Parental College Tuition Anxiety Decreases, Student Loan Use Persistent

Table of Contents

The Decline in Parental College Tuition Anxiety

While the fear of crippling college tuition debt still looms large for many, recent data suggests a slight decrease in parental anxiety surrounding college costs. This shift can be attributed to several key factors:

Factors Contributing to Reduced Anxiety

-

Increased financial aid availability: The expansion of grant and scholarship programs, along with improved accessibility to information about these resources, has lessened the financial burden for many families. The Pell Grant program, for example, continues to provide crucial support to low-income students. Furthermore, many universities are increasing their merit-based scholarship offerings, further reducing the need for substantial loans.

-

Growing awareness of cost-saving strategies: Parents are becoming more informed about strategies like 529 plans and the benefits of attending community colleges for the first two years before transferring to a four-year institution. These options provide significant cost savings without necessarily compromising the quality of education. The use of 529 plans, in particular, has shown a marked increase in recent years.

-

Shifting perceptions of college value: There’s a growing understanding that the return on investment (ROI) from a college education needs careful consideration. Parents are increasingly evaluating the cost of college against the potential career outcomes and earning potential of their children. This leads to more strategic choices about college majors and career paths.

-

Increased parental financial preparedness: Many parents are now actively saving for their children's college education for a longer period, starting earlier and contributing consistently. This proactive approach mitigates the financial shock of college expenses. This improved financial preparedness reduces reliance on high-interest loans.

Regional Variations in Anxiety Levels

Parental college tuition anxiety levels aren't uniform across the country. Families in higher-cost-of-living areas, particularly in the Northeast and West Coast, often report higher stress levels than those in the South and Midwest. Socioeconomic factors also play a significant role, with lower-income families experiencing significantly more anxiety about affording college. These regional discrepancies highlight the need for tailored financial aid programs and support resources. A recent study showed a 15% higher anxiety rate among parents in California compared to those in Texas, largely attributed to differences in tuition costs and the availability of financial aid.

The Persistence of Student Loan Use

Despite the decrease in parental anxiety, the use of student loans remains persistently high. This is due to a number of factors:

Reasons for Continued Reliance on Student Loans

-

Rising tuition costs despite financial aid increases: While financial aid has expanded, tuition costs have also continued to rise, often outpacing the growth in aid. This gap leaves many families still needing to rely on loans to cover the remaining expenses.

-

Limited savings and investment opportunities for families: Not all families have the financial resources or the opportunity to save adequately for college. Economic downturns, job insecurity, and unexpected expenses can significantly impact savings plans.

-

Increased pressure on students to pursue higher education: The societal expectation that higher education is essential for career success puts immense pressure on families to fund college, even when it's financially challenging.

-

Lack of awareness regarding alternative funding options: Many families remain unaware of alternative funding options like apprenticeships, vocational training, or income share agreements, which can provide viable pathways to career success without incurring significant student loan debt.

Long-Term Implications of Student Loan Debt

The long-term consequences of significant student loan debt are considerable. It can impact:

-

Future financial stability: Paying off student loans can delay major life milestones like homeownership, marriage, and starting a family. It can also severely restrict retirement savings, potentially leading to financial insecurity in later life.

-

Psychological stress: The weight of substantial student loan debt can contribute to significant psychological stress and anxiety, impacting mental well-being.

-

Delayed major life milestones: The burden of loan repayments can force graduates to delay or forgo important life decisions like purchasing a home, starting a family, or pursuing further education.

Bridging the Gap: Strategies for Managing College Costs

To effectively address both parental anxiety and the persistent use of student loans, a multi-pronged approach is necessary:

Proactive Financial Planning for Parents

-

Start early: Begin saving and investing for your child's college education as early as possible. Even small, consistent contributions can make a significant difference over time.

-

Utilize savings vehicles: Explore different savings vehicles, such as 529 plans and education savings accounts (ESAs), which offer tax advantages and help grow your savings.

-

Financial literacy: Improve your financial literacy by utilizing budgeting tools and seeking advice from financial professionals. Understanding your family's financial situation and setting realistic goals are crucial.

Strategies for Students

-

Aggressive scholarship applications: Apply for as many scholarships and grants as possible. Many scholarships are available based on academic merit, extracurricular activities, and community involvement.

-

Community college option: Consider starting at a community college for the first two years, which is significantly more affordable than a four-year university.

-

Part-time jobs/internships: Working part-time or pursuing internships can help reduce the financial burden and provide valuable work experience.

-

Student loan repayment options: Understand various student loan repayment options and explore income-driven repayment plans if necessary.

Conclusion

While parental college tuition anxiety is decreasing, the continued reliance on student loans remains a significant concern. Proactive financial planning, exploring diverse funding options, and understanding the long-term implications of student loan debt are crucial for mitigating this challenge. Don't let parental college tuition anxiety control your future. Take proactive steps today to plan for college costs effectively and minimize your reliance on student loans. Explore resources and strategies to ensure a brighter financial future. Start planning early, research all available options, and make informed decisions to navigate the complexities of college financing successfully.

Featured Posts

-

Knicks Redemption Thibodeaus Evolution And The Turnaround

May 17, 2025

Knicks Redemption Thibodeaus Evolution And The Turnaround

May 17, 2025 -

Best No Kyc Casinos 2025 7 Bit Casinos Instant Withdrawals

May 17, 2025

Best No Kyc Casinos 2025 7 Bit Casinos Instant Withdrawals

May 17, 2025 -

Nba Teisejo Klaida Leme Pistons Ir Knicks Rungtyniu Baigti Taip Nutinka Retai

May 17, 2025

Nba Teisejo Klaida Leme Pistons Ir Knicks Rungtyniu Baigti Taip Nutinka Retai

May 17, 2025 -

Top Rated Bitcoin Casino 2025 Jackbit Review

May 17, 2025

Top Rated Bitcoin Casino 2025 Jackbit Review

May 17, 2025 -

Play At The Best No Id Verification Casinos In 2025

May 17, 2025

Play At The Best No Id Verification Casinos In 2025

May 17, 2025

Latest Posts

-

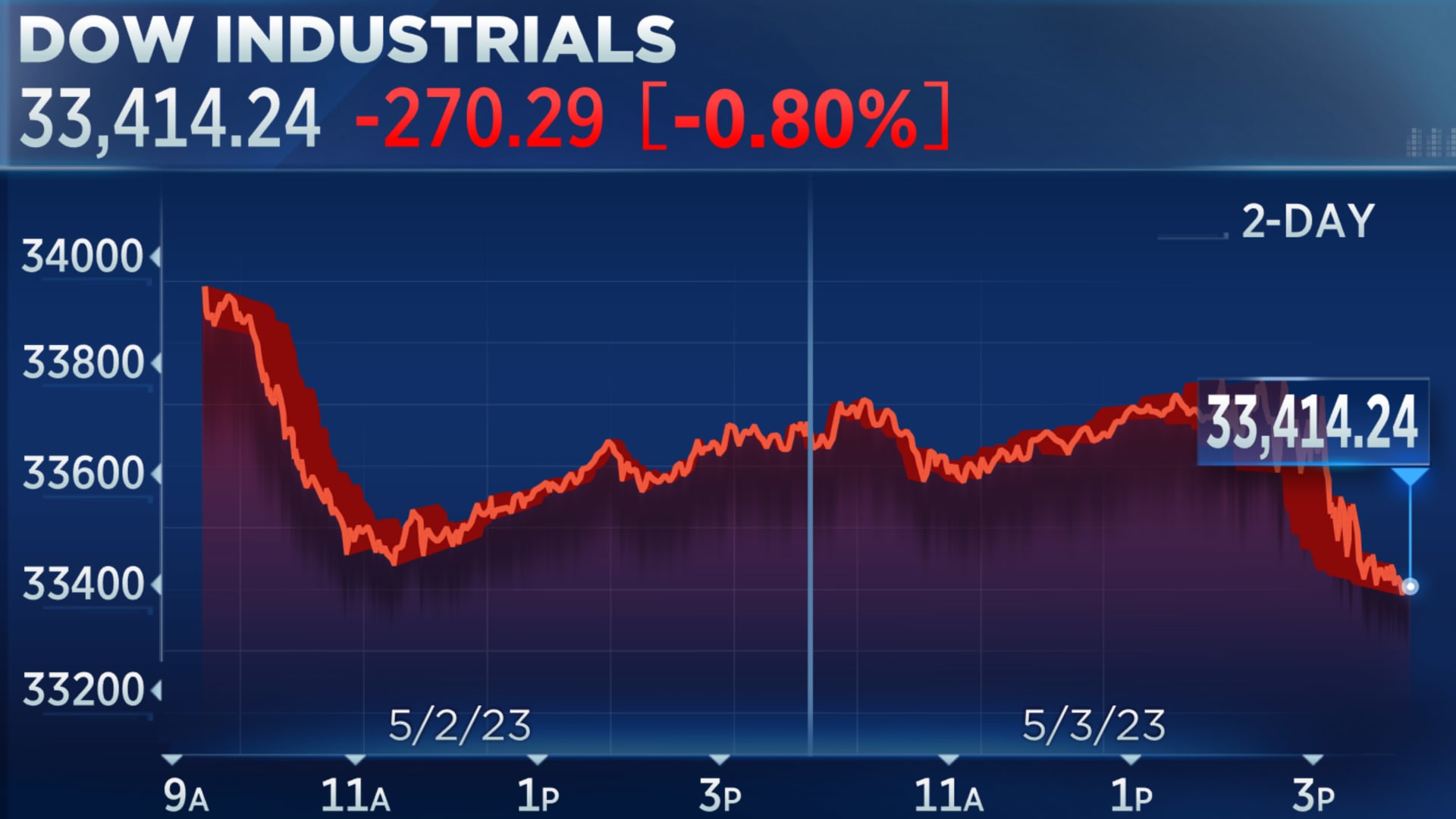

Stock Market Update Strong Earnings Boost Rockwell Automation And Other Big Names

May 17, 2025

Stock Market Update Strong Earnings Boost Rockwell Automation And Other Big Names

May 17, 2025 -

Brunson Injury Highlights Knicks Critical Flaw

May 17, 2025

Brunson Injury Highlights Knicks Critical Flaw

May 17, 2025 -

Rockwell Automation Earnings Beat Expectations Wednesdays Stock Market Winners

May 17, 2025

Rockwell Automation Earnings Beat Expectations Wednesdays Stock Market Winners

May 17, 2025 -

Ankle Sprain Sidelines Brunson Return Expected Sunday

May 17, 2025

Ankle Sprain Sidelines Brunson Return Expected Sunday

May 17, 2025 -

Knicks Biggest Problem Revealed By Jalen Brunsons Injury

May 17, 2025

Knicks Biggest Problem Revealed By Jalen Brunsons Injury

May 17, 2025