Investor Briefing: QNB Corp At The Virtual Banking Conference (March 6th)

Table of Contents

QNB Corp's Financial Performance in Q4 2023 and Full Year 2023

The QNB Corp investor briefing highlighted impressive financial results for both Q4 2023 and the full year. The presentation detailed robust revenue growth and strong profitability, exceeding expectations in several key areas. This positive QNB Corp Financial Results demonstrate the bank's resilience and effective strategic execution.

-

Key Revenue Streams and Growth: Significant growth was reported across key revenue streams, including retail banking, corporate banking, and investment banking. Retail banking saw a particularly strong performance, driven by increased customer acquisition and engagement. Specific growth percentages were presented during the briefing, showcasing a healthy upward trend.

-

Operating Expenses and Profitability: While operating expenses saw a moderate increase, reflecting investments in technology and expansion, QNB Corp maintained strong profit margins. The briefing emphasized the efficiency of cost management strategies implemented to offset these increases, resulting in strong net income.

-

Net Income and Return on Equity (ROE): QNB Corp reported a substantial increase in net income compared to the previous year and quarter (YoY and QoQ). This, combined with a healthy ROE, indicates a strong financial position and efficient capital allocation.

Strategic Initiatives and Technological Advancements

QNB Corp's commitment to digital transformation and Fintech integration was a central theme of the investor briefing. The bank showcased its proactive approach to leveraging innovative technologies to enhance its offerings and improve operational efficiency. The QNB Technology strategy is clearly focused on delivering a superior customer experience while bolstering long-term growth.

-

AI and Blockchain Implementation: Specific examples of AI and blockchain implementation were discussed, highlighting how these technologies are being utilized to improve fraud detection, enhance customer service, and streamline internal processes. This demonstrates QNB Corp's dedication to staying at the forefront of Banking Technology.

-

Impact on Efficiency and Customer Experience: The briefing detailed how these technological advancements have resulted in increased efficiency in various operational areas and a noticeably improved customer experience, leading to higher customer satisfaction and loyalty.

-

Fintech Partnerships and Collaborations: QNB Corp also highlighted new partnerships and collaborations with leading Fintech companies, showcasing a commitment to strategic alliances to accelerate innovation and expansion into new markets. These collaborations are expected to enhance QNB Corp's Digital Banking Strategy.

Growth Opportunities and Future Outlook

The investor briefing painted an optimistic picture of QNB Corp's future, outlining several promising growth opportunities and strategic initiatives. The bank's Growth Strategy is underpinned by a commitment to expansion, innovation, and delivering exceptional value to its stakeholders. This presents compelling Investment Opportunities.

-

Projected Growth Rates: QNB Corp shared projected growth rates for key business segments, indicating a confident outlook for continued expansion and market share gains.

-

Market Expansion and Geographic Expansion: The briefing outlined plans for expansion into new markets and geographic regions, highlighting a strategic approach to diversification and growth.

-

New Product Launches and Strategic Partnerships: The company indicated plans for new product launches and strategic partnerships aimed at further strengthening its market position and capitalizing on emerging opportunities within the digital banking landscape.

Addressing Investor Questions and Concerns

The Q&A session provided a platform for investors to address their concerns and seek clarification on various aspects of QNB Corp's performance and future outlook. This open dialogue further reinforced QNB Investor Relations' transparency and commitment to shareholder value.

-

Key Investor Questions: Investors raised questions regarding the impact of global economic uncertainties, competitive pressures, and the long-term sustainability of QNB Corp's growth strategy.

-

QNB's Management Responses: Management addressed these concerns comprehensively, providing detailed explanations and outlining mitigation strategies to address potential risks. This demonstrated the bank's preparedness and proactive approach to challenges.

Conclusion

The QNB Corp investor briefing at the Virtual Banking Conference on March 6th provided valuable insights into the company's robust financial performance, strategic technological advancements, and promising future growth prospects. The briefing highlighted QNB Corp's strong financial position, its commitment to digital transformation, and its ambitious plans for expansion and market leadership. To stay informed about QNB Corp's future developments and explore potential Investment Opportunities following this insightful QNB Corp Investor Briefing, visit [link to investor relations website].

Featured Posts

-

The Ripple Effect How Federal Funding Cuts Impact Trump Supporting Communities

Apr 30, 2025

The Ripple Effect How Federal Funding Cuts Impact Trump Supporting Communities

Apr 30, 2025 -

Istoriya Vorombe Krupneyshie Ptitsy V Istorii I Prichiny Ikh Ischeznoveniya

Apr 30, 2025

Istoriya Vorombe Krupneyshie Ptitsy V Istorii I Prichiny Ikh Ischeznoveniya

Apr 30, 2025 -

Process Safety Revolution New Patent Integrates Ai For Hazard Reduction

Apr 30, 2025

Process Safety Revolution New Patent Integrates Ai For Hazard Reduction

Apr 30, 2025 -

Rozkrittya Tayemnitsi Prichini Vidsutnosti Trampa Poruch Iz Zelenskim Pid Chas Zustrichi

Apr 30, 2025

Rozkrittya Tayemnitsi Prichini Vidsutnosti Trampa Poruch Iz Zelenskim Pid Chas Zustrichi

Apr 30, 2025 -

Trumps 51st State Remarks A Trolling Of Canada

Apr 30, 2025

Trumps 51st State Remarks A Trolling Of Canada

Apr 30, 2025

Latest Posts

-

Delayed Launch Blue Origin Identifies Vehicle Subsystem Problem

Apr 30, 2025

Delayed Launch Blue Origin Identifies Vehicle Subsystem Problem

Apr 30, 2025 -

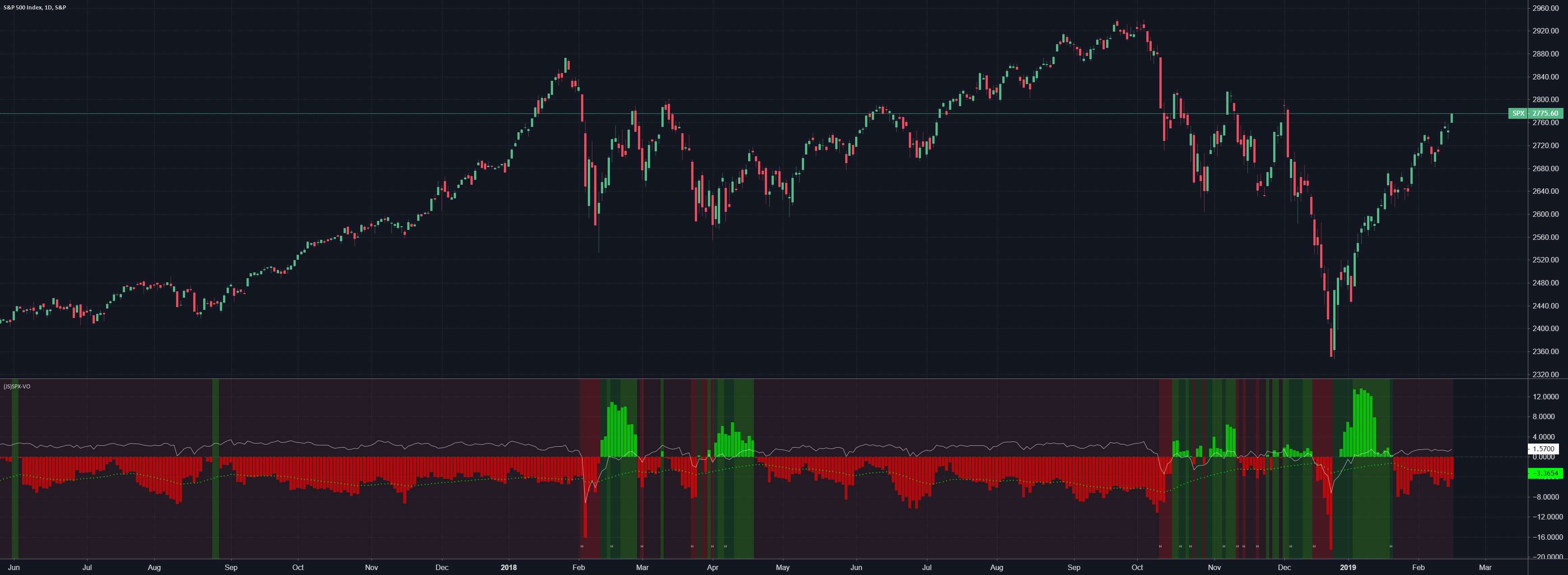

S And P 500 Risk Management Protecting Your Investments During Market Uncertainty

Apr 30, 2025

S And P 500 Risk Management Protecting Your Investments During Market Uncertainty

Apr 30, 2025 -

Selling Sunset Star Accuses Landlords Of Price Gouging Amid La Fires

Apr 30, 2025

Selling Sunset Star Accuses Landlords Of Price Gouging Amid La Fires

Apr 30, 2025 -

Blue Origins Rocket Launch Abruptly Halted By Subsystem Malfunction

Apr 30, 2025

Blue Origins Rocket Launch Abruptly Halted By Subsystem Malfunction

Apr 30, 2025 -

Capital Preservation Strategies For Navigating S And P 500 Volatility

Apr 30, 2025

Capital Preservation Strategies For Navigating S And P 500 Volatility

Apr 30, 2025