Is Riot Platforms Stock A Buy Near Its 52-Week Low?

Table of Contents

Riot Platforms' Current Financial Performance and Market Position

Revenue and Profitability

Analyzing Riot Platforms' recent quarterly and annual reports reveals key insights into its revenue generation and profitability. While the Bitcoin price significantly impacts their bottom line, examining metrics like revenue per Bitcoin mined, operating margin, and net income provides a clearer picture.

- Bitcoin Production: Riot Platforms' Bitcoin production, measured in newly mined coins, is a crucial indicator of their operational efficiency. Increased production, coupled with a higher Bitcoin price, directly translates to higher revenue.

- Operational Costs: Energy consumption, mining equipment maintenance, and personnel costs are significant operational expenses. Riot Platforms' ability to manage these costs efficiently directly impacts its profitability.

- Bitcoin Price Fluctuations: The price of Bitcoin is a primary driver of Riot Platforms' profitability. A surge in Bitcoin's value boosts revenue, while a downturn can significantly impact profitability. Understanding this correlation is crucial for assessing risk.

Key financial metrics like revenue per Bitcoin mined, operating margin, and net income should be meticulously tracked and compared against industry benchmarks to gain a comprehensive understanding of Riot Platforms' financial health.

Debt and Liquidity

A robust assessment of Riot Platforms' financial health necessitates an analysis of its debt levels, cash flow, and liquidity. This helps determine the company's ability to withstand market downturns and service its debts.

- Debt Levels: Examining Riot Platforms' debt-to-equity ratio offers a crucial insight into its financial leverage. A high ratio suggests a higher level of risk.

- Cash Flow: Analyzing Riot Platforms' cash flow from operations indicates its ability to generate cash from its core business activities. Strong positive cash flow is a positive indicator of financial strength.

- Liquidity: The current ratio and quick ratio provide insights into Riot Platforms' short-term liquidity, reflecting its ability to meet its short-term obligations. Healthy ratios suggest a lower risk of insolvency.

Bitcoin's Price and its Impact on Riot Platforms Stock

Bitcoin Price Correlation

The relationship between Bitcoin's price and Riot Platforms' stock performance is undeniably strong. This correlation stems from the fact that Riot Platforms' primary revenue source is Bitcoin mining.

- Historical Price Movements: Analyzing past price movements reveals a clear pattern: when Bitcoin's price rises, Riot Platforms' stock price generally follows suit, and vice-versa.

- Investment Risk: This correlation highlights a key investment risk: investing in Riot Platforms stock exposes investors to the inherent volatility of the Bitcoin market. Price swings in Bitcoin can significantly impact Riot Platforms' share price.

Bitcoin Market Outlook and Predictions

Forecasting Bitcoin's future price is inherently speculative, but analyzing expert opinions and market predictions can inform investment strategies.

- Potential Catalysts: Factors like increased institutional adoption, regulatory clarity, technological advancements, and macroeconomic conditions can influence Bitcoin's price. Understanding these factors is crucial for assessing the potential for price appreciation or depreciation.

- Market Forecasts: While no prediction is guaranteed, understanding various market forecasts can help investors gauge the potential risk and reward associated with investing in Bitcoin-related assets like Riot Platforms stock.

Risks and Considerations for Investing in Riot Platforms

Regulatory Risks

The cryptocurrency mining industry faces evolving regulatory landscapes, presenting significant risks.

- Mining Regulations: Changes in regulations governing Bitcoin mining operations, such as licensing requirements or restrictions on energy consumption, can impact Riot Platforms' profitability and operations.

- Environmental Regulations: Growing concerns about the environmental impact of Bitcoin mining could lead to stricter regulations, potentially increasing operating costs for Riot Platforms.

- Tax Implications: Changes in tax laws related to cryptocurrency mining could significantly affect Riot Platforms' profitability.

Market Volatility and Competition

The cryptocurrency market is inherently volatile, and Riot Platforms operates in a competitive landscape.

- Competitive Landscape: Riot Platforms faces competition from other Bitcoin mining companies, vying for market share and efficiency gains. Technological advancements and operational efficiency play a crucial role in this competition.

- Technological Advancements: The rapid pace of technological innovation in the Bitcoin mining industry means that Riot Platforms must continuously invest in upgrading its equipment to maintain its competitiveness.

Energy Costs and Sustainability

Energy costs are a major factor influencing Riot Platforms' profitability, and the increasing focus on environmental sustainability is impacting the industry.

- Energy Sourcing Strategies: Riot Platforms' energy sourcing strategies, including its reliance on renewable energy sources, are important factors impacting its cost structure and environmental footprint. Investors should scrutinize their sustainability initiatives.

Conclusion

This analysis of Riot Platforms' financial health, the Bitcoin market outlook, and associated risks provides a clearer picture of its investment potential. While the current 52-week low might seem an attractive entry point for some, the inherent volatility and risks associated with Bitcoin mining and cryptocurrency investments cannot be ignored.

Ultimately, the decision to buy Riot Platforms stock near its 52-week low is a personal one, depending heavily on your risk tolerance and investment strategy. Conduct thorough due diligence, carefully weigh the potential rewards against the inherent risks, and consider seeking advice from a qualified financial advisor before investing in Riot Platforms stock or any other cryptocurrency-related investments. Remember to diversify your portfolio to mitigate risk.

Featured Posts

-

England Women Vs Spain Women In Depth Preview And Score Prediction

May 02, 2025

England Women Vs Spain Women In Depth Preview And Score Prediction

May 02, 2025 -

Fortnite Update V34 30 Sabrina Carpenter Collaboration Gameplay Changes And Downtime

May 02, 2025

Fortnite Update V34 30 Sabrina Carpenter Collaboration Gameplay Changes And Downtime

May 02, 2025 -

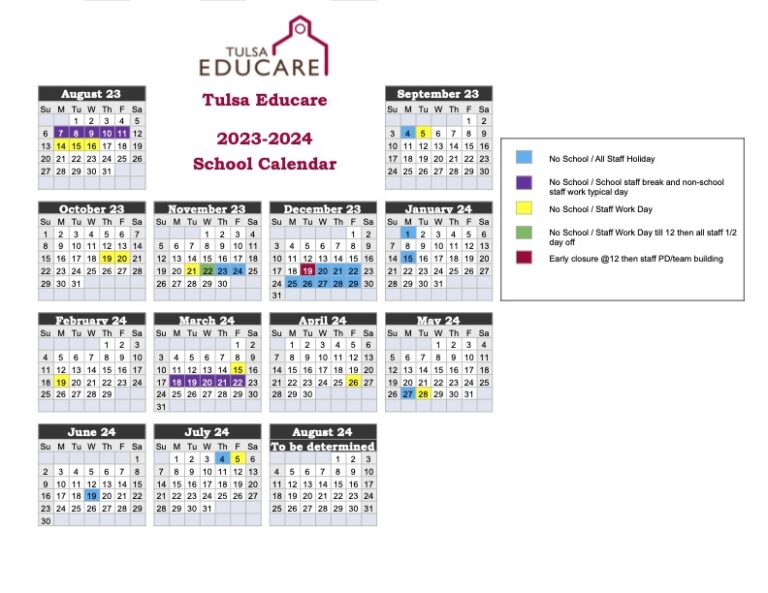

Severe Weather Tulsa Public Schools Closure Wednesday

May 02, 2025

Severe Weather Tulsa Public Schools Closure Wednesday

May 02, 2025 -

Remembering Saigons Fall Us Officers Who Risked Their Careers To Save Lives

May 02, 2025

Remembering Saigons Fall Us Officers Who Risked Their Careers To Save Lives

May 02, 2025 -

Big Islands Merrie Monarch Festival A Deep Dive Into Polynesian Arts

May 02, 2025

Big Islands Merrie Monarch Festival A Deep Dive Into Polynesian Arts

May 02, 2025

Latest Posts

-

Loblaws Commitment To Canadian Products A Temporary Trend

May 03, 2025

Loblaws Commitment To Canadian Products A Temporary Trend

May 03, 2025 -

Analysis Bank Of Canadas Response To Trump Tariffs In April Interest Rate Decision

May 03, 2025

Analysis Bank Of Canadas Response To Trump Tariffs In April Interest Rate Decision

May 03, 2025 -

Canadian Dollars Gain Analyzing Trumps Influence On Currency Markets

May 03, 2025

Canadian Dollars Gain Analyzing Trumps Influence On Currency Markets

May 03, 2025 -

The Bank Of Canada And The Trump Tariffs An April 2018 Interest Rate Analysis

May 03, 2025

The Bank Of Canada And The Trump Tariffs An April 2018 Interest Rate Analysis

May 03, 2025 -

Impact Of Trumps Statement On Canadian Dollar Exchange Rate

May 03, 2025

Impact Of Trumps Statement On Canadian Dollar Exchange Rate

May 03, 2025