestling And The Future

May 17, 2025

Josh Alexanders Aew Journey Don Callis Impact Wrestling And The Future

May 17, 2025 -

Motocross Enduro And More The Latest Moto News And Results

May 17, 2025

Motocross Enduro And More The Latest Moto News And Results

May 17, 2025 -

Student Loan Reform Key Changes In The Gops New Plan

May 17, 2025

Student Loan Reform Key Changes In The Gops New Plan

May 17, 2025 -

The Steepening Japanese Government Bond Yield Curve Risks And Opportunities

May 17, 2025

The Steepening Japanese Government Bond Yield Curve Risks And Opportunities

May 17, 2025

Latest Posts

-

Noticias Sobre Prestamos Estudiantiles Acciones Del Departamento De Educacion

May 17, 2025

Noticias Sobre Prestamos Estudiantiles Acciones Del Departamento De Educacion

May 17, 2025 -

Recent Survey A Look At Changing Parental Attitudes Toward College Costs

May 17, 2025

Recent Survey A Look At Changing Parental Attitudes Toward College Costs

May 17, 2025 -

New University Of Utah Hospital And Medical Campus Coming To West Valley City

May 17, 2025

New University Of Utah Hospital And Medical Campus Coming To West Valley City

May 17, 2025 -

Actuaciones Del Gobierno Ante La Morosidad De Prestamos Estudiantiles En Puerto Rico

May 17, 2025

Actuaciones Del Gobierno Ante La Morosidad De Prestamos Estudiantiles En Puerto Rico

May 17, 2025 -

Parental College Tuition Anxiety Decreases Student Loan Use Persistent

May 17, 2025

Parental College Tuition Anxiety Decreases Student Loan Use Persistent

May 17, 2025