Regulatory Rollback: Canadian Pause On Diversity And Climate Reporting

Table of Contents

The Scope of the Regulatory Rollback

The Canadian government's pause on mandatory reporting represents a significant shift in its approach to ESG (Environmental, Social, and Governance) regulations. While the exact details are still emerging, the rollback affects several key areas of corporate reporting, creating uncertainty for businesses across various sectors. This policy change impacts both climate-related financial disclosures and diversity reporting mandates, particularly those concerning board representation.

- Specific Regulations Impacted: The pause affects proposed regulations requiring detailed climate-related financial disclosures, aligned with international standards such as the Task Force on Climate-related Financial Disclosures (TCFD). Additionally, mandates for increased diversity on corporate boards and in senior management positions are also temporarily suspended. The exact timeframe for these requirements remains unclear.

- Affected Industries: The regulatory rollback impacts a broad range of industries, including finance, energy, extractives, and technology. Companies in these sectors were preparing to implement new reporting frameworks and compliance measures, leading to significant uncertainty in their planning processes.

- Timeline of the Delay: The government has not yet announced a definitive timeline for reinstating or revising these mandatory reporting requirements. The delay creates a period of uncertainty for businesses, hindering their ability to plan long-term ESG strategies.

- Government Justification: The government's justification for the rollback cites the need for further consultation and review of the proposed regulations. Concerns about potential burdens on businesses and the complexities of implementation have also been cited as contributing factors.

Impacts on Businesses and Investors

The regulatory rollback creates significant short-term and long-term impacts on Canadian businesses and the investment landscape. The pause introduces considerable uncertainty, affecting investor confidence and potentially hindering Canada's ability to attract foreign investment.

- Increased Uncertainty for Businesses: Companies that have already invested resources in developing their ESG reporting capabilities now face uncertainty, potentially delaying or scaling back their efforts. This can affect their ability to access green financing and compete globally.

- Potential for Reduced Investor Interest: International investors often prioritize ESG factors in their investment decisions. The pause in mandatory reporting may decrease investor confidence in Canadian companies and potentially divert investment to jurisdictions with more robust ESG regulations.

- Impact on Corporate Social Responsibility Initiatives: The rollback sends a mixed message about Canada's commitment to corporate social responsibility, potentially discouraging companies from proactively pursuing ambitious ESG initiatives.

- Difficulty in Benchmarking: The absence of consistent and comparable ESG data for Canadian companies will make it more difficult to benchmark performance against international standards, hindering progress towards global sustainability goals.

Political and Social Reactions to the Regulatory Rollback

The decision to pause mandatory diversity and climate reporting has drawn criticism from various stakeholder groups, highlighting the political sensitivity of ESG issues.

- Stakeholder Responses: Environmental groups, Indigenous communities, and some business leaders have expressed deep concern over the rollback, viewing it as a step backward in addressing climate change and promoting diversity.

- Political Implications: The decision has become a focal point in the political discourse, with opposition parties criticizing the government's approach and questioning its commitment to ESG goals.

- Public Opinion: Public opinion on the matter is divided, with some supporting the pause due to concerns about regulatory burden, while others see it as detrimental to sustainability efforts. Further research is needed to gauge public sentiment accurately.

- International Reactions: International organizations focused on sustainable development and climate action have voiced concern over the potential negative consequences of the regulatory rollback for Canada's international standing on ESG issues.

Comparison to International ESG Reporting Standards

Compared to other developed countries, Canada's decision contrasts sharply with the growing trend towards mandatory ESG reporting.

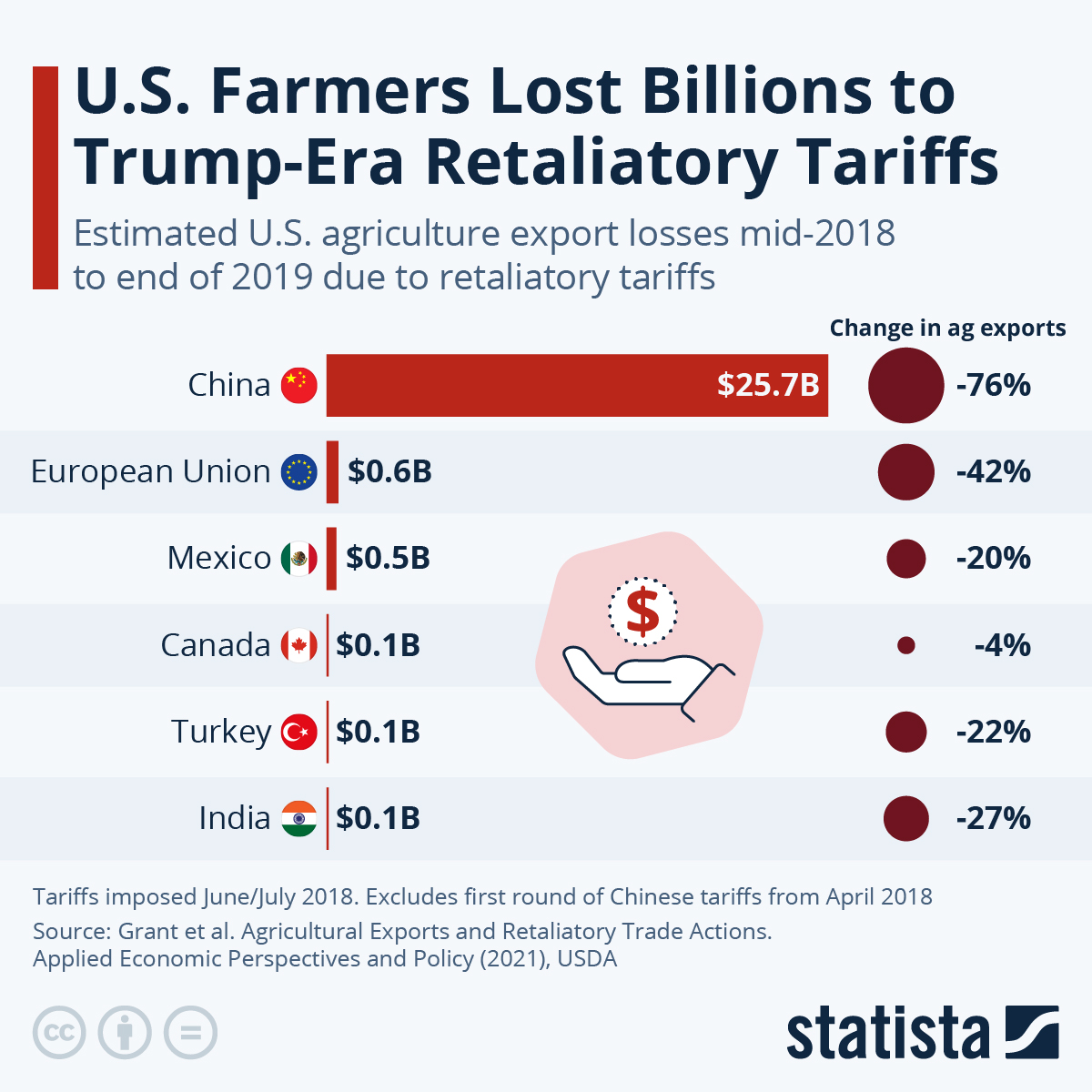

- Comparison with EU and US: The European Union and the United States are leading the way in implementing comprehensive ESG reporting requirements. The EU's Corporate Sustainability Reporting Directive (CSRD) is particularly ambitious. Canada's pause stands in stark contrast to this global movement.

- Implications for Attracting Foreign Investment: The lack of stringent ESG regulations may make Canada less attractive to foreign investors seeking companies with robust sustainability practices.

- Potential for Isolation: Canada risks international isolation by not aligning its ESG reporting standards with global norms. This could hinder its ability to participate in international initiatives related to climate change and sustainable development.

Conclusion

The pause on mandatory diversity and climate reporting represents a significant shift in Canadian policy. This regulatory rollback creates considerable uncertainty for businesses, potentially dampening investor confidence and hindering Canada's progress on ESG goals. The implications are far-reaching, affecting not only corporate practices but also Canada's international standing on environmental and social issues. The lack of clarity surrounding the timeline for reinstating or revising these regulations further exacerbates the concerns. Staying informed about future developments regarding this regulatory rollback is crucial for businesses and investors alike. Continue to monitor updates and advocate for transparent and accountable ESG practices in Canada. Engage in discussions about the future direction of regulatory changes related to diversity and climate reporting to ensure a sustainable and equitable future.

Featured Posts

-

Golazos En La Liga Santafesina Repaso De La Fecha

Apr 25, 2025

Golazos En La Liga Santafesina Repaso De La Fecha

Apr 25, 2025 -

Understanding The Recent Volatility Of The Canadian Dollar

Apr 25, 2025

Understanding The Recent Volatility Of The Canadian Dollar

Apr 25, 2025 -

2025 Nfl Draft Predicting The Jets Picks And Addressing Key Needs

Apr 25, 2025

2025 Nfl Draft Predicting The Jets Picks And Addressing Key Needs

Apr 25, 2025 -

Cellnexs Ceo Network Overhaul Complete By Years End Focus On Uk Growth

Apr 25, 2025

Cellnexs Ceo Network Overhaul Complete By Years End Focus On Uk Growth

Apr 25, 2025 -

Chinas Economy Under Pressure Special Bonds To Counter Trumps Tariffs

Apr 25, 2025

Chinas Economy Under Pressure Special Bonds To Counter Trumps Tariffs

Apr 25, 2025

Latest Posts

-

The China Factor Analyzing The Difficulties Faced By Bmw Porsche And Other Auto Brands

Apr 26, 2025

The China Factor Analyzing The Difficulties Faced By Bmw Porsche And Other Auto Brands

Apr 26, 2025 -

The Growing Problem Of Betting On Natural Disasters Focus On Los Angeles

Apr 26, 2025

The Growing Problem Of Betting On Natural Disasters Focus On Los Angeles

Apr 26, 2025 -

Los Angeles Wildfires A Case Study In Disaster Speculation

Apr 26, 2025

Los Angeles Wildfires A Case Study In Disaster Speculation

Apr 26, 2025 -

How Middle Management Drives Company Growth And Employee Development

Apr 26, 2025

How Middle Management Drives Company Growth And Employee Development

Apr 26, 2025 -

Analyzing The Trend People Betting On The Los Angeles Wildfires

Apr 26, 2025

Analyzing The Trend People Betting On The Los Angeles Wildfires

Apr 26, 2025