Goldman Sachs: Coalition's Fiscal Policy Looser Than Labor's?

Table of Contents

Goldman Sachs' Report: Key Findings on Coalition Fiscal Policy

Goldman Sachs' analysis of the Coalition's fiscal policy paints a picture of continued emphasis on targeted spending and tax cuts aimed at stimulating economic growth. However, the report also highlights potential risks associated with maintaining this approach.

Government Spending Projections

The Coalition's plan projects a continuation of moderate increases in government spending, primarily focused on:

- Infrastructure: Significant investment in infrastructure projects is intended to boost economic activity and create jobs.

- Healthcare: Incremental increases in healthcare funding are projected, primarily focused on addressing specific needs within the existing system.

- Defense: Increased defense spending is anticipated, reflecting geopolitical shifts and national security priorities.

These spending initiatives, while aiming to stimulate economic growth and job creation, may face challenges in terms of efficient delivery and achieving optimal economic impact. Goldman Sachs notes concerns about potential cost overruns and the need for robust project management to maximize the return on investment. Concerns also exist regarding the sustainability of this spending level in the long-term, especially given projected revenue.

Taxation Policies and Revenue Projections

The Coalition's tax policies largely maintain the status quo, with minor adjustments to certain tax brackets. Key aspects include:

- Income Tax Rates: Minimal changes are proposed to personal income tax rates, aiming for stability rather than significant alterations.

- Corporate Tax Rates: The current corporate tax rate is expected to remain largely unchanged.

- GST: No significant changes to the Goods and Services Tax (GST) are anticipated.

This approach, while aiming for fiscal stability, could limit potential revenue increases, potentially creating challenges in funding the projected government spending. Goldman Sachs points out that the revenue projections are contingent on sustained economic growth, and any slowdown could impact the government's ability to meet its spending commitments.

Debt and Deficit Implications

Goldman Sachs' analysis suggests that under the Coalition's plan, the national debt-to-GDP ratio will continue to increase, albeit at a slower pace than under some alternative scenarios. The budget deficit is projected to gradually decrease, but the long-term fiscal sustainability remains a point of concern. The report emphasizes that continued strong economic growth is crucial to maintaining this trajectory. Any unexpected economic downturn could significantly worsen the deficit and debt levels.

Goldman Sachs' Report: Key Findings on Labor's Fiscal Policy

Goldman Sachs' assessment of Labor's fiscal policy reveals a contrasting approach, prioritizing social spending and investment in key areas while also proposing targeted tax increases for higher-income earners.

Government Spending Projections

Labor's plan prioritizes increased spending in areas such as:

- Social Welfare: Significant investment in social welfare programs designed to alleviate poverty and inequality.

- Education: Increased funding for education at all levels, aiming to improve educational outcomes and human capital.

- Climate Change Initiatives: Substantial investment in climate change mitigation and adaptation measures.

While this spending is intended to address social needs and contribute to long-term economic prosperity, Goldman Sachs highlights potential challenges in effectively managing these increased expenditures and ensuring value for money. The report suggests a need for detailed cost-benefit analyses to ensure these investments deliver optimal social and economic outcomes.

Taxation Policies and Revenue Projections

Labor's tax proposals focus on:

- Income Tax Rates: Increased income tax rates for high-income earners.

- Corporate Tax Rates: Potential adjustments to corporate tax rates are under consideration.

- Targeted Taxes: New taxes or increased taxes on specific sectors (e.g., mining) may be introduced.

These tax proposals aim to generate additional revenue to fund the increased government spending. Goldman Sachs’ analysis suggests that the revenue projections are sensitive to economic conditions and potential behavioral responses to tax changes. The effectiveness of these tax measures in achieving revenue targets, while minimizing negative economic impacts, is a crucial factor.

Debt and Deficit Implications

According to Goldman Sachs, Labor's fiscal plan projects a slower reduction in the budget deficit compared to the Coalition's plan, potentially leading to a higher national debt-to-GDP ratio in the medium term. However, the report also suggests that the longer-term fiscal sustainability could be improved through the increased tax revenue generated from the proposed tax changes. This outcome is contingent upon the effectiveness of the spending programs and the realization of projected revenue.

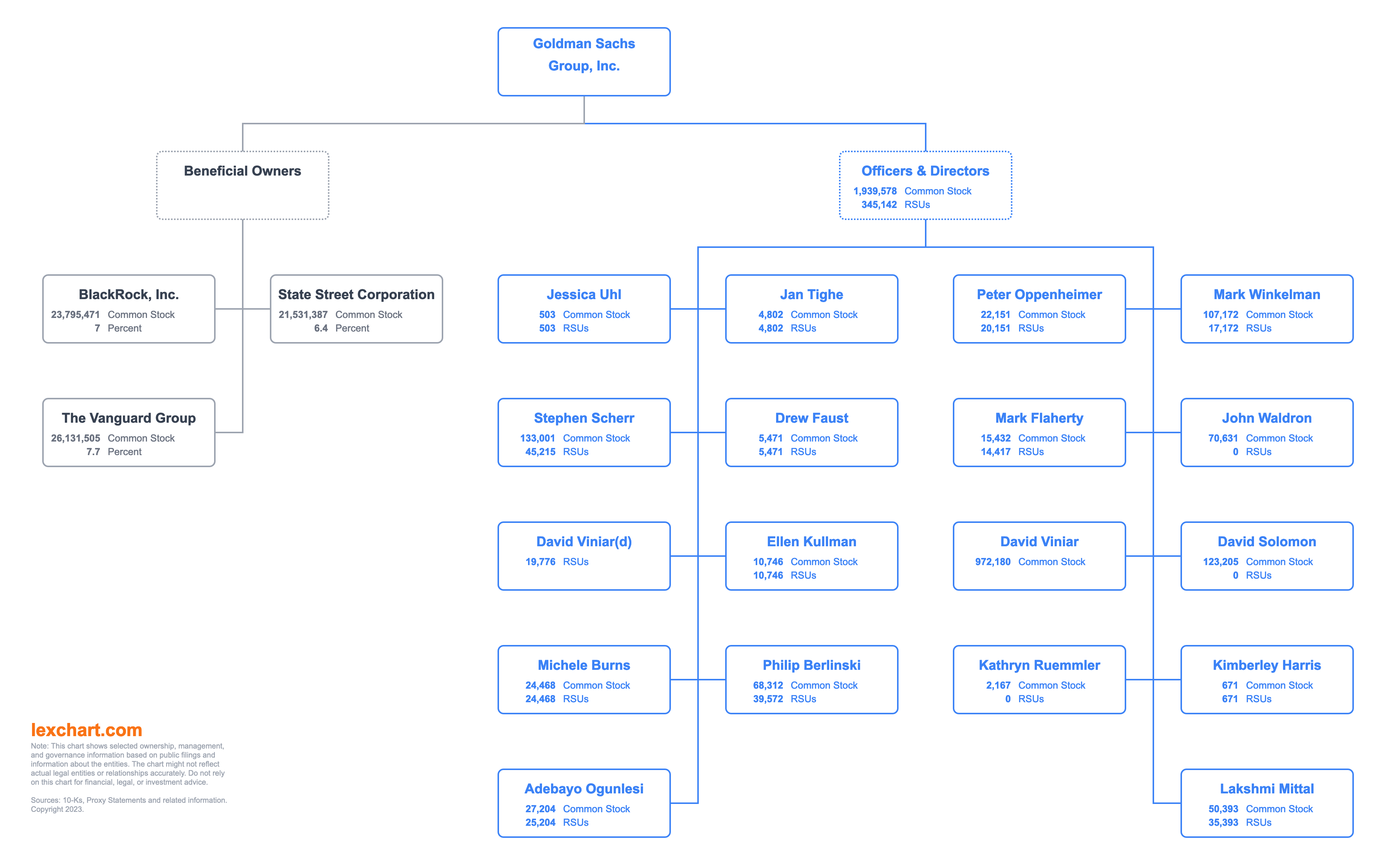

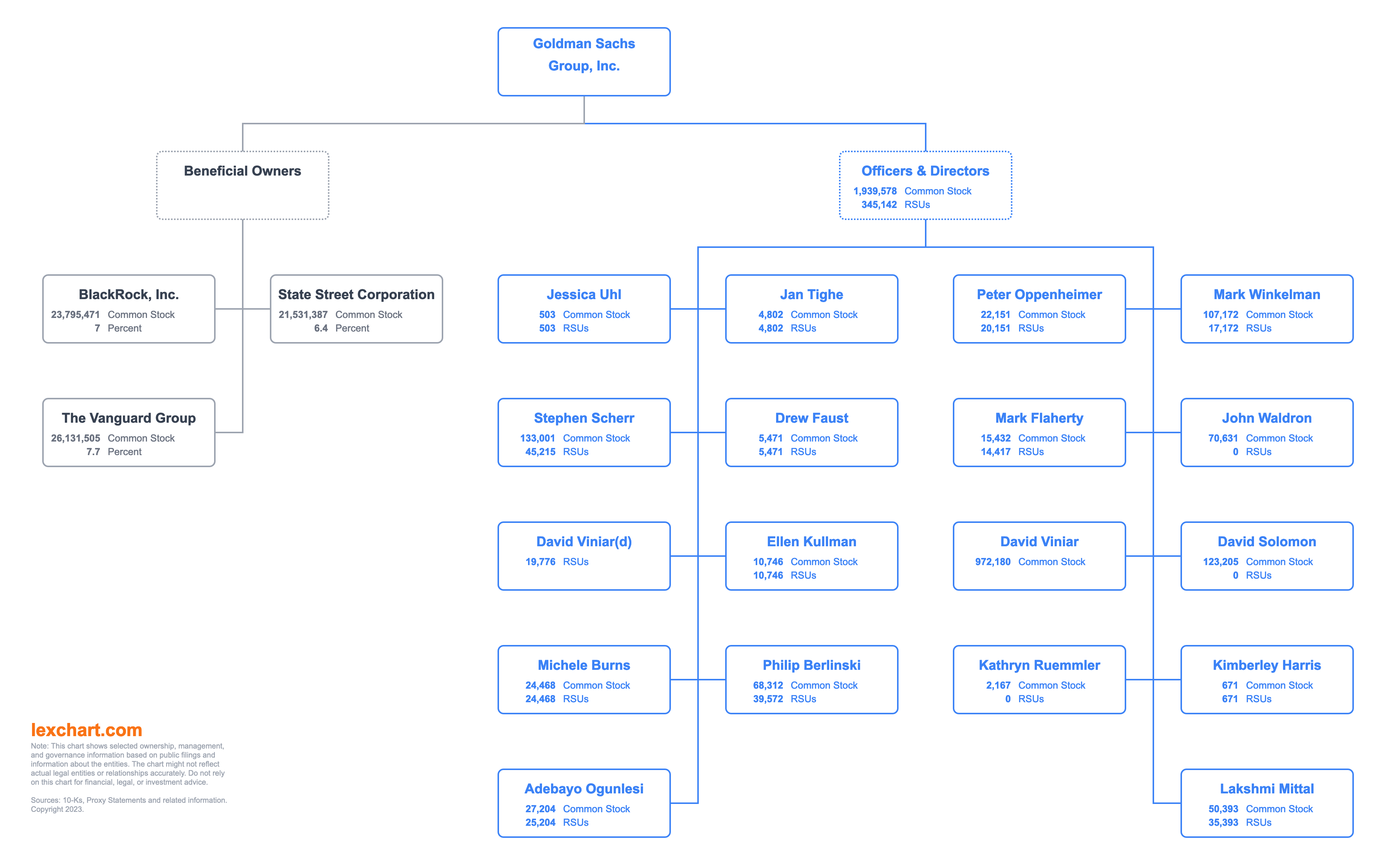

Comparison and Contrast: Coalition vs. Labor Fiscal Policies According to Goldman Sachs

Goldman Sachs' report highlights key differences between the Coalition and Labor's fiscal approaches:

- Spending Priorities: The Coalition prioritizes infrastructure and targeted spending, while Labor emphasizes social programs and climate change initiatives.

- Taxation: The Coalition favors tax stability, while Labor proposes tax increases for higher-income earners and potentially other sectors.

- Debt and Deficit: Both plans aim to reduce the deficit, but their projected trajectories for debt-to-GDP differ, with Labor's potentially resulting in a higher ratio in the medium term.

Goldman Sachs' assessment suggests that the Coalition's fiscal policy is considered "looser" due to its reliance on sustained economic growth to fund its spending plans and its more limited use of tax increases. This assessment highlights the inherent risks associated with a more expansive fiscal approach in a period of economic uncertainty.

Conclusion: Understanding the Implications of Goldman Sachs' Fiscal Policy Analysis

Goldman Sachs' report provides a valuable analysis of the fiscal policies proposed by the Coalition and Labor parties. The key takeaway is that while both parties aim for fiscal sustainability, their approaches differ significantly, with the Coalition favoring a more "loose" fiscal stance. This difference carries implications for economic growth, income inequality, and long-term debt sustainability. The potential impact of each approach on the Australian economy will depend significantly on future economic conditions and the effective implementation of proposed policies. Learn more about the detailed findings of the Goldman Sachs report to make informed decisions about Australia’s future fiscal policy.

Featured Posts

-

Is Ashton Jeanty Headed To The Chicago Bears In The 2025 Nfl Draft

Apr 25, 2025

Is Ashton Jeanty Headed To The Chicago Bears In The 2025 Nfl Draft

Apr 25, 2025 -

White House Considers Slashing China Tariffs An Exclusive Look At Trade War De Escalation

Apr 25, 2025

White House Considers Slashing China Tariffs An Exclusive Look At Trade War De Escalation

Apr 25, 2025 -

Millions Lost Office365 Security Breach Impacts Executives Fbi Investigation Underway

Apr 25, 2025

Millions Lost Office365 Security Breach Impacts Executives Fbi Investigation Underway

Apr 25, 2025 -

Understanding The Recent Volatility Of The Canadian Dollar

Apr 25, 2025

Understanding The Recent Volatility Of The Canadian Dollar

Apr 25, 2025 -

Pozitsiya Trampa Schodo Viyni V Ukrayini Analiz Yogo Zayav

Apr 25, 2025

Pozitsiya Trampa Schodo Viyni V Ukrayini Analiz Yogo Zayav

Apr 25, 2025

Latest Posts

-

Former Republican Rep Condemns Newsoms Bannon Podcast Interview

Apr 26, 2025

Former Republican Rep Condemns Newsoms Bannon Podcast Interview

Apr 26, 2025 -

Gavin Newsom An Analysis Of Recent Criticisms

Apr 26, 2025

Gavin Newsom An Analysis Of Recent Criticisms

Apr 26, 2025 -

Newsoms Podcast Debut Could Charlie Kirks Interview Be A Political Disaster

Apr 26, 2025

Newsoms Podcast Debut Could Charlie Kirks Interview Be A Political Disaster

Apr 26, 2025 -

Gavin Newsom Podcast A Risky Gamble Charlie Kirks Perspective

Apr 26, 2025

Gavin Newsom Podcast A Risky Gamble Charlie Kirks Perspective

Apr 26, 2025 -

Charlie Kirk Claims Gavin Newsoms Podcast Will Derail His Political Ambitions

Apr 26, 2025

Charlie Kirk Claims Gavin Newsoms Podcast Will Derail His Political Ambitions

Apr 26, 2025