Record Equity Trading Volumes At BNP Paribas Amidst Increased Costs

Table of Contents

Record-Breaking Equity Trading Volume at BNP Paribas: A Deep Dive

Factors Driving Increased Trading Activity

Several key factors have contributed to the unprecedented rise in equity trading volume at BNP Paribas. These include:

- Increased Market Volatility: Heightened uncertainty in global markets, driven by geopolitical events, economic fluctuations, and inflation, has spurred increased trading activity as investors actively manage risk and seek opportunities. This volatility translates directly into higher trading frequency and volume.

- Growth in Algorithmic and High-Frequency Trading: The proliferation of sophisticated algorithms and high-frequency trading strategies has significantly amplified trading volumes across the board. BNP Paribas' robust technological infrastructure and expertise in this area likely contribute to its success in this segment.

- Strong Performance in Specific Sectors: Strong performances in key economic sectors, such as technology or renewable energy, attract substantial investor interest, leading to a surge in trading within those specific equities. BNP Paribas' strategic focus on these sectors may further explain its high volumes.

- Expansion into New Markets and Client Segments: Strategic expansion into new geographical markets and diversification into previously untapped client segments has broadened BNP Paribas' reach, contributing to overall volume growth. This growth strategy necessitates robust infrastructure and operational capacity.

- Data Points: While precise figures may be confidential, internal reports suggest a double-digit percentage increase in year-on-year equity trading volume for BNP Paribas, exceeding previous records by a significant margin. (Note: Replace this with specific data if available.)

Geographic Distribution of Trading Activity

The surge in trading volume isn't uniformly distributed. Key regions contributing significantly to BNP Paribas' success include:

- Asia-Pacific: The dynamic growth of Asian markets, particularly in China and India, has provided significant opportunities. BNP Paribas’ strategic investments in this region are paying dividends.

- Europe: While European markets have experienced some volatility, BNP Paribas' strong established presence continues to drive substantial trading activity.

- North America: The North American market remains a vital contributor, with BNP Paribas leveraging its strong network and client relationships.

Client Segmentation and Portfolio Strategies

Analyzing BNP Paribas' client base reveals further insights:

- Institutional Investors: Large institutional investors, such as pension funds and hedge funds, form a core part of BNP Paribas' client base, generating considerable trading volume through their active portfolio management.

- Retail Investors: The rise of online brokerage and increased retail investor participation has also contributed to the overall increase in trading volume, albeit potentially with a different trading style compared to institutional investors.

- Popular Trading Strategies: BNP Paribas likely facilitates a range of trading strategies, including long-term buy-and-hold, short-term swing trading, and options trading, all contributing to the overall volume.

Increased Costs and BNP Paribas' Strategies for Managing Expenses

The remarkable growth in equity trading volume has naturally resulted in increased costs:

Sources of Increased Costs

- Higher Technology Infrastructure Costs: Supporting the increased trading volume requires significant investment in robust and scalable technology infrastructure, including high-performance computing, data storage, and network capabilities.

- Increased Regulatory Compliance Costs: Stringent regulatory requirements in the financial sector necessitate increased compliance efforts, leading to higher associated costs.

- Rising Compensation Costs: Attracting and retaining top talent in the competitive financial industry involves increasing compensation packages, contributing to higher personnel costs.

- Inflationary Pressures: General inflationary pressures impact operational expenses across the board, from energy costs to administrative fees.

BNP Paribas' Cost-Cutting and Efficiency Measures

To counteract the rising costs, BNP Paribas is likely employing various strategies:

- Process Automation: Automating various back-office functions reduces manual labor costs and improves efficiency.

- Operational Efficiency Improvements: Streamlining workflows and optimizing operational processes can significantly reduce expenses.

- Investment in Cost-Effective Technologies: Investing in advanced technologies designed to improve efficiency and reduce operational costs is crucial.

Balancing Growth and Profitability

BNP Paribas faces the challenge of balancing its record trading volumes with the associated cost increases to maintain profitability. This involves a meticulous approach that combines efficient cost management with a strategic focus on high-value activities. Specific financial performance indicators (e.g., net profit margin, return on equity) will be crucial in evaluating the success of this balancing act.

Conclusion: Navigating Record Equity Trading Volumes at BNP Paribas – A Path Forward

BNP Paribas' achievement of record equity trading volumes demonstrates its strong market position and strategic capabilities. However, the associated cost increases necessitate a robust approach to cost management. The factors driving this growth—market volatility, technological advancements, and strategic expansion—are likely to persist. BNP Paribas' ability to effectively manage costs while leveraging these growth opportunities will be critical in determining its future success. Stay tuned for further updates on record equity trading volumes at BNP Paribas and the evolving landscape of the financial industry.

Featured Posts

-

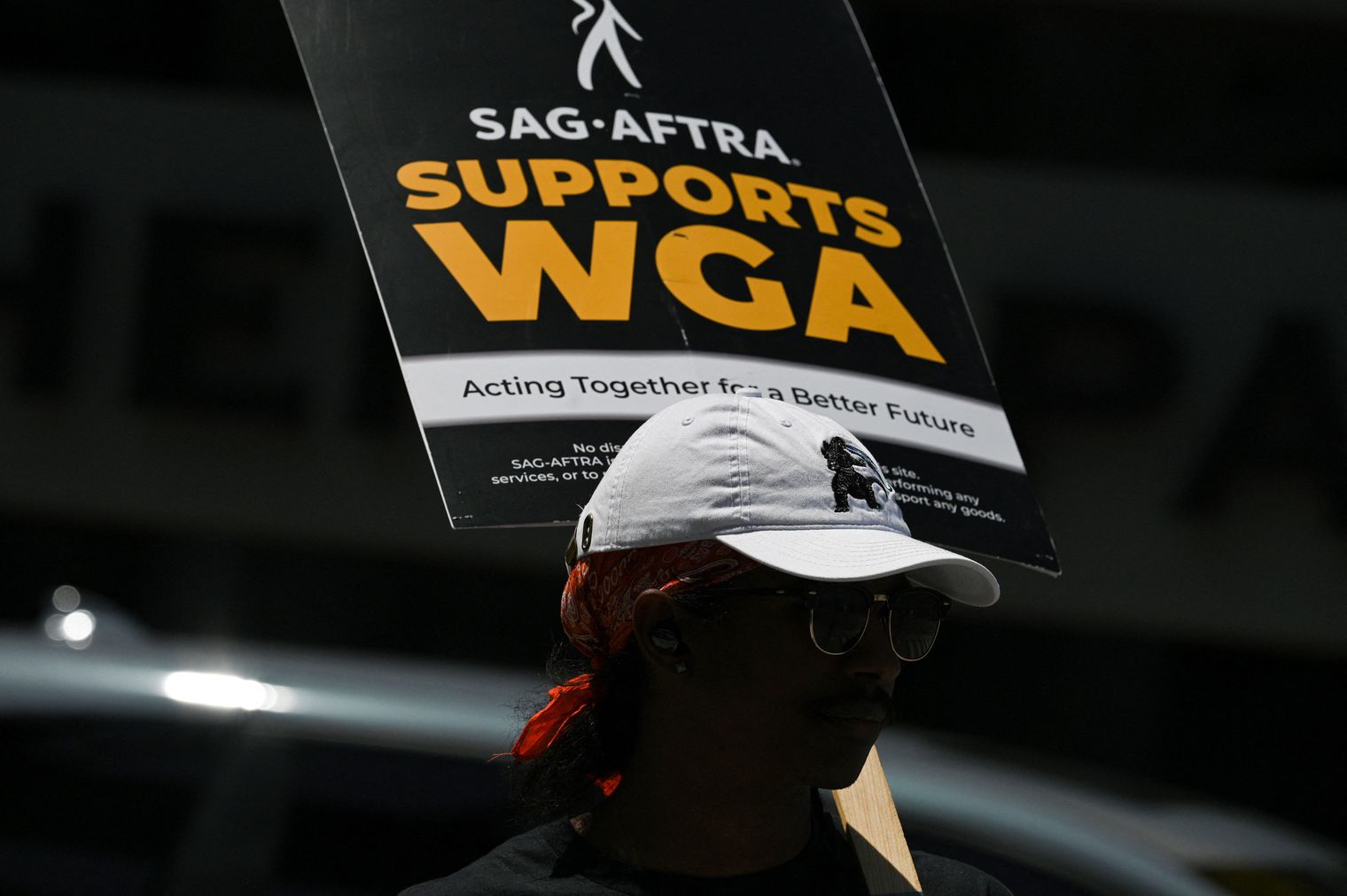

Hollywood Production Grinds To Halt As Sag Aftra Joins Wga On Strike

Apr 25, 2025

Hollywood Production Grinds To Halt As Sag Aftra Joins Wga On Strike

Apr 25, 2025 -

Europes Top 10 Retail Destinations

Apr 25, 2025

Europes Top 10 Retail Destinations

Apr 25, 2025 -

Bota De Oro 2024 25 Clasificacion Y Aspirantes

Apr 25, 2025

Bota De Oro 2024 25 Clasificacion Y Aspirantes

Apr 25, 2025 -

Revealed The 2025 Anzac Day Guernsey Design

Apr 25, 2025

Revealed The 2025 Anzac Day Guernsey Design

Apr 25, 2025 -

Unilever Sales Surge Increased Pricing And Improved Demand Outperform Projections

Apr 25, 2025

Unilever Sales Surge Increased Pricing And Improved Demand Outperform Projections

Apr 25, 2025

Latest Posts

-

Addressing Investor Concerns Bof As View On High Stock Market Valuations

Apr 26, 2025

Addressing Investor Concerns Bof As View On High Stock Market Valuations

Apr 26, 2025 -

Bof A On Stock Market Valuations A Rationale For Investor Confidence

Apr 26, 2025

Bof A On Stock Market Valuations A Rationale For Investor Confidence

Apr 26, 2025 -

Why Current Stock Market Valuations Are Not A Reason To Panic According To Bof A

Apr 26, 2025

Why Current Stock Market Valuations Are Not A Reason To Panic According To Bof A

Apr 26, 2025 -

Understanding Stock Market Valuations Bof As Argument For Calm

Apr 26, 2025

Understanding Stock Market Valuations Bof As Argument For Calm

Apr 26, 2025 -

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025