Interest Rate Hikes Vs. Cuts: Why The Fed Is Different

Table of Contents

The Fed's Mandate and its Impact on Interest Rate Decisions

The Federal Reserve operates under a dual mandate: maintaining price stability and maximizing employment. This differs from many other central banks that primarily focus on inflation control. This dual mandate significantly influences the Fed's approach to interest rate hikes vs. cuts.

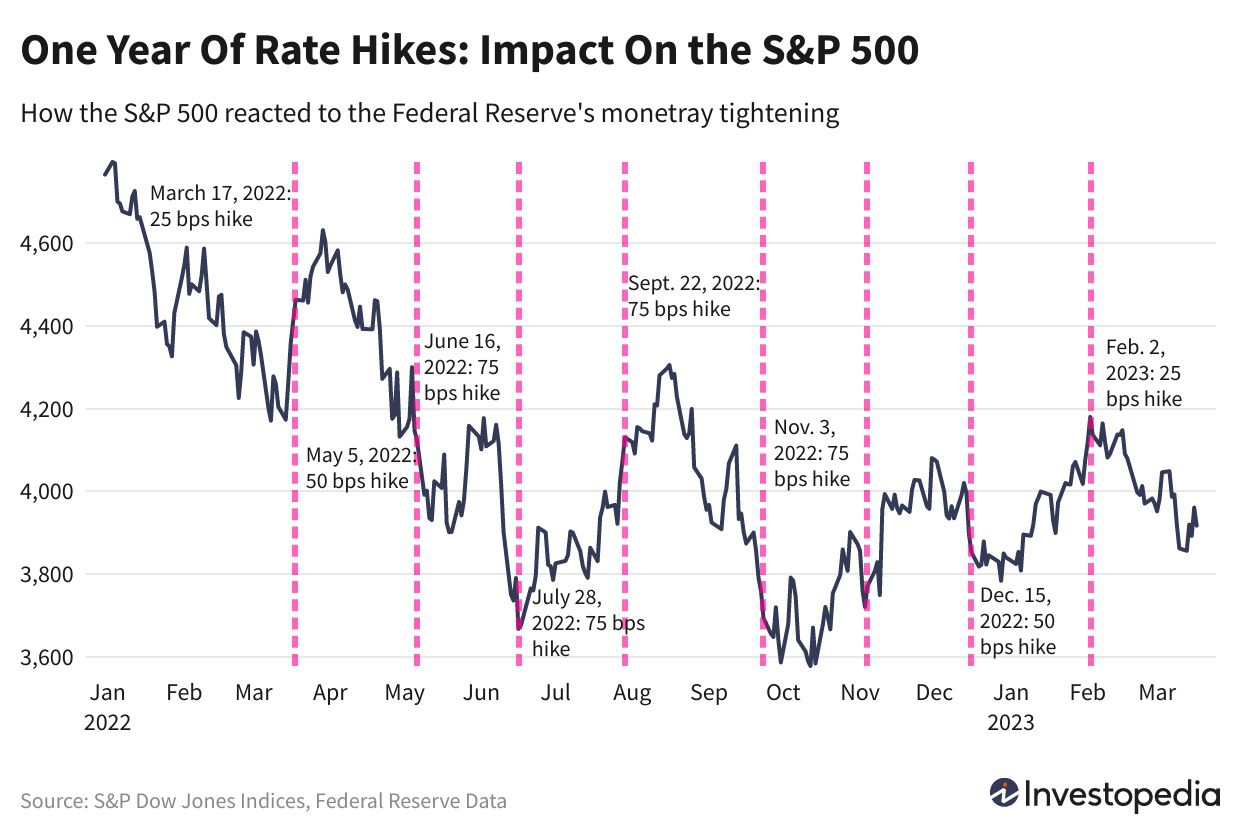

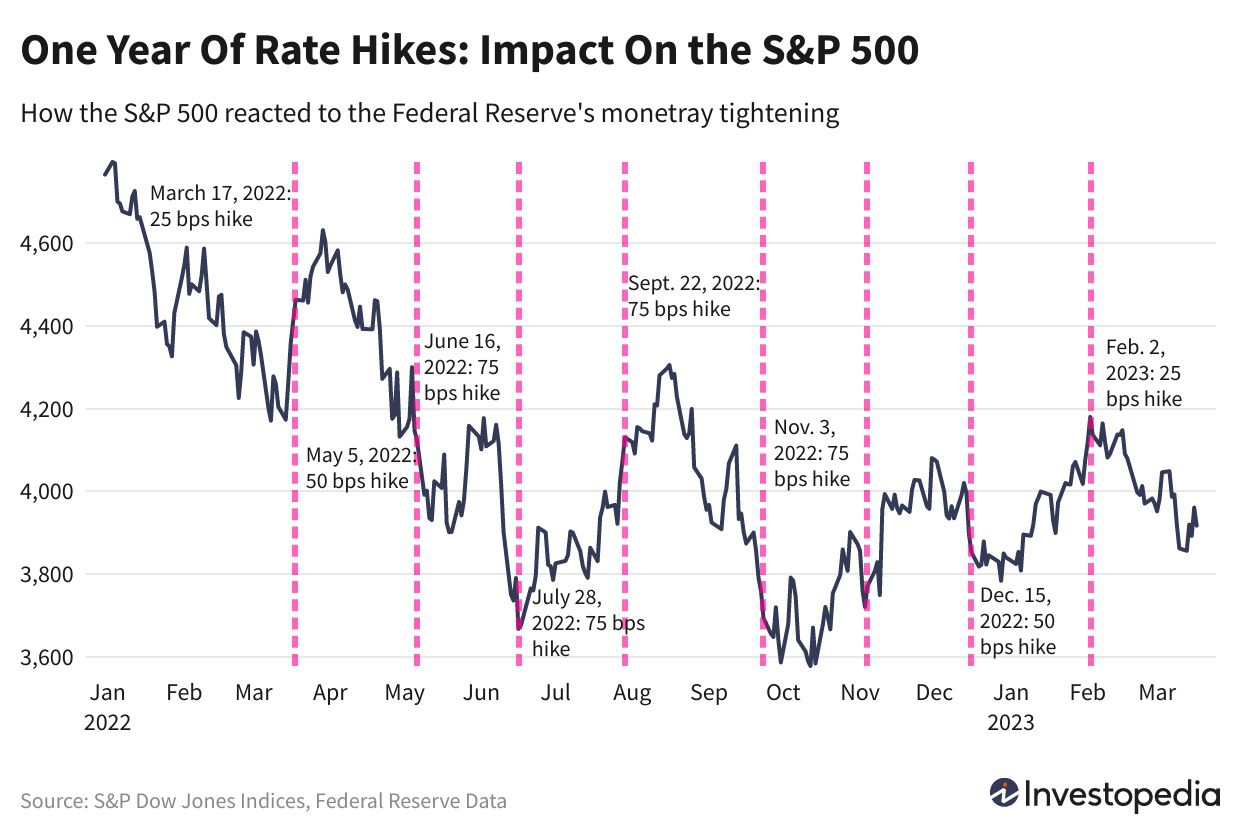

- Impact of Inflation on Interest Rate Hikes: High inflation prompts the Fed to raise interest rates. Higher rates make borrowing more expensive, cooling down economic activity and reducing demand-pull inflation. This is a classic example of contractionary monetary policy.

- Impact of Unemployment on Interest Rate Cuts: Conversely, high unemployment levels may lead the Fed to lower interest rates. Lower rates stimulate borrowing and investment, boosting economic activity and job creation. This is expansionary monetary policy.

- Balancing Act Between Inflation Control and Economic Growth: The Fed constantly walks a tightrope, balancing the need to control inflation without triggering a recession. This delicate balancing act is central to understanding its decisions regarding interest rate hikes and cuts, making the Fed's approach uniquely challenging. The optimal rate of inflation and the acceptable level of unemployment are constantly debated and reevaluated.

Tools and Mechanisms Used by the Fed

The Federal Open Market Committee (FOMC) is the key decision-making body for setting interest rates. The FOMC uses several tools to influence the money supply and achieve its objectives:

- Federal Funds Rate: This is the target rate that the Fed wants banks to charge each other for overnight loans. Changes to the federal funds rate directly impact other interest rates throughout the economy, influencing borrowing costs for consumers and businesses.

- Quantitative Easing (QE): During economic crises, the Fed may employ QE, injecting liquidity into the market by purchasing government securities and other assets. This increases the money supply and lowers long-term interest rates, stimulating economic activity.

- Quantitative Tightening (QT): The opposite of QE, QT involves the Fed reducing its balance sheet by selling assets. This reduces the money supply and can help curb inflation. QT is a powerful tool for managing inflation, but it carries risks as well.

Comparing the Fed to Other Central Banks

The Fed's approach to interest rate hikes vs. cuts differs significantly from other major central banks. For instance:

- Differences in Inflation Targets: The European Central Bank (ECB), Bank of Japan (BOJ), and Bank of England (BoE) may have different inflation targets than the Fed, influencing their responses to inflationary pressures.

- Variations in Monetary Policy Frameworks: Each central bank employs a unique monetary policy framework tailored to its specific economic circumstances and institutional structure. Some may prioritize exchange rate stability more heavily than others.

- Impact of Global Economic Events: Global economic shocks, such as oil price fluctuations or international trade disputes, affect each central bank differently based on the degree of their country's integration into the global economy.

Predicting Future Interest Rate Movements

Predicting the Fed's future moves is a complex undertaking. Numerous factors influence its decisions:

- Key Economic Indicators to Watch: Inflation data (CPI, PCE), employment reports (nonfarm payrolls, unemployment rate), and GDP growth are crucial indicators the Fed considers.

- Analyzing the Fed's Statements and Press Releases: Careful analysis of FOMC statements and press conferences provides crucial insights into the Fed's thinking and potential future actions.

- Understanding Market Sentiment and its Impact: Market expectations and investor sentiment play a significant role in shaping interest rate movements.

Conclusion

The Federal Reserve's approach to interest rate hikes and cuts is uniquely shaped by its dual mandate and its toolkit, making it distinct from other global central banks. Understanding the nuances of its decision-making process, including its response to inflation and unemployment, is critical for navigating the complexities of the US and global economies. To stay informed about the Fed's actions and their impact, subscribe to updates from the Federal Reserve website (federalreserve.gov), follow reputable financial news sources, and continue researching Interest Rate Hikes vs. Cuts. The Fed's actions profoundly impact investment strategies and the overall economic well-being of individuals and businesses; thus, remaining informed is essential.

Featured Posts

-

Canola Trade Diversification Chinas Response To Canada Tensions

May 09, 2025

Canola Trade Diversification Chinas Response To Canada Tensions

May 09, 2025 -

Market Update Sensex Nifty Rally Adani Ports Eternal Top Movers

May 09, 2025

Market Update Sensex Nifty Rally Adani Ports Eternal Top Movers

May 09, 2025 -

Dakota Johnsons Role Choices The Chris Martin Factor

May 09, 2025

Dakota Johnsons Role Choices The Chris Martin Factor

May 09, 2025 -

High Potential Theory Could David Uncover Morgans Biggest Flaw

May 09, 2025

High Potential Theory Could David Uncover Morgans Biggest Flaw

May 09, 2025 -

The Fed And Interest Rates A Cautious Path Forward

May 09, 2025

The Fed And Interest Rates A Cautious Path Forward

May 09, 2025