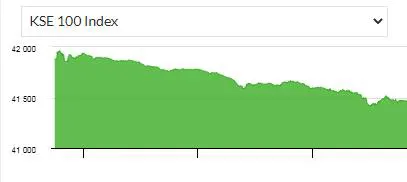

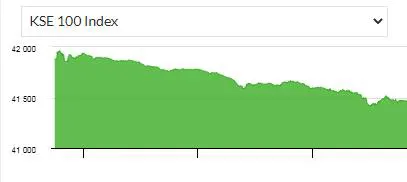

Pakistan's Stock Market Volatility Causes Exchange Portal Shutdown

Table of Contents

Causes of Pakistan's Stock Market Volatility

Several interconnected factors contribute to the significant volatility observed in Pakistan's stock market. Understanding these underlying causes is crucial for investors and policymakers alike.

Political Instability and Economic Uncertainty

Political events and policy changes profoundly influence investor sentiment. Recent political instability in Pakistan, characterized by [mention specific recent examples, e.g., changes in government, political protests, etc.], has created a climate of uncertainty. This uncertainty directly impacts investor confidence, leading to market fluctuations.

- Changes in government policy: Frequent shifts in economic policy create unpredictability for businesses and investors.

- Geopolitical tensions impacting Pakistan: Regional conflicts and international relations significantly impact investor perception of risk.

- Uncertainty regarding foreign investment: Political instability discourages foreign direct investment, a crucial component for economic growth and stock market stability.

Inflation and Currency Devaluation

High inflation and a depreciating Pakistani Rupee are major contributors to stock market volatility. Recent data shows inflation rates at [insert recent inflation data] and the Pakistani Rupee experiencing devaluation against major currencies like the US dollar. This economic instability erodes purchasing power and increases the cost of imports, impacting businesses and consumer confidence, which in turn affects stock prices.

- Reduced purchasing power impacting consumer spending: High inflation reduces disposable income, leading to decreased consumer spending and impacting company profitability.

- Increased cost of imports affecting businesses: A weaker Rupee makes imports more expensive, increasing production costs and reducing profit margins for many businesses.

- Erosion of investor confidence leading to sell-offs: Fear of further economic decline prompts investors to sell their holdings, exacerbating market volatility.

Global Economic Headwinds

Pakistan's stock market is not immune to global economic forces. Rising interest rates in developed economies, fears of a global recession, and geopolitical risks all exert pressure on the PSX. These external factors influence investor behavior, leading to capital flight and market fluctuations.

- Global inflation and interest rate hikes: Higher interest rates in developed countries often attract foreign investment away from emerging markets like Pakistan.

- Geopolitical risks and international conflicts: Global instability creates uncertainty, impacting investor sentiment across borders, including in Pakistan.

- Slowdown in global economic growth: A global economic slowdown reduces demand for Pakistani exports and affects overall economic performance.

The Impact of the Exchange Portal Shutdown

The recent shutdown of the exchange portal had several significant consequences, further undermining investor confidence and disrupting market activities.

Disruption to Trading Activities

The shutdown prevented investors from accessing the market, resulting in missed trading opportunities and potential financial losses. The duration of the shutdown [insert duration] amplified these impacts.

- Missed trading opportunities: Investors were unable to capitalize on potential market gains or mitigate losses during the shutdown period.

- Inability to buy or sell shares: This created significant inconvenience and potentially forced investors into unfavorable positions.

- Potential losses for investors: The inability to react to market changes during the shutdown period may have resulted in substantial financial losses for some investors.

Damage to Investor Confidence

The shutdown, coupled with existing market volatility, severely damaged investor confidence in the PSX. This erosion of trust could have long-term consequences, potentially deterring both domestic and foreign investment.

- Reduced trust in the market's stability: The event raised questions about the reliability and resilience of the Pakistani stock market infrastructure.

- Hesitation from potential investors: The incident could discourage potential investors from entering the market, hindering growth and development.

- Capital flight from the PSX: Investors might move their capital to perceived safer markets, further destabilizing the PSX.

Government Response and Future Outlook

The Pakistani government [describe the government's response to the volatility and shutdown, including any measures taken to stabilize the market]. The future outlook for the PSX depends largely on the effectiveness of these measures and the ability to address the underlying causes of volatility. [Mention any planned reforms or regulatory changes].

Conclusion: Navigating the Volatility of Pakistan's Stock Market

Pakistan's stock market volatility, culminating in the recent exchange portal shutdown, is a result of a complex interplay of political, economic, and global factors. Understanding these interconnected forces is crucial for investors seeking to navigate this challenging market. The incident highlights the importance of carefully assessing risks, diversifying portfolios, and staying informed about developments in the PSX. Before making any investment decisions related to Pakistan Stock Exchange volatility, seek professional financial advice to understand the risks and opportunities within the Pakistan stock market.

Featured Posts

-

Ashhr Laeby Krt Alqdm Aldhyn Kanwa Mdkhnyn

May 09, 2025

Ashhr Laeby Krt Alqdm Aldhyn Kanwa Mdkhnyn

May 09, 2025 -

Analyzing The Net Worth Changes Of Elon Musk Jeff Bezos And Mark Zuckerberg Since Donald Trumps Presidency

May 09, 2025

Analyzing The Net Worth Changes Of Elon Musk Jeff Bezos And Mark Zuckerberg Since Donald Trumps Presidency

May 09, 2025 -

Bayern Munich Vs Eintracht Frankfurt Match Preview And Prediction

May 09, 2025

Bayern Munich Vs Eintracht Frankfurt Match Preview And Prediction

May 09, 2025 -

Is Palantir Stock A Good Investment In 2024

May 09, 2025

Is Palantir Stock A Good Investment In 2024

May 09, 2025 -

Wall Streets 110 Prediction Why Billionaires Are Investing In This Black Rock Etf

May 09, 2025

Wall Streets 110 Prediction Why Billionaires Are Investing In This Black Rock Etf

May 09, 2025