High Stock Market Valuations: A BofA Analyst's Rationale For Investor Calm

Table of Contents

The BofA Analyst's Core Argument: Why Current Valuations Aren't Overvalued

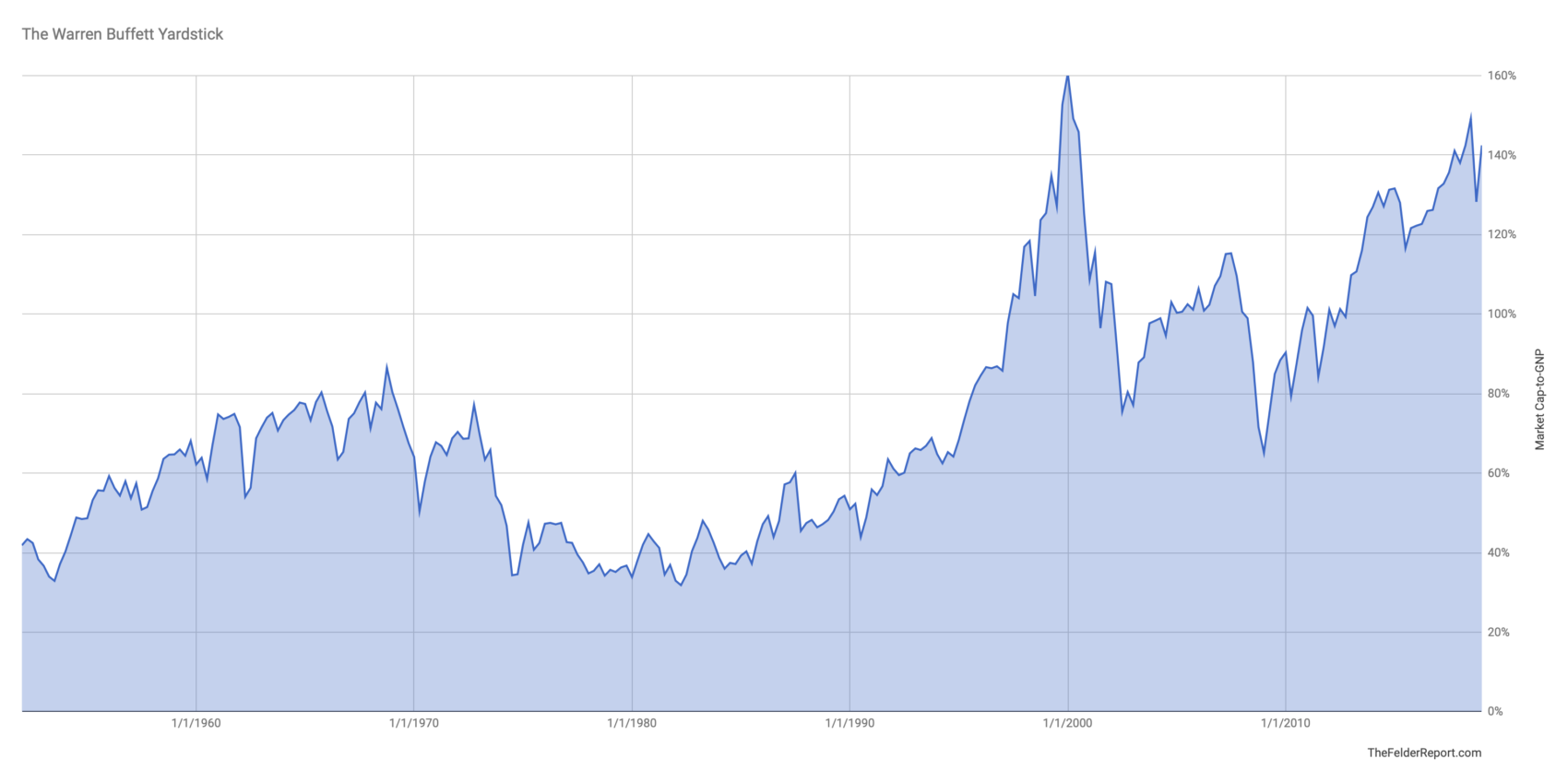

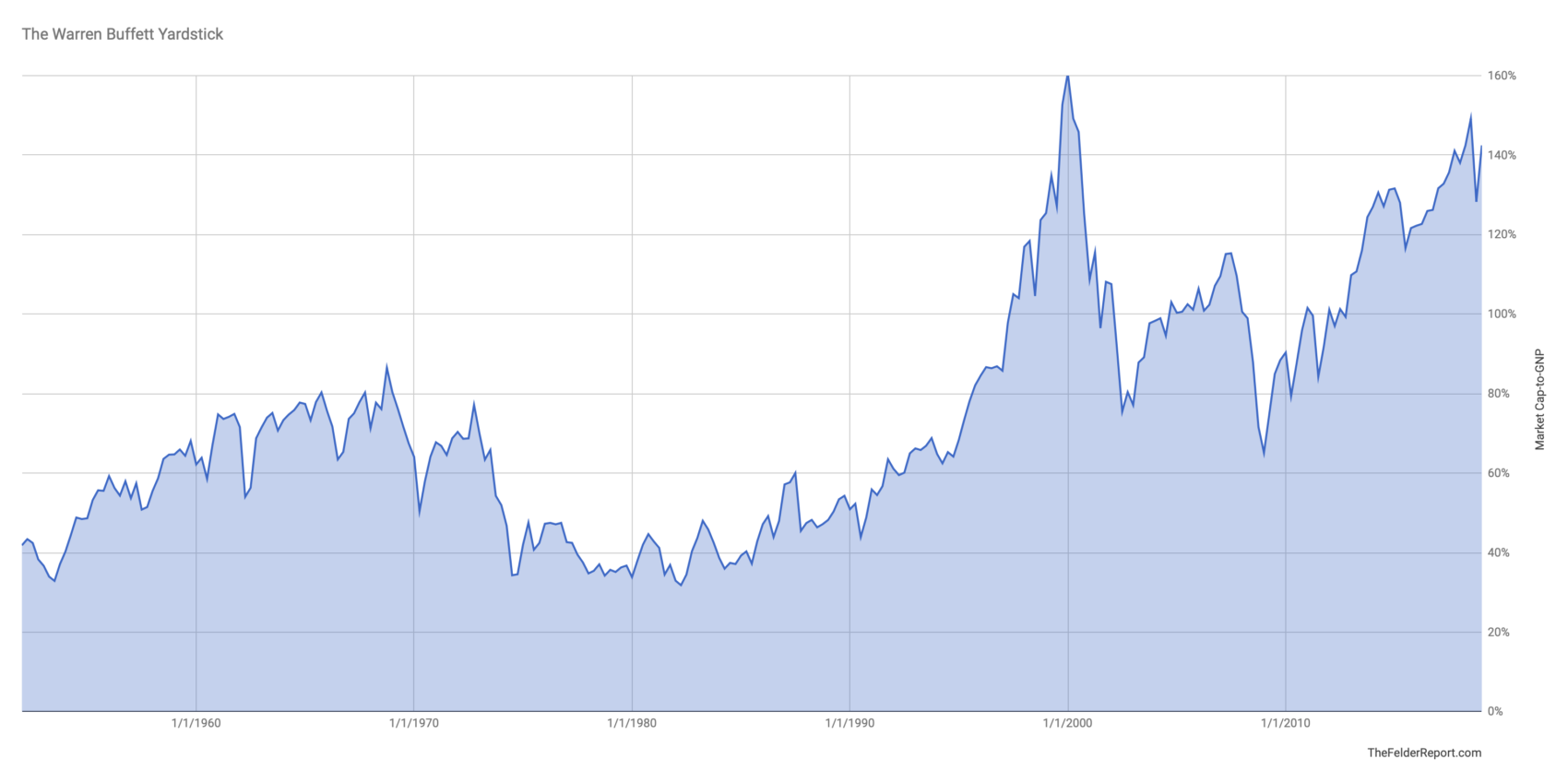

A leading BofA analyst recently published a report arguing that current high stock market valuations are not necessarily overvalued. Their central thesis rests on a combination of factors pointing to sustained long-term growth potential and the impact of low interest rates. The analyst contends that focusing solely on traditional valuation metrics like price-to-earnings (P/E) ratios presents an incomplete picture.

- Key Supporting Data: The report cited robust corporate earnings growth exceeding initial forecasts, particularly within the technology and consumer discretionary sectors. Specific P/E ratios were presented, comparing them to historical averages while considering future earnings projections.

- Methodology and Sources: The analysis incorporated a blend of quantitative modeling and qualitative assessments, drawing upon financial statements, industry reports, and economic forecasts.

- Specific Sectors Highlighted: The report specifically mentioned technology companies as key drivers of growth, highlighting their disruptive innovation and potential for market expansion. Similarly, the resilience of the consumer sector, despite economic uncertainties, was also cited as a supporting factor.

Factors Supporting High Stock Market Valuations: Beyond Simple Metrics

Beyond traditional valuation metrics, several significant factors contribute to justifying the current high stock market valuations. Simply looking at P/E ratios without considering these broader economic and market forces would provide an incomplete picture.

- Low Interest Rates: The persistently low interest rate environment globally has significantly reduced the cost of capital for businesses, allowing them to invest more aggressively in growth initiatives. This, in turn, fuels higher valuations.

- Strong Corporate Earnings Growth: Consistent and substantial earnings growth across various sectors supports the higher valuations. Future projections for earnings further bolster this argument.

- Technological Innovation: Rapid advancements in technology continue to drive productivity gains and create entirely new markets. This creates immense long-term growth potential for tech companies and related sectors.

- Government Stimulus: Government spending programs and initiatives, while debated, have undeniably stimulated economic activity and supported corporate growth in certain sectors.

Addressing Potential Risks and Counterarguments: A Balanced Perspective

While the BofA analyst presents a compelling case, it's crucial to acknowledge potential risks and counterarguments. A balanced perspective is essential for informed decision-making.

- Potential Risks: Inflationary pressures, geopolitical instability, and the potential for future interest rate hikes pose significant threats to sustained market growth and could impact high stock market valuations.

- Counterarguments: Some critics argue that current valuations are detached from underlying fundamentals and that a market correction is inevitable. They point to historically high P/E ratios compared to previous economic cycles.

- BofA Analyst's Response: The analyst likely addresses these concerns by acknowledging the inherent uncertainty in market forecasts but emphasizing the long-term growth potential and resilience of certain sectors, suggesting these outweigh the short-term risks.

Strategies for Investors in a High-Valuation Market: Navigating Uncertainty

Navigating a market with high stock market valuations requires a strategic approach. Investors should consider the following:

- Diversification: Spreading investments across different asset classes (stocks, bonds, real estate) and sectors reduces overall portfolio risk.

- Sector-Specific Opportunities: Based on the BofA analyst's insights, focusing on high-growth sectors like technology, while acknowledging their inherent volatility, might offer potential rewards.

- Long-Term Investment Horizon: A long-term perspective is crucial, allowing investors to weather short-term market fluctuations and benefit from long-term growth.

- Regular Portfolio Reviews: Regularly reviewing and adjusting your portfolio based on changing market conditions and your own risk tolerance is paramount.

Conclusion: Maintaining Investor Calm Despite High Stock Market Valuations

The BofA analyst's perspective offers a nuanced view of high stock market valuations, arguing that a combination of factors beyond simple metrics justify current market levels. While acknowledging potential risks, the analyst emphasizes the long-term growth prospects driven by technological innovation, strong corporate earnings, and the impact of low interest rates. Investors should not solely rely on traditional valuation metrics but should consider the broader economic context and potential future growth. Conduct your own thorough research, carefully weigh the factors discussed, and develop a well-informed investment strategy to navigate the current market environment confidently. Understanding the complexities of high stock market valuations is crucial for making sound investment decisions. For further information, refer to [link to BofA report, if available].

Featured Posts

-

Exploring Tom Cruises Romantic Past Marriages And Dating Speculation

May 17, 2025

Exploring Tom Cruises Romantic Past Marriages And Dating Speculation

May 17, 2025 -

Reebok X Angel Reese A Powerful Collaboration

May 17, 2025

Reebok X Angel Reese A Powerful Collaboration

May 17, 2025 -

Analyzing The Mariners And Tigers Injured Lists Ahead Of Their Series March 31 April 2

May 17, 2025

Analyzing The Mariners And Tigers Injured Lists Ahead Of Their Series March 31 April 2

May 17, 2025 -

Knicks Off Season Puzzle How To Handle Landry Shamet

May 17, 2025

Knicks Off Season Puzzle How To Handle Landry Shamet

May 17, 2025 -

Injury Report Giants Vs Mariners Series April 4th 6th

May 17, 2025

Injury Report Giants Vs Mariners Series April 4th 6th

May 17, 2025

Latest Posts

-

The Ultimate Guide To Refinancing Federal Student Loans

May 17, 2025

The Ultimate Guide To Refinancing Federal Student Loans

May 17, 2025 -

Federal Student Loan Refinancing Pros Cons And Considerations

May 17, 2025

Federal Student Loan Refinancing Pros Cons And Considerations

May 17, 2025 -

Homeownership With Student Loans Tips And Strategies

May 17, 2025

Homeownership With Student Loans Tips And Strategies

May 17, 2025 -

Is Refinancing Federal Student Loans Worth It

May 17, 2025

Is Refinancing Federal Student Loans Worth It

May 17, 2025 -

Navigating Home Buying With Existing Student Loan Payments

May 17, 2025

Navigating Home Buying With Existing Student Loan Payments

May 17, 2025