Market Volatility: Strategies For S&P 500 Downside Protection

Table of Contents

Understanding S&P 500 Volatility and its Impact

Historical Volatility Analysis

The S&P 500 has experienced periods of significant volatility throughout its history. Understanding these historical patterns can provide valuable insights into potential future market behavior. Analyzing historical data allows us to identify the frequency, magnitude, and duration of past market corrections.

- Examples of significant market corrections: The dot-com bubble burst of 2000, the 2008 financial crisis, and the COVID-19 market crash of 2020 all demonstrate the potential for sharp and sudden declines in the S&P 500. These events highlight the importance of having a robust S&P 500 downside protection strategy in place.

- Data points: While average annual volatility can vary, historical data reveals that the S&P 500 has experienced maximum drawdowns (peak-to-trough declines) ranging from 10% to over 50% during significant market downturns. This emphasizes the need for strategies to mitigate these potential losses.

Identifying Risk Factors

Several factors contribute to S&P 500 volatility, impacting portfolio performance significantly. Effective S&P 500 risk management requires identifying and understanding these risks.

- Examples of risk factors:

- Interest rate hikes: Increased interest rates can lead to higher borrowing costs for businesses, potentially slowing economic growth and impacting stock prices.

- Inflation: High inflation erodes purchasing power and can lead to increased uncertainty about future earnings, negatively affecting market sentiment.

- Geopolitical instability: International conflicts and political uncertainties can trigger market volatility as investors react to changing global dynamics.

- Unexpected economic data: Poor economic reports can shake investor confidence and lead to sharp market corrections.

Strategies for S&P 500 Downside Protection

Hedging Strategies

Hedging involves using financial instruments to offset potential losses in your S&P 500 investments. Several effective hedging strategies exist:

- Options strategies:

- Protective puts: Buying put options on the S&P 500 provides downside protection by giving you the right to sell your shares at a predetermined price, limiting potential losses.

- Collars: This strategy involves simultaneously buying put options and selling call options, creating a range-bound protection strategy.

- Inverse ETFs: These exchange-traded funds (ETFs) aim to generate returns that are inversely correlated with the S&P 500. They can be used to hedge against market declines. However, it's crucial to understand their inherent risks and limitations.

Diversification and Asset Allocation

Diversifying your portfolio across various asset classes is a fundamental S&P 500 downside protection strategy. This reduces the overall volatility of your portfolio by reducing reliance on any single asset class.

- Examples of asset classes: Including bonds, real estate, commodities (gold, oil), and alternative investments can help balance risk and potentially reduce portfolio volatility. Effective asset allocation strategies are crucial for optimizing risk-adjusted returns. This is a key component of reducing market risk and building a resilient portfolio.

Stop-Loss Orders and Position Sizing

Implementing stop-loss orders and carefully considering position sizing are vital risk management techniques.

- Stop-loss orders: These automatically sell your S&P 500 holdings when the price falls to a predetermined level, limiting potential losses.

- Position sizing: Determining the appropriate amount to invest in any given asset is crucial for risk management. Never invest more than you can afford to lose. Careful position sizing is a key element of loss limitation.

Evaluating and Implementing Your Chosen Strategy

Risk Tolerance Assessment

Before implementing any S&P 500 downside protection strategy, it's crucial to assess your risk tolerance. Understanding your comfort level with potential losses is vital for making informed investment decisions.

- Methods for assessing risk tolerance: Use online risk tolerance questionnaires, consult with a financial advisor, or review your past investment behavior.

Monitoring and Adjustment

Market conditions change constantly. Regularly monitoring your portfolio's performance and adjusting your strategy as needed is essential.

- Triggers for adjusting a strategy: Significant market events (geopolitical crises, economic downturns), changes in your personal circumstances (retirement, job loss), and changes in your investment goals all warrant reviewing and adjusting your S&P 500 downside protection plan.

Seeking Professional Advice

Consulting with a qualified financial advisor is highly recommended before making significant investment decisions. A financial advisor can help you develop a personalized S&P 500 downside protection plan tailored to your individual risk tolerance, investment goals, and financial circumstances.

Conclusion

By understanding and implementing these strategies for S&P 500 downside protection—hedging, diversification, stop-loss orders, and position sizing—you can navigate market volatility more effectively and work towards achieving your long-term financial goals. Remember to assess your risk tolerance and monitor market conditions regularly. Start planning your S&P 500 downside protection strategy today by researching the options discussed and, most importantly, consulting with a financial advisor to create a personalized plan that aligns with your unique circumstances. Effective S&P 500 downside protection is a crucial aspect of responsible investing.

Featured Posts

-

Det Baesta Kycklingnuggets Receptet Majsflingor And Laettlagad Asiatisk Kalsallad

May 01, 2025

Det Baesta Kycklingnuggets Receptet Majsflingor And Laettlagad Asiatisk Kalsallad

May 01, 2025 -

Savor The World Windstar Cruises And Fine Dining

May 01, 2025

Savor The World Windstar Cruises And Fine Dining

May 01, 2025 -

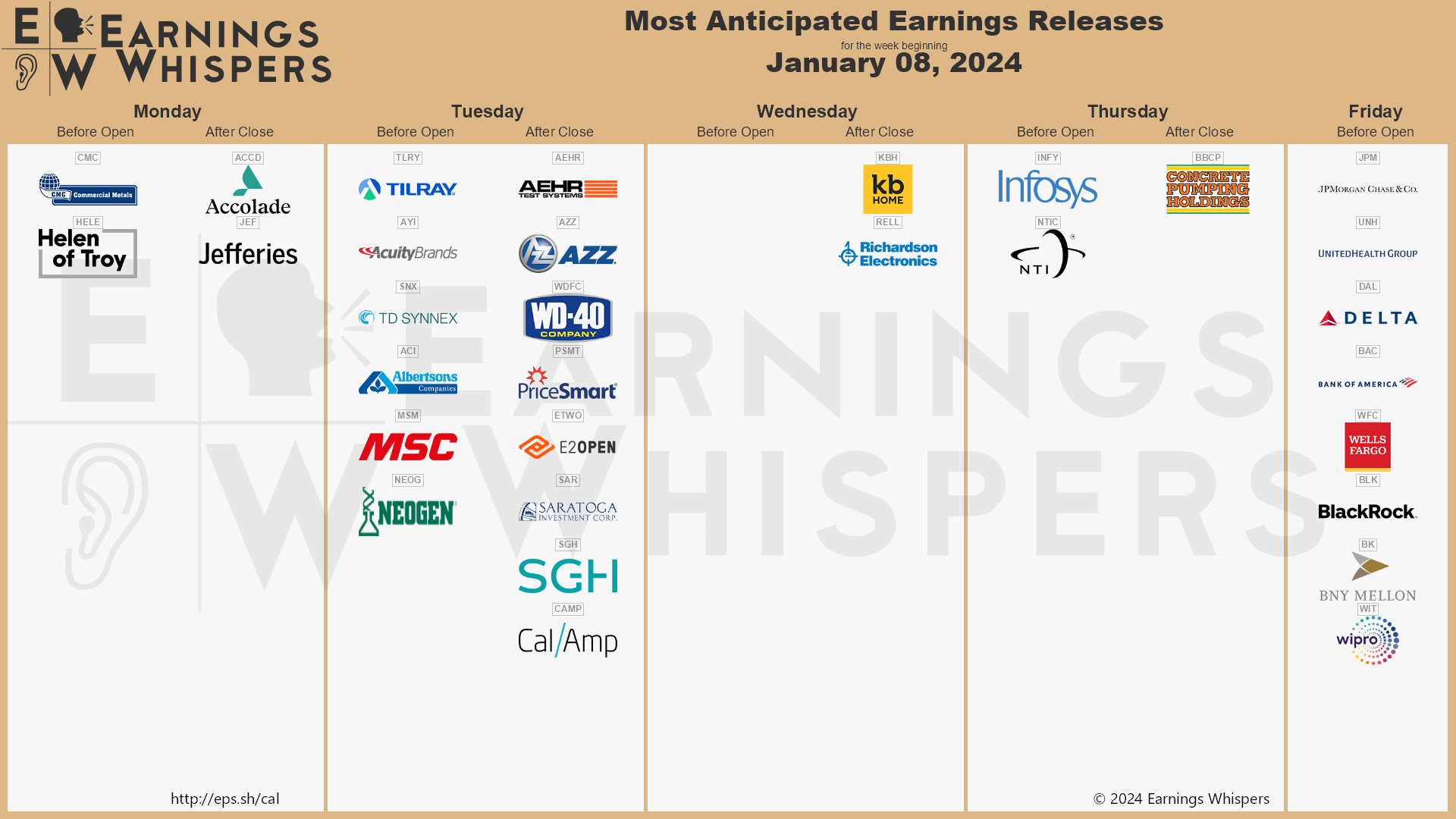

Stock Market Today Earnings Season Impact On Dow Futures And Market Indices

May 01, 2025

Stock Market Today Earnings Season Impact On Dow Futures And Market Indices

May 01, 2025 -

Understanding Rare Seabirds The Work Of Te Ipukarea Society

May 01, 2025

Understanding Rare Seabirds The Work Of Te Ipukarea Society

May 01, 2025 -

Dallas Tv Show The Passing Of Another 80s Icon

May 01, 2025

Dallas Tv Show The Passing Of Another 80s Icon

May 01, 2025

Latest Posts

-

V Mware Costs To Soar 1050 At And T Sounds The Alarm On Broadcoms Price Hike

May 01, 2025

V Mware Costs To Soar 1050 At And T Sounds The Alarm On Broadcoms Price Hike

May 01, 2025 -

List Of Cruise Lines Owned By Carnival Corporation And Plc

May 01, 2025

List Of Cruise Lines Owned By Carnival Corporation And Plc

May 01, 2025 -

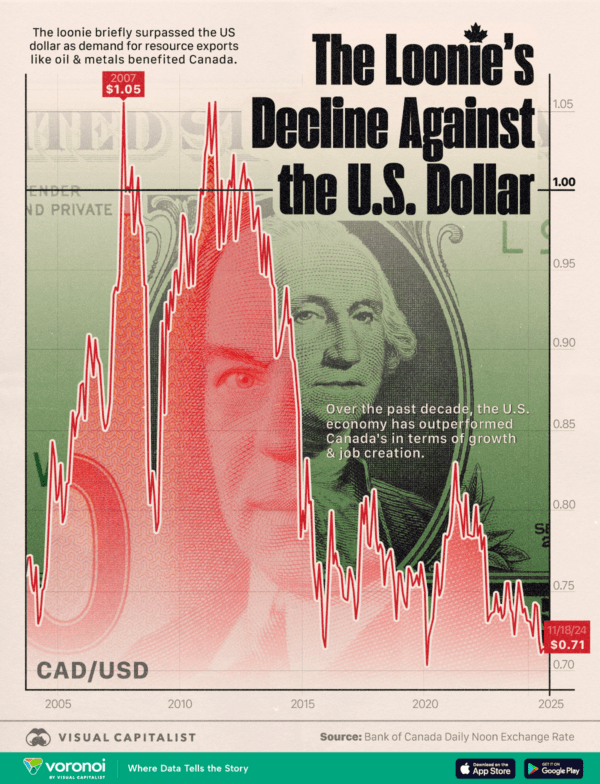

Will A Minority Government Weaken The Canadian Dollar

May 01, 2025

Will A Minority Government Weaken The Canadian Dollar

May 01, 2025 -

Understanding Carnival Corporation A List Of Its Owned Cruise Lines

May 01, 2025

Understanding Carnival Corporation A List Of Its Owned Cruise Lines

May 01, 2025 -

Disneys Alaska Expansion Two Ships Set For Summer 2026

May 01, 2025

Disneys Alaska Expansion Two Ships Set For Summer 2026

May 01, 2025