Market Reaction: Gold Climbs As Trump Adopts Less Confrontational Stance

Table of Contents

Trump's Shift in Tone and its Market Impact

Former President Trump's recent change in public rhetoric has been noticeable. His previous administration was often characterized by aggressive and confrontational foreign policy statements, impacting investor confidence and market stability. This shift towards a less confrontational approach has had a tangible effect on market sentiment.

- Examples of previous confrontational stances: Trade wars initiated with several countries, strong rhetoric against specific nations, and unpredictable policy announcements.

- Specific examples of recent less confrontational actions: More measured statements in international relations, a less aggressive approach to trade negotiations, and a general toning down of public pronouncements.

- Analysis of the impact on investor confidence: Reduced geopolitical uncertainty often leads to decreased demand for safe-haven assets like gold, thus impacting the gold price. Trump's softer tone has likely contributed to a sense of increased stability, causing some investors to shift away from gold.

Safe-Haven Asset: Gold's Response to Reduced Geopolitical Uncertainty

Gold is traditionally viewed as a safe-haven asset. Investors often flock to gold during times of economic or political instability, seeking to preserve their capital. This is because gold is generally seen as a non-yielding, non-correlated asset that holds value irrespective of broader market fluctuations.

- Explanation of the inverse relationship between geopolitical stability and gold prices: Generally, as geopolitical stability increases, the demand for gold as a safe haven decreases, leading to lower gold prices. The opposite is also true.

- Mention other factors that influence gold prices: Inflation, currency fluctuations (particularly the US dollar), and changes in central bank policies all play a significant role in influencing gold prices.

- Historical examples of gold price movements during periods of increased/decreased geopolitical risk: The 2008 financial crisis and various periods of international conflict have historically shown a surge in gold prices. Conversely, periods of sustained economic growth and global stability have often seen gold prices moderate.

Technical Analysis: Gold Price Charts and Indicators

Analyzing recent gold price charts reveals interesting insights. While a detailed technical analysis requires charting software and in-depth study, key price movements are worth noting. For instance, a sustained break above a key resistance level might signal a bullish trend.

- Key price levels to watch (support and resistance): These levels represent potential price floors (support) and ceilings (resistance) and are often significant indicators of future price movement.

- Interpretations of technical indicators: Indicators like Moving Averages (MA), Relative Strength Index (RSI), and MACD provide valuable insight into momentum and potential trend reversals. A rising RSI above 70 could suggest gold is overbought, while a falling RSI below 30 could indicate it's oversold.

- Potential future price predictions (with disclaimers): It's crucial to remember that technical analysis is not an exact science. Any predictions are subject to market volatility and unforeseen events.

Alternative Investments and Diversification Strategies

While gold plays a valuable role in a diversified portfolio, it's essential to consider other investment options. A well-rounded investment strategy should incorporate various asset classes to mitigate risk and enhance returns.

- Mention alternative safe-haven assets: Government bonds, particularly those issued by stable economies, and currencies like the Swiss franc are often considered safe-haven assets.

- Discuss risk tolerance and the role of gold in mitigating risk: Gold can act as a hedge against inflation and geopolitical uncertainty, reducing overall portfolio risk. However, gold itself carries some risk, and its inclusion should align with an investor's risk profile.

- Suggest different portfolio allocation strategies incorporating gold: The ideal allocation depends on individual circumstances and risk tolerance, but a small percentage (5-10%) of a portfolio allocated to gold is a common approach among diversification strategies.

Conclusion: Understanding the Gold Market's Reaction

In summary, the recent increase in gold prices is multifaceted. Former President Trump's shift to a less confrontational stance has contributed to reduced geopolitical uncertainty, impacting investor confidence and the demand for safe-haven assets like gold. This demonstrates the inverse relationship between geopolitical stability and gold price movements. Understanding this correlation is vital for navigating the gold market. The technical analysis of gold price charts and relevant indicators can further inform investment decisions. To build a robust investment strategy, consider diversifying your portfolio and incorporating gold investment strategies that align with your risk tolerance. Stay tuned for further updates on how the market reacts to changes in political climate and consider incorporating gold into your investment portfolio as part of a sound diversification strategy.

Featured Posts

-

Analyzing The Montana Senate The Democratic And Republican Coalition Fight

Apr 25, 2025

Analyzing The Montana Senate The Democratic And Republican Coalition Fight

Apr 25, 2025 -

Zelenskyy Faces Pressure From Trump As Russia Launches New Missile Attacks In Ukraine

Apr 25, 2025

Zelenskyy Faces Pressure From Trump As Russia Launches New Missile Attacks In Ukraine

Apr 25, 2025 -

Smi O Vizite Kota Kelloga V Ukrainu 20 Fevralya Poslednie Novosti

Apr 25, 2025

Smi O Vizite Kota Kelloga V Ukrainu 20 Fevralya Poslednie Novosti

Apr 25, 2025 -

Controversia Por Q6 Millones Es Justa La Condena Contra Kevin Malouf El Hijo De Floridalma Roque Habla

Apr 25, 2025

Controversia Por Q6 Millones Es Justa La Condena Contra Kevin Malouf El Hijo De Floridalma Roque Habla

Apr 25, 2025 -

Best Official Coachella 2025 Merchandise From Amazon

Apr 25, 2025

Best Official Coachella 2025 Merchandise From Amazon

Apr 25, 2025

Latest Posts

-

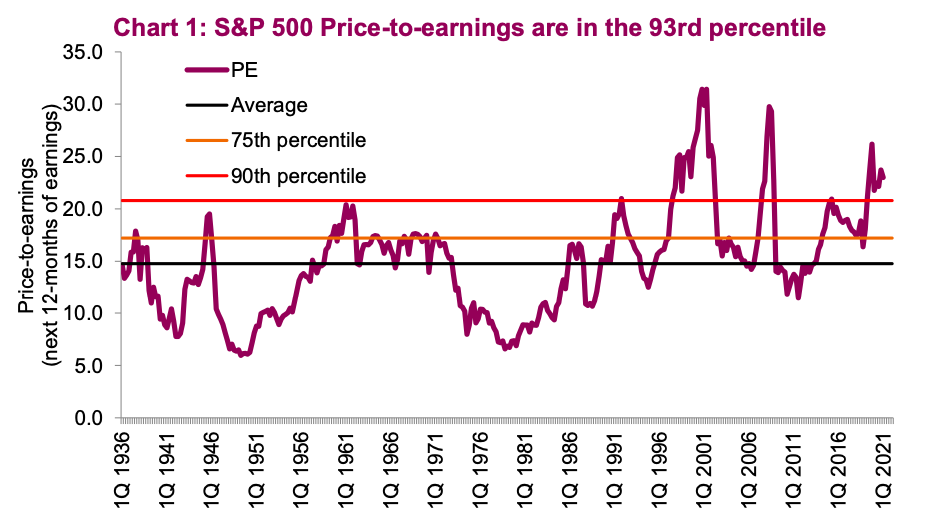

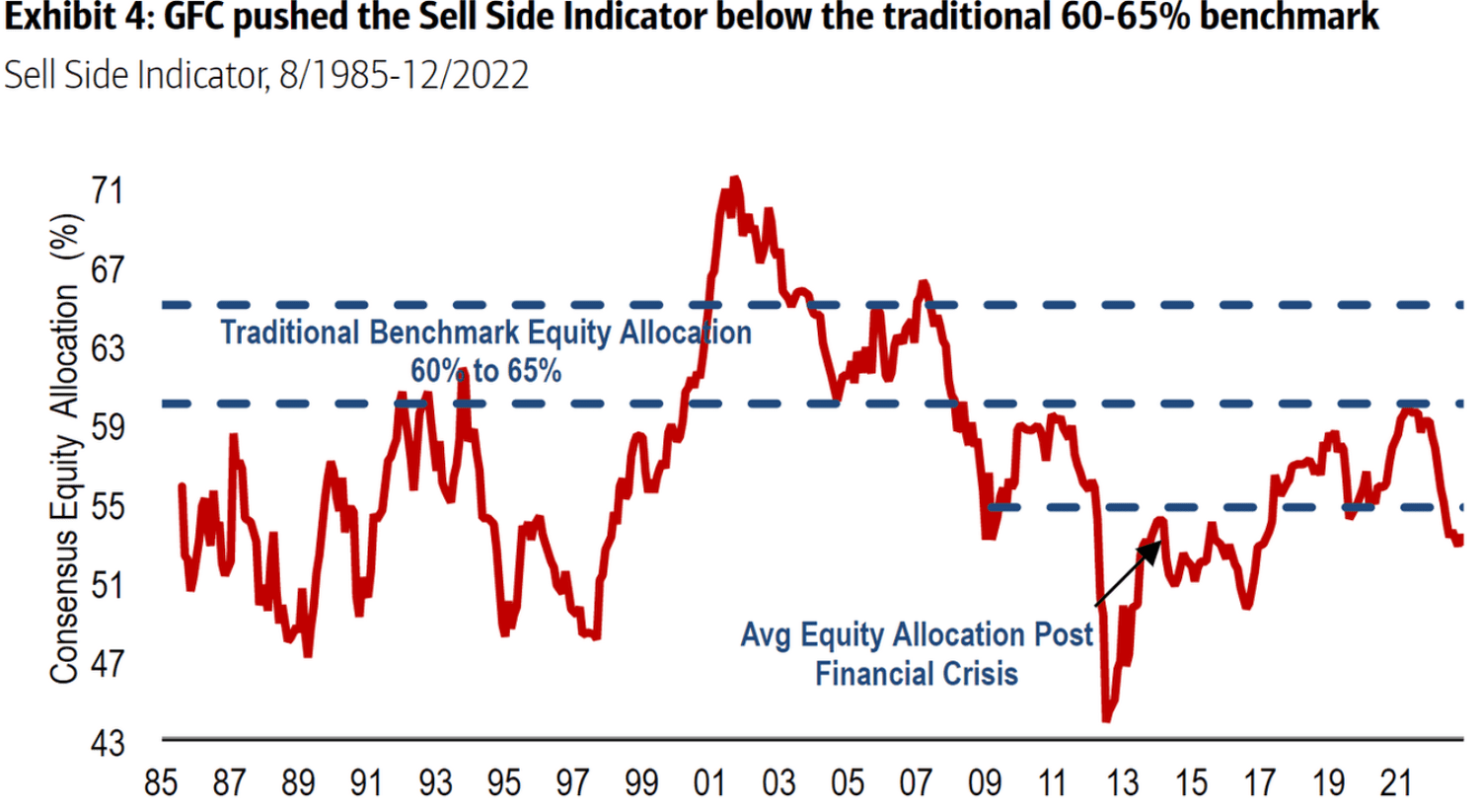

Addressing Investor Concerns Bof As View On High Stock Market Valuations

Apr 26, 2025

Addressing Investor Concerns Bof As View On High Stock Market Valuations

Apr 26, 2025 -

Bof A On Stock Market Valuations A Rationale For Investor Confidence

Apr 26, 2025

Bof A On Stock Market Valuations A Rationale For Investor Confidence

Apr 26, 2025 -

Why Current Stock Market Valuations Are Not A Reason To Panic According To Bof A

Apr 26, 2025

Why Current Stock Market Valuations Are Not A Reason To Panic According To Bof A

Apr 26, 2025 -

Understanding Stock Market Valuations Bof As Argument For Calm

Apr 26, 2025

Understanding Stock Market Valuations Bof As Argument For Calm

Apr 26, 2025 -

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025