Japan's Bond Market: Steep Yield Curve Poses Economic Challenges

Table of Contents

The Steepening Yield Curve: A Detailed Look

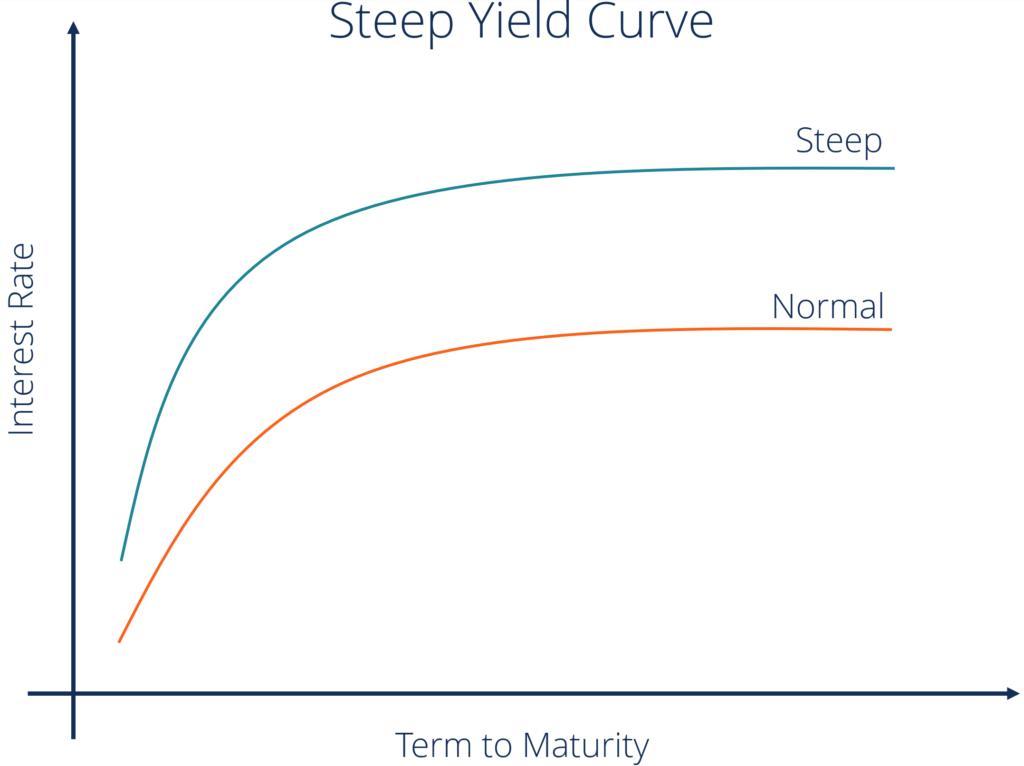

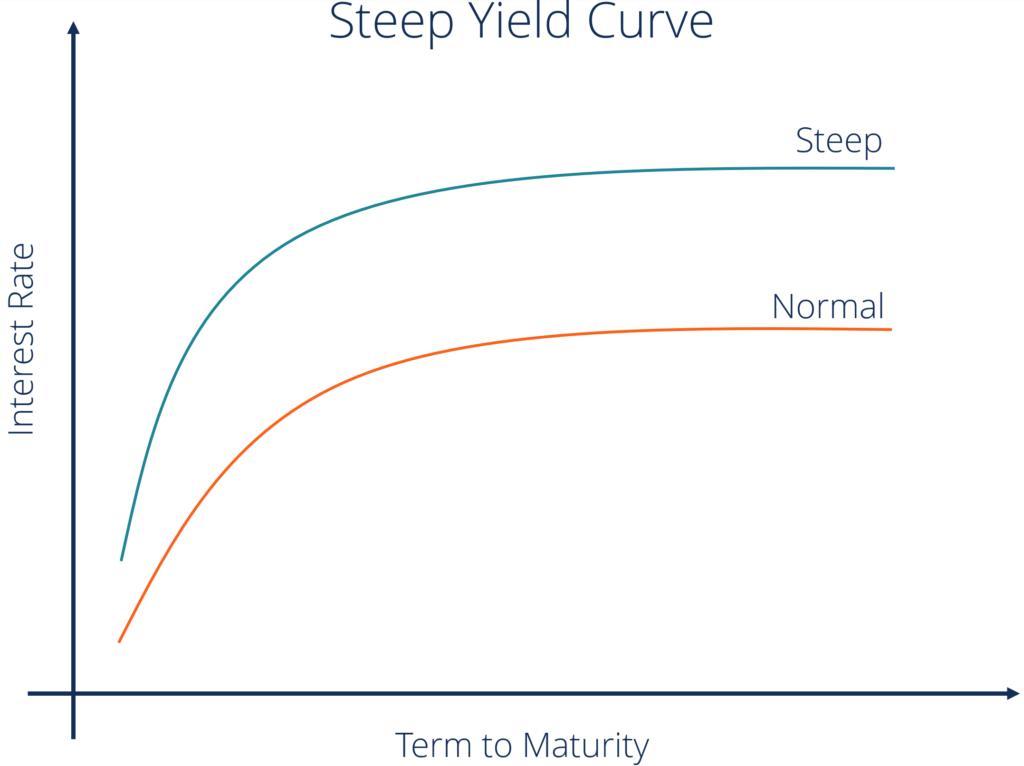

A yield curve graphically represents the relationship between the interest rates (or yields) and the time to maturity of debt instruments of the same credit quality. A normal yield curve slopes upwards, indicating that longer-term bonds offer higher yields to compensate investors for the increased risk associated with longer maturities. However, a steep yield curve signifies a significant difference between short-term and long-term yields, often indicating economic uncertainty or shifts in monetary policy.

Short-term Japanese Government Bonds (JGBs) typically mature within a year, while long-term JGBs have maturities of 10 years or more. The recent steepening of the JGB yield curve reflects a growing gap between the yields offered by these two categories of bonds.

[Insert chart/graph here visually representing the recent steepening of the JGB yield curve. Source should be cited.]

Several factors are contributing to this steepening:

- Bank of Japan (BOJ) Policy Shifts: The BOJ's gradual tapering of its quantitative easing (QE) program, aimed at controlling yields, has allowed market forces to play a larger role in determining JGB yields. This shift has contributed to the rise in long-term yields.

- Rising Global Interest Rates: The global trend of rising interest rates, driven by factors such as inflation and tightening monetary policies in major economies like the US and Europe, has put upward pressure on Japanese long-term bond yields.

- Increased Inflationary Pressures in Japan: While relatively low compared to other developed nations, inflation in Japan is rising, leading investors to demand higher yields to compensate for the erosion of purchasing power.

- Investor Expectations of Future Interest Rate Hikes: Anticipation of further interest rate hikes by the BOJ, in response to inflationary pressures, is contributing to the increase in long-term JGB yields.

Economic Implications of a Steep Yield Curve in Japan

A steepening yield curve in Japan carries significant economic implications:

-

Increased Borrowing Costs: Higher long-term yields translate into increased borrowing costs for businesses and consumers, potentially dampening investment and consumer spending. This can lead to slower economic growth. Companies financing large-scale projects through long-term debt will be particularly affected.

-

Impact on Economic Growth and Investment: Higher borrowing costs can stifle economic activity, leading to reduced investment in infrastructure and capital projects. Businesses may postpone expansion plans or reduce hiring, impacting overall economic growth. This is a concern for a country like Japan that relies heavily on exports and manufacturing.

-

Implications for the Japanese Yen: A steepening yield curve can influence the Japanese yen's exchange rate. Higher long-term yields can attract foreign investment, potentially leading to a stronger yen. While this might benefit consumers through lower import prices, it can negatively impact Japanese exports by making them more expensive in global markets.

-

Government Budgetary Pressure: The Japanese government faces increased pressure on its budget due to the higher interest payments required on its substantial JGB holdings as yields rise. This further strains public finances and could necessitate fiscal austerity measures.

BOJ's Response and Future Outlook for Japan's Bond Market

The BOJ faces a challenging task in managing the steepening yield curve. Its current monetary policy is a delicate balance between maintaining price stability and supporting economic growth. The effectiveness of the BOJ's existing policies in mitigating the impact of the steep yield curve is subject to ongoing debate.

Potential future policy adjustments by the BOJ could include:

- Further Yield Curve Control Adjustments: The BOJ might tweak its yield curve control (YCC) policy to adjust the target range for long-term JGB yields or potentially abandon the policy altogether.

- Gradual Normalization of Monetary Policy: The BOJ might gradually normalize its monetary policy, moving away from extremely accommodative measures.

- Impact of Global Economic Conditions: Global economic conditions, particularly changes in US interest rates and the strength of the dollar, significantly impact Japan's bond market and the BOJ's policy decisions.

Challenges faced by the BOJ include:

- Balancing inflation control with economic growth.

- Managing a large accumulation of JGBs on its balance sheet.

- Dealing with potential capital outflows if interest rate differentials between Japan and other developed economies widen.

The long-term implications for Japanese government debt sustainability are a significant concern. A prolonged period of high yields could make it increasingly difficult for the government to finance its debt.

Conclusion

The steepening yield curve in Japan's bond market presents significant economic challenges, impacting borrowing costs, economic growth, and the yen's exchange rate. The BOJ's response will be crucial in navigating these complexities. The interplay between domestic economic factors and global financial conditions makes forecasting future developments in Japan's bond market highly uncertain. Monitoring Japan's bond market is essential not only for understanding the Japanese economy but also for comprehending global financial dynamics. Stay informed about the developments in Japan's bond market by regularly checking our website for the latest analysis and insights on this crucial aspect of the Japanese economy. Understanding the dynamics of Japan’s bond market is critical for navigating the complexities of global finance.

Featured Posts

-

Reduce Your Student Loan Burden A Financial Planners Recommendations

May 17, 2025

Reduce Your Student Loan Burden A Financial Planners Recommendations

May 17, 2025 -

The End Of Ryujinx A Nintendo Related Shutdown

May 17, 2025

The End Of Ryujinx A Nintendo Related Shutdown

May 17, 2025 -

Mapping The Countrys Hottest New Business Hubs

May 17, 2025

Mapping The Countrys Hottest New Business Hubs

May 17, 2025 -

Rfk Jr S Hhs To Halt Routine Covid Vaccine Recommendations For Children And Pregnant Women

May 17, 2025

Rfk Jr S Hhs To Halt Routine Covid Vaccine Recommendations For Children And Pregnant Women

May 17, 2025 -

Lynas The First Heavy Rare Earths Producer Outside Of China

May 17, 2025

Lynas The First Heavy Rare Earths Producer Outside Of China

May 17, 2025

Latest Posts

-

Should I Refinance My Federal Student Loans A Practical Assessment

May 17, 2025

Should I Refinance My Federal Student Loans A Practical Assessment

May 17, 2025 -

When Does Refinancing Federal Student Loans Make Sense

May 17, 2025

When Does Refinancing Federal Student Loans Make Sense

May 17, 2025 -

Federal Student Loan Refinancing A Comprehensive Guide

May 17, 2025

Federal Student Loan Refinancing A Comprehensive Guide

May 17, 2025 -

Refinancing Federal Student Loans Is It Right For You

May 17, 2025

Refinancing Federal Student Loans Is It Right For You

May 17, 2025 -

The Consequences Of Consistently Late Student Loan Payments

May 17, 2025

The Consequences Of Consistently Late Student Loan Payments

May 17, 2025