Microsoft-Activision Deal: FTC's Appeal And Future Implications

Table of Contents

The FTC's Arguments Against the Microsoft-Activision Merger

The FTC's opposition to the Microsoft-Activision merger centers on concerns about anti-competitive practices and potential harm to consumers.

Concerns about Anti-Competitive Practices

The FTC's primary argument is that the merger would create a monopoly, significantly reducing competition, particularly within the console gaming market. A key concern revolves around Call of Duty, one of the most popular and profitable video game franchises globally. The FTC argues that Microsoft could leverage its ownership of Activision Blizzard to make Call of Duty exclusive to Xbox consoles, harming PlayStation players and potentially stifling competition from other console manufacturers and game publishers. Keywords: Antitrust lawsuit, market dominance, Call of Duty exclusivity, consumer harm, competition concerns.

- Reduced Choice for Consumers: Exclusivity of Call of Duty would limit consumer choice and potentially drive gamers towards the Xbox ecosystem.

- Higher Prices: Reduced competition could lead to increased prices for games and gaming consoles.

- Stifled Innovation: Less competition can stifle innovation within the gaming industry.

The Role of Game Pass and Subscription Services

The FTC also highlights concerns about Microsoft's Game Pass subscription service. The acquisition of Activision Blizzard's extensive game portfolio could significantly strengthen Game Pass, giving Microsoft a substantial competitive advantage. This could harm competitors relying on individual game sales, potentially driving them out of the market. Keywords: Game Pass, subscription services, competitive advantage, market share.

- Unfair Competitive Advantage: The combined strength of Microsoft's Game Pass and Activision's titles would create an almost insurmountable advantage over rivals.

- Reduced Incentives for Competitors: Other subscription services or game publishers might struggle to compete with such a robust offering.

- Potential for Lock-in: Consumers might become locked into the Microsoft ecosystem, reducing their options.

Evidence Presented by the FTC

The FTC presented substantial evidence during the initial proceedings and its appeal, including:

- Market analysis data: Demonstrating Microsoft’s potential market dominance post-merger.

- Expert witness testimony: From economists and industry analysts supporting their claims.

- Internal Microsoft documents: Potentially revealing the company’s intentions regarding Call of Duty exclusivity. Keywords: Evidence, data, expert witnesses, legal arguments.

Microsoft's Defense and Counterarguments

Microsoft has vigorously defended the merger, arguing it won't harm competition and will ultimately benefit consumers.

Microsoft's Commitment to Maintaining Call of Duty Availability

Central to Microsoft's defense is its repeated commitment to maintain Call of Duty's availability on PlayStation and other platforms. They've offered long-term contracts to Sony and other competitors to ensure continued cross-platform play. Keywords: Call of Duty availability, cross-platform play, PlayStation, long-term contracts.

- Long-term agreements: Demonstrate Microsoft’s intent to keep Call of Duty multi-platform.

- Commitment to competition: Microsoft aims to show that the merger will enhance, not harm, competition.

- Benefits to players: Continued access to Call of Duty across various platforms.

Benefits of the Merger for Gamers

Microsoft emphasizes the benefits for gamers, such as:

- Expanded Game Pass catalog: Bringing more games to more players through the Game Pass subscription service.

- Increased game development resources: Allowing for greater innovation and more high-quality games.

- Wider accessibility: Making games more accessible to a broader audience through various platforms. Keywords: Game development, innovation, consumer benefits.

Microsoft's Legal Strategy

Microsoft's legal strategy focuses on demonstrating the merger’s pro-competitive aspects and refuting the FTC’s claims of market dominance and consumer harm. They are likely to rely on legal precedents and arguments emphasizing the benefits of the merger for innovation and consumer choice. Keywords: Legal strategy, precedent, legal arguments.

Potential Outcomes and Future Implications of the FTC's Appeal

The outcome of the FTC's appeal holds significant implications for the gaming industry and antitrust law.

Scenarios for the Appeal

Several scenarios are possible:

- FTC victory: The appeal could result in the merger being blocked permanently, setting a major precedent for future mergers in the tech sector.

- Microsoft victory: The merger could proceed, potentially leading to increased consolidation in the gaming industry.

- Settlement: A negotiated settlement might involve concessions from Microsoft, such as stricter commitments regarding Call of Duty’s availability. Keywords: Appeal outcome, settlement, legal precedent.

Impact on the Gaming Industry

The outcome will significantly shape the future of mergers and acquisitions in the gaming industry. It could influence competition, innovation, and potentially even game pricing. Keywords: Merger implications, industry impact, competition, innovation.

- Increased Consolidation or Increased Scrutiny: A Microsoft win could encourage further consolidation; an FTC win might lead to heightened regulatory scrutiny.

- Shift in Market Dynamics: The outcome will reshape the competitive landscape of the gaming industry.

Wider Antitrust Implications

This case has broader implications for antitrust law and regulation. The outcome could set a precedent for future merger reviews, particularly in rapidly evolving tech sectors. Keywords: Antitrust law, regulatory impact, precedent.

Conclusion: The Future of the Microsoft-Activision Deal and Antitrust Regulation

The Microsoft-Activision deal presents a complex case with arguments for and against the merger. The FTC's appeal highlights significant concerns regarding anti-competitive practices and market dominance, while Microsoft emphasizes the benefits for consumers and game developers. The potential outcomes—FTC victory, Microsoft victory, or a negotiated settlement—will have far-reaching consequences for the gaming industry and the application of antitrust law. Follow the Microsoft-Activision merger developments closely to understand the evolving landscape of antitrust regulation in the gaming industry. Stay updated on the FTC's appeal and learn more about antitrust implications in the gaming industry.

Featured Posts

-

Shifting Strategies A Turning Point In Wyomings Otter Management

May 22, 2025

Shifting Strategies A Turning Point In Wyomings Otter Management

May 22, 2025 -

Allentowns Historic Penn Relays 4x100m A Sub 43 School Record

May 22, 2025

Allentowns Historic Penn Relays 4x100m A Sub 43 School Record

May 22, 2025 -

Abn Amro Facing Potential Fine Over Executive Bonuses

May 22, 2025

Abn Amro Facing Potential Fine Over Executive Bonuses

May 22, 2025 -

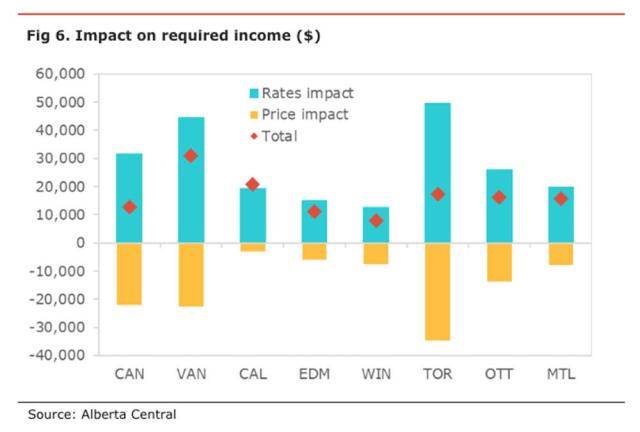

Posthaste Are Canadian Home Prices Entering A Correction

May 22, 2025

Posthaste Are Canadian Home Prices Entering A Correction

May 22, 2025 -

Showbiz Fallout David Walliams And Simon Cowell No Longer Speaking

May 22, 2025

Showbiz Fallout David Walliams And Simon Cowell No Longer Speaking

May 22, 2025

Latest Posts

-

Vstup Ukrayini Do Nato Ostanni Peregovori Ta Pozitsiya Yevrokomisara

May 22, 2025

Vstup Ukrayini Do Nato Ostanni Peregovori Ta Pozitsiya Yevrokomisara

May 22, 2025 -

Nato Nun Yeni Plani Tuerkiye Ve Italya Nin Rolue

May 22, 2025

Nato Nun Yeni Plani Tuerkiye Ve Italya Nin Rolue

May 22, 2025 -

Rossiya I Nato Ugroza Kaliningradu I Slova Patrusheva

May 22, 2025

Rossiya I Nato Ugroza Kaliningradu I Slova Patrusheva

May 22, 2025 -

Tuerkiye Ile Italya Nin Ortak Nato Goerevi Aciklandi

May 22, 2025

Tuerkiye Ile Italya Nin Ortak Nato Goerevi Aciklandi

May 22, 2025 -

Tuerkiye Italya Ortakligi Nato Plani Detaylari

May 22, 2025

Tuerkiye Italya Ortakligi Nato Plani Detaylari

May 22, 2025