Network18 Media & Investments Share Price Today (21 Apr 2025): Live NSE/BSE Rates, Analysis & Forecasts

Table of Contents

Network18 Media & Investments Share Price: Live NSE/BSE Rates (as of 21 Apr 2025)

(Note: This section would be dynamically updated with live data from NSE and BSE. The following is placeholder information.)

- NSE Live Share Price: ₹XXX.XX

- BSE Live Share Price: ₹XXX.XX

- Previous Day's Closing Price (NSE): ₹YYY.YY

- Percentage Change (NSE): +X.XX% / -X.XX%

- Percentage Change (BSE): +X.XX% / -X.XX%

Disclaimer: The share price information provided above is subject to change and is for informational purposes only. This data is a snapshot in time and may not reflect the current market conditions. Consult your financial advisor before making any investment decisions.

In-depth Analysis of Network18 Media & Investments Performance

This section provides a detailed analysis of Network18 Media & Investments' recent performance, incorporating recent news, financial indicators, and a brief technical overview.

Recent News and Events Impacting the Stock Price:

- Q4 2024 Earnings Report: (Insert summary of the Q4 earnings report, highlighting key revenue figures, profit margins, and any significant announcements.) This announcement significantly impacted investor sentiment, leading to [positive/negative] market reaction.

- New Partnerships/Acquisitions: (Discuss any recent partnerships or acquisitions that may influence the company's future growth and stock price.) The strategic partnership with [Partner Name] is expected to [positively/negatively] impact revenue streams in the coming quarters.

- Industry Trends: (Analyze relevant trends in the media sector, such as the growth of digital media, changing advertising landscapes, and competitive pressures.) The increasing adoption of digital platforms presents both opportunities and challenges for Network18 Media & Investments, necessitating strategic adaptations.

Financial Performance Indicators:

- Revenue Growth: (Analyze the company's revenue growth over the past few quarters or years. Compare this growth to industry benchmarks.) Revenue growth has [increased/decreased] by X% compared to the previous year, indicating [positive/negative] momentum.

- Profit Margins: (Examine the company's profit margins, highlighting any trends or anomalies.) Profit margins have been [stable/increasing/decreasing] due to [reasons].

- Debt Levels: (Discuss the company's debt levels and their potential impact on future performance.) Network18 Media & Investments' debt-to-equity ratio is currently at [X], which [is a cause for concern/is within acceptable limits].

Technical Analysis of the Stock:

(Optional: If appropriate, include a brief, non-technical description of the stock's chart performance, mentioning support and resistance levels, trends, and any significant indicators.) A brief look at the stock's chart suggests [upward/downward] trend, with support levels around ₹Z and resistance at ₹W. However, this is a simplified overview and should not be solely relied upon for investment decisions.

Network18 Media & Investments Share Price Forecast (21 Apr 2025 and Beyond)

Predicting future stock prices is inherently uncertain. However, based on our analysis of Network18 Media & Investments' performance, recent news, and market trends, we offer a cautious outlook.

- Short-Term Forecast (Next 3 Months): We anticipate a [stable/moderate increase/moderate decrease] in the share price, contingent on [specific factors, e.g., successful execution of new strategies, overall market conditions].

- Long-Term Forecast (Next 12 Months): The long-term prospects appear [positive/cautiously optimistic/uncertain] depending on [specific factors, e.g., the company's ability to adapt to the changing media landscape, macroeconomic conditions].

Limitations: This forecast is subject to significant uncertainty and should not be considered financial advice. Numerous unforeseen events could significantly impact the actual share price performance.

Conclusion

Network18 Media & Investments' share price performance reflects the complex interplay of internal company performance and broader market conditions. While our analysis offers insights into the current situation and potential future trends, it’s crucial to remember that investing in the stock market always involves risk. Thorough research and professional financial advice are essential before making any investment decisions. Stay informed about the latest Network18 Media & Investments share price and market trends. Check back regularly for updated live NSE/BSE rates and analysis!

Featured Posts

-

Tam Krwz Ke Jwte Pr Chrhne Waly Mdah Ka Waqeh Wayrl

May 17, 2025

Tam Krwz Ke Jwte Pr Chrhne Waly Mdah Ka Waqeh Wayrl

May 17, 2025 -

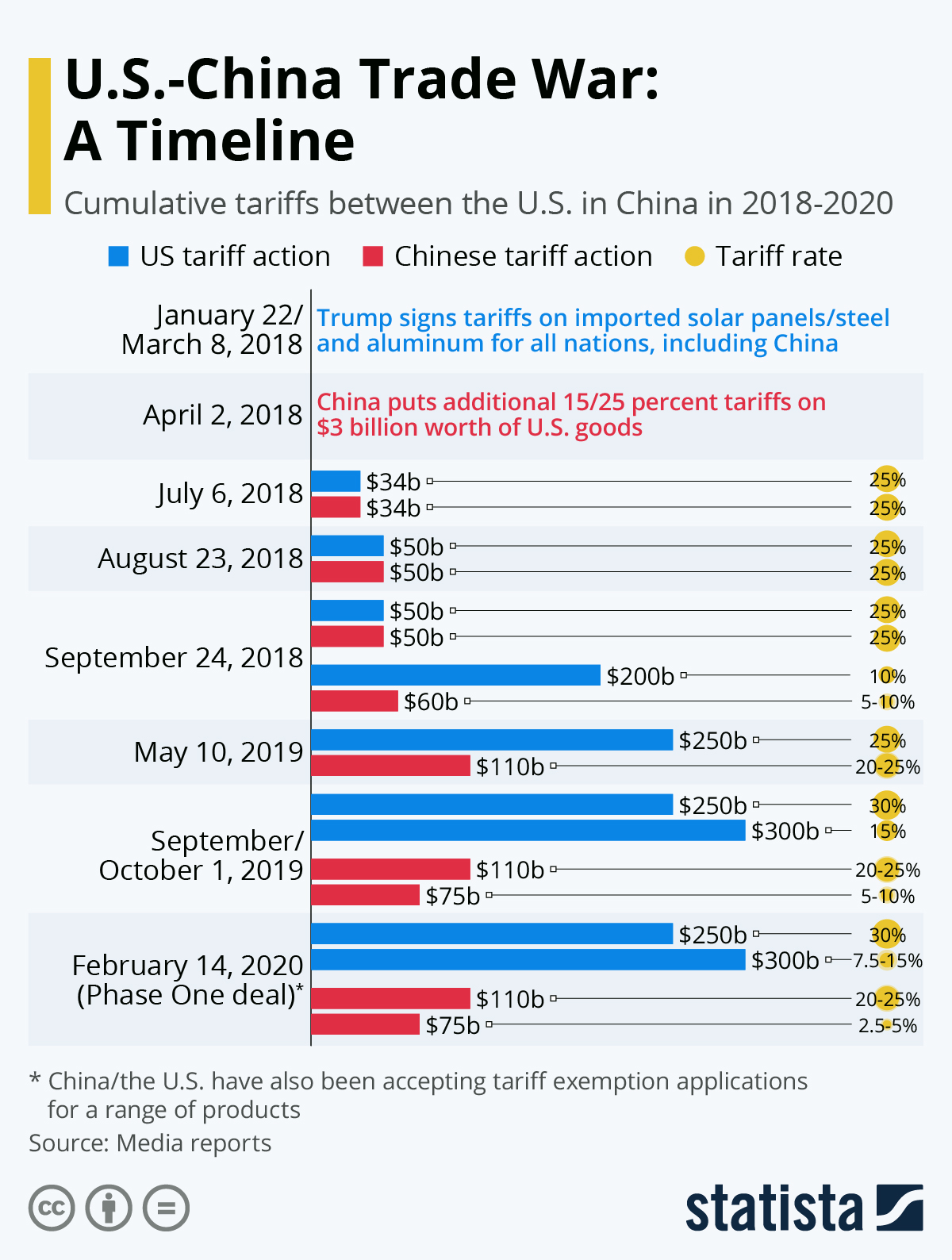

Trumps 30 Tariffs On China An Extended Forecast Through 2025

May 17, 2025

Trumps 30 Tariffs On China An Extended Forecast Through 2025

May 17, 2025 -

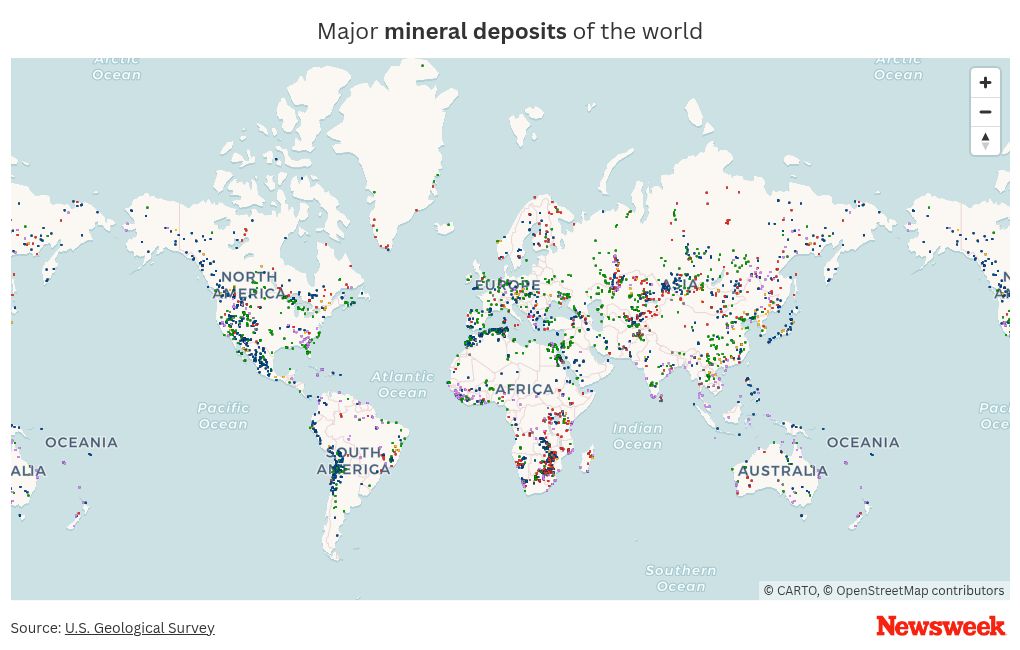

A New Cold War The Rare Earth Minerals Struggle

May 17, 2025

A New Cold War The Rare Earth Minerals Struggle

May 17, 2025 -

Analysis The Impact Of The Nbas No Call On The Pistons In Game 4

May 17, 2025

Analysis The Impact Of The Nbas No Call On The Pistons In Game 4

May 17, 2025 -

Trumps Vip Military Events Exclusive Access For Donors Revealed

May 17, 2025

Trumps Vip Military Events Exclusive Access For Donors Revealed

May 17, 2025

Latest Posts

-

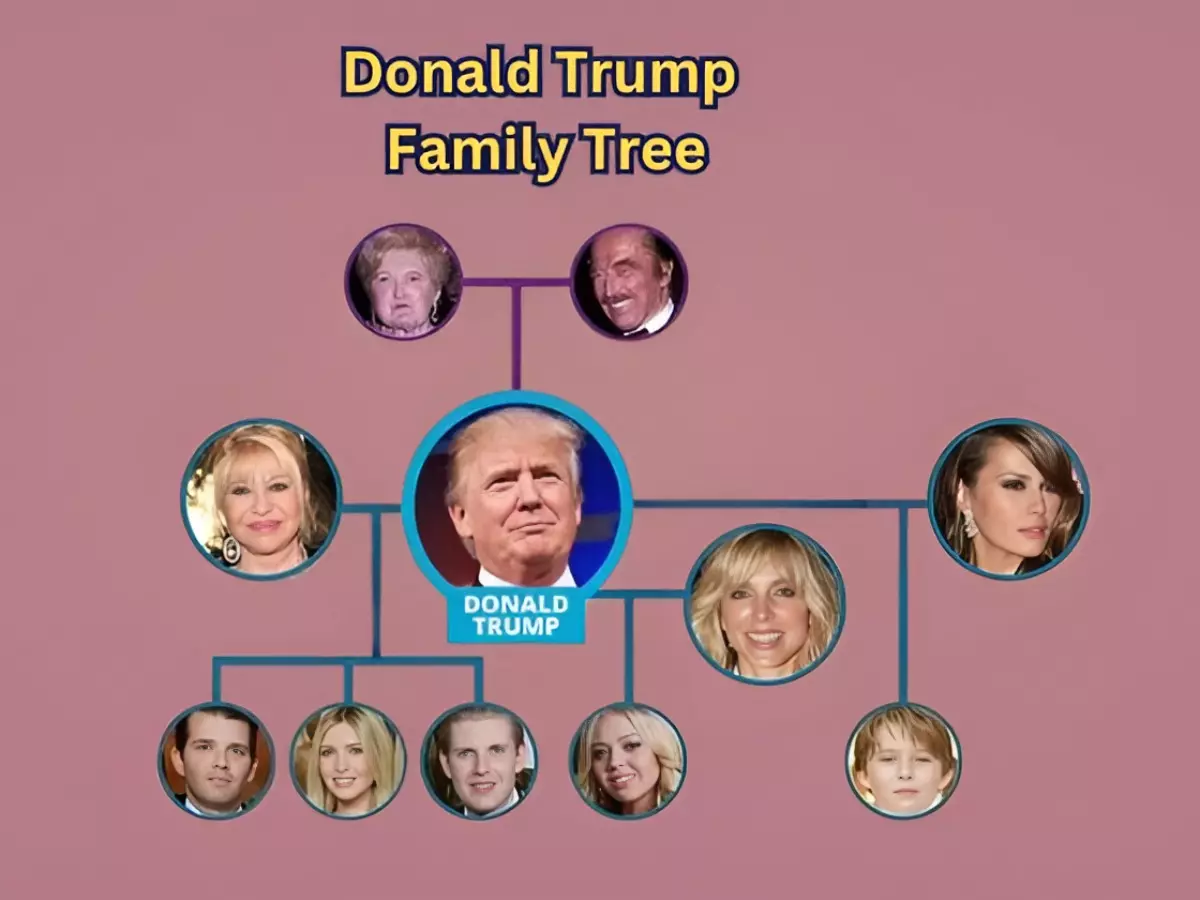

Donald Trump Family Tree Update Tiffany And Michaels Son Alexander

May 17, 2025

Donald Trump Family Tree Update Tiffany And Michaels Son Alexander

May 17, 2025 -

A Look At The Trump Family Tree New Addition Alexander Arrives

May 17, 2025

A Look At The Trump Family Tree New Addition Alexander Arrives

May 17, 2025 -

Tiffany Trump And Michael Boulos Welcome First Child Expanding The Trump Family Tree

May 17, 2025

Tiffany Trump And Michael Boulos Welcome First Child Expanding The Trump Family Tree

May 17, 2025 -

Donald Trumps Family Tree Grows Tiffany And Michaels Baby Alexander

May 17, 2025

Donald Trumps Family Tree Grows Tiffany And Michaels Baby Alexander

May 17, 2025 -

Donald Trump And The Politics Of Sexual Misconduct An Examination Of Multiple Affairs And Their Impact

May 17, 2025

Donald Trump And The Politics Of Sexual Misconduct An Examination Of Multiple Affairs And Their Impact

May 17, 2025