Record High For DAX Possible? Frankfurt Equities Opening Shows Strength

Table of Contents

Strong Opening Signals for the DAX

Early Trading Activity

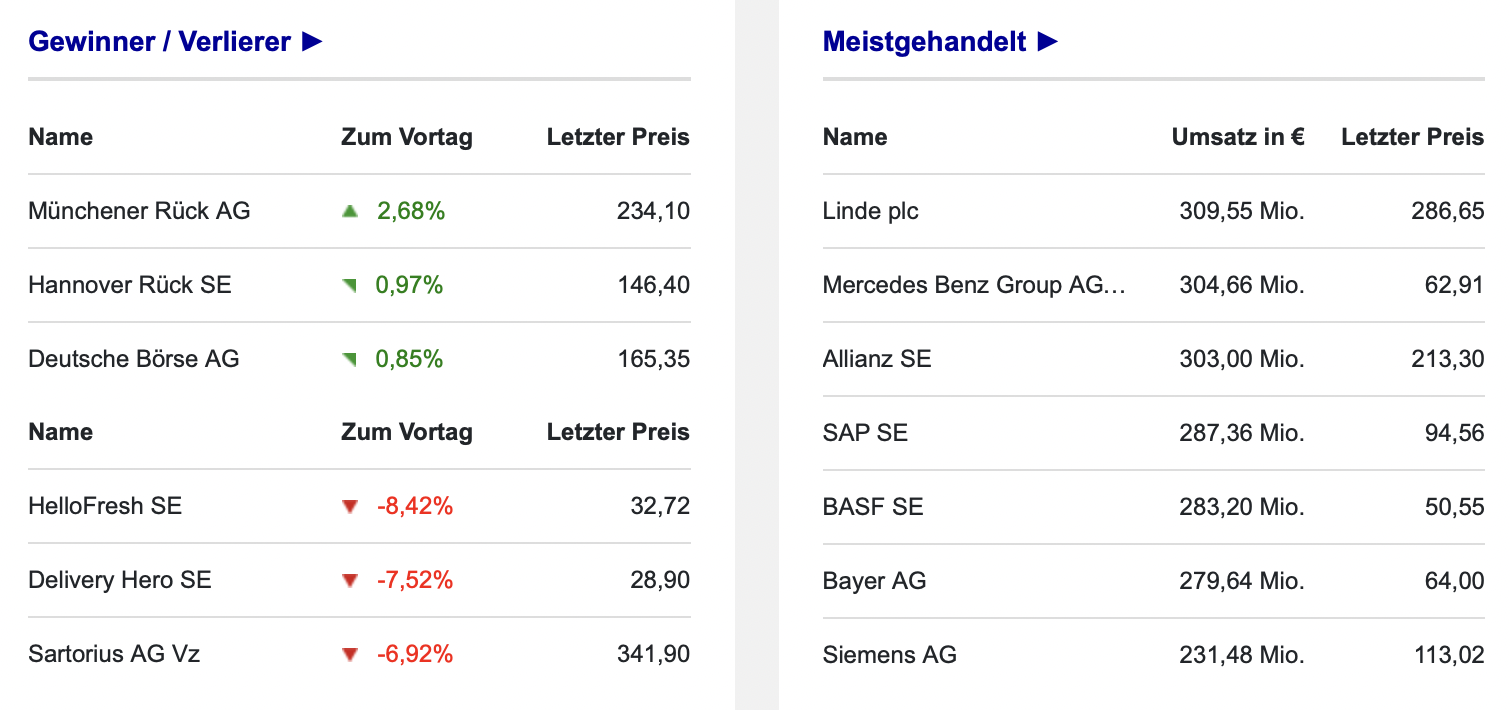

The DAX experienced a robust opening, signaling a potentially bullish trend. Early trading saw the index surge by 1.5%, surpassing the 16,000-point mark. This positive momentum reflects a strong underlying confidence in the German economy.

- Strong Performing Sectors: The technology and automotive sectors led the gains, indicating strong investor optimism in these key German industries.

- Significant Gainers: Companies like Volkswagen and Siemens saw significant percentage increases in their share prices, contributing substantially to the overall DAX surge.

- High Trading Volume: The increased volume of trades further underlines the market's enthusiasm and the significant interest from investors.

Positive Investor Sentiment

The positive opening is fueled by a generally optimistic investor sentiment. Several factors contribute to this positive market mood.

- Robust Economic Data: Recent economic data, including positive GDP growth figures and a decline in unemployment, have boosted investor confidence.

- Analyst Upward Revisions: Several leading financial analysts have revised their DAX forecasts upwards, predicting continued growth in the coming months. This positive outlook encourages investment.

- Positive News from Germany and Europe: Positive news regarding economic reforms and improved trade relations within the European Union has also played a role in boosting investor confidence.

Economic Indicators Suggesting a Potential Record High

Robust German Economy

The German economy is exhibiting considerable strength, bolstering the potential for a DAX record high. Several key indicators point towards a positive outlook.

- Low Unemployment Rate: Germany's unemployment rate remains low, indicating a strong and healthy labor market. This translates to increased consumer spending and overall economic stability.

- Strong Industrial Production: Industrial production figures show consistent growth, highlighting the resilience and competitiveness of German manufacturing.

- Increased Consumer Spending: Rising consumer spending indicates strong domestic demand and confidence in the economy, further supporting market growth.

- Positive Export Figures: Robust export figures demonstrate the strength of German businesses in the global market, contributing to overall economic growth.

Global Economic Outlook

While the German economy is a significant driver, the global economic climate also plays a critical role in the DAX's performance.

- Positive Global Growth Forecasts: Positive global growth forecasts suggest a supportive international environment for German businesses and the DAX.

- Geopolitical Risks (Mitigated): While geopolitical risks exist, their impact seems currently manageable, allowing the positive domestic factors to dominate. However, ongoing monitoring is crucial.

- Stable International Trade: Stable international trade relations are crucial for Germany's export-oriented economy, and current conditions appear largely supportive.

Potential Risks and Challenges to Reaching a Record High

Geopolitical Instability

Geopolitical instability remains a significant risk factor that could impact the DAX.

- War in Ukraine: The ongoing conflict in Ukraine presents an ongoing risk, impacting energy prices and investor sentiment.

- International Tensions: Escalating international tensions could negatively affect investor confidence and lead to market volatility.

Inflationary Pressures

Inflationary pressures pose a substantial challenge to reaching a record high.

- High Inflation Rates: Elevated inflation rates could lead to decreased consumer spending and potentially trigger interest rate hikes by the European Central Bank.

- Interest Rate Hikes: Interest rate increases, while designed to combat inflation, could also negatively impact economic growth and investor behavior.

Energy Crisis

The energy crisis continues to be a major concern for the German economy and the DAX.

- Energy Price Volatility: High and volatile energy prices significantly impact German businesses, particularly energy-intensive industries.

- Government Intervention: Government policies aimed at mitigating the energy crisis will play a crucial role in determining its impact on the DAX.

Conclusion

The DAX's strong opening, supported by positive economic indicators and generally optimistic investor sentiment, suggests the possibility of a record high. However, significant risks, including geopolitical instability, inflationary pressures, and the ongoing energy crisis, need careful consideration. While the current outlook is positive, investors should remain vigilant and closely monitor these factors.

Call to Action: Stay tuned for updates on the DAX and monitor the index for potential record-breaking opportunities. Learn more about investing in the DAX, but always remember that investing involves inherent risks. While a DAX record high remains a possibility, thorough due diligence and careful risk management are essential.

Featured Posts

-

Country Escape Making The Move To A Rural Lifestyle

May 25, 2025

Country Escape Making The Move To A Rural Lifestyle

May 25, 2025 -

Ferrari 296 Speciale Apresentacao Do Motor Hibrido De 880 Cv

May 25, 2025

Ferrari 296 Speciale Apresentacao Do Motor Hibrido De 880 Cv

May 25, 2025 -

Dax Verluste Bei Frankfurter Aktienmarktoeffnung Am 21 Maerz 2025

May 25, 2025

Dax Verluste Bei Frankfurter Aktienmarktoeffnung Am 21 Maerz 2025

May 25, 2025 -

Repression Chinoise En France Des Dissidents Reduits Au Silence

May 25, 2025

Repression Chinoise En France Des Dissidents Reduits Au Silence

May 25, 2025 -

Kyle Walker And The Mysterious Brunettes In Milan

May 25, 2025

Kyle Walker And The Mysterious Brunettes In Milan

May 25, 2025

Latest Posts

-

En France La Chine Et La Censure Des Voix Critiques

May 25, 2025

En France La Chine Et La Censure Des Voix Critiques

May 25, 2025 -

Auto Tariff Relief Speculation Drives European Stock Market Gains Lvmh Shares Fall

May 25, 2025

Auto Tariff Relief Speculation Drives European Stock Market Gains Lvmh Shares Fall

May 25, 2025 -

Le Silence Force Des Dissidents Francais Face A La Puissance Chinoise

May 25, 2025

Le Silence Force Des Dissidents Francais Face A La Puissance Chinoise

May 25, 2025 -

Trumps Tariff Relief Signals Boost European Stock Markets Lvmh Decline

May 25, 2025

Trumps Tariff Relief Signals Boost European Stock Markets Lvmh Decline

May 25, 2025 -

Repression Chinoise En France Des Dissidents Reduits Au Silence

May 25, 2025

Repression Chinoise En France Des Dissidents Reduits Au Silence

May 25, 2025