Republican Revolt: Will Trump's Tax Plan Face Defeat?

Table of Contents

Internal Republican Divisions over Tax Cuts

The Republican party is far from a monolith, and Trump's tax plan has exposed deep fissures within its ranks. The proposed cuts, while broadly aimed at stimulating the economy, have faced significant pushback from various factions.

-

Conservative Concerns about the National Debt: Many fiscal conservatives express deep concern about the plan's potential to dramatically increase the national debt. They argue that the long-term consequences of unsustainable deficits outweigh any short-term economic benefits. Senator [Insert Senator's Name], for example, has publicly voiced these concerns, emphasizing the need for fiscal responsibility.

-

Moderate Republicans Pushing for More Targeted Tax Relief: Moderate Republicans advocate for a more targeted approach to tax cuts, focusing on benefits for middle-class families rather than broad-based reductions that disproportionately favor the wealthy. They argue that the current plan exacerbates income inequality and fails to address the needs of working families.

-

Libertarian Republicans Opposing Certain Aspects of the Plan: Libertarian-leaning Republicans oppose certain aspects of the plan, such as the continued existence of certain tax loopholes or the lack of significant tax simplification. They believe the plan doesn't go far enough in reducing the size and scope of government.

-

Specific Republican Representatives and Statements: The debate has involved vocal opposition from prominent figures like Representative [Insert Representative's Name], who has openly criticized the plan's lack of transparency and potential negative impact on specific sectors of the economy.

Economic Impacts and Projected Deficits

The economic consequences of Trump's tax plan are a central point of contention. Independent analyses offer varying projections, but the potential for increased national debt is a major concern.

-

Projected Increases in the National Debt: The Congressional Budget Office (CBO) and other independent analysts have projected significant increases in the national debt under the proposed plan. These projections vary depending on economic growth assumptions, but the potential for long-term fiscal instability is undeniable. This contributes significantly to the anxieties felt by fiscally conservative Republicans.

-

Potential Impact on Different Income Brackets: The plan's impact on different income brackets is another point of debate. While proponents argue it will benefit all taxpayers, critics contend that the wealthiest Americans will receive the largest tax cuts, further exacerbating income inequality. This fuels the concerns of moderate Republicans who prioritize fairer distribution of wealth.

-

Independent Economic Analyses: Numerous independent economic analyses have been published, offering varied perspectives on the plan's potential economic impact. Some support the administration's claims of increased economic growth, while others predict slower growth and increased deficits. These differing analyses contribute to the uncertainty surrounding the plan's overall effectiveness.

Public Opinion and Political Fallout

Public opinion plays a critical role in the success or failure of any major legislative initiative. The Trump tax plan is no exception, facing significant public scrutiny.

-

Polling Data Reflecting Public Support or Opposition: Public opinion polls show a divided public, with varying levels of support and opposition depending on the pollster and methodology. However, consistent themes emerge: concern over the national debt and the potential for increased inequality.

-

Potential Electoral Consequences for Republicans in Upcoming Elections: The political fallout from the tax plan could significantly impact Republican prospects in upcoming elections. Negative public perception could hurt candidates in key races, especially those in swing districts.

-

Impact of the Debate on Public Trust in the Government: The intense debate surrounding the tax plan further erodes public trust in government. The perception of partisan gridlock and political maneuvering contributes to widespread cynicism.

The Role of Lobbying and Special Interests

The influence of lobbying groups and special interests is a significant factor in the ongoing debate. Their financial contributions and strategic advocacy efforts shape the legislative process and public perception.

-

Key Lobbying Groups Involved and Their Positions: Powerful lobbying groups representing various industries are actively involved, each pushing for outcomes beneficial to their members. This includes business groups advocating for tax cuts and labor unions concerned about the impact on workers.

-

Financial Contributions Influencing the Debate: Significant financial contributions flow into political campaigns and lobbying efforts, influencing the debate and shaping the narrative around the proposed tax plan. Transparency concerns surrounding these contributions further fuel public distrust.

-

Potential Impact of These Influences on the Final Outcome: The influence of lobbying and special interests raises ethical questions about fairness and impartiality in the legislative process. Their powerful role makes the outcome of the debate even more uncertain.

Conclusion

This article has explored the various factors contributing to the potential defeat of Trump's tax plan, from internal Republican divisions and economic concerns to public opinion and the influence of lobbyists. The future of this legislation remains uncertain, and the ongoing debate will likely shape the political landscape for years to come. The potential for a Republican revolt and the resulting impact on tax reform are significant factors to watch. Stay informed about the unfolding developments regarding the Trump tax plan and its potential impact on the nation's economy and political future. Follow our updates on the Republican revolt and the continuing fight over tax reform.

Featured Posts

-

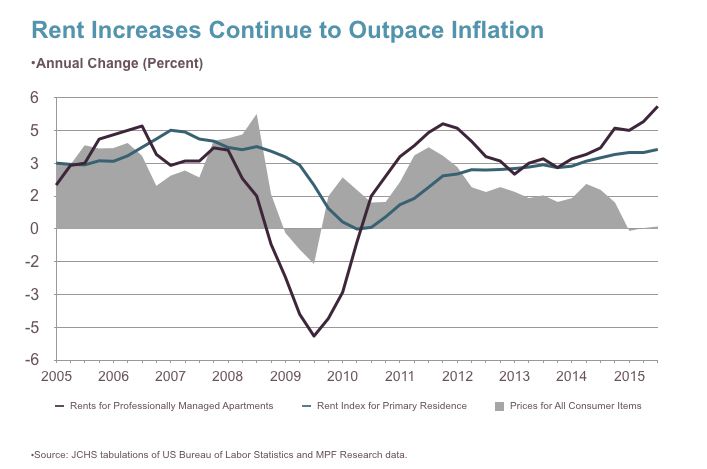

Increased Rental Costs Following La Fires Spark Outrage A Selling Sunset Perspective

Apr 29, 2025

Increased Rental Costs Following La Fires Spark Outrage A Selling Sunset Perspective

Apr 29, 2025 -

Develop Voice Assistants Effortlessly With Open Ais New Tools

Apr 29, 2025

Develop Voice Assistants Effortlessly With Open Ais New Tools

Apr 29, 2025 -

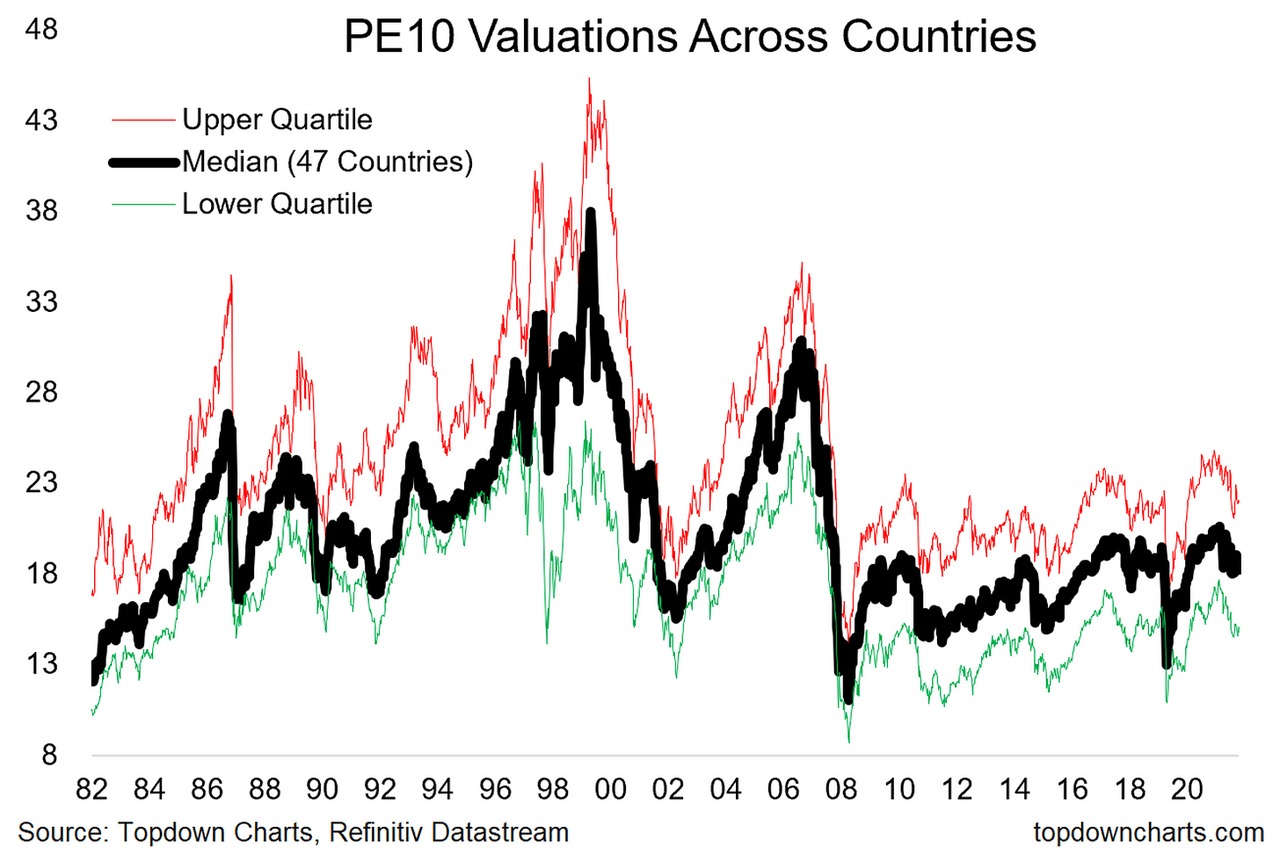

Addressing High Stock Market Valuations Bof As View For Investors

Apr 29, 2025

Addressing High Stock Market Valuations Bof As View For Investors

Apr 29, 2025 -

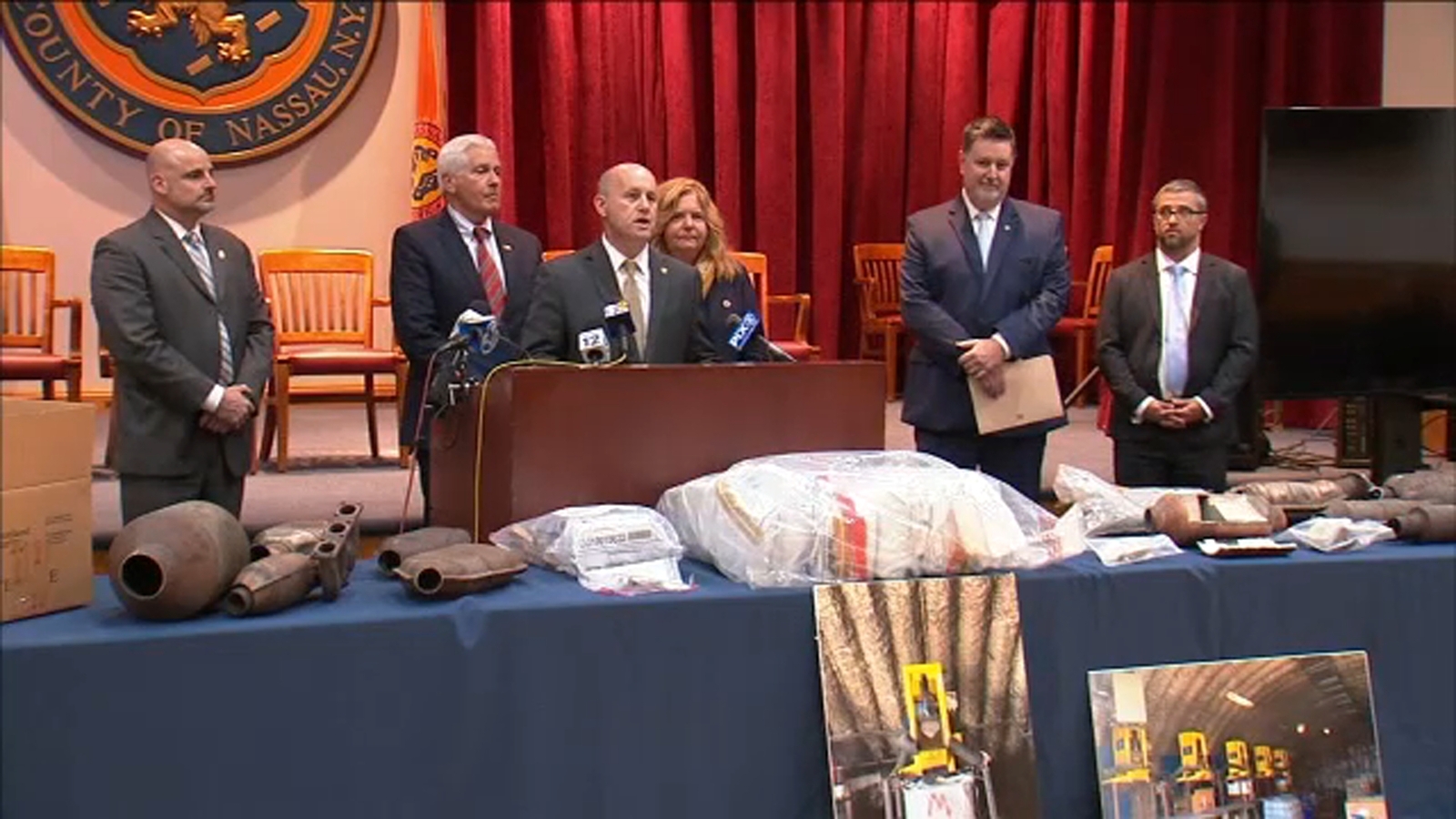

Criminal Charges Lab Owner Convicted Of Fraudulent Covid Testing

Apr 29, 2025

Criminal Charges Lab Owner Convicted Of Fraudulent Covid Testing

Apr 29, 2025 -

Minnesota Faces Pressure Attorney Generals Transgender Athlete Ban Warning

Apr 29, 2025

Minnesota Faces Pressure Attorney Generals Transgender Athlete Ban Warning

Apr 29, 2025

Latest Posts

-

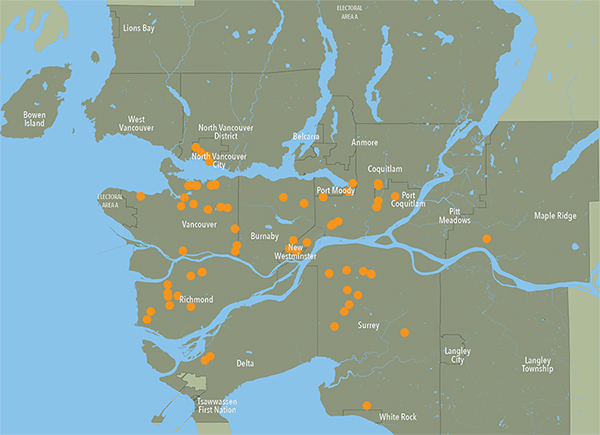

Rent Increases Ease But Housing Costs Persist In Metro Vancouver

Apr 29, 2025

Rent Increases Ease But Housing Costs Persist In Metro Vancouver

Apr 29, 2025 -

Metro Vancouver Housing Rent Increase Slowdown But Costs Still Climbing

Apr 29, 2025

Metro Vancouver Housing Rent Increase Slowdown But Costs Still Climbing

Apr 29, 2025 -

Cybercriminal Accused Of Millions In Office365 Executive Account Hacks

Apr 29, 2025

Cybercriminal Accused Of Millions In Office365 Executive Account Hacks

Apr 29, 2025 -

Office365 Executive Inboxes Targeted Millions Stolen Authorities Say

Apr 29, 2025

Office365 Executive Inboxes Targeted Millions Stolen Authorities Say

Apr 29, 2025 -

Navigating The Difficulties Of All American Production

Apr 29, 2025

Navigating The Difficulties Of All American Production

Apr 29, 2025