Rentedaling: ABN Amro Verwacht Toch Stijging Huizenprijzen

Table of Contents

Despite widespread predictions of rentedaling and a cooling housing market, a surprising forecast has emerged from ABN Amro, a major Dutch bank: they expect house prices to rise. This contradicts many current analyses suggesting a downturn in the rental and housing markets. This article will explore the factors contributing to ABN Amro's unexpected prediction and its implications for the Dutch housing market, examining what this means for both buyers and renters. We'll delve into the nuances of the current market and consider the potential future scenarios.

ABN Amro's Reasoning Behind the Upward Trend Prediction

ABN Amro's upward prediction for house prices rests on several key arguments. Their analysis points to a fundamental imbalance between supply and demand in the Dutch housing market.

-

Limited housing supply: The Netherlands faces a persistent and significant shortage of homes. Years of under-construction and insufficient new builds haven't kept pace with population growth and demand. This scarcity directly impacts pricing, pushing prices upward. The lack of available properties creates a highly competitive market, benefiting sellers.

-

Increased demand: Several factors fuel the high demand. Population growth, fueled by both natural increase and immigration, consistently increases the number of people seeking housing. Furthermore, the attractive economic climate in the Netherlands and its desirable lifestyle attract individuals and families, adding to the demand pressure.

-

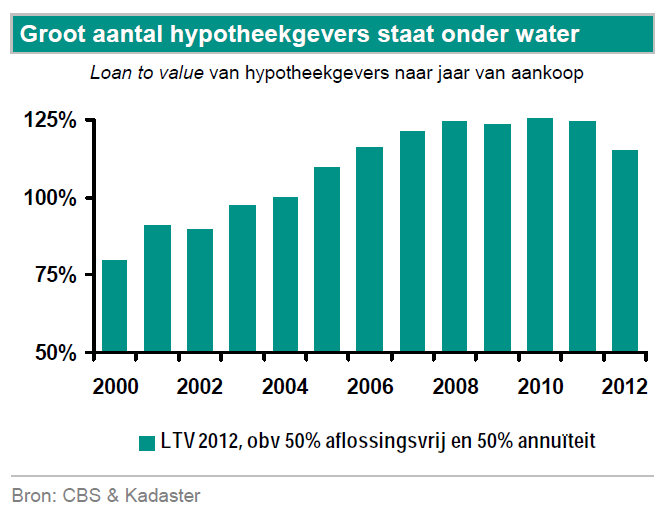

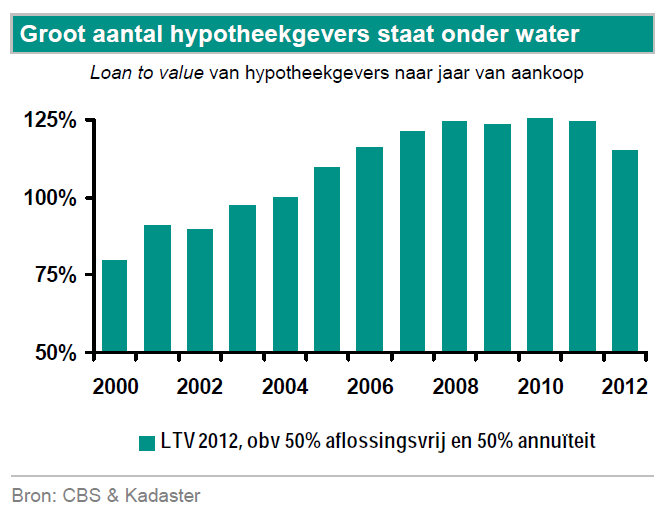

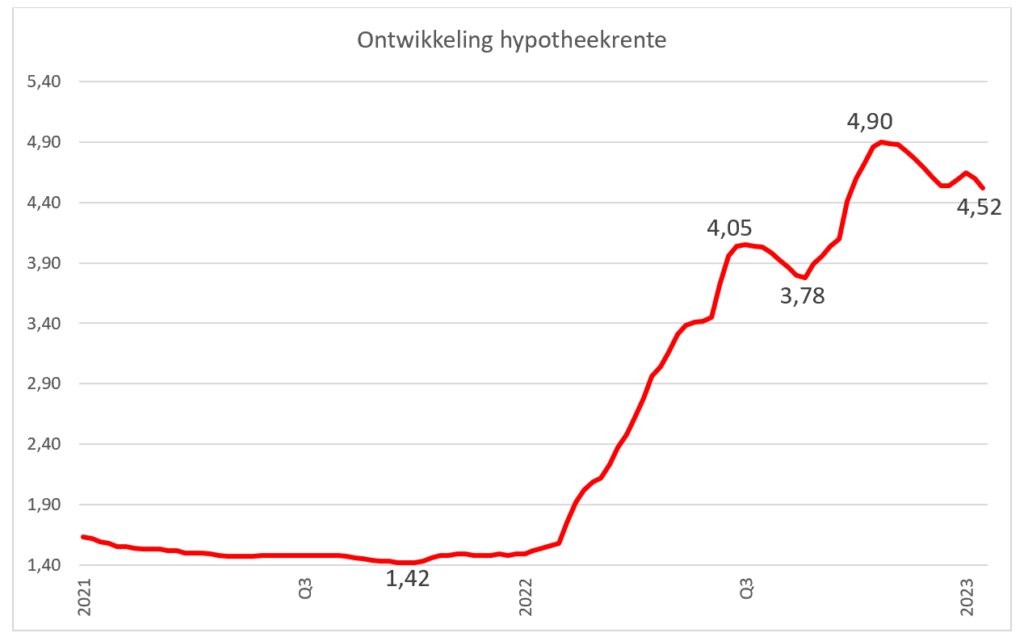

Low interest rates (historically): While interest rates have risen recently, they remain relatively low historically, making mortgages more affordable for many. This increased affordability, though lessened compared to previous years, continues to contribute to the demand for housing. However, the impact of rising interest rates on affordability will need further monitoring.

-

Government policies: Government policies, while aiming to increase housing supply, have not yet effectively addressed the shortage. Regulations and permitting processes can sometimes delay construction projects, further exacerbating the supply shortage and impacting the market.

-

Inflation and its effects: The current inflationary environment plays a crucial role. The rising cost of building materials and construction increases the cost of new homes, directly impacting the prices of existing properties. This inflationary pressure further contributes to upward price movement.

Contrasting Predictions and the Current State of Rentedaling

While ABN Amro predicts rising house prices, other institutions foresee a slowdown or even rentedaling. These differing predictions highlight the complexities of the market.

-

Conflicting forecasts: Many experts believe the market is cooling down, citing increased interest rates and reduced buyer confidence. Some predict a significant correction in house prices, reflecting a potential rentedaling scenario.

-

Comparing predictions: The key difference lies in the weighting of various factors. While other institutions emphasize the impact of rising interest rates, ABN Amro highlights the persistent imbalance between supply and demand.

-

Evidence for both viewpoints: Data on recent sales figures provides a mixed picture. While transaction volumes might have decreased, prices haven't fallen significantly in many areas. Rental prices, however, show signs of stabilization or slight decreases in some regions, suggesting a potential for rentedaling in certain segments of the market.

-

Market activity: Analyzing market activity, including the number of properties listed for sale and the time they spend on the market, provides valuable insight into the current trends.

Implications for Buyers and Renters

The potential rise in house prices has significant consequences for both buyers and renters.

-

Challenges for first-time buyers: Rising prices make homeownership increasingly challenging for first-time buyers. Competition is fierce, requiring larger down payments and potentially higher mortgage payments.

-

Rental market pressures: While some regions might experience rentedaling, upward pressure on house prices can indirectly lead to increased rental costs in the long run, as landlords adjust their prices to reflect higher property values.

-

Investment opportunities: For investors, the potential rise in house prices presents opportunities, though risks are involved. Careful analysis of market trends and location-specific factors is crucial for successful investment strategies.

-

Advice for navigating the market: Both buyers and renters need to carefully assess their financial situation, seek professional advice (mortgage advisors, real estate agents), and monitor market trends closely before making any significant decisions.

Long-Term Outlook and Future Predictions for the Dutch Housing Market

The long-term outlook for the Dutch housing market remains uncertain. ABN Amro's prediction, while surprising, adds another layer to the ongoing debate.

-

Sustainable growth or a bubble?: The question of sustainable growth versus a potential housing bubble is paramount. The current imbalance between supply and demand raises concerns about a potential bubble, but long-term sustainable growth is also possible with sufficient government intervention and increased housing supply.

-

Government intervention possibilities: Government intervention, including policies to incentivize construction and streamline building permits, is crucial to address the housing shortage and create a more balanced market.

-

Predictions for rental prices: Rental prices are expected to remain relatively stable or potentially see slight increases in areas with high demand and limited supply.

-

Future of rentedaling: While rentedaling might occur in specific segments of the market, the overall trend predicted by ABN Amro suggests a less dramatic downturn than some initially predicted.

Conclusion

While many predicted rentedaling, ABN Amro's forecast of rising house prices offers a compelling alternative perspective on the Dutch housing market. Limited housing supply, strong demand, and various economic factors contribute to this prediction. Understanding these interwoven factors is essential for navigating the complexities of the Dutch housing market.

Call to Action: Stay informed about the ever-evolving Dutch housing market and the ongoing debate surrounding rentedaling. Continue following our updates for insightful analysis and expert commentary on the future of house prices in the Netherlands. Learn more about the implications of ABN Amro's prediction and how it might affect your own housing plans. Understanding the nuances of rentedaling and the potential for rising house prices is key to making informed decisions in this dynamic market.

Featured Posts

-

Stijgende Huizenprijzen Abn Amros Verwachting Ondanks Economische Onzekerheid

May 22, 2025

Stijgende Huizenprijzen Abn Amros Verwachting Ondanks Economische Onzekerheid

May 22, 2025 -

The Pilbara Debate Rio Tinto Counters Forrests Wasteland Claims

May 22, 2025

The Pilbara Debate Rio Tinto Counters Forrests Wasteland Claims

May 22, 2025 -

Bilateral Discussions Switzerland And China Seek Tariff Solutions

May 22, 2025

Bilateral Discussions Switzerland And China Seek Tariff Solutions

May 22, 2025 -

Screen Free Week For Kids Strategies For Success

May 22, 2025

Screen Free Week For Kids Strategies For Success

May 22, 2025 -

Cybersecurity Failure Costs Marks And Spencer 300 Million

May 22, 2025

Cybersecurity Failure Costs Marks And Spencer 300 Million

May 22, 2025

Latest Posts

-

Home Depot Disappointing Earnings Despite Tariff Guidance Confirmation

May 22, 2025

Home Depot Disappointing Earnings Despite Tariff Guidance Confirmation

May 22, 2025 -

The Man Behind United Healths Rise Facing The Challenge Of Restructuring A Healthcare Giant

May 22, 2025

The Man Behind United Healths Rise Facing The Challenge Of Restructuring A Healthcare Giant

May 22, 2025 -

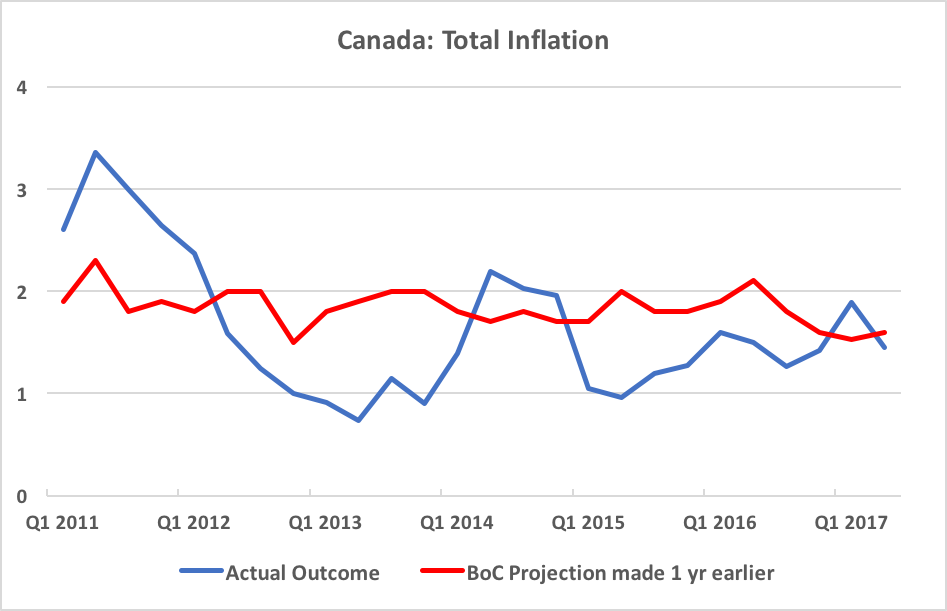

The Bank Of Canadas Inflation Challenge A Balancing Act

May 22, 2025

The Bank Of Canadas Inflation Challenge A Balancing Act

May 22, 2025 -

Home Depots Q Quarter Report Lower Than Expected Results Tariff Outlook Unchanged

May 22, 2025

Home Depots Q Quarter Report Lower Than Expected Results Tariff Outlook Unchanged

May 22, 2025 -

Bank Of Canada Navigating The Tightrope Of Inflation Control

May 22, 2025

Bank Of Canada Navigating The Tightrope Of Inflation Control

May 22, 2025