ABN Amro Facing Potential Fine Over Executive Bonuses

Table of Contents

H2: The Allegations Against ABN Amro's Executive Bonus Scheme

The core of the controversy lies in allegations surrounding ABN Amro's executive compensation structure and its alleged failure to adhere to regulatory compliance standards. The Dutch Central Bank (DNB), the primary regulatory body overseeing Dutch banks, is scrutinizing the bank's bonus practices, focusing on several key areas. The allegations suggest that the bonus scheme may have incentivized excessive risk-taking and rewarded executives even in the face of poor performance or breaches of ethical conduct. This alleged financial misconduct is a serious breach of trust and could lead to significant regulatory repercussions.

- Specific examples of allegedly excessive bonuses: Reports indicate that certain executives received bonuses far exceeding their performance metrics and industry standards, sparking accusations of unfair enrichment.

- Details on the bonus scheme structure being questioned: The specific structure of the bonus scheme, including the criteria used for bonus calculations and the weighting of different performance indicators, is under intense scrutiny. Concerns have been raised about the lack of transparency and potential biases within the system.

- Mention any internal investigations conducted by ABN Amro: While details are limited, it's understood that ABN Amro conducted internal investigations. The outcomes and extent of these internal reviews remain largely undisclosed, fueling further speculation.

- Link to relevant news articles or official statements: [Insert links to relevant news articles and official statements from ABN Amro or the DNB]. (Note: This section would require up-to-date links to relevant news sources.)

H2: The Potential Magnitude of the Fine and Its Impact

The potential financial penalty facing ABN Amro is substantial. While the exact amount remains uncertain, various financial analysts predict a range between [Insert range of potential fine amounts with sources, e.g., €50 million to €150 million]. Such a financial penalty would significantly impact the bank's financial performance, potentially reducing its profitability and straining its financial stability.

- Range of potential fine amounts (with sources): [Insert specific figures and links to sources supporting those figures].

- Impact on ABN Amro's profitability and financial stability: A large fine could force the bank to curtail investments, reduce dividends, or even initiate cost-cutting measures, impacting shareholders and potentially employees.

- Predicted effect on the bank's stock price: The controversy has already negatively impacted ABN Amro's stock price, and a substantial fine could trigger a further decline, leading to losses for investors.

- Analysis of reputational harm to the bank and its brand: Beyond the financial implications, the reputational damage is considerable. The scandal erodes public trust, potentially affecting customer relationships and future business prospects.

H2: ABN Amro's Response and Future Implications

In response to the allegations, ABN Amro has released official statements [link to statement]. [Summarize their official response here: did they admit any wrongdoing? Did they cooperate with the investigation?]. The bank is reportedly undertaking a thorough internal review of its executive compensation practices and implementing corrective measures. This might involve significant changes to its bonus structure, enhancing risk management protocols, and strengthening corporate governance mechanisms.

- Summary of ABN Amro’s official statement: [Insert summary of the official statement released by ABN Amro]

- Details of any corrective actions taken or planned: [Insert details of any actions taken or planned by ABN Amro]

- Discussion of potential changes to their bonus structure: [Discuss anticipated changes to their bonus structure and how they intend to avoid similar issues in the future]

- Analysis of the long-term consequences for the bank: [Analyze the potential long-term effects on ABN Amro's operations, reputation, and financial health]

3. Conclusion:

The ABN Amro executive bonus controversy highlights the critical need for robust regulatory oversight and ethical corporate governance within the financial sector. The potential fine, coupled with the reputational damage, underscores the serious consequences of failing to comply with regulatory standards and maintain ethical executive compensation practices. The ongoing investigation and the uncertainty surrounding the final outcome make this a case to watch closely. The ultimate impact on ABN Amro, and indeed the wider banking industry, will depend on the final decision and the subsequent changes implemented. Stay informed about the developing situation surrounding the ABN Amro executive bonus controversy. Follow our website for updates on the potential fine and its implications. Continue to monitor the news for updates on the ABN Amro executive bonus case and its impact on the financial sector.

Featured Posts

-

Arda Gueler In Kariyeri Real Madrid In Yeni Teknik Direktoeruenuen Etkisi

May 22, 2025

Arda Gueler In Kariyeri Real Madrid In Yeni Teknik Direktoeruenuen Etkisi

May 22, 2025 -

Record Breaking Run Man Fastest To Cross Australia On Foot

May 22, 2025

Record Breaking Run Man Fastest To Cross Australia On Foot

May 22, 2025 -

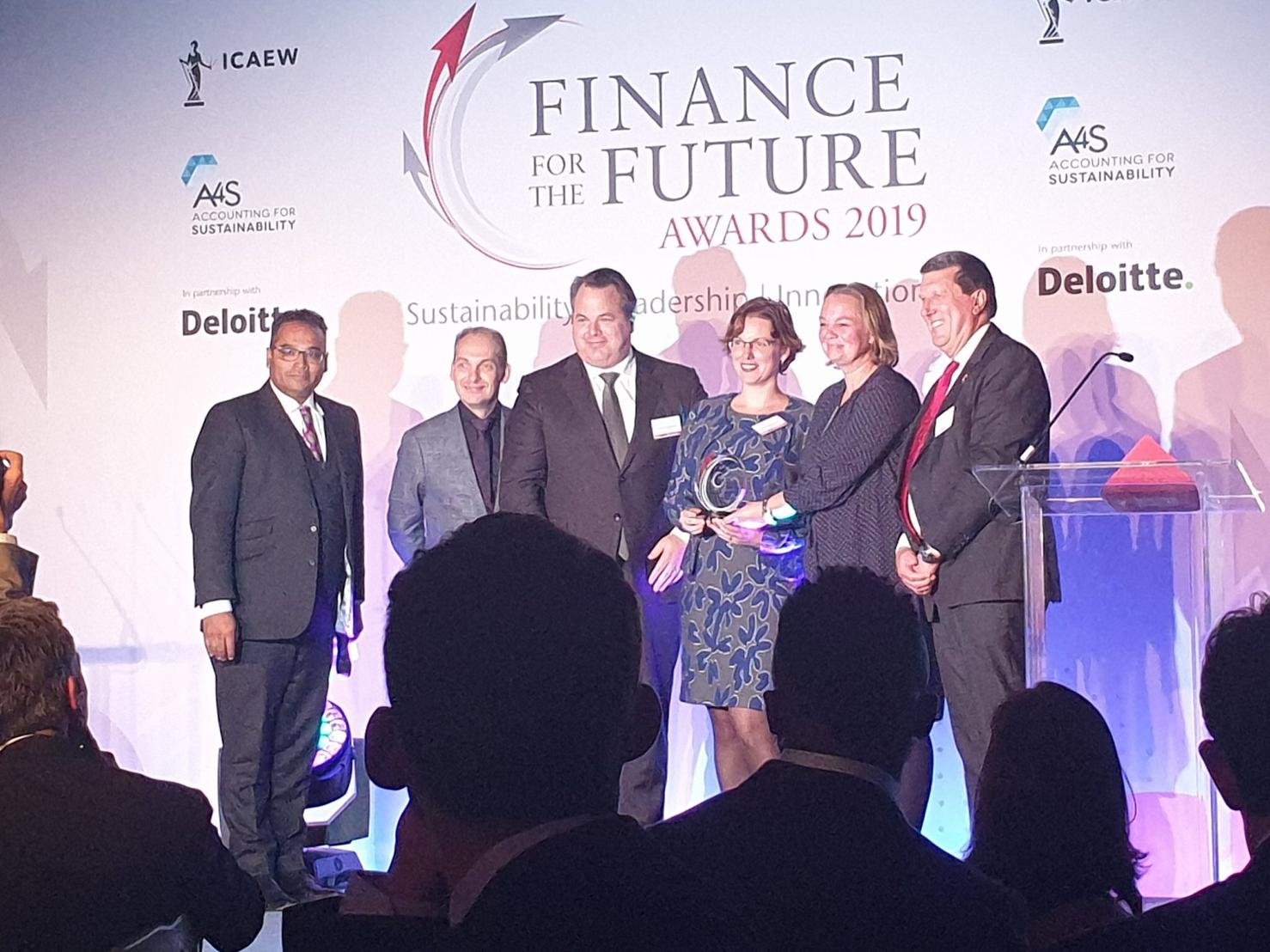

Abn Amro Zijn Nederlandse Huizen Wel Betaalbaar Een Geen Stijl Analyse

May 22, 2025

Abn Amro Zijn Nederlandse Huizen Wel Betaalbaar Een Geen Stijl Analyse

May 22, 2025 -

Trans Australia Run Challenging The Existing World Record

May 22, 2025

Trans Australia Run Challenging The Existing World Record

May 22, 2025 -

Rentedaling Abn Amro Verwacht Toch Stijging Huizenprijzen

May 22, 2025

Rentedaling Abn Amro Verwacht Toch Stijging Huizenprijzen

May 22, 2025

Latest Posts

-

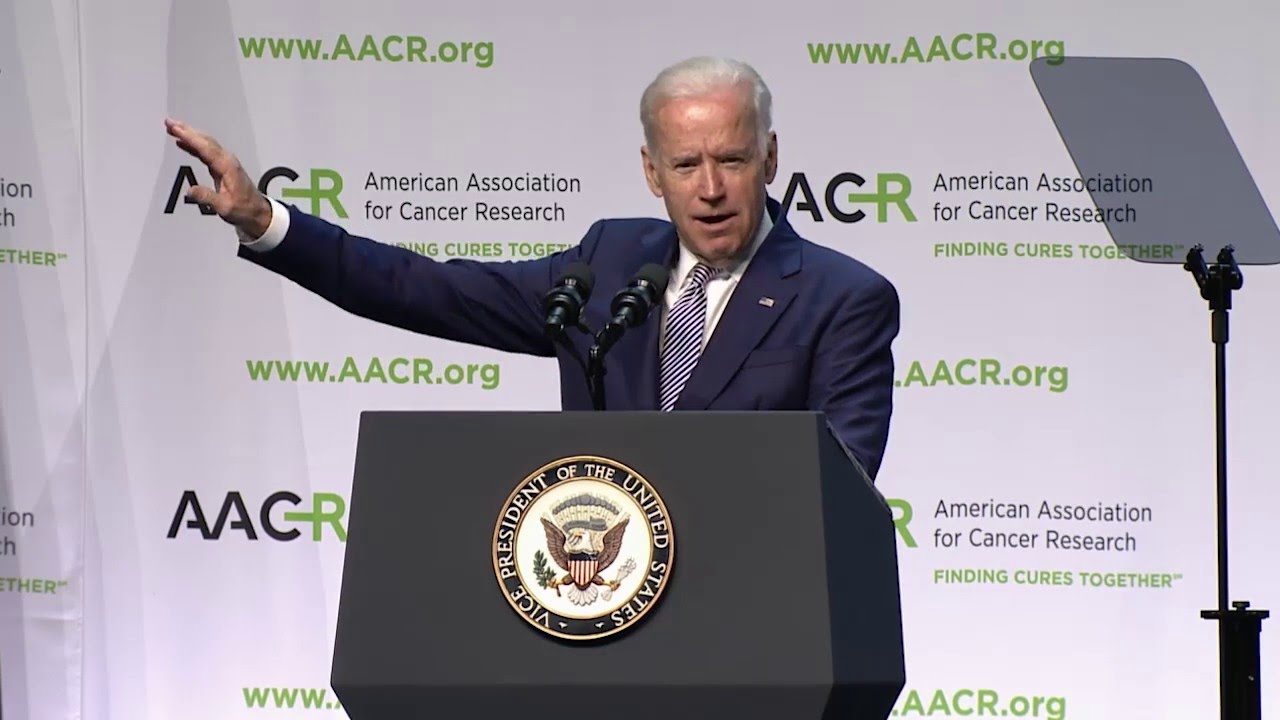

Update On President Bidens Prostate Cancer Screenings Last Check In 2014

May 22, 2025

Update On President Bidens Prostate Cancer Screenings Last Check In 2014

May 22, 2025 -

Bidens Prostate Cancer History A Look At His 2014 Screening

May 22, 2025

Bidens Prostate Cancer History A Look At His 2014 Screening

May 22, 2025 -

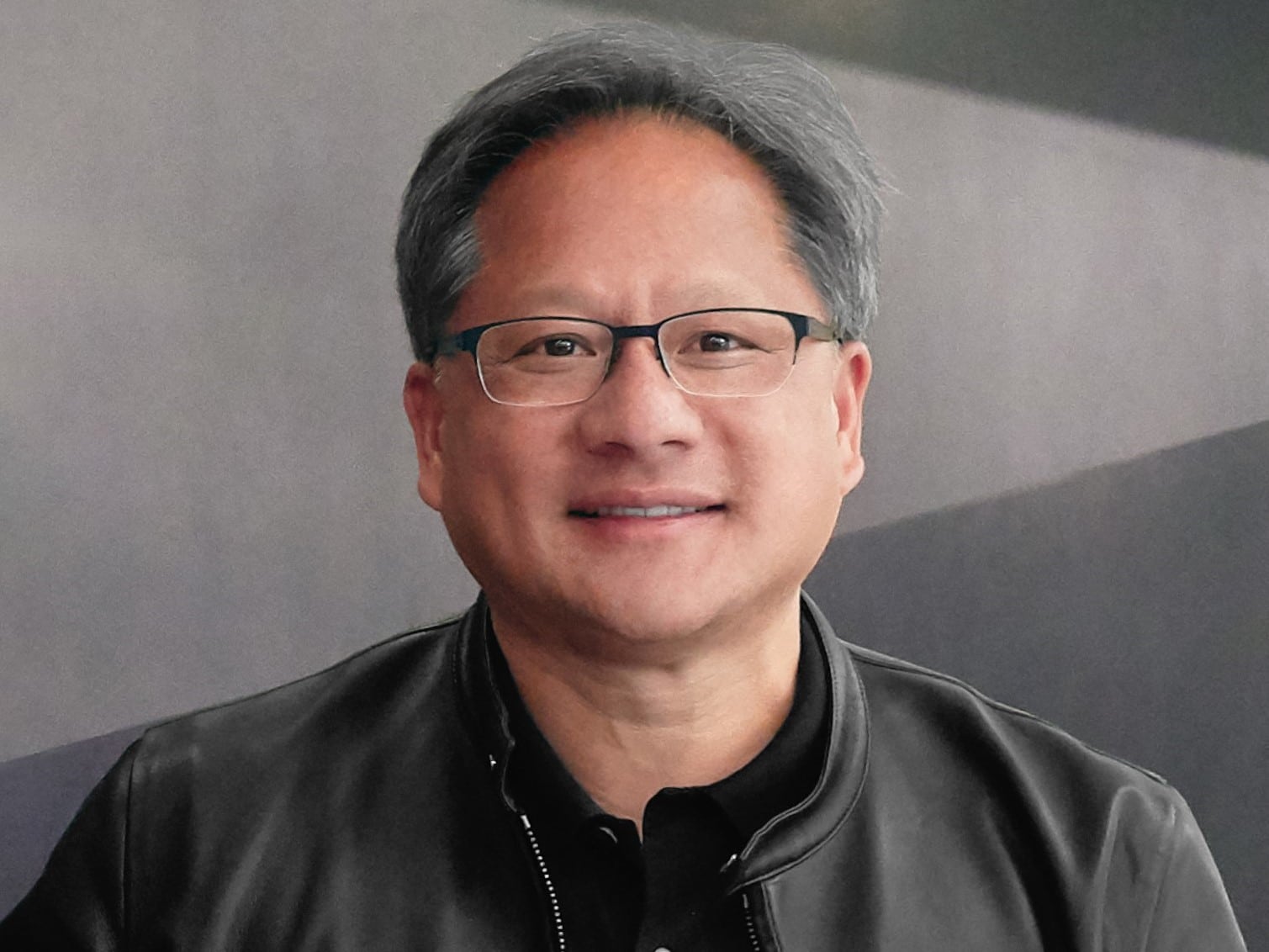

Analysis Nvidia Ceos View On Us Export Controls And Trumps Role

May 22, 2025

Analysis Nvidia Ceos View On Us Export Controls And Trumps Role

May 22, 2025 -

3 Financial Blunders Women Often Commit A Guide To Better Financial Health

May 22, 2025

3 Financial Blunders Women Often Commit A Guide To Better Financial Health

May 22, 2025 -

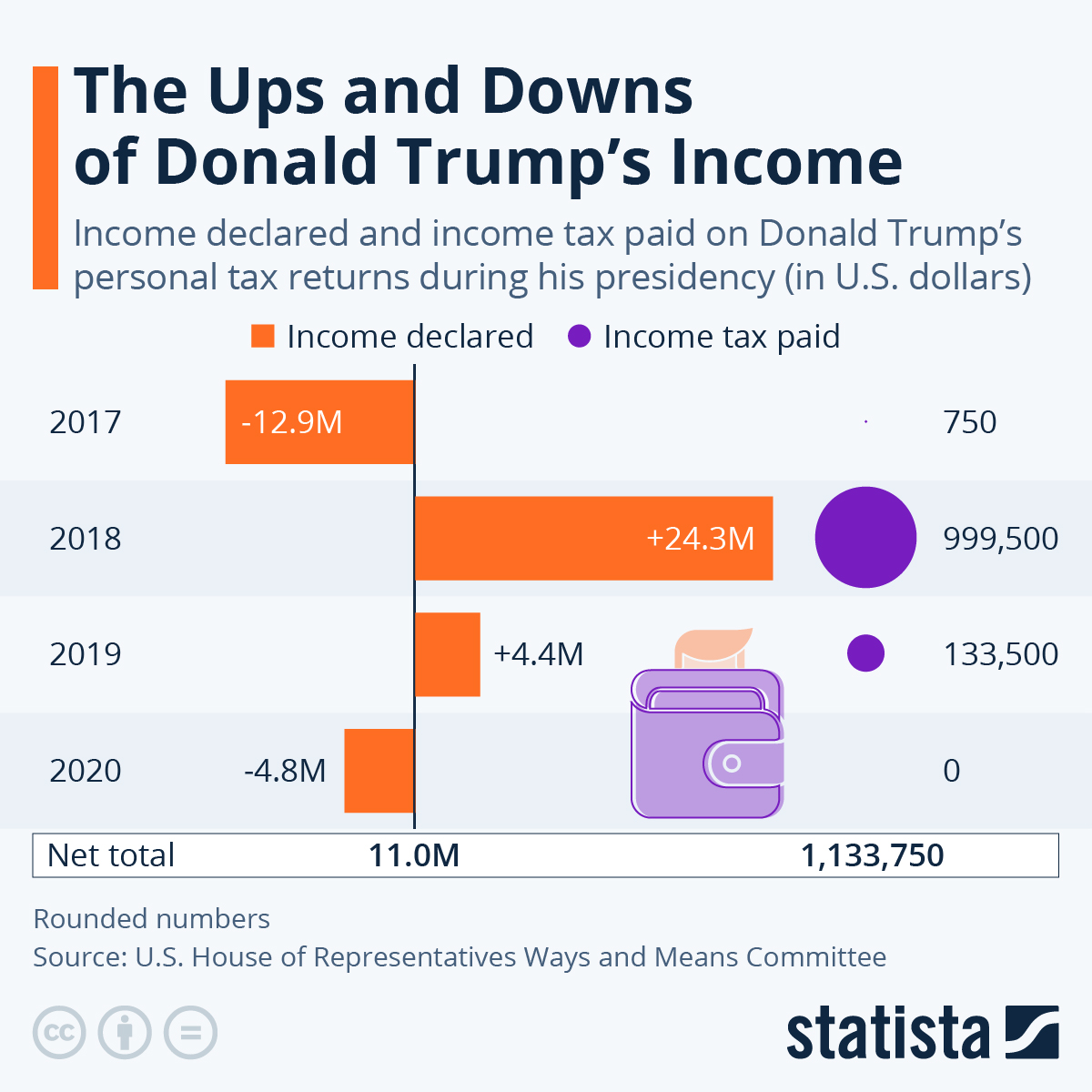

The Future Of Trumps Tax Plan A Divided Republican Party Weighs In

May 22, 2025

The Future Of Trumps Tax Plan A Divided Republican Party Weighs In

May 22, 2025