Potential Changes To Tariffs On Chinese Goods: A G-7 Perspective

Table of Contents

The G7 nations are grappling with significant economic challenges, and a key aspect involves the complex web of international trade, specifically concerning tariffs on Chinese goods. Recent geopolitical shifts and evolving economic strategies have prompted discussions regarding potential changes to these tariffs, leading to considerable uncertainty for businesses and consumers alike. This article examines the potential ramifications of these tariff adjustments from a G7 perspective, considering the diverse economic interests and political considerations at play. Understanding the potential shifts in tariffs on Chinese goods is crucial for navigating the evolving global economic landscape.

H2: The Current State of Tariffs on Chinese Goods:

The current tariff landscape on Chinese goods within the G7 is a patchwork of varying rates and policies reflecting the culmination of years of trade negotiations, disputes, and evolving geopolitical tensions. The legacy of the US-China trade war, initiated in 2018, continues to cast a long shadow, impacting not only bilateral relations but also the global trading system.

- Bullet Points:

- Overview of the US-China trade war and its lingering effects: The trade war, characterized by reciprocal tariff increases on hundreds of billions of dollars worth of goods, significantly disrupted global supply chains and led to increased costs for businesses and consumers. While some tariffs have been reduced, many remain in place, creating ongoing uncertainty.

- Existing tariff rates imposed by different G7 countries: Tariff rates vary widely across G7 members. The US, for instance, maintains significant tariffs on certain Chinese goods, while other nations like Canada and Japan have adopted more nuanced approaches. These differences reflect varying national priorities and trade relationships.

- Sector-specific tariffs (e.g., technology, agriculture): Tariffs are often targeted at specific sectors deemed strategically important. Technology, particularly semiconductors and telecommunications equipment, has been a focal point of tariff disputes, reflecting concerns about intellectual property rights and national security. Agricultural products have also been subject to significant tariff changes.

- Impact of tariffs on consumer prices in G7 nations: Tariffs on Chinese goods ultimately contribute to increased costs for consumers in G7 nations, as these tariffs are frequently passed onto the end consumer through higher prices. This has exacerbated inflationary pressures in recent years.

H2: Factors Driving Potential Tariff Changes:

Several interconnected factors are driving the current discussions about potential changes to tariffs on Chinese goods from a G7 perspective:

- Bullet Points:

- Geopolitical tensions and national security concerns: Growing geopolitical tensions between the G7 and China, particularly surrounding issues like Taiwan, human rights, and cybersecurity, are driving a reassessment of economic reliance on China. National security concerns are prompting calls for greater diversification of supply chains and reduced reliance on Chinese manufacturing.

- Concerns over unfair trade practices and intellectual property theft: Concerns persist regarding China's trade practices, including allegations of intellectual property theft, forced technology transfer, and state-sponsored industrial subsidies. These concerns fuel calls for continued or even increased tariffs as a means of addressing these issues.

- Supply chain resilience and diversification strategies: The COVID-19 pandemic exposed vulnerabilities in global supply chains heavily reliant on China. G7 nations are now actively pursuing strategies to diversify their supply chains and reduce their dependence on Chinese manufacturing, influencing their approach to tariffs.

- Inflationary pressures and the need for cost reduction: High inflation rates in many G7 countries are creating pressure to reduce import costs. The debate around tariffs involves weighing the cost of protectionism against the potential for lower consumer prices through unrestricted trade.

- Pressure from domestic industries for protection: Domestic industries in G7 countries often lobby for increased protection from foreign competition, including calls for higher tariffs on Chinese imports to safeguard jobs and market share.

H3: The Role of the G7 in Shaping Tariff Policy:

The G7 plays a significant role in shaping the global trade agenda, including its approach to tariffs on Chinese goods. However, the G7 is not a monolithic entity; differing national interests and political priorities often lead to diverse approaches to trade policy:

- Bullet Points:

- Potential for coordinated tariff adjustments among G7 members: While there's potential for coordinated action, achieving consensus among G7 members on tariff policy concerning China remains a challenge due to diverging economic interests and political considerations.

- Differing national interests within the G7 regarding trade with China: Some G7 members have stronger economic ties with China and might be less inclined to implement aggressive tariff policies compared to others with less economic interdependence.

- The influence of the WTO and other international trade agreements: The WTO framework and existing trade agreements constrain the scope of unilateral tariff actions by G7 members, influencing the manner in which tariff adjustments are pursued.

- The role of bilateral trade agreements in shaping tariff policies: Bilateral trade agreements between individual G7 members and China can influence the overall tariff landscape, adding layers of complexity to the collective G7 approach.

H2: Economic Implications of Tariff Changes:

Adjusting tariffs on Chinese goods carries significant economic implications, both positive and negative:

- Bullet Points:

- Impact on consumer prices in G7 countries: Increased tariffs generally lead to higher consumer prices, potentially exacerbating inflation and reducing consumer purchasing power. Conversely, reducing tariffs could lead to lower prices.

- Effects on businesses reliant on Chinese imports: Businesses heavily reliant on Chinese imports face increased costs with higher tariffs, potentially impacting profitability and competitiveness. Reductions in tariffs could offer relief.

- Potential for trade diversion and the impact on other trading partners: Changes in tariffs on Chinese goods could lead to trade diversion, as businesses shift sourcing to other countries, impacting their economies.

- Growth implications for the global economy: Significant changes to tariffs could negatively impact global economic growth by disrupting supply chains and reducing overall trade volume.

- Potential impact on inflation in G7 nations: Tariffs act as an inflationary pressure; increased tariffs raise prices while reduced tariffs have the potential to ease inflationary pressures.

H2: Potential Future Scenarios and their Impacts:

Several scenarios regarding future tariff adjustments on Chinese goods are plausible:

- Bullet Points:

- Scenario 1: Increased tariffs across the board: A broad-based increase in tariffs would likely lead to increased costs for consumers, reduced trade volumes, and greater economic uncertainty.

- Scenario 2: Targeted tariffs on specific sectors: Targeted tariffs on specific sectors (e.g., technology) would have more localized impacts, affecting particular industries and supply chains more significantly.

- Scenario 3: Negotiation and reduction of existing tariffs: Negotiations could lead to a reduction or removal of some tariffs, potentially boosting trade and reducing prices.

- Scenario 4: A complete decoupling from China: A complete decoupling is unlikely in the short term but would entail significant economic restructuring and potential disruptions across various sectors.

- Analysis of the potential outcomes of each scenario on the global economy and G7 member states: Each scenario carries distinct consequences for global economic growth, inflation rates, and the competitive landscape within specific sectors. Careful analysis is required to evaluate the potential implications of each scenario.

Conclusion:

The potential changes to tariffs on Chinese goods are a complex issue with far-reaching economic and geopolitical ramifications. The G7’s response will be pivotal in shaping the future of global trade. Understanding the factors driving potential changes, their economic implications, and possible future scenarios is crucial for businesses and policymakers alike. Careful consideration of the interconnectedness of global trade and the potential for both positive and negative consequences is paramount. Stay informed on further developments regarding tariffs on Chinese goods and the G7’s ongoing response to ensure your business can effectively navigate these uncertain times. Monitoring the official statements and actions of the G7 nations regarding China trade policy and tariff adjustments is essential for informed decision-making.

Featured Posts

-

Kapitaalmarktrentes Stijgen Verder Impact Op De Euro En De Markt

May 25, 2025

Kapitaalmarktrentes Stijgen Verder Impact Op De Euro En De Markt

May 25, 2025 -

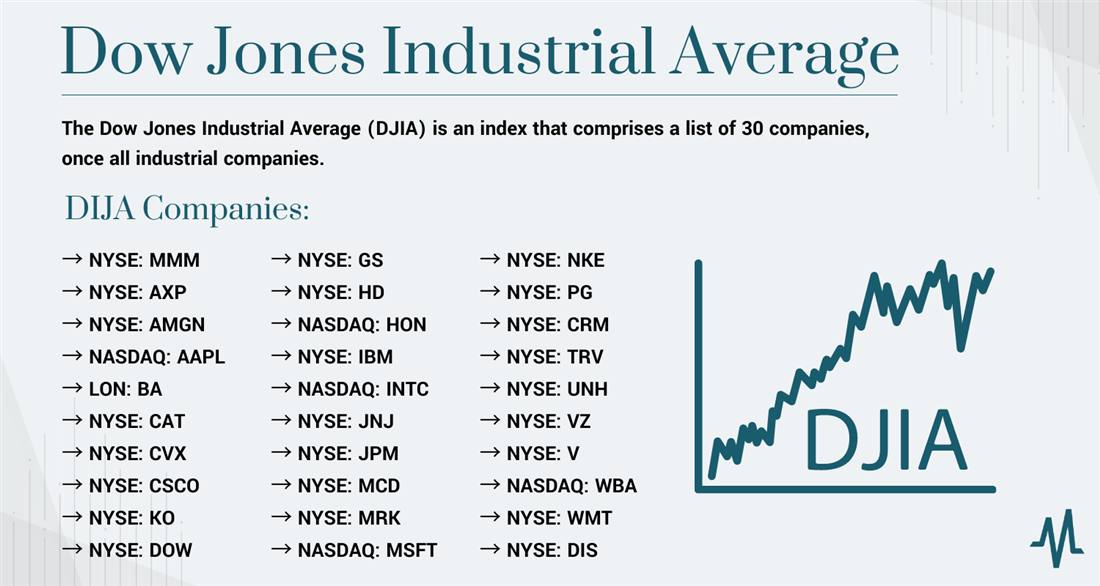

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 25, 2025

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 25, 2025 -

The Unrealized M62 Relief Road A History Of Burys Bypassed Bypass

May 25, 2025

The Unrealized M62 Relief Road A History Of Burys Bypassed Bypass

May 25, 2025 -

Naujas Porsche Elektromobiliu Ikrovimo Centras Europoje

May 25, 2025

Naujas Porsche Elektromobiliu Ikrovimo Centras Europoje

May 25, 2025 -

Intimacy Growth And The Making Of Her In Deep An Interview With Matt Maltese

May 25, 2025

Intimacy Growth And The Making Of Her In Deep An Interview With Matt Maltese

May 25, 2025

Latest Posts

-

Ohio Train Derailment The Persistence Of Toxic Chemicals In Buildings

May 25, 2025

Ohio Train Derailment The Persistence Of Toxic Chemicals In Buildings

May 25, 2025 -

Elon Musks Dogecoin Investments A Comprehensive Overview

May 25, 2025

Elon Musks Dogecoin Investments A Comprehensive Overview

May 25, 2025 -

The Impact Of Elon Musks Actions On Dogecoins Price

May 25, 2025

The Impact Of Elon Musks Actions On Dogecoins Price

May 25, 2025 -

Analyzing Elon Musks Recent Dogecoin Activity

May 25, 2025

Analyzing Elon Musks Recent Dogecoin Activity

May 25, 2025 -

Is Elon Musk Abandoning Dogecoin A Deep Dive

May 25, 2025

Is Elon Musk Abandoning Dogecoin A Deep Dive

May 25, 2025