Investor Concerns About Stock Market Valuations: BofA's Response

Table of Contents

BofA's Assessment of Current Stock Market Valuations

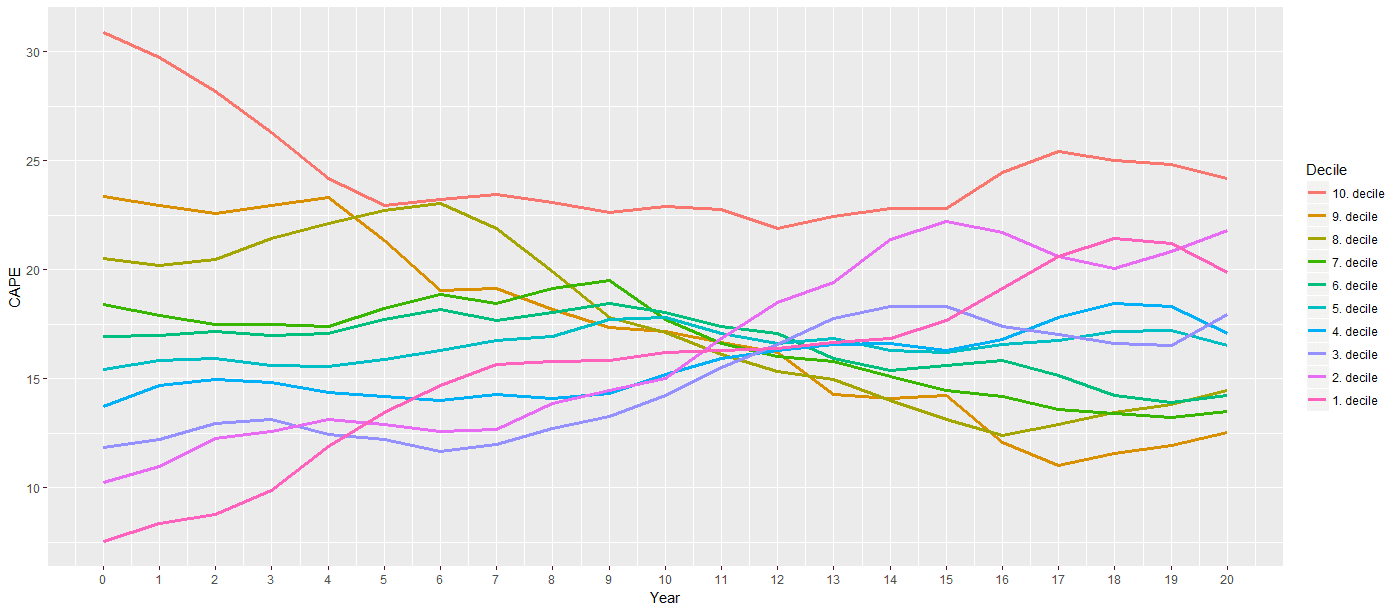

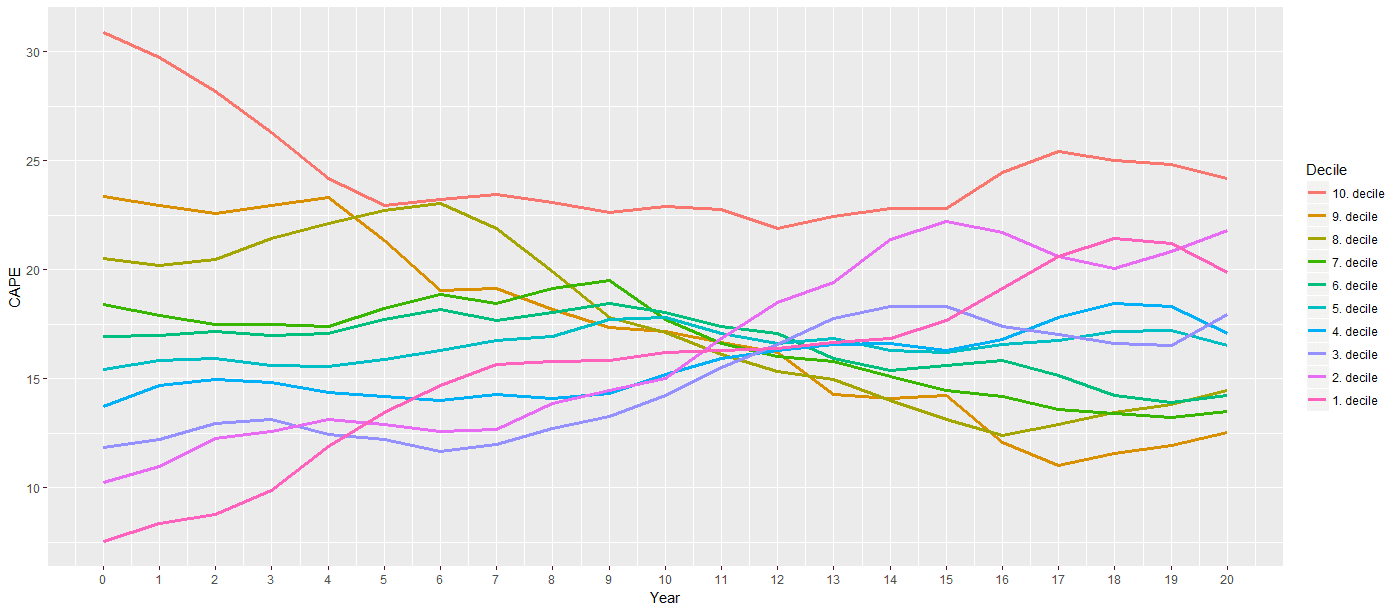

BofA's recent report delves into the current state of stock market valuations, employing various metrics to gauge market health. Their analysis focuses on key valuation metrics, comparing them to historical averages and identifying potential overvalued and undervalued sectors.

- Key Valuation Metrics: BofA likely employs several methods, including the Price-to-Earnings ratio (P/E ratio), which compares a company's stock price to its earnings per share; market capitalization, representing the total market value of a company's outstanding shares; and Discounted Cash Flow (DCF) analysis, a more complex method that projects future cash flows to determine present value. They may also utilize relative valuation, comparing the company's valuation to similar companies in the same industry.

- Comparison to Historical Valuations: A core aspect of BofA's analysis is likely a comparison of current valuation metrics to historical averages. This helps determine whether current valuations are significantly higher or lower than what's considered normal, providing context for the current market environment. High P/E ratios compared to historical averages, for example, could signal potential overvaluation.

- Specific Sectors and Indices: BofA's report probably highlights specific sectors or indices showing signs of overvaluation or undervaluation. For instance, the technology sector, often subject to significant volatility, may be a focal point of their analysis. They might also comment on the performance of major market indices like the S&P 500 or Nasdaq Composite.

- Potential Biases: It’s important to acknowledge that any analysis, including BofA's, may have inherent biases. These could stem from the data used, the methodologies employed, or even the firm’s own investment positions. A critical review of the methodology used in the report is therefore essential before drawing conclusions.

Identifying Key Drivers of Investor Anxiety

Investor apprehension regarding stock market valuations stems from several significant factors. BofA's analysis likely addresses these key drivers and their potential impact:

- Inflation: Persistent inflation erodes purchasing power and increases the cost of borrowing, impacting corporate profitability and potentially dampening investor sentiment. BofA's outlook on inflation's trajectory and its implications for stock valuations is crucial.

- Interest Rates: Interest rate hikes by central banks, aimed at controlling inflation, increase borrowing costs for businesses and consumers, potentially slowing economic growth and impacting stock prices. BofA's assessment of future interest rate movements and their effects on market valuations is key.

- Recession Risk: Concerns about a potential recession are prevalent. A recession would likely lead to decreased corporate earnings and lower stock prices. BofA's probability assessment of a recession and its potential severity is a critical element of their analysis.

- Geopolitical Uncertainty: Global geopolitical events, such as wars or trade disputes, introduce significant uncertainty into the market, affecting investor confidence and potentially leading to market volatility. BofA's analysis of the geopolitical landscape and its impact on markets is important to consider.

- Earnings Growth: Slower-than-expected earnings growth can negatively impact stock valuations. BofA's forecast for future earnings growth is a major factor influencing their market outlook.

- Supply Chain Disruptions: Ongoing disruptions to global supply chains contribute to inflationary pressures and can impact corporate profitability. BofA’s assessment of supply chain recovery and its effect on the market is also a key consideration.

BofA's Recommendations for Investors

Based on their analysis of stock market valuations and the identified risk factors, BofA likely provides strategic recommendations for investors:

- Portfolio Diversification: BofA will probably advocate for diversifying investment portfolios across different asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate risk.

- Risk Management: They may suggest employing risk management strategies, such as hedging or stop-loss orders, to protect against potential market downturns.

- Investment Strategy: The recommendations likely include a suggested investment strategy, considering an investor's risk tolerance and time horizon. This may entail adjusting asset allocation based on current market conditions.

- Long-Term Investment: BofA likely encourages a long-term investment approach, emphasizing the importance of staying invested despite short-term market volatility.

- Sector Focus: Their recommendations might suggest focusing on specific sectors deemed less vulnerable to the identified risks or exhibiting strong growth potential. This may involve shifting from growth stocks to more defensive stocks during uncertain times.

Addressing Specific Investor Concerns

BofA's report may address specific investor concerns, such as anxieties about particular sectors or the impact of specific geopolitical events on portfolio performance. These detailed responses provide valuable insights into the specific risks and opportunities in the current market.

Conclusion

BofA's analysis provides valuable insights into current stock market valuations, highlighting the key factors driving investor concerns. Their recommendations, emphasizing diversification, risk management, and a long-term perspective, offer a measured approach to navigating the current market environment. To develop a well-informed investment strategy and stay informed on stock market valuations, it is crucial to understand investor concerns and the nuances of risk assessment. For a comprehensive understanding of BofA's findings and recommendations, we encourage you to delve into their full report (link to report if available). Learn more about BofA's market outlook and manage your investment portfolio effectively by staying abreast of these crucial developments.

Featured Posts

-

Elite Universities Form Secret Coalition To Oppose Trump Administration

Apr 29, 2025

Elite Universities Form Secret Coalition To Oppose Trump Administration

Apr 29, 2025 -

Republican Revolt Will Trumps Tax Plan Face Defeat

Apr 29, 2025

Republican Revolt Will Trumps Tax Plan Face Defeat

Apr 29, 2025 -

Trumps Transgender Athlete Ban Us Attorney General Issues Warning To Minnesota

Apr 29, 2025

Trumps Transgender Athlete Ban Us Attorney General Issues Warning To Minnesota

Apr 29, 2025 -

Texas Woman Killed In Wrong Way Crash Near Minnesota North Dakota Border

Apr 29, 2025

Texas Woman Killed In Wrong Way Crash Near Minnesota North Dakota Border

Apr 29, 2025 -

Unveiling The Ccp United Fronts Activities In Minnesota

Apr 29, 2025

Unveiling The Ccp United Fronts Activities In Minnesota

Apr 29, 2025

Latest Posts

-

Teens Rock Throwing Spree Ends In Murder Conviction

Apr 29, 2025

Teens Rock Throwing Spree Ends In Murder Conviction

Apr 29, 2025 -

The Impact Of Zombie Office Buildings On Chicagos Real Estate Market

Apr 29, 2025

The Impact Of Zombie Office Buildings On Chicagos Real Estate Market

Apr 29, 2025 -

Key Republican Groups Threaten To Block Trumps Tax Bill

Apr 29, 2025

Key Republican Groups Threaten To Block Trumps Tax Bill

Apr 29, 2025 -

Zombie Buildings In Chicago Understanding The Office Real Estate Collapse

Apr 29, 2025

Zombie Buildings In Chicago Understanding The Office Real Estate Collapse

Apr 29, 2025 -

Can Trumps Tax Cuts Survive Internal Republican Opposition

Apr 29, 2025

Can Trumps Tax Cuts Survive Internal Republican Opposition

Apr 29, 2025