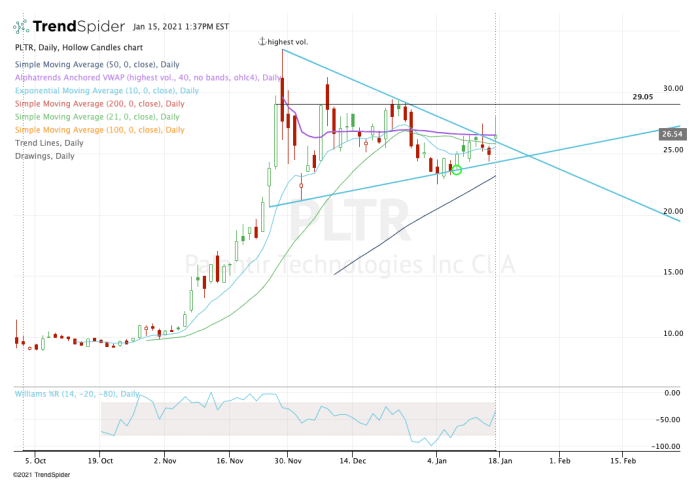

Is Palantir Stock A Buy Before May 5th? Wall Street's Unanimous Opinion

Table of Contents

Palantir's Recent Performance and Financial Health

Palantir Technologies (PLTR) has experienced a period of mixed performance, making the decision to buy before May 5th complex. Examining its recent financial health is crucial for any potential investor.

Revenue Growth and Profitability

Palantir's recent earnings reports paint a picture of growth, though profitability remains a focus area. Let's examine some key metrics:

- Q4 2022 Revenue: [Insert actual Q4 2022 revenue figure]. This represents [percentage] growth compared to Q4 2021. This figure indicates [positive or negative interpretation of the growth].

- Full-Year 2022 Revenue: [Insert actual full-year 2022 revenue figure]. This shows [percentage] growth year-over-year.

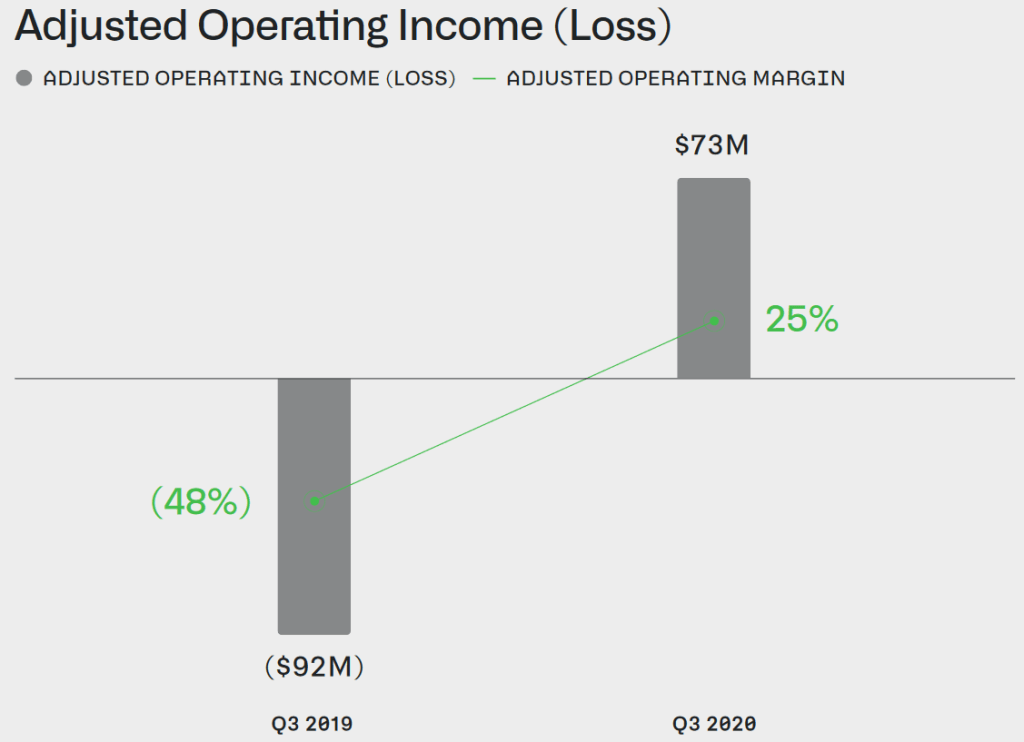

- Operating Income: [Insert actual operating income figure]. While still operating at a loss, the trend shows [improving or worsening] profitability compared to previous years.

- Free Cash Flow: [Insert actual free cash flow figure]. This key metric indicates Palantir's ability to generate cash from operations, showing [positive or negative interpretation of the figure] compared to previous quarters. Positive free cash flow is a strong sign for a company's financial health.

These Palantir earnings and Palantir revenue growth figures, combined with its Palantir profitability and Palantir free cash flow, offer a complex picture that needs further scrutiny.

Government Contracts and Commercial Partnerships

Palantir's revenue stream is built upon a two-pronged approach: government contracts and commercial partnerships. Both are vital for its continued growth and success.

- Government Contracts: Palantir continues to secure significant contracts with various government agencies, demonstrating the value of its Palantir data analytics solutions in national security and intelligence. [Mention any recent significant contract wins or losses, and their impact].

- Commercial Partnerships: The company is actively expanding its commercial partnerships, aiming to leverage its technology in various sectors. [Mention key partnerships and their potential impact on future Palantir revenue growth]. Successful commercial partnerships are crucial for diversification and reducing reliance on government contracts. The success of these Palantir commercial partnerships is vital for long-term growth.

Analyzing the balance between Palantir government contracts and its commercial endeavors gives a more complete view of the company's stability and future prospects.

Key Metrics & Valuation

Understanding Palantir's valuation is essential for determining whether its current Palantir stock price is justified. Key metrics to consider include:

- P/E Ratio: [Insert current P/E ratio]. Compared to industry competitors, this signifies [high, low, or average] valuation.

- Price-to-Sales Ratio: [Insert current Price-to-Sales ratio]. This metric offers [interpretation of the ratio], reflecting market expectations for future growth.

- Debt-to-Equity Ratio: [Insert current Debt-to-Equity ratio]. This ratio shows the company's financial leverage and risk profile.

A comprehensive Palantir stock analysis necessitates a thorough understanding of these Palantir valuation metrics in relation to its competitors.

Wall Street's Consensus and Analyst Ratings

Wall Street's overall sentiment towards Palantir plays a significant role in its stock price. Analyzing analyst ratings and price targets is crucial.

Analyst Ratings and Price Targets

The consensus among analysts regarding Palantir stock rating appears to be [summarize the overall consensus: bullish, bearish, or neutral].

- Buy Ratings: [Number of Buy ratings].

- Hold Ratings: [Number of Hold ratings].

- Sell Ratings: [Number of Sell ratings].

- Average Price Target: [Insert average price target]. This implies [interpretation of the average price target relative to the current stock price]. The rationale behind these Palantir analyst price targets often cites [mention key factors driving the price target].

This Wall Street Palantir forecast, while indicative, shouldn't be the sole basis for investment decisions.

Factors Influencing Analyst Opinions

Several factors contribute to the current analyst consensus. These include:

- Growth Prospects: Analysts assess Palantir's potential for future Palantir revenue growth based on its current contracts, partnerships, and market opportunities.

- Market Conditions: Broader market trends and economic uncertainties significantly impact the Palantir stock outlook.

- Competitive Landscape: The intense competition in the data analytics sector influences analyst predictions. [Mention key competitors and their impact].

Understanding these factors contributing to the Palantir market analysis provides a broader perspective on the analyst opinions.

Risks and Potential Downsides

Despite positive aspects, investing in Palantir involves risks.

Market Volatility and Economic Uncertainty

- Inflation: High inflation rates can impact consumer spending and corporate investment, potentially affecting Palantir stock price.

- Recession: A potential recession could reduce demand for Palantir's services, impacting revenue growth and Palantir stock risk.

- Geopolitical Instability: Global political uncertainties can influence investor sentiment and market volatility.

These macroeconomic factors represent significant economic uncertainty impacting Palantir stock performance.

Competition and Technological Disruption

The data analytics sector is highly competitive.

- Key Competitors: [List key competitors and their strengths]. The competitive landscape poses a substantial threat to Palantir's growth.

- Technological Disruption: Rapid technological advancements may render Palantir's current technology obsolete, requiring significant investment in R&D to remain competitive. This technological disruption risk is inherent in the sector.

Considering this Palantir competition is crucial for a realistic assessment of the company's future prospects.

May 5th Deadline and its Implications (if applicable)

[If there's a specific event or deadline on May 5th relevant to Palantir, explain it here and its potential impact on the stock price. This section should be tailored to the specific event].

Conclusion: Should You Buy Palantir Stock Before May 5th?

In summary, Palantir exhibits signs of growth, supported by a largely positive (though not unanimous) Wall Street consensus. However, significant risks remain, including market volatility, intense competition, and potential technological disruption.

Based on the analysis, the decision of whether to buy Palantir stock before May 5th is a nuanced one. The potential for future growth is there, but the risks should not be underestimated. A conservative investor might choose to wait for clearer indications of sustained profitability and market stability. A more aggressive investor, comfortable with higher risk, might see the current price as a potential entry point.

Ultimately, the decision of whether to buy Palantir stock before May 5th is yours. However, armed with this analysis of Palantir's performance and Wall Street's sentiment, you can approach your investment strategy with greater confidence. Remember to conduct thorough due diligence and consider your individual risk tolerance before making any investment decisions.

Featured Posts

-

Inter Milan Upsets Bayern Munich In Champions League Quarterfinal

May 09, 2025

Inter Milan Upsets Bayern Munich In Champions League Quarterfinal

May 09, 2025 -

Nyt Strands Game 374 Hints And Solutions For Wednesday March 12

May 09, 2025

Nyt Strands Game 374 Hints And Solutions For Wednesday March 12

May 09, 2025 -

Understanding The Great Decoupling A Comprehensive Guide

May 09, 2025

Understanding The Great Decoupling A Comprehensive Guide

May 09, 2025 -

Evaluating Palantir After A Significant 30 Price Correction

May 09, 2025

Evaluating Palantir After A Significant 30 Price Correction

May 09, 2025 -

Wall Streets 110 Prediction Why Billionaires Are Investing In This Black Rock Etf

May 09, 2025

Wall Streets 110 Prediction Why Billionaires Are Investing In This Black Rock Etf

May 09, 2025