White House Considers Slashing China Tariffs: An Exclusive Look At Trade War De-escalation

Table of Contents

Potential Reasons Behind the Tariff Reduction Consideration

The White House's contemplation of reducing China tariffs stems from a confluence of economic and geopolitical factors. Let's delve into the key drivers.

Easing Inflationary Pressures

High inflation is currently a major concern for the US economy. Reducing tariffs on Chinese goods could significantly lower prices for consumers, thereby alleviating inflationary pressures.

- Reduced import costs: Lower tariffs directly translate to reduced costs for businesses importing goods from China.

- Lower prices for consumers: These savings are passed on to consumers, leading to lower prices on a wide range of products.

- Impact on the Consumer Price Index (CPI): A decrease in import prices directly impacts the CPI, potentially leading to a lower inflation rate.

- Potential for easing Federal Reserve interest rate hikes: Lower inflation could allow the Federal Reserve to slow or pause its interest rate hikes, mitigating potential economic slowdown.

Boosting Domestic Supply Chains

The China tariffs have significantly disrupted global supply chains, leading to shortages and higher prices for many goods. Reducing tariffs could help restore stability and improve the flow of goods.

- Improved access to Chinese goods: Easing tariffs would make Chinese goods more readily available, addressing existing supply chain bottlenecks.

- Reduced dependence on alternative suppliers: Businesses may be able to shift back to more reliable and cost-effective Chinese suppliers.

- Resilience of US supply chains: A smoother flow of goods from China contributes to greater resilience in US supply chains.

- Impact on manufacturing and logistics sectors: The changes would positively impact businesses in these sectors by increasing efficiency and reducing costs.

Strategic Geopolitical Considerations

The global political landscape plays a crucial role in this decision. Easing tensions with China could be a strategic move to allow the US to focus on other geopolitical priorities.

- Improved US-China relations: Reducing tariffs could be seen as a gesture of goodwill, potentially leading to improved diplomatic relations.

- Potential for increased cooperation on global issues: Improved relations could facilitate cooperation on issues such as climate change and global health.

- Impact on global trade negotiations: The move could influence negotiations with other countries and set a precedent for future trade agreements.

- Strategic implications for other trade partners: The decision’s impact on relationships with other trading partners must be carefully considered.

Potential Economic Impacts of Slashing China Tariffs

The potential impact of slashing China tariffs on the US and global economy is multifaceted and complex.

Impact on Businesses

Businesses will experience a mixed bag of effects. While some will benefit, others might face challenges.

- Increased profitability for businesses importing from China: Lower input costs will increase profit margins for businesses relying on Chinese imports.

- Potential job losses in competing domestic industries: Increased competition from cheaper imports could lead to job losses in certain domestic sectors.

- Impact on small and medium-sized enterprises (SMEs): SMEs might be particularly vulnerable to increased competition, requiring adaptation strategies.

- Need for business adaptation strategies: Businesses will need to adapt their strategies to compete in a market with potentially lower prices.

Impact on Consumers

Consumers are likely to see the most immediate benefits from reduced China tariffs.

- Lower prices on consumer goods: Consumers will likely see lower prices on a wide variety of goods.

- Increased consumer spending: Lower prices could lead to increased consumer spending, boosting economic activity.

- Impact on household budgets: Lower prices will free up household budgets, allowing consumers to allocate funds elsewhere.

- Potential for increased demand: Lower prices could lead to increased demand for certain goods, potentially stimulating economic growth.

Impact on the Global Economy

The ripple effects of reduced China tariffs will be felt worldwide.

- Increased global trade volumes: Lower tariffs could stimulate global trade and increase overall economic activity.

- Potential for economic growth in other countries: Increased trade could lead to economic growth in countries connected to the US-China trade relationship.

- Impact on currency exchange rates: The changes could influence currency exchange rates, creating both winners and losers.

- Global market stability: The move could contribute to greater stability in global markets by reducing trade tensions.

Political Ramifications and Public Opinion

The decision to slash China tariffs will have significant political consequences, both domestically and internationally.

Domestic Political Fallout

The move will likely spark intense political debate within the United States.

- Reactions from different political parties: Different political parties will likely have different reactions to the decision.

- Potential criticism from protectionist groups: Protectionist groups will likely oppose the reduction of tariffs.

- Impact on the upcoming elections: The decision could influence the outcome of upcoming elections.

- Public opinion polls and surveys: Public opinion polls will be crucial in gauging public sentiment regarding the tariff reduction.

International Response

The decision will also have implications for US relations with other countries.

- Reactions from other countries: Other countries will likely react differently to the decision, depending on their own trade relations with China and the US.

- Impact on existing trade deals: The decision could influence existing trade deals and agreements.

- Influence on future trade negotiations: The decision could set a precedent for future trade negotiations.

- Global response to US trade policy: The global community will be observing how the decision impacts the US’s trade policy moving forward.

Conclusion

The White House's potential decision to slash China tariffs presents a complex scenario with far-reaching economic and political implications. While lower prices for consumers and eased inflationary pressures are potential benefits, the impact on domestic industries and the broader geopolitical landscape warrants careful consideration. Understanding the potential ramifications of this significant policy shift is crucial for businesses, policymakers, and consumers alike. Further analysis of the potential effects of changing China tariffs is essential for navigating this evolving trade environment. Stay informed on the latest developments regarding China tariffs and their impact on the global economy.

Featured Posts

-

Confirmed Speakers For Harrogate Spring Flower Show 2025

Apr 25, 2025

Confirmed Speakers For Harrogate Spring Flower Show 2025

Apr 25, 2025 -

Zavershenie Rossiysko Ukrainskoy Voyny Slozhneyshaya Zadacha Dlya Trampa Foreign Policy

Apr 25, 2025

Zavershenie Rossiysko Ukrainskoy Voyny Slozhneyshaya Zadacha Dlya Trampa Foreign Policy

Apr 25, 2025 -

Xis Climate Pledge Chinas Tougher Emissions Targets Without Us Collaboration

Apr 25, 2025

Xis Climate Pledge Chinas Tougher Emissions Targets Without Us Collaboration

Apr 25, 2025 -

Eurovision 2025 Your Guide To Betting And Predictions

Apr 25, 2025

Eurovision 2025 Your Guide To Betting And Predictions

Apr 25, 2025 -

Trumps Auto Tariffs How They Scuttled Renaults Us Sports Car Dreams

Apr 25, 2025

Trumps Auto Tariffs How They Scuttled Renaults Us Sports Car Dreams

Apr 25, 2025

Latest Posts

-

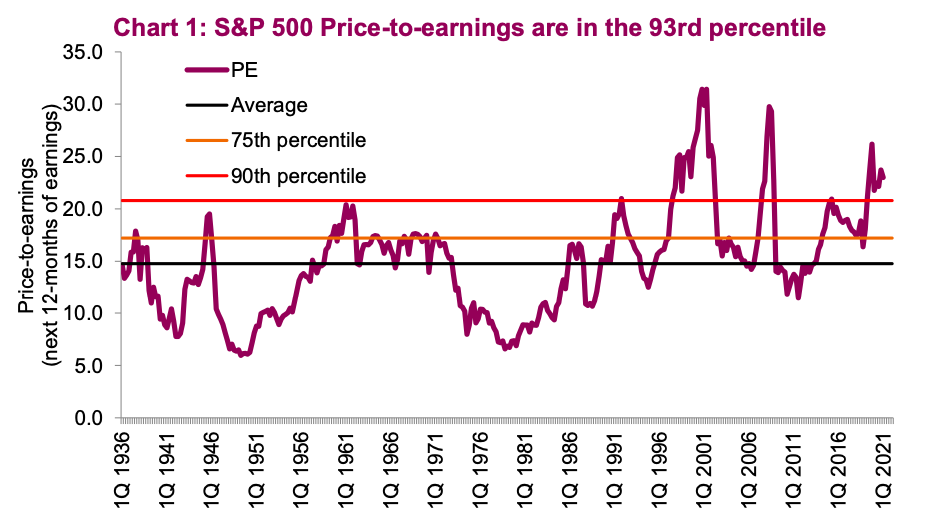

Addressing Investor Concerns Bof As View On High Stock Market Valuations

Apr 26, 2025

Addressing Investor Concerns Bof As View On High Stock Market Valuations

Apr 26, 2025 -

Bof A On Stock Market Valuations A Rationale For Investor Confidence

Apr 26, 2025

Bof A On Stock Market Valuations A Rationale For Investor Confidence

Apr 26, 2025 -

Why Current Stock Market Valuations Are Not A Reason To Panic According To Bof A

Apr 26, 2025

Why Current Stock Market Valuations Are Not A Reason To Panic According To Bof A

Apr 26, 2025 -

Understanding Stock Market Valuations Bof As Argument For Calm

Apr 26, 2025

Understanding Stock Market Valuations Bof As Argument For Calm

Apr 26, 2025 -

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025